September Crypto Winners: Chainlink builds momentum with ANZ as ‘Uptober’ hopium hits

"OOh-ctober next?" Pic via Getty Images

Crypto is dead, right? All going to zero. Give up, go home, just buy lithium.

Wait , cool your jets, because Septembear didn’t quite eventuate, Bitcoin held up okay, Chainlink is building and Uptober has started pretty well.

September is statistically the worst month of the year for Bitcoin and other cryptos. It’s generally not historically too crash for stocks, either, for that matter, but we’ll stick to our lane in this article.

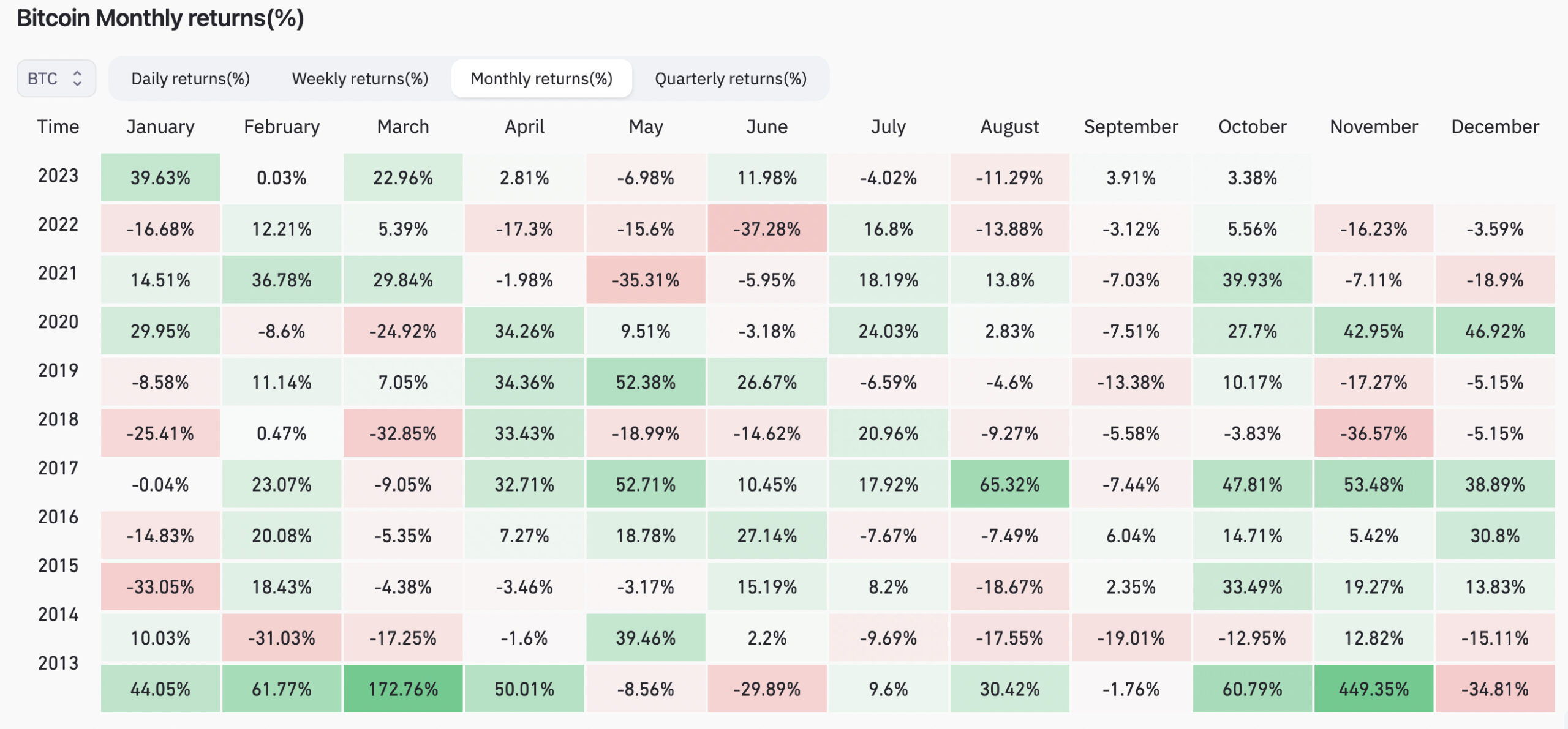

You can get a sense of Septembers past from the following coinglass.com chart below.

