Something called Matrixport dumped the crypto market midweek. Was BlackRock involved?

Pic via Getty Images (BTC icon added by Coinhead)

Whoa, Bitcoin flash crash on Thursday. ETF still likely? Bloomberg’s experts think so. Is crypto’s moon mission still on? And what/who the hell is Matrixport anyway?

We’re only a handful of days into 2024 and Bitcoin and crypto is already showing more volatility than a Prime-chugging tween with laggy WiFi.

Some would say this is a good thing and the return of the kind of froth that has typified crypto bull markets of yore, with monster gains followed by face-planting dumps a regularity on the ladder to the cycle top.

It seems like just a day ago that Bitcoin was flying, surging past US$45k, flipping the bird at every commodity and several securities in its wake.

And that’s because it was. So, what happened to cause this, then?

Matrixport did. Who, or what is Matrixport? And what did it do or say? Good questions.

It’s known as a crypto-financial service platform, and had actually been, on the whole, pretty optimistic about the approval of a spot Bitcoin ETF in January.

Until that is, a report surfaced midweek that indicated a sharp shift in its sentiment, speculating that the US Securities and Exchange Commission (SEC) may be about to reject all current BTC ETF proposals.

The Matrixport report partly based this on the fact five voting SEC commissioners are Democrats, and “Democrats don’t like crypto”.

UPDATE ‼️ Bitcoin price dumped 9% in 1 hour on the basis of a report by Matrixport predicting an SEC rejection of ALL Bitcoin ETF applications.

Their justification? Politics.

– 5 voting commissioners are Democrats.

– Democrats don't like 'crypto'.

– Applicants haven't satisfied… pic.twitter.com/v6oD7zwPj7— Bitcoin Archive (@BTC_Archive) January 3, 2024

Larry, was this you? Okay, probably not

Tinfoil hat time. Is BlackRock and its crypto-digging CEO Larry Fink involved? That’d be tasty, wouldn’t it?

The leading spot Bitcoin ETF candidate has been called out by a number of rando posters on Twitter/X for pulling the strings on the Matrixport thought piece to supposedly tank the price ahead of its possible ETF approval by a reluctant SEC.

We’re yet to see a single bit of evidence posted by anyone to back up the speculation, though.

LOL

Blackrock put out a fake Matrixport report to get a lower seeding price?

Classic Larry 😂

— Mike Alfred (@mikealfred) January 3, 2024

“Blackrock needs a better entry. You still got that contact at Matrixport?” pic.twitter.com/lquRjDv47l

— Sal 🦎 (@Salmander0) January 3, 2024

A little digging around of our own reveals a vague degree of separation that brings in the name BlackRock along the line. It’s a tenuous link, but here we go…

Matrixport is a spin-off company of Bitmain, a Chinese-founded Bitcoin mining-sector company (the world’s leading manufacturer of digital currency mining servers), which late last year fuelled Core Scientific, a major producer of Bitcoin in North America, with a US$53.9 million investment.

That’s interesting in of itself because Core Scientific became a high-profile crypto contagion victim in 2022, amid the implosion of the FTX exchange and, in particular, for Core Scientific, the collapse of the Celsius crypto borrowing/lending platform and one of the mining firm’s biggest customers.

Core Scientific is currently working its way back from bankruptcy, thanks in part to the huge Bitmain investment, but also thanks to a loan back in late 2022/early 2023 from… BlackRock.

According to a court filing, reported by Bloomberg, BlackRock and other high-profile investors lent approximately US$500 million to Core Scientific by purchasing its secured convertible notes. BlackRock’s contribution amounted to roughly US$38m.

BlackRock, according to Core Scientific’s CEO Adam Sullivan, “has a top five position in almost all of the public companies in our space”, by which he largely means Bitcoin mining companies. BlackRock has a position in four out of the five biggest Bitcoin miners by market capitalisation, including Riot Blockchain, Marathon Digital Holdings, Cipher Mining and TerraWulf. All of these companies use Bitmain mining equipment for at least part of their operations – Antminer servers.

“They’ve [BlackRock] been a strong supporter of Core and continue to be through the bankruptcy process. We can’t say enough about BlackRock – they’ve been a strong aid to the industry. They’re working on the ETF. They continue to invest in all of the Bitcoin mining companies in our industry. They’re supporters of the crypto industry… I couldn’t be happier about having someone like that be an advocate for us.”

Like we caveated earlier, linking Bitmain/Matrixport directly to BlackRock is about as tenuous as an SEC lawsuit and so is the idea of a deliberate FUD (fear, uncertainty and doubt) blitz to help temporarily pull back the price of an asset BlackRock seems very keen to hold more of.

Still, that doesn’t mean it isn’t fun to entertain and we wouldn’t put it past Wall Street puppet mastery to pull something like that.

After all, how’s this… JP Morgan CEO Jamie Dimon recently commented that he thinks the US government should ban crypto. Not long after that, it came to light that JP Morgan is actually listed as an authorised participant in the BlackRock Bitcoin ETF, meaning the bank could act as a custodian for the new Bitcoin product.

Things that make you go… hmmm…

Correction: At the time of originally publishing this article, we incorrectly stated that Singaporean investment firm Temasek Holdings is an investor/backer of Bitmain. Temasek has no investment/holdings in Bitmain. Pavilion Capital, a venture round investor into Bitmain in 2018, is owned by Temasek Holdings but operates independently.

Bloomberg’s ETF pundits still believe

Meanwhile, the crypto industry has been holding on to the words of Bloomberg ETF experts Eric Balchunas and James Seyffart for some time now.

And that’s because the two analysts have been covering ETFs of all kinds day in day out for years, and they are extraordinarily bullish on a raft of spot BTC ETFs finally making it over the line in the first half of this year, giving that a 90% chance of happening.

And even as soon as… Christ, maybe even next week – January 10, which is the date the Gary Gensler-run agency is slated to approve, delay or deny the majority of the Bitcoin ETF filings from BlackRock, VanEck, Fidelity among others.

At this point saying SEC rejecting it isn’t just going against @JSeyff and I like it was in the early days, now you basically saying multiple mainstream news reporters w multiple sources on inside of this also have it wrong too. Not saying it’s imposs (again we still ‘only’ at…

— Eric Balchunas (@EricBalchunas) January 3, 2024

Looks like the Matrix Report took both the blue pill and the red pill.. https://t.co/1VpA7t2vq6

— Eric Balchunas (@EricBalchunas) January 3, 2024

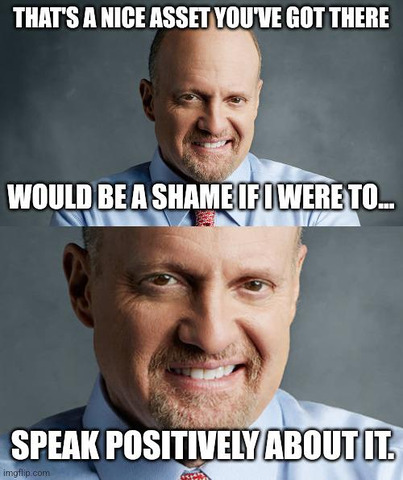

No, Jim, no. Flip back immediately

Finally, we can’t finish off without a mention of this bloke – hapless CNBC pundit Jim Cramer, who recently flipped somewhat bullish on Bitcoin. Please, just stick to the recent script and keep hating crypto, would ya? Thanks, Jim…

Yesterday Jim Cramer said he was bullish on Bitcoin at $45,675

Today price nuked to $40,800pic.twitter.com/kq6HC8LAwv

— borovik (@3orovik) January 3, 2024

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.