Risk on, risk off: Crypto’s top stablecoins hold more US Treasury debt than Warren Buffett’s Berkshire Hathaway

HODLer: Warren "Mr T-Bill" Buffett. (Getty Images)

Warren Buffet has reportedly been pivoting most of Berkshire Hathaway’s cash position into US Treasury bills (T-Bills) of late. He’s in company with crypto’s leading stablecoins, then.

In fact, in one sense, you can even claim that this significant, DeFi-enabling sector of crypto is higher up TradFi’s risk-off list than Buffett and his crypto-hating cronies.

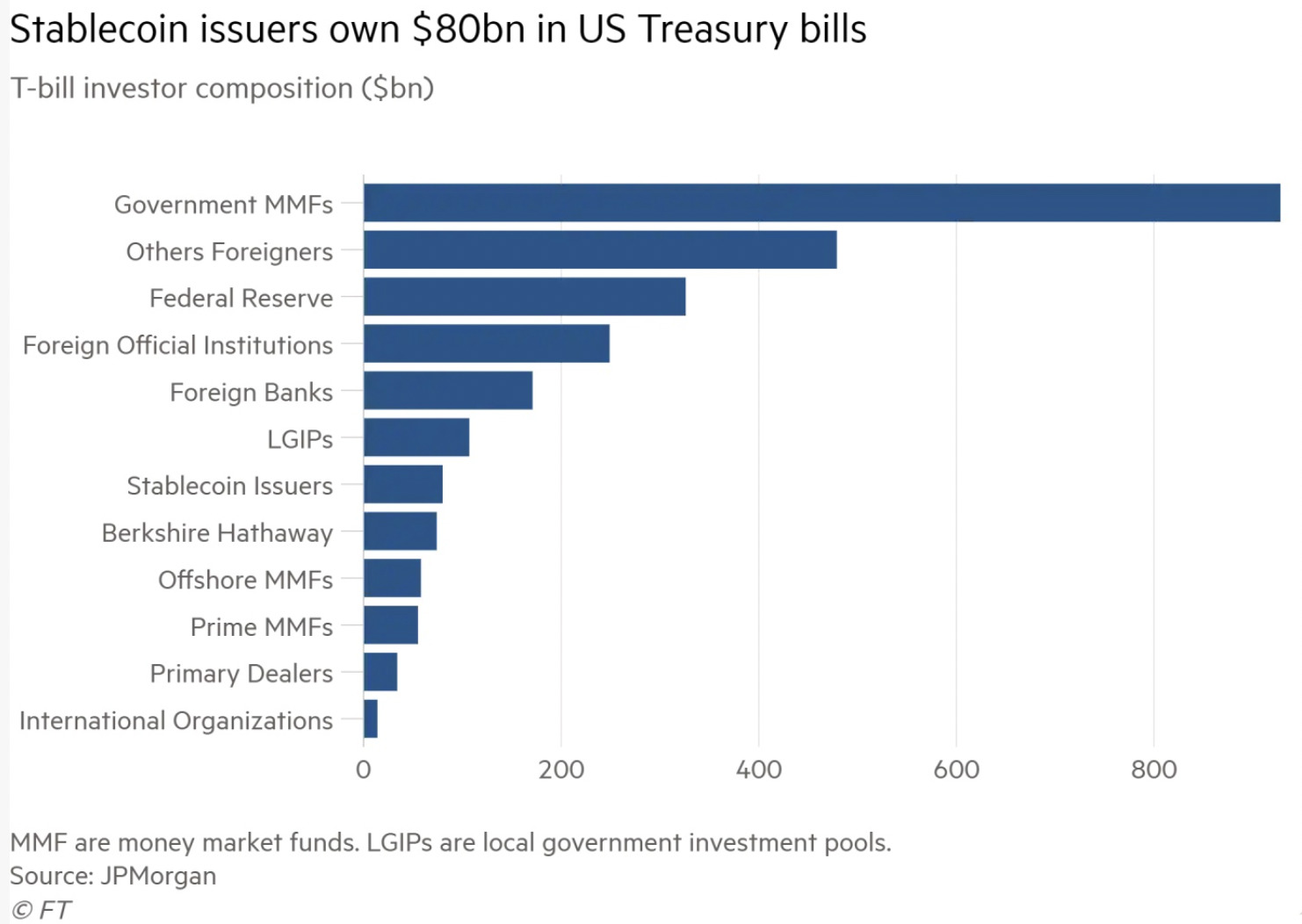

According to the Financial Times, referencing a recent JP Morgan report, the likes of Tether (USDT) and USD Coin (USDC) collectively held about US$80 billion worth of T-Bills – the American government’s short-term debt vehicle – as of May this year.

Berkshire Hathaway, meanwhile, reportedly had a net cash position of US$105 billion as of June 30, of which US$75 billion was held in the Treasury debt assets, up from US$58.53 billion at the start of the year.

T-Bills are used by companies as a cash equivalent on corporate balance sheets and are widely regarded as low-risk and secure investments.

Buffet’s move is seen by many as a particularly high-allocation safety play in the face of the Fed’s rate-hiking spree and a macroeconomic climate that’s cloudier than the bottom of a Coopers Original Pale Ale.

Meanwhile, for their part, USDT’s Tether, and Circle, the issuer of USDC, have both vowed to buy more US Treasury bills in order to reduce their allocation to commercial paper – the far riskier, unsecured short-term debt form of cash collateral.

Tether, in particular, has come under fire and scrutiny for a lack of transparency regarding its reserves. However, the company’s most recent quarterly statement assured that the percentage of commercial paper in its reserves was decreasing and its reserves were fully backed.

Circle’s latest monthly asset breakdown (as of June 30) actually reveals that USDC is fully backed by cash (US$13.6 billion) and three-month Treasury bills (US$42.1 billion).

Its cash pile is held at various US-regulated financial institutions, including Bank of New York Mellon, Citizens Trust Bank, Customers Bank, New York Community Bank and US Bancorp among others.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.