Crypto roundup: ProShares Bitcoin ETF makes strong start on NYSE; market steady

Getty Images

The ProShares Bitcoin futures exchange-traded fund (BITO) is up and running, trading on the New York Stock Exchange. So far, it hasn’t been the sell-the-news event some have predicted.

In fact, according to experts, including Bloomberg’s senior ETF analyst Eric Balchunas, it’s off to a bit of a flyer, even if this isn’t dramatically reflected in the actual price of Bitcoin at the time of writing.

Balchunas has been tweeting about it all afternoon (guess it’s his job), and chronicling BITO’s progress. Here are his thoughts on the new financial product’s performance in its first hour of listing…

$BITO has officially passed $BUZZ in opening day volume w/ $440mil so far, making it the biggest new launch of 2021 by that measure. Is now #7 on all time list (and #1 if you filter out the massive seed ones). All that in UNDER AN HOUR. pic.twitter.com/mHT5OgGVGx

— Eric Balchunas (@EricBalchunas) October 19, 2021

$BITO officially over half a billion in volume. Almost all of it is small trades. Unknown how much natural vs some flipping. The spread is a penny wide and the price is moving in line with its INAV (which is good). pic.twitter.com/v8r9q7O2AH

— Eric Balchunas (@EricBalchunas) October 19, 2021

Meanwhile, others were decrying the lack of “shadowy super coder” types among the bell-ringing ProShares crew…

https://twitter.com/samvolkering/status/1450476985386418176

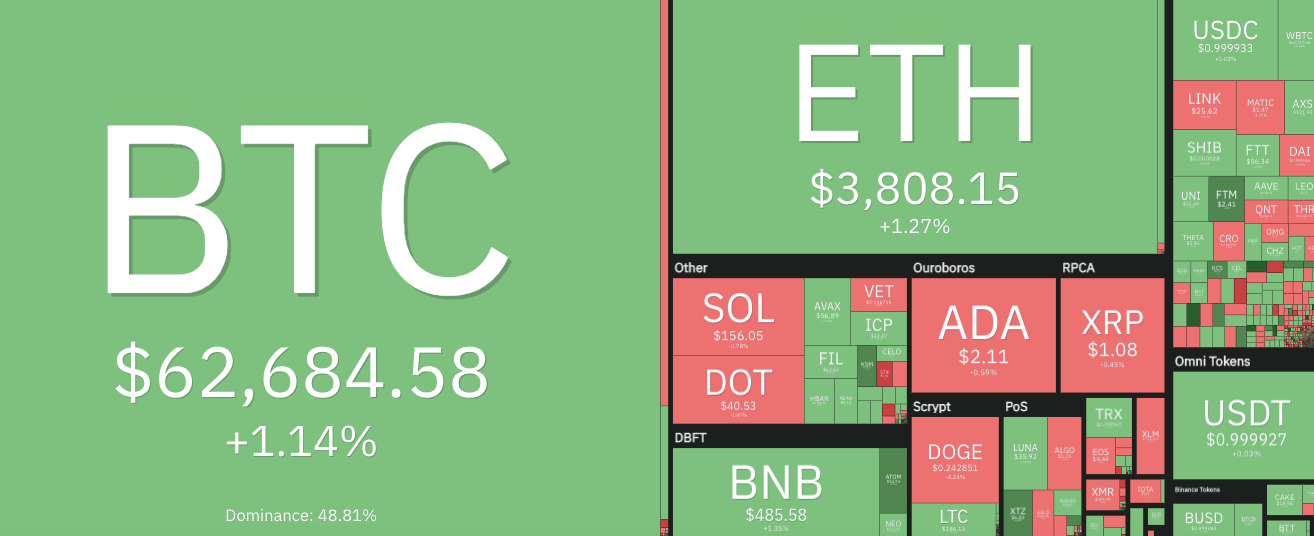

But more importantly, let’s check in with the OG asset itself. At the time of writing, Bitcoin (BTC) is changing hands for US$62,719, up 1.15 per cent since this time yesterday, but down a bit on its daily high, which was US$63,432, hit about 14 hours ago in the froth leading up to the ETF.

Sell the news? Nah, not at this point – Bitcoin just appears to be chopping around as per usual. Let’s give it a few more hours and/or days to properly assess the effect of this ETF, however, and others to come.

As for the US Securities Exchange (SEC), the regulator that’s essentially green-lit this ETF, its boss Gary Gensler has taken the time to remind us all that he’s all about investor protection.

“We should ensure, to the best we can, to bring projects into the investor-protection perimeter,” said Gensler on the approval of ETF futures over spot-backed BTC ETFs. “Bitcoin futures have been overseen by the sibling agency CTFC for four years. That’s wrapped inside the 1940 Act, which brings it inside investor protection.”