Bitcoin, as the go-to health barometer for the entire sector and usual first mover has a roughly -4.4% average price performance when considering all Bitcoin Septembers past, including the one just wrapped up.

And yet, with a late spurt or two, September 2023 somehow finished in the green – making it only the fourth out of 11 Bitcoin Septembers to have done so, as noted by Coinglass.

What’s most tantalising about that chart, though, is the month of October Bitcoin’s just surged into, not to mention November, too. (What stoopid name can we give that one? Go-vember?) These are historically two of the most consistently bullish months of the year for Bitcoin.

Of course, past price performance is not indicative of you buying Bitboy’s Lambo in the future, though… or whatever that saying is…

Ok, dumping my life savings in Bitcoin.

Thanks for the heads up, Jim.

— The ₿itcoin Therapist (@TheBTCTherapist) October 1, 2023

Bitcoin, by the way, is currently changing hands for about US$27,600, down a bit from where it was surging overnight, up above US$28k for the first time in seemingly ages.

It remains to be seen whether it can recapture those short-lived levels, but at least it appears to be holding the mid US$27k range it struggled through August and September to breach and retain.

Uptober has kicked off to a good start. pic.twitter.com/IT37VMd6wG

— Coin Bureau (@coinbureau) October 2, 2023

What other cryptos had a decent September?

There a couple of standouts worth mentioning, namely Chainlink and Kaspa. But we’d best also caveat the green September notes with some hues of reality. September was, for the most part pretty dull for crypto prices, and was actually a bit of a shocker for hacks and exploits.

That said, the sector kept its head above water, in part thanks to the great Bitcoin (and Ethereum) ETF hope, led by Larry Fink’s BlackRock, as well as Fidelity and VanEck and others.

Are we any closer to that being approved? Maybe a fraction. Just don’t ask Gary Gensler.

JUST IN: 🇺🇸 US Congressman slams SEC Chair Gary Gensler for attacking crypto. pic.twitter.com/FFfIaETSO4

