October Crypto Winners: Dogecoin, Tokenize Xchange and Huobi all sprayed the champers

From left: Chad, Buck, Tyler, Randy and Chad. Probably. (Getty Images)

Well, “Uptober” happened. Or did it? Yeah, technically it did, with the October crypto market making a late rally to at least post an overall result that wasn’t a complete and utter bloodbath.

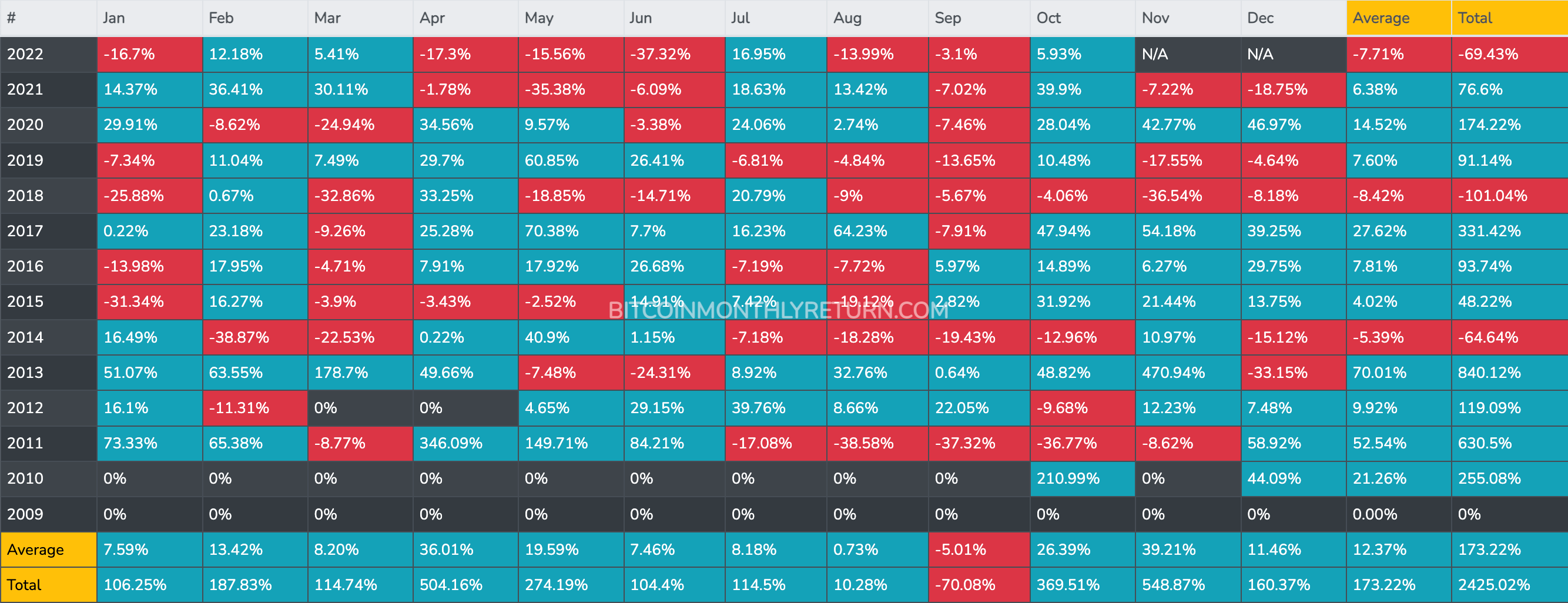

A 5.93% Bitcoin gain. It was “underwhelming, not like a bee sting, more like an itch that never needs a scratch”, to quote Melbourne band The Fauves. But by Christ, in this sh*tty macro climate, we’ll absolutely take that.

Moonvember here we come? It’s got an even better track record than “Uptober” (see chart below), although last year’s effort wasn’t exactly awesome.

There is, of course, some potentially highly significant, ahem, Fed f**kery to navigate first. But before looking too far ahead, let’s take a quick look behind at some of crypto’s best and worst performers for the month just passed.

