OpenSea listing bug sees Bored Apes and other NFTs nabbed for dirt-cheap prices

Shocked Ape Yacht Club? (Getty Images)

At least one “sniper” has taken advantage of a bug on the non-fungible token (NFT) marketplace OpenSea, buying high-value NFTs for a fraction of their most-recent listing prices and selling them for huge profit.

Bored Apes, Cool Cats, CryptoPunks, Fidenzas… these are non-fungible token (NFT) “blue chips” and right now their owners are in potential danger of losing them for a fraction of what they’ve come to be worth.

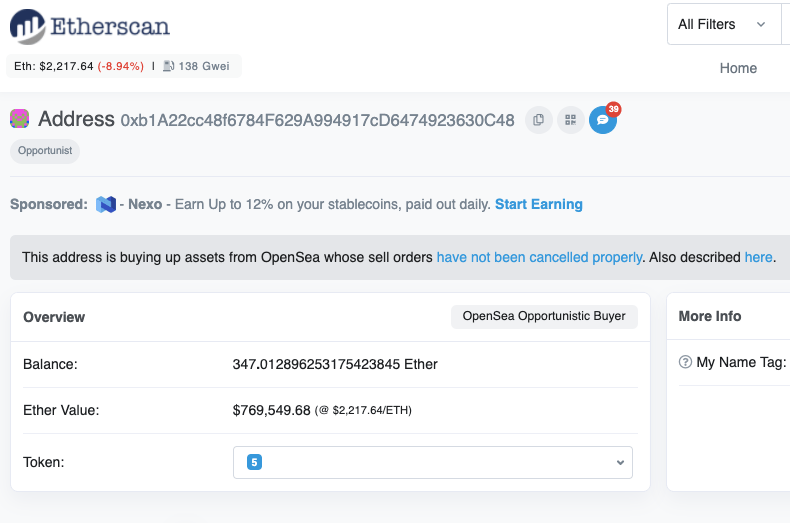

Labelled “OpenSea Opportunistic Buyer” on the Ethereum Block Explorer transactional data platform Etherscan, it appears the opportunist has so far made about 332 ETH, (roughly US$754,000) from the quick trades.

— jalapenocheetos (@bhsu168) January 24, 2022

According to CoinDesk an OpenSea user called jpegdegenlove, who only created the account this month, seems to be behind the trades.

Apparently this has been an issue waiting to become a major problem since at least December 2021, when the founder of NFT projects freshdrops_io first alerted Crypto Twitter to the bug.

What’s reportedly been happening is linked to the fact that some NFT holders have been moving their listed assets off OpenSea to other wallets in a workaround that lets them avoid an expensive delisting fee.

By sending these NFTs back to their original ETH addresses, however, it appears the NFTs are effectively then recognised as still being listed through the back end of OpenSea’s API only and accessible to see via Rarible (another prominent NFT marketplace, which aggregates listing orders from OpenSea).

The worst part about that, though, is that the blockchain recognises this back-end listing at the NFT’s original listing price, which in many cases might be far lower than the price at the point the owner thought they were delisting the asset.

This allows anyone sharp enough to jump in and make quick buys and sales of any affected blue-chip NFTs now showing inordinately low prices compared with their most recent market value or listed price – all for potentially hefty profit.

The well-known Aussie (possibly) Bitcoin trader and Twitter identity “Crypto Bitlord”, shot out an urgent warning to his 193k+ followers, breaking it all down.

⚠️⚠️⚠️ WARNING ⚠️⚠️⚠️

MAJOR OPEN SEA BUG ALLOWING HACKERS TO STEAL YOUR #NFTS 🚨

-Please check your listings were taken down appropriately or you can be scammed instantly but the hackers.

Check my RT and also listen up 👇 pic.twitter.com/qBtIgmw6cL

— Crypto Bitlord (@crypto_bitlord7) January 24, 2022

Some of the assets affected so far include Bored Apes (Bored Ape Yacht Club), Mutant Ape Yacht Club, Cool Cats, CyberKongz, and Universe of Women.

One Bored Ape was listed under its old July 2021 price of 23 ETH, and the opportunist was able to sell it for 130 ETH, making a profit of more than 100 ETH, according to Tal Be’ery, the CTO of ZenGo crypto wallet.

1/ Seems related to the issue reported by @yakirrotem (h/t @OurielOhayon ):

Attackers were able to abuse old NFT listings to buy them in the old price then sell in the new price.

Lets take a look at the most lucrative asset sold by attackers for ~130ETHhttps://t.co/GE7bi8GA89 https://t.co/eyViNWSpl2 pic.twitter.com/eGnVpDQQer— Tal Be'ery (@TalBeerySec) January 24, 2022

Any NFT holders who’ve attempted to delist in this problematic way and suspect they’re now vulnerable to this exploitable quirk should immediately check on Rarible to see if their listing has been removed there.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.