— Watcher.Guru (@WatcherGuru) September 27, 2023

But we digress…

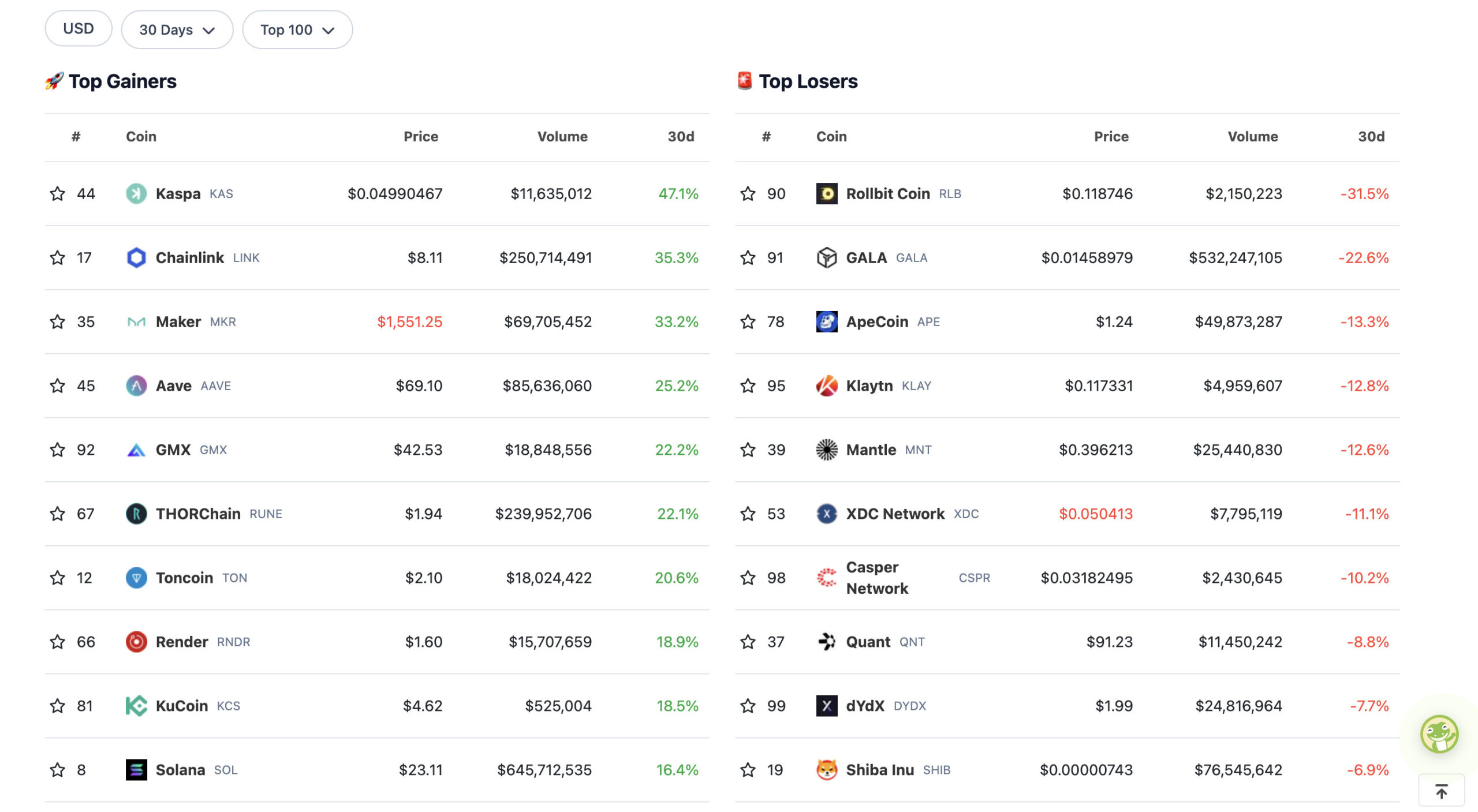

September’s top 10 (in the top 100 by market cap)

Yep, layer 1 Proof of Work blockchain Kaspa had a good month, and we’ll make like a marketer and “circle back” to that in a sec. But first, we quite like the form of popular altcoin Chainlink, so let’s talk about that, especially as we headlined it, too…

Chainlink makes waves with CCIP

Chainlink (LINK) caught many a crypto-focused eye in September after it began to show some whale (large investor) activity in late August.

Wait, what’s Chainlink again? It’s a web3 oracle – and by far the one that’s got that seemingly very important corner of the crypto market well covered.

Oracle? Wut? Please explain. Sure. It’s a web3 services network built on Ethereum and is ubiquitous across the crypto industry. It helps decentralised-app-building developers seamlessly bridge “real-world data” and off-chain computation over to smart contracts running on blockchains.

When you think of web3/blockchain infrastructure (and we wouldn’t blame you if that’s never), this is the one that should probably spring to mind first.

What’s been driving its 30%+ price surge in September?

CCIP. Sounds like it was made in China. It wasn’t (Chainlink Labs is based in San Francisco). It stands for Cross-Chain Interoperability Protocol and is a big step forward in Chainlink’s tech stack and overall mission.

1/ As the industry standard for secure cross-chain interoperability, #CCIP is already unlocking a new wave of Web3 innovation.

Explore CCIP’s growing momentum🧵👇 pic.twitter.com/zZwWTggG9R

— Chainlink (@chainlink) October 2, 2023

Along with decentralisation, privacy, scalability and immutability, interoperability is one of the major pillars that the blockchain/crypto world is trying to nail.

Crypto has numerous blockchains all competing for attention and aiming to communicate in a multi-chain existence, but establishing safe and effective bridging tech has thus far been a challenge.

CCIP aims to create a universal, secure open standard for cross-chain comms between hundreds of public and private blockchains for all sorts of applications – especially decentralised finance.

> 'Why is the Hong Kong Monetary Authority at Chainlink #SmartCon?'