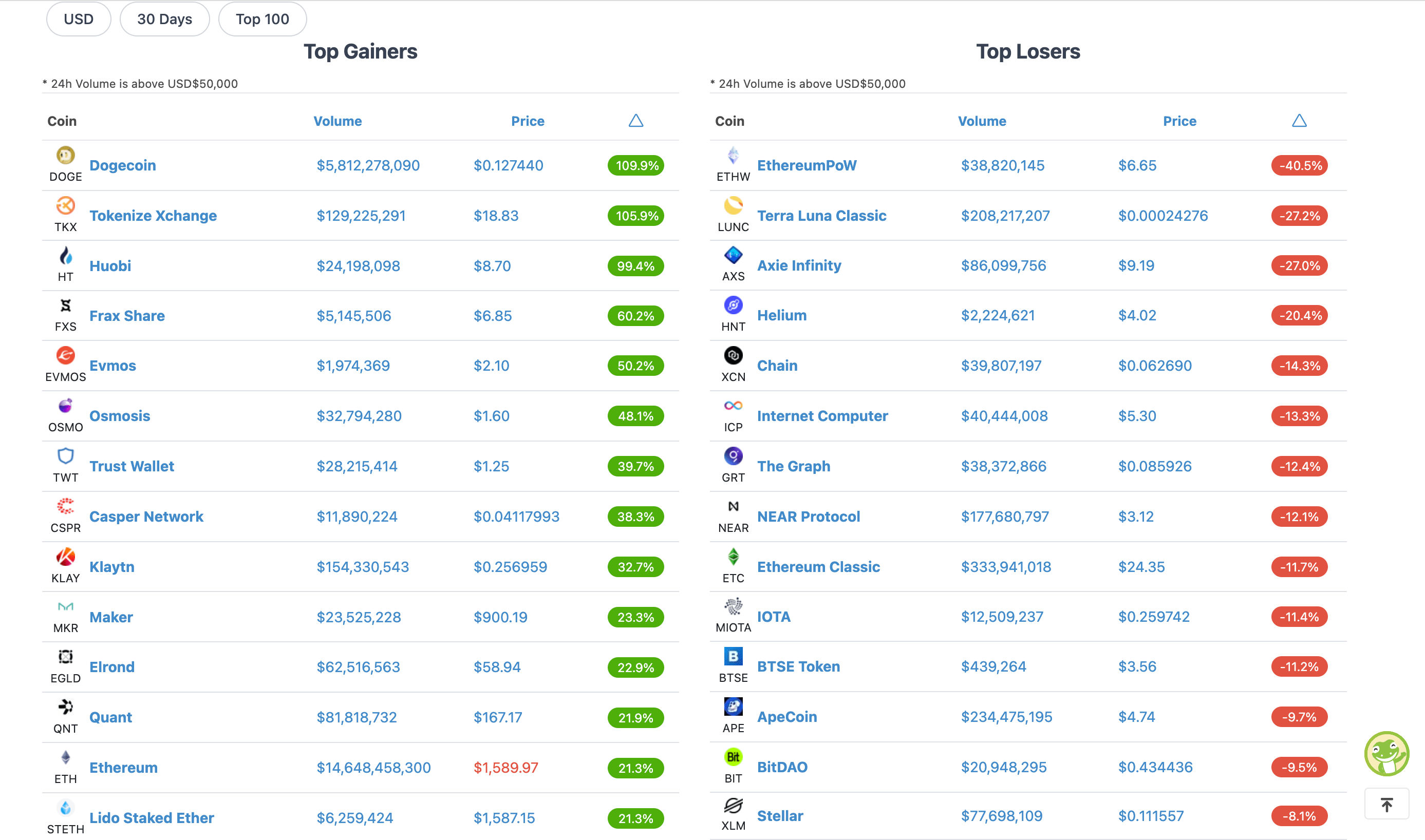

October’s leading gainers and losers in the top 100

DOGE tail keeps wagging

If you’ve been glancing at Mooners and Shakers on a daily basis, or just following Crypto Twitter and/or your portfolio in general, then you’ll know Dogegin (DOGE) has been doing its best over the past week to spur an alt season that may or may not yet materialise.

