SelfWealth to offer crypto trading by end of 2021; TitanSwap, Axie Infinity hit fresh ATH

Getty Images

Low-cost share trading platform Selfwealth (ASX:SWF) says it is on track to roll out a cryptocurrency investment option to its clients by year-end. Hopefully by then, Bitcoin and Ethereum will have broken out of the tight trading pattern they’ve been trapped in for over a month now.

The Melbourne fintech said in its quarterly report that it is negotiating with several cryptocurrency exchanges to add the investment option to its product suite as part of a strategy to diversify its offerings.

Since SelfWealth launched access to United States shares in December in partnership with global wholesale stockbroking provider PhillipCapital, 29 per cent of the company’s 95,189 customers have bought US securities.

“SelfWealth’s strategy is to be the first investment platform to offer CHESS sponsored share trading on the ASX, US trading and cryptocurrency access to Australian investors,” the company said.

“We want to make investing for our customers as seamless as possible,” SelfWealth CEO Cath Whitaker said.

“Currently, moving between popular investment types usually requires access to multiple trading platforms and for investors to move money multiple times.”

SelfWealth recently surveyed 3,500 of its customers and found 30 per cent were already investing in cryptocurrency, with another 38 per cent intending to invest.

“Australians have decided that cryptocurrency is here to stay and are looking for trusted platforms to facilitate their investment decisions,” Whitaker said.

Access to other international markets, including Hong Kong, is also expected to come in the December quarter.

The company is also rolling out a user experience (UX) update to its website this quarter that will include instant payments and live data.

SelfWealth held $523 million in client cash and $5.86 billion in securities for its clients at the end of the June quarter, the company’s second-best quarter on record.

It is the second-largest non-bank share trading platform in Australia, offering flat-fee A$9.50 ASX and US$9.50 US trades.

Top cryptos listless but TitanSwap, Axie Infinity hit ATH

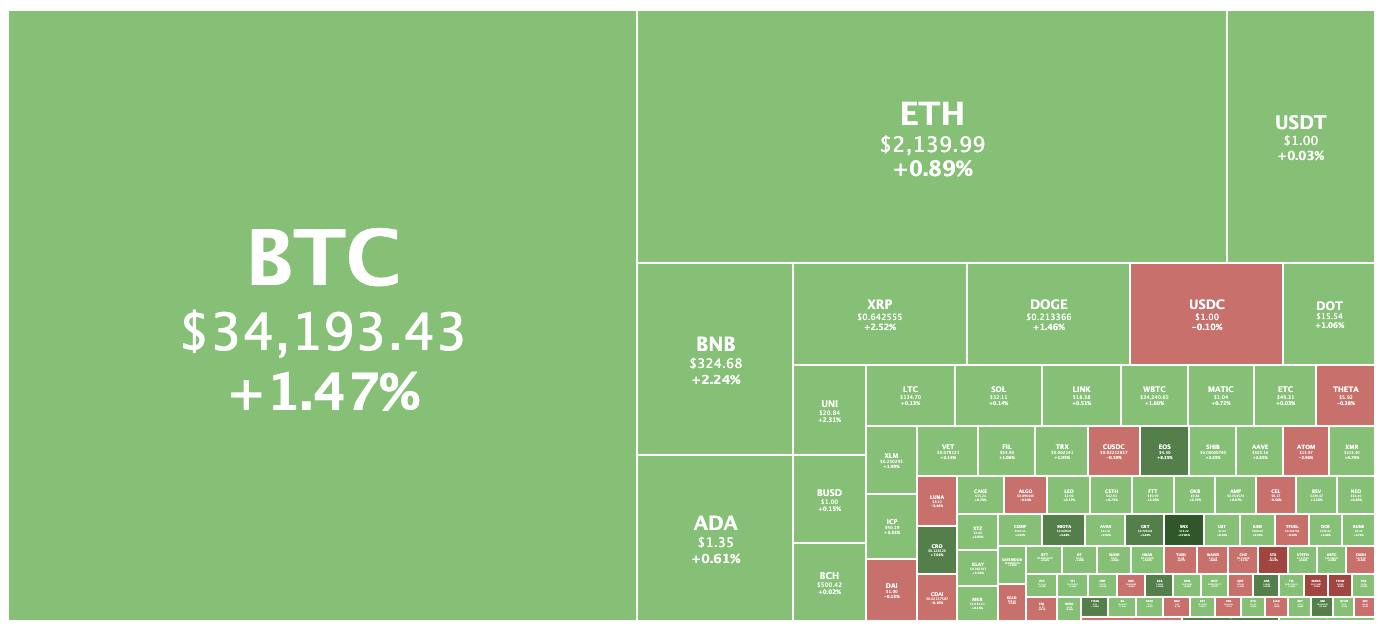

Meanwhile, Bitcoin and Ethereum are still range-bound, as they have been for weeks.

Bitcoin was changing hands for US$34,253 at 12.05pm AEST, up 1.6 per cent from 24 hours ago, while Ethereum was trading at US$2,141, up 0.9 per cent.

Synthetix Network Token was the biggest gainer in the top 100, up 17.5 per cent, followed by ECOMI, up 11.8 per cent.

TitanSwap, the No. 3 gainer, was up 11.1 per cent to US$9.13, and had hit an all-time high of US$9.56 over the weekend.

The token is used to power a namesake exchange that features a bridge between the Ethereum and Binance Smart Chain networks.

Axie Infinity hit an all-time high yesterday as well, of US$19.63. The ASX token was trading at US$18.05 this afternoon, up 7.4 per cent. Stockhead wrote about the gaming token on Thursday, when the coin was trading at $14.

According to Coingolive, the only other top 100 coins to reach all-time peaks since the May 19 crash are Quant, Amp, Theta Fuel, Celsius Network and Helium.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.