> 'We've been talking to & working with Chainlink. Specifically #CCIP. We like what they do'

> 'Interoperability is key'

> 'Absolutely. Thats why we're here.'

Storms comin'$LINK https://t.co/6febAPCXs4 pic.twitter.com/UbfaPomIYw

— run ⬡ the ⬡ juels (GFS visionary arc) (@nullpackets) October 2, 2023

Chainlink and ANZ

And here’s the local kicker. In September, Chainlink teamed up with ANZ, with the banking giant taking part in a CCIP-tech case study.

Per the study:

“[The] case study shows how Australia and New Zealand Banking Group (ANZ) – a leading institutional bank with $1+ trillion in total assets under management – successfully demonstrated how ANZ customers could use CCIP to securely transfer ANZ-issued stablecoins cross-chain to purchase nature-based assets.

“Similar to how interoperability standards transformed the Internet and global banking, a cross-chain interoperability standard could accelerate the adoption of tokenized assets amongst financial institutions.”

Per an ANZ statement:

“We’re excited to drive financial innovation at ANZ by providing our clients with seamless access to tokenized assets through an easy-to-use platform. Chainlink CCIP played a key role in abstracting away the blockchain complexity of moving tokenized assets across different chains and ensuring atomic cross-chain DvP.”

7/ Leading Australian bank @ANZ_AU worked with Chainlink to demonstrate how CCIP can enable secure and efficient cross-chain tokenized asset settlement.https://t.co/kD14TFuwiB pic.twitter.com/3Hqp4Pn71F

— Chainlink (@chainlink) October 2, 2023

Chainlink and SWIFT

Oh, and by the way, ANZ isn’t the only one of its ilk sniffing around Chainlink. In June, SWIFT announced it was testing blockchain interoperability with several other financial institutions on the Chainlink network.

In a recent CNBC interview, Chainlink creator Sergey Nazarov confirmed that the SWIFT collab was going to plan.

“All the key goals we wanted to achieve were achieved. We were able to use SWIFT messages, a widely used existing banking standard for initiating blockchain events through CCIP, the cross-chain interoperability protocol made by the Chainlink network,” said Nazarov.

❤💛💚💙

(Clip)

What is SWIFT?

Sergey, #ChainLINK creator, explains what it is, and also shares why $LINK was chosen by the Bug Overlords.

ChainLINK is the Chosen One to help Trillions of Dollars pump our Crypto Bags. pic.twitter.com/8sNUlpkoD3

— yourfriendSOMMI ❤️💛💚💙 (@yourfriendSOMMI) October 2, 2023

Cool, Chainlink, we get it. What about Kaspa?

More to the point, what IS Kaspa?

It’s yet another layer 1, open-source, decentralised blockchain, but based on a Directed Acyclic Graph (DAG) Proof of Work model (unlike Ethereum and Solana’s Proof of Stake).

It calls itself the ‘fastest and most scalable instant confirmation transaction layer ever built on a proof-of-work engine’, and for that reason, in a sense, probably reckons it’s a new, improved version of Bitcoin.

Its fans certainly seem to believe that…

$KAS #Kaspa is the new hotness in the crypto game, utilizing cutting-edge DAG technology and blockchain similar to Bitcoin, but with a faster and more efficient model. It's like a hyperdrive engine for crypto, saving tons of time and resources.#Bitcoin #Crypto #Ethereum pic.twitter.com/jANtBjGC75

— Kasfinex (@Kasfinex) October 2, 2023

In any case, what drove its price pump in September? Possibly some growing hype after what looks like a successful crowd fund capital raise finished in early August.

✅The Tier-1 Exchange Crowdfund for #Kaspa has been successfully completed, thanks to your immense support! More details coming soon.

👨🏽💻The $KAS browser wallet crowdfund is still live.

Let's keep the momentum going!Let's continue to shape the future of finance.… pic.twitter.com/8Oda5yivFA

— Kaspa (@KaspaCurrency) August 2, 2023

📢What you've all been waiting for and so graciously helped make possible! #Kaspa is excited to announce the upcoming listing of $KAS on @Bybit_Official spot trading platform!