In fact, the leading meme coin’s performance ever since Elon “Dogefather” Musk took over Twitter late last week might actually be one of the biggest reasons the crypto market has been able to keep its head above the US$1 trillion parapet as we closed out the month.

A bit of froth can beget more froth, particularly when it comes to crypto, and even more particularly when it comes to crypto meme coins.

As for the Dogecoin exuberance, it’s now up 110% over the past 30 days, with the token overtaking star layer 1 protocols Cardano (ADA) and Solana (SOL) in the past few days. Perhaps it’s due a bit of a lie down in its basket/kennel, soon?

For the moment, it’s still riding high on the expectation it will somehow play a central role in a crypto-enabled future for Twitter, now that Bitcoin (BTC) and DOGE holder Elon Musk has the social media platform more or less on a leash.

Tokenize Xchange – the next Binance?

Okay, about time we looked at this one, then. Boring name, but it’s kind of exploded out of seemingly nowhere this month. What is TKX? Glad we finally asked.

It’s not come out of absolutely nowhere – it was founded in late 2017 and is a Singaporean-headquartered crypto exchange.

Another exchange, eh? Boooorrrring. Well, maybe so, but if you take the Binance exchange as the benchmark with its BNB ecosystem token and Binance Chain blockchain, then you can see how powerful a narrative that can be.

It’d be hard to ever replicate BNB’s 832,339.1% gain from its humble beginning – that coin reached its crypto major status for a multitude of early established network-reach reasons during past bull markets.

However, Tokenize Xchange has some pretty lofty goals, including placing a significant part of its focus on reportedly interested institutional investors, and a plan to become “the dominant player in the Web3 world in Asia,” according to the firm’s founder and CEO, Hong Qi Yu.

Huobi – erm, also the next Binance?

Another looming, potential crypto-exchange behemoth, the Chinese-founded, Seychelles-based Huobi (HT), which is run by Huobi Global, also has a strong focus on the frothy, crypto-loving Asian market.

In fact, it now also has offices in Hong Kong (where it’s a publicly listed company), South Korea and Japan, along with the United States.

The HT token pumped this month on the news Huobi Global was acquired by huge Hong Kong investment firm About Capital Management’s M&A fund.

One of the richest blokes in crypto, TRON blockchain founder Justin Sun, was also said to be involved in the purchase, later clarifying his role as an adviser. It’s been reported that Sun has, however, been making some pretty hefty investment into the token of late.

74 million HT of Huobi’s two official wallets have been transferred to two new addresses on October 13, and the first transactions were from Justin Sun’s poloniex. The HT officially held by Huobi may be part of the acquisition of Huobi Exchange and has been handed over to Sun. https://t.co/O3SexjA8io

— Wu Blockchain (@WuBlockchain) October 14, 2022

In any case, HT has crushed it this month, with also a near triple-figure percentage gain.