Ah yes investor protections from 79 years ago when you had to send a carrier pigeon to distribute information. We all have the Internet and ability to learn about whatever we want in a matter of seconds. Let us free

— 1.hbar | 18th.eth (@thefarklord) October 19, 2021

This #ETF news is exciting for mainstream adoption but let’s all encourage people to buy #Bitcoin directly and learn to self-custody. 🚀

— Natalie Brunell ⚡️ (@natbrunell) October 19, 2021

Also making news: Coinbase, Facebook, Epic Games, Square

Here are some recent, pretty significant news bites from the past few days that have possibly been a little lost amid all this US Bitcoin ETF noise…

• Coinbase shares (NASDAQ:COIN) have risen sharply on the news the crypto exchange will be Facebook’s official custody partner for the social media giant’s Novi digital wallet.

• While gaming-store giant Steam has banned from its app games built with blockchain, Fortnite creator Epic Games says it’s “open to games that support cryptocurrency assets.”

• New York Attorney General Letitia James has ordered two crypto-lending platforms to cease operations in the state of New York. They are reportedly Nexo and Celsius.

• Jack Dorsey and his payments-processing company Square is reportedly considering creating an open-source Bitcoin mining system using “custom silicon”.

Square is considering building a Bitcoin mining system based on custom silicon and open source for individuals and businesses worldwide. If we do this, we’d follow our hardware wallet model: build in the open in collaboration with the community. First some thoughts and questions.

— jack (@jack) October 15, 2021

Mooners and shakers

Nothing much of significance to report in the top 10 cryptos by market cap today, although Dogecoin (DOGE) is down by about 5 per cent since this time yesterday. Still, it’s Australia’s fourth-most-widely adopted crypto according to a Finder survey, so that’s gotta count for something…

Moving further down the list, two “layer 1” smart-contract blockchains are both up by about 10 per cent in the past 24 hours at the time of writing. And these are Cosmos (ATOM), currently changing hands for US$34.31; and Fantom (FTM), which hit its all-time high of US$2.48 just a few hours ago.

The FTM surge may have something to do with the launch of a new cross-chain bridge project by SpiritSwap (SPIRIT), a leading decentralised exchange within the Fantom ecosystem. The bridging protocol allows users to send assets between Binance Smart Chain, Ethereum, Polygon, and Fantom.

Our SpiritBridge is now open! 🌉

Users can now bridge from:

BSC

MATIC

ETHDirectly to FTM via @Spirit_Swap bridge.

LET THE GREAT MIGRATION COMMENCE

Comment below to let us know of any other chains you want added to the SpiritBridgehttps://t.co/VCU7E3B8Wx pic.twitter.com/Ec0luSiEPt

— SilverSwap (@SilverSwapDex) October 19, 2021

Elsewhere in the market cap lists, Livepeer (LPT) is still pumping hard, as reported earlier by Stockhead. It’s up 28.67 per cent on the day at press time, and +53 per cent across the past seven days.

And others having a good double-digit percentage day include: Wonderland (TIME), +18%; API3, +17.5%; Parsiq (PRQ), +16.5%; and insurance play Nexus Mutual (NXM), +14%, among several others.

Maybe a tweet from Nexus Mutual founder Hugh Karp has encouraged more women to enter the crypto space and ape into smart-contract insurance-based applications? Either way, he makes a salient point…

Apart from just being the right thing to do we need to encourage more women building in crypto.

We can't expect to improve entire industries without taking a diverse and inclusive approach. https://t.co/F3l7nrzJTk

— Hugh Karp 🐢 (@HughKarp) October 19, 2021

And finally, we topped this news bulletin with Bitcoin, so let’s tail it with the OG crypto, too. A bit more hopium for you, if you didn’t already have enough…

Analyst MICKrypto has spotted a golden cross involving the 100-day and 200-day simple moving averages. This can be a bullish signal, although not always. The last time it happened, however, it preceded a classic BTC moon mission.

“History never repeats… but it often rhymes.” Mark Twain said that.

$BTC Golden Cross#Bitcoin will see a Golden Cross between the 100-day and 200-day SMAs tonight!

The last time we saw this happen we saw a 640% pump!#BTC pic.twitter.com/KaeQTUFy3U

— The Thrive Index. (@TheThriveIndex) October 18, 2021

$BTC V-shape recovery.

Last time we saw this price action this bullish was October – January. pic.twitter.com/0bOyaLEjkF

— Johnny (@CryptoGodJohn) October 19, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.