🗓 Listing time: 10:00 AM September 7, 2023 UTC

Join the event: https://t.co/X7qrAxZKkG #TheCryptoArk… pic.twitter.com/0aqqHPoPa0

— Kaspa (@KaspaCurrency) September 6, 2023

KAS is yet to hit Coinbase or Binance, but it’s managed to nail down listings on a few other prominent exchanges, including Bitget and ByBit among others.

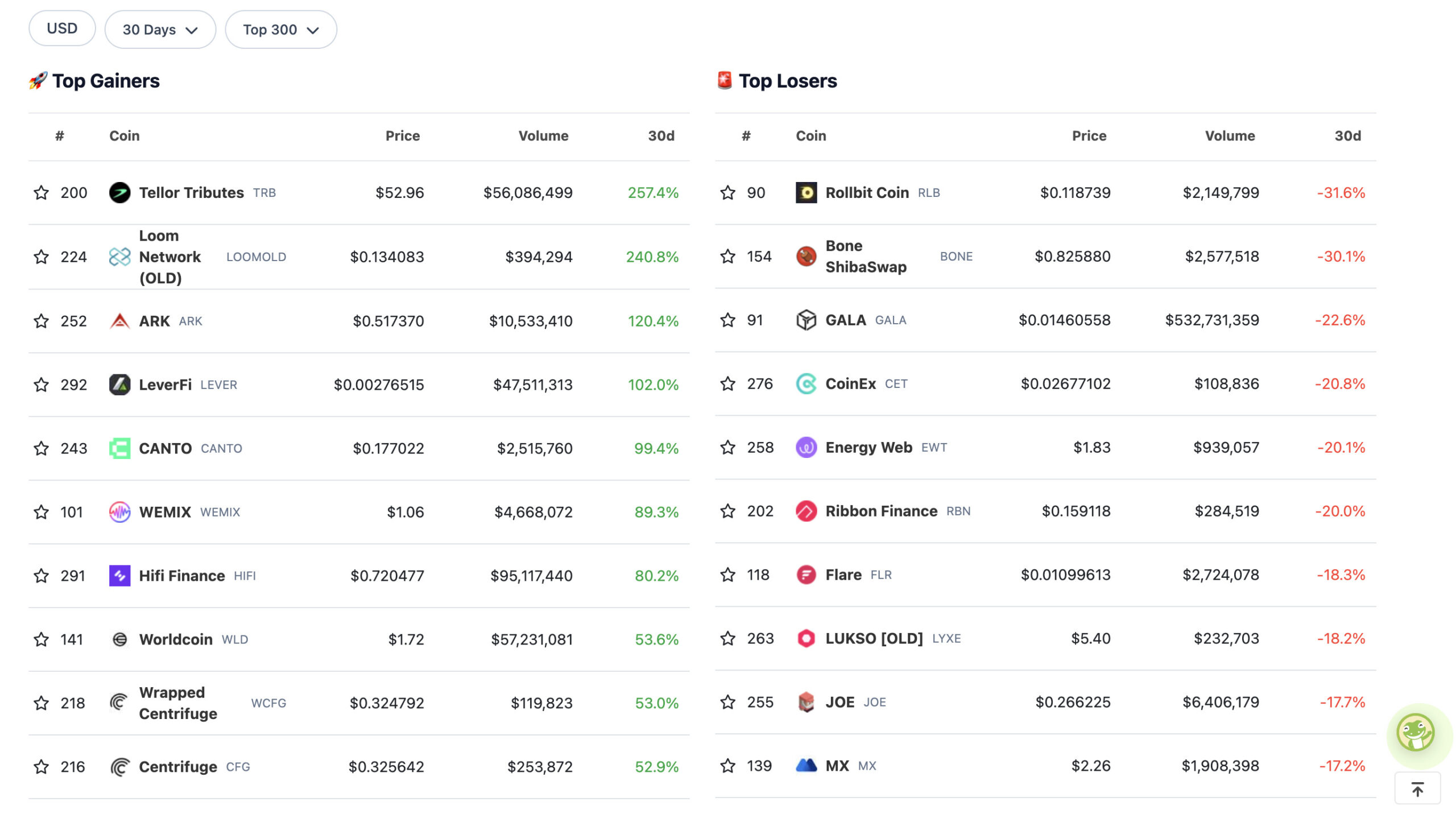

September’s top 10 (in the top 300 by market cap)

