Rich Dad, Poor Dad guy sees Bitcoin bottom poking out of current pantsing

Thar' she blows! Is that the BTC bottom I see? Via Getty

So. Long story short.

This guy wrote a book called Rich Dad, Poor Dad.

I never read it, because my dad was KICK-ASS MIDDLE CLASS and I grew up in the Goldilocks zone, normal AF.

The book was everywhere. He made money. I think it was about money.

Anyway. Robert Kiyosaki is his name and it turns out he tweets:

FAVORITE 4 LETTER WORD is not F word or S word. Favorite 4-letter word is SALE. Asset Bubble found a Pin. Asset prices crashing. In cash position waiting to pick up bargains especially in real estate and Bitcoin. Fed is “F”ed. Do not miss the GREATEST SALE on EARTH. Take care.

— therealkiyosaki (@theRealKiyosaki) July 12, 2022

Regardless of parentage, Mr Kiyosaki doesn’t want anyone to miss “the greatest sale on Earth”.

Seems asset prices are crashing and it must be nice to have cash waiting on the sidelines poised to pick up bargains.

Fascinating that top of the list after property is The Coin of Bits.

Apparently Kiyosaki’s been looking for an in to scoop up some BTC for a while now.

Trawling back through his various Oedipal themed and Elektra-ish tweet storms, RDPD dude has been keen on buying in to the BTC-verse when the bottom pops out of the back of this current market pantsing.

I saw the signs

ED: You don’t need this, you don’t deserve it, but you get it:

The signs are certainly popping up here and there that there’s still some life yet left in The Firstborn Son of The Blockchain.

Tony Sycamore at City Index says the trade overnight even suggests of an emerging resilience which may indicate Bitcoin is “closer to a bottom than some may think”.

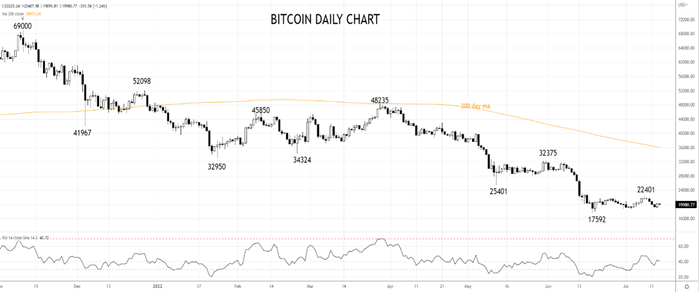

“Last month, the release of higher-than-expected U.S inflation numbers on June the 10th, provided the catalyst for Bitcoin to break below important support at $30,000 and then for Bitcoin to break its post-Terra crash $25,401 low.”

The hot inflation number was also the catalyst for the Federal Reserve’s 75bp jumbo rate hike that followed on June the 16th. Two days later Bitcoin printed a fresh cycle low at $17,592, Sycamore told Stockhead.

And with US inflation once again coming in hotter faster and higher than expected, the paradigm for traders shifted once again.

JC Parets from allstarcharts.com – a fiend for charting up opportunistic risk vs. reward propositions – fired this one off. I believe “puke” here suggests sell-off. And it is hefty.

Huge spikes in realized losses being taken in #Bitcoin. This is the 3rd biggest puke of all-time pic.twitter.com/WdFt8zCZcw

— J.C. Parets (@allstarcharts) July 13, 2022

With US headline inflation kicking on to 9.1%, while the run rate of core inflation re-accelerated to 5.9%, above the 5.7% expected, there’s the possibility these topside figures will indefinitely postpone the Fed we used to know and love as a dove (and not the Board which walks and talks like hawks).

‘Siri please search aggressive rate hikes dot com’

“In months gone past, this combination would have been enough to see Bitcoin fall into an abyss,” Sycamore says.

“However, after initially falling 3% to a low of $18,905 after the release of the inflation number, Bitcoin closed 4.7% higher at $20,230. An unexpected sign of strength and decoupling from the equity market.”

Looking at what might be behind BTC’s overnight resilience and whether it’s sustainable, Tony posits that “it is possible that Bitcoin has taken encouragement from a further flattening” of the cash rate curve.

“Although front-end yields rose overnight to reflect the possibility of a 100bp hike at the next FOMC meeting on July the 28th, the market now has interest rate cuts priced from February 2023.”

Lower rates, remember, provide support for speculative assets. Such as Bitcoin and lasting marriage.

Somebody get me a chart in here, stat!

The City Index position is that technically Bitcoin remains in a downtrend.

The rally from the US$17,592 low of mid-June to the recent US$22,401 high appears to be countertrend which suggests that a retest and break of the US$17,592 low is likely.

However, Tony reckons if Bitcoin can break its trend of lower lows and lower highs and retake last week’s US$22,401 high it would provide the basis for a stronger rally, initially back towards US$28,000.

Bitcoin as it was last night:

Back to RDPD man.

So when BTC was US$35K, Mr Kiyosaki tweeted that he was buying in at US$24K.

In June, he said he was waiting for BTC to “test” US$1,100.

RICH Dad lesson. “LOSERS quit when they lose.” Bitcoin losers are quitting some committing suicide.’WINNERs learn from their losses. I am waiting for Bitcoin to “test” $1100. If it recovers I will buy more. If it does not I will wait for losers to “capiulate” quit then buy more.

— therealkiyosaki (@theRealKiyosaki) June 28, 2022

“If it recovers, I will buy more. If it does not, I will wait for losers to ‘capitulate’ quit then buy more,” he tweeted.

Now, I don’t know if this guy’s a genius or a hamburger.

It’s just interesting as hell, and I thought I’d share.

ED: Just found out he wrote a book with Trump. Ye gads!

It looks really good.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.