‘Probably nothing’: Mastercard buys crypto intelligence firm CipherTrace

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Mastercard has made another significant move into the world of digital assets, buying the leading crypto intelligence company CipherTrace for an undisclosed sum.

Cue the “probably nothing” Twitter comments from CryptoPunk-profile-pic-sporting industry participants? Yep, there’s one…

https://twitter.com/mdudas/status/1435971053726146566

The multinational card payments giant made the announcement on Thursday (September 9) via a press release and revealed it aims to use the analytics capabilities of the Califorina-based crypto firm to enhance security and fraud detection in digital assets.

Commenting on the acquisition, the president of Cyber & Intelligence at Mastercard, Ajay Bhalla, said:

“Digital assets have the potential to reimagine commerce, from everyday acts like paying and getting paid to transforming economies, making them more inclusive and efficient.

“With the rapid growth of the digital asset ecosystem comes the need to ensure it is trusted and safe. Our aim is to build upon the complementary capabilities of Mastercard and CipherTrace to do just this.”

According to the press release, Mastercard views this acquisition as an important part of its strategy to merge its own cards-sector data intelligence with the rapidly growing crypto space.

Dave Jevans, CEO of CipherTrace, meanwhile said: “We help companies – whether they are banks or cryptocurrency exchanges, government regulators or law enforcement to keep the crypto economy safe.

“Our two companies share this vision to provide security and trust throughout the ecosystem. We are thrilled to join the Mastercard family to scale CipherTrace’s reach across the globe.”

I am proud to announce that @CipherTrace is being acquired by @Mastercard. This will bring a new era of legitimacy to cryptocurrencies and digital assets, and will extend our capabilities to 20,000+ banks, crypto companies and governments.https://t.co/9ecbkzYIIR

— Dave Jevans (@davejevans) September 9, 2021

Mastercard’s crypto moves

By integrating a solution like CipherTrace to help detect and avoid crypto fraud, it seems likely that this is also a compliance play by Mastercard to stay well ahead of increasingly zealous US regulators targeting various aspects of the crypto space.

Mastercard has been increasingly deepening its movement into crypto and blockchain this year. It recently made other significant crypto-related investments, including: launching an accelerator program for cryptocurrency startups, and partnering with Gemini and WebBank to create crypto rewards cards.

In February, the card payments firm announced its intention to support cryptocurrency payments in 2021 – “for spending, not investment”, hinting stablecoins such as USDC would be the more likely focus.

Mastercard’s biggest rival, Visa, is also well in the crypto-strategy game, having partnered with more than 50 cryptocurrency companies, including FTX and Coinbase, to issue payment cards and support stablecoin payments.

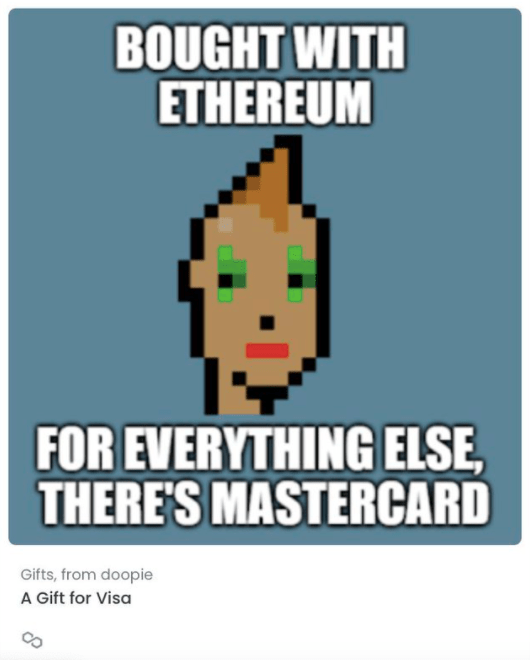

Visa even recently bought a CryptoPunk for US$150,000.

Will Mastercard ape in with an NFT avatar purchase or two next? A million-dollar rock jpeg perhaps? Nothing surprises in crypto any more.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.