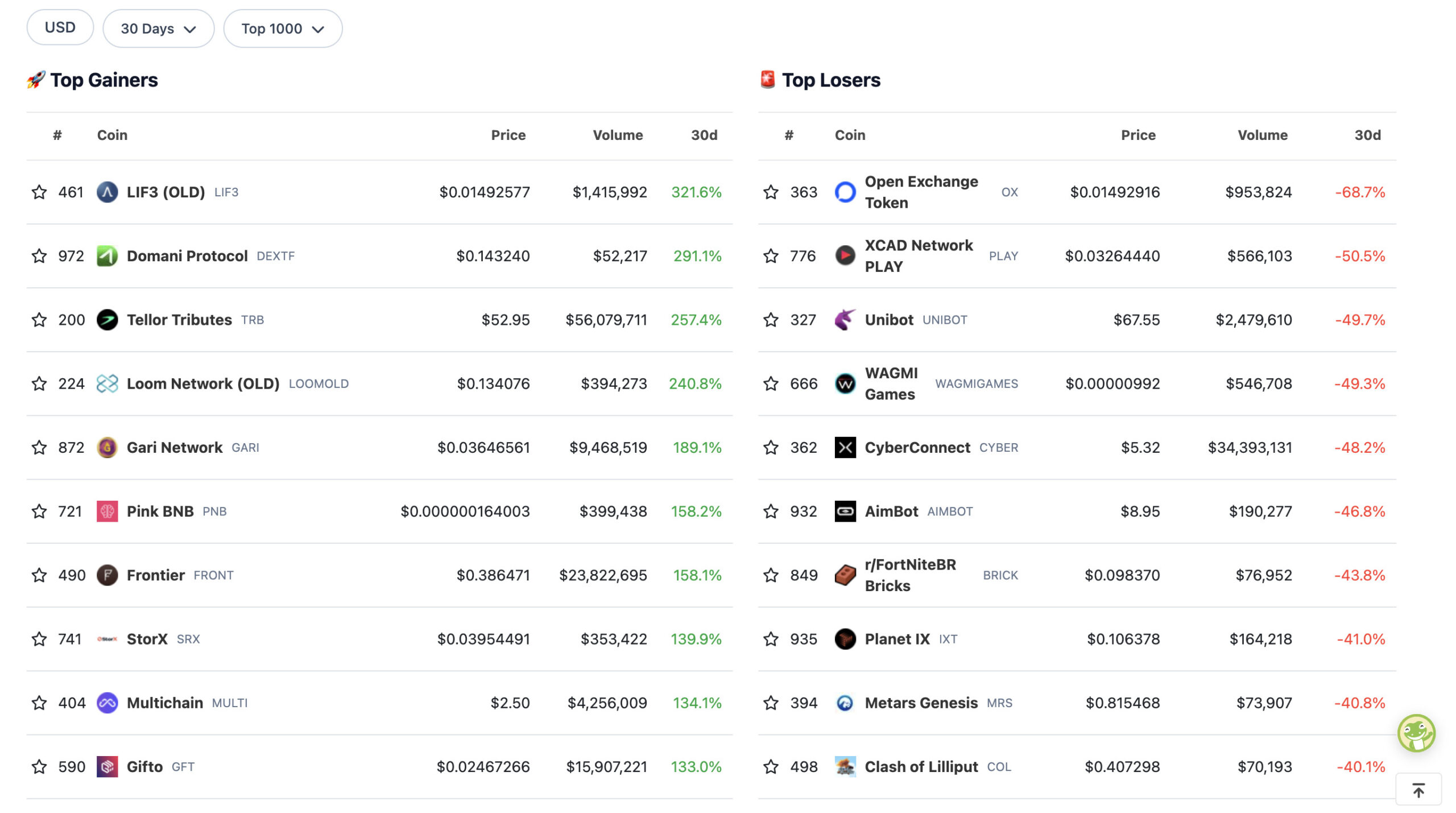

September’s top 10 (in the top 1,000 by market cap)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.