Solana gains another 20pc, up over 4x in 4 weeks; El Salvador buys 400 BTC

Picture: Getty Images

Solana doesn’t know when to quit — and another Sam Bankman-Fried token, FTT, is hitting new peaks as well.

Sol traded for an all-time peak of US$172 this morning, up 20 per cent from yesterday and from just US$39 four weeks ago.

I bought 8 $sol one month ago sub $30 … should have bought more

— Crypto Incognito (@crypto_toon) September 6, 2021

Thank you #Solana

From 3.96% of portfolio to 10.95% without adding a single penny.

Follow my Watchlist with @CoinMarketCap.https://t.co/73VXWIBqML pic.twitter.com/7kZI26Im3S— hmwCrypto (@hmwCrypto) September 7, 2021

Many enthusiasts still regard Solana, the No. 6 coin, as significantly undervalued compared to Cardano at No. 3.

$SOL has smart contracts as a reminder.

They are moving right now at $49 Billion and over 15% growth in the last 24 hours. #Solana #SolanaSummer

— Crypto Hotep (@CryptoHotep) September 7, 2021

Meanwhile FTT was up 20 per cent as well, to a record US$76, making the native coin of the FTX exchange the No. 26 crypto.

The gains came after FTX unveiled a marketplace for its United States-based customers to mint and trade NFTs, which have seen explosive growth this year.

Over 1000 NFTs have been submitted to be created on https://t.co/edQRgsBpDG in the ~8 hours since that option went live

— FTX – Built By Traders, For Traders (@FTX_Official) September 6, 2021

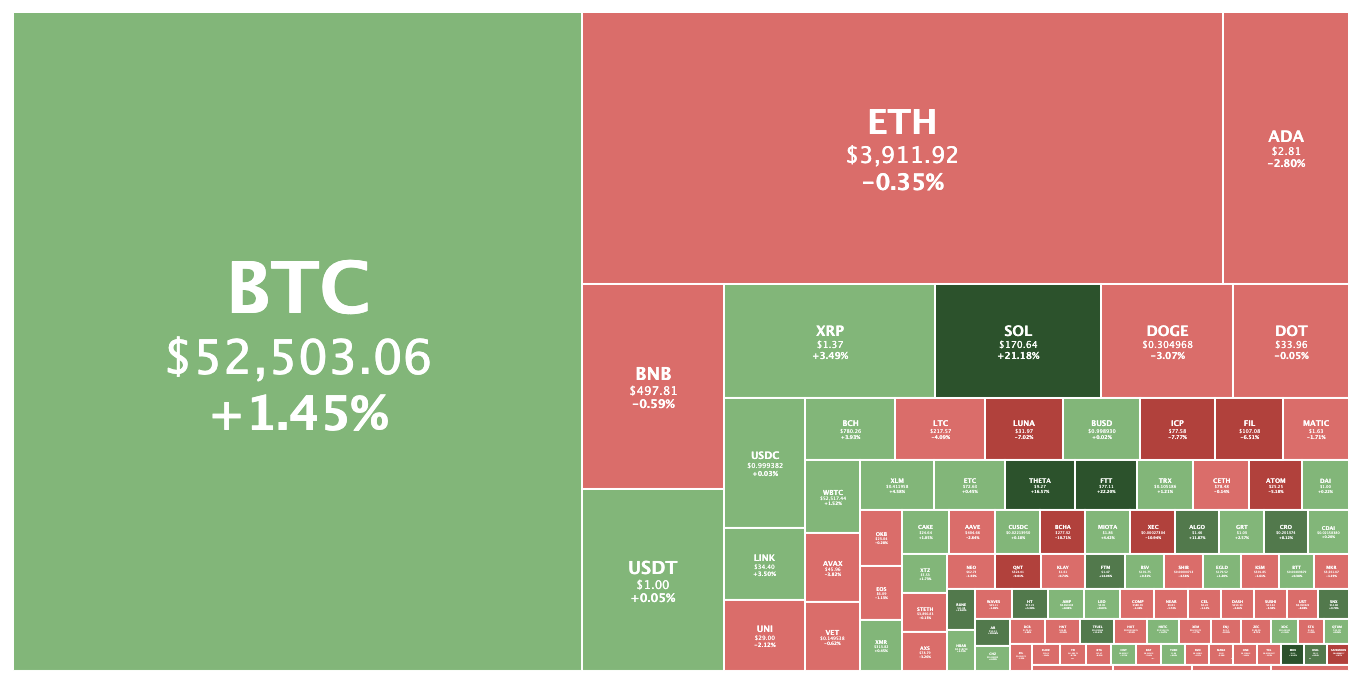

Crypto market up 1.2%

Overall the crypto market was at US$2.46 trillion, up 1.2 per cent from yesterday.

Bitcoin was trading at US$52,500, up 1.5 per cent from yesterday, as El Salvador’s “Bitcoin law” takes effect later tonight (Australian time), making the Latin American country the first to adopt BTC as legal tender.

President Nayib Bukele announced on Twitter that El Salvador had bought 400 Bitcoins (worth roughly US$21 million) in two 200 BTC purchases. It wasn’t clear whether the country was done buying.

The country is planning on giving all its citizens US$30 in free BTC to jumpstart its Bitcoin economy.

Microstrategy chief executive Michael Saylor, whose company owns 108,992 BTC (worth roughly US$5.7 billion), tweeted that “every cyber hornet I know is planning to buy BTC tomorrow in solidarity with the people of #ElSalvador and their leader @nayibbukele”.

Ethereum meanwhile was trading for US$3,911, down 0.4 per cent from yesterday.

FTT and Solana were the best gainers in the top 100, followed by Mdex, Theta, Fantom, ThorChain and Algorand, which had gained from 17 to 13 per cent.

Fantom had hit an all-time high of US$1.48 – up from around 50c at the end of August. The Ethereum-compatible smart contract platform is now the No. 44 crypto.

Monochrome Asset Management founder and chief executive Jeff Yew told Stockhead, “what we’re seeing is a battle among a specific genre of crypto-asset trying to figure out who will emerge as the dominant application layer.”

“Digital commodities such as Bitcoin have a different use case, ideology, and audience, to application layers such as Ethereum, Solana, or the Lighting Network. Hence I wouldn’t categorise them the same.”

There’s been signs of decreasing price correlation between these assets and base monetary layers such as Bitcoin, as the market gains a clearer understanding of these different product categories in this space, “but it’s still too early to tell,” Yew said.

eCash, the crypto rebranded from Bitcoin Cash ABC, was the worst performer in the top 100, falling 11.3 per cent, according to Coingecko.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.