‘One-trick pony’ Bitcoin to hit all-time high of more than $80k this year: Finder report

Getty Images

Take this with a tokenised grain of salt, but according to Finder’s latest Bitcoin Price Predictions report, Bitcoin (BTC) should crack an all-time high in 2022, peaking above US$80k.

In fact, Finder’s panel of 35 fintech and cryptocurrency specialists have “done some math” and the averaged-out results show that:

• BTC will peak at US$81,680 (AUD $114,442) in 2022…

• before dropping to US$65,185 (AUD $91,355) by the end of the year.

Bulls, bears and somewhere in between

The Finder poll comprises several crypto and/or financial experts including CoinJar CEO Asher Tan, Origin Protocol founder John Fraser and University of Canberra senior lecturer John Hawkins. And there’s a fair old mix of bullishness and bearishness spread among them, as you’d expect.

For instance, Martin Fröhler, CEO of US/Austrian crypto-trading platform, gave one of the most bullish end-of-2022 forecasts, saying: “political uncertainty, inflation, and an ever increasing desire to own non-government controlled assets will propel Bitcoin to new all-time highs”.

Meanwhile CoinJar’s Asher Tan offered a more conservative look into the crystal ball, predicting a BTC peak of US$60k, before dipping a bit to US$56,000 by the end of the year.

“There’s still plenty of uncertainty about the short-term Bitcoin outlook,” said Tan. “Given the macroeconomic headwinds, it would not surprise me to see Bitcoin spend the whole year bouncing around between US$30-60k – the sort of conditions that are terrible for traders, but rewarding for accumulators with a multi-year timeframe.”

As for the panel’s bears, University of Canberra senior lecturer John Hawkins might have the gloomiest outlook for the leading crypto asset, predicting Bitcoin will be worth a mere US$5,000 and US$100 by the end of 2025 and 2030 respectively as it’s overtaken by Ethereum.

“As well as private crypto being replaced by CBDCs, and a general collapse of the speculative bubble, I think Bitcoin will lose out to Ethereum, which has a stronger use case,” offered Hawkins, adding: “[And that’s] especially if Ethereum ever converts to PoS and so becomes more environmentally responsible.”

Bitcoin is… ‘a one-trick pony’?

Hawkins isn’t the only panel member who believes Bitcoin is losing its lustre compared with other digital assets.

In fact, half of Finder’s panel, including Thomson Reuters technologist and futurist, Joseph Raczynski, believes BTC’s position as the no.1 crypto will eventually be usurped by a more advanced blockchain.

“Bitcoin is a one-trick pony,” claims Raczynski. “For now it really only serves as another currency, akin to a dollar, euro, or pound. Other blockchains that serve a multitude of purposes will likely have a chance to take the throne,” he said.

One trick? Maybe. But if Bitcoin’s “gold 2.0” store-of-value proposition plays out, that’s some trick. Not to mention the thought some hold that it could become the world’s reserve currency.

Like Hawkins, though, Raczynski favours Ethereum to become the Bitcoin usurper, which many an ETHhead tends to prophesise as an inevitable event called… (dramatic music)… “the Flippening”.

“[Ethereum] can serve as money, but has created a platform to tokenise all assets and create a massive platform of the internet of value,” said Raczynski, adding: “This is far grander than BTC potentially.”

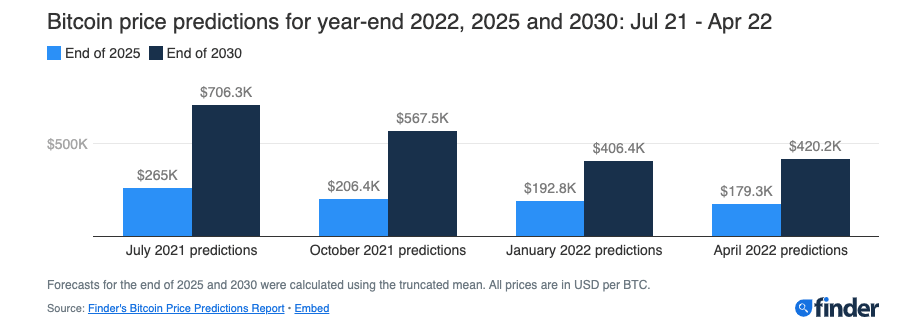

The panel’s price predictions have dipped over time…

Although the Finder panel’s average forecast for the end of 2022 is a good deal higher than the price of Bitcoin at the time of writing, it’s 15 per cent lower than its January prediction of US$76,360.

And the panel’s longer-term outlooks for BTC have also been on the downtrend since October 2021. By 2025, the panel predicts BTC will be worth US$179,280, which, according to the report is a 13% drop from the panel’s October prediction of US$206,351, and a 7% drop from the January forecast of US$192,800.

And the panel’s price predictions for 2030 have also dropped since October. The panel now expects BTC will be worth $420,240 by the end of 2030, which is about 25% lower than their October forecast of $567,472.

… However, now might be a good time to buy

Interestingly, despite the bullish price predictions for Bitcoin waning a little, more than two thirds (67%) of the panel believe now is a good time to buy, with a further 24 per cent saying it’s time to just hodl on.

Only nine per cent of the panel reckons it’s a good time to pull up stumps and get out of BTC.

Panel member Joe Burnett, a Blockware Solutions analyst, views it like this: “Bitcoin is the only asset in the world with no counterparty risk and no dilution risk. It is the world’s best savings technology.”

You can find the full report here.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.