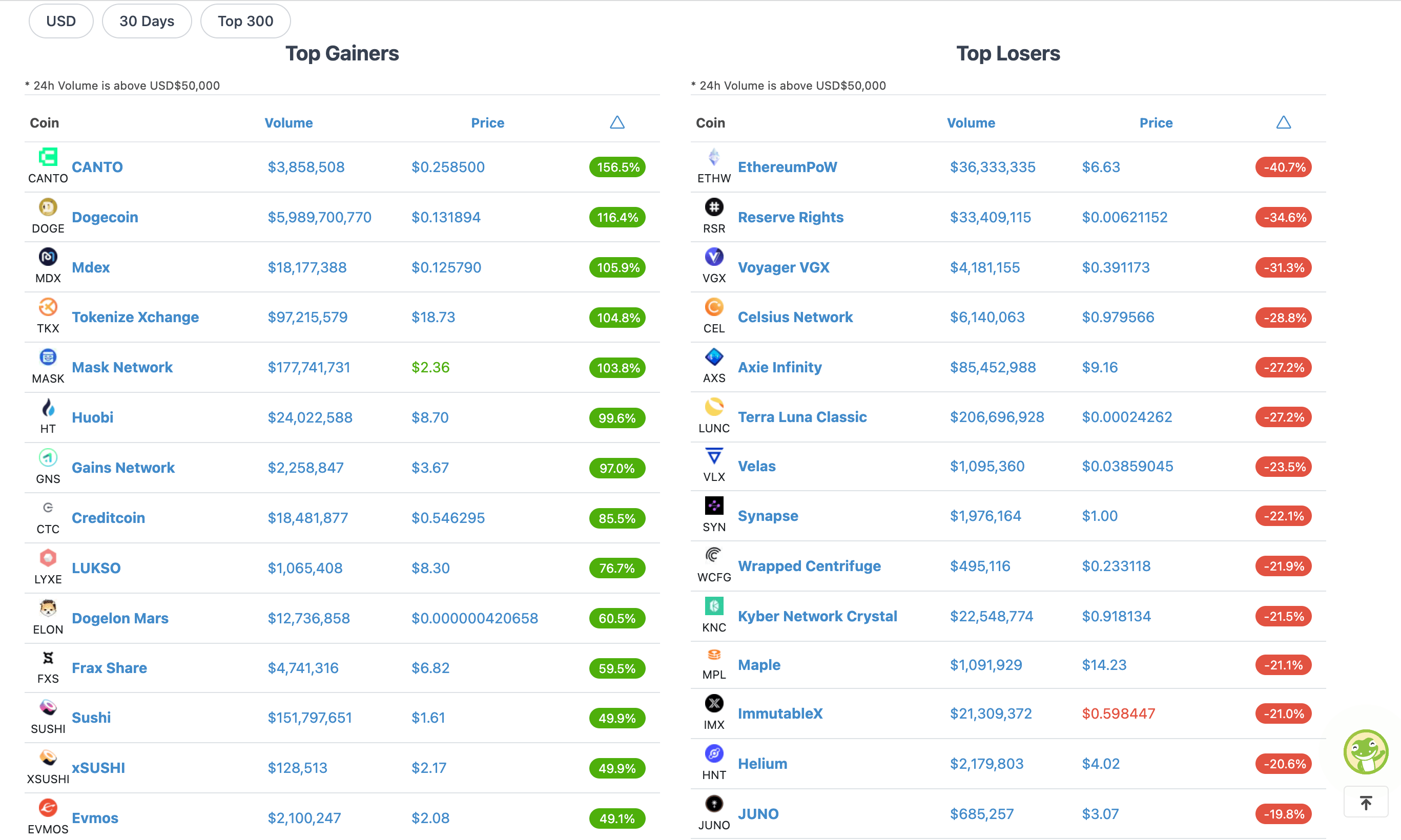

Top 10 gainers and losers in the top 300

Zooming out a tad, here then, were the top 10 winners and losers from the top 300 cryptos by market cap, with thanks again to CoinGecko…

Let’s talk about a couple of these other top gainers catching our eye, and then get on out of here so we can focus on November.

Firstly, Canto (CANTO); +156%. What is it? It’s a DeFi-focused layer 1 blockchain built on the Cosmos network.

Gotta be honest, this is a pretty obscure one as far as we can tell, and it’s only trading so far on its own native decentralised exchange, and on the small-medium platform Bitget.

According to this Bybit blog, “Canto is a general-purpose Layer 1 blockchain built using the Cosmos SDK and Tendermint core, and has full EVM [Ethereum] compatibility”.

Some of the core team members have apparently worked on other well-known crypto projects including Acala and Karura, as well as DeFi Pulse.

Marketcap: 82M

TVL: 80MTVL ratio -> 1.02

It smells like a pretty healthy project is growing in the shadow…@canto #cryptomarket pic.twitter.com/0Sl2rzsoR8

— Blender of Crypto (@BlenderofCrypto) October 31, 2022

Mdex (MDX) meanwhile, is, according to CoinMarketCap, “an automated market making (AMM) decentralized exchange protocol that operates on the concept of fund pools, sharing some similarities with standard DEXs, but differentiating itself from competitors by using a dual-chain model modelled on both the Ethereum network and the Huobi Ecological Chain (HECO).”

It’s up 105% for the month. An Uptober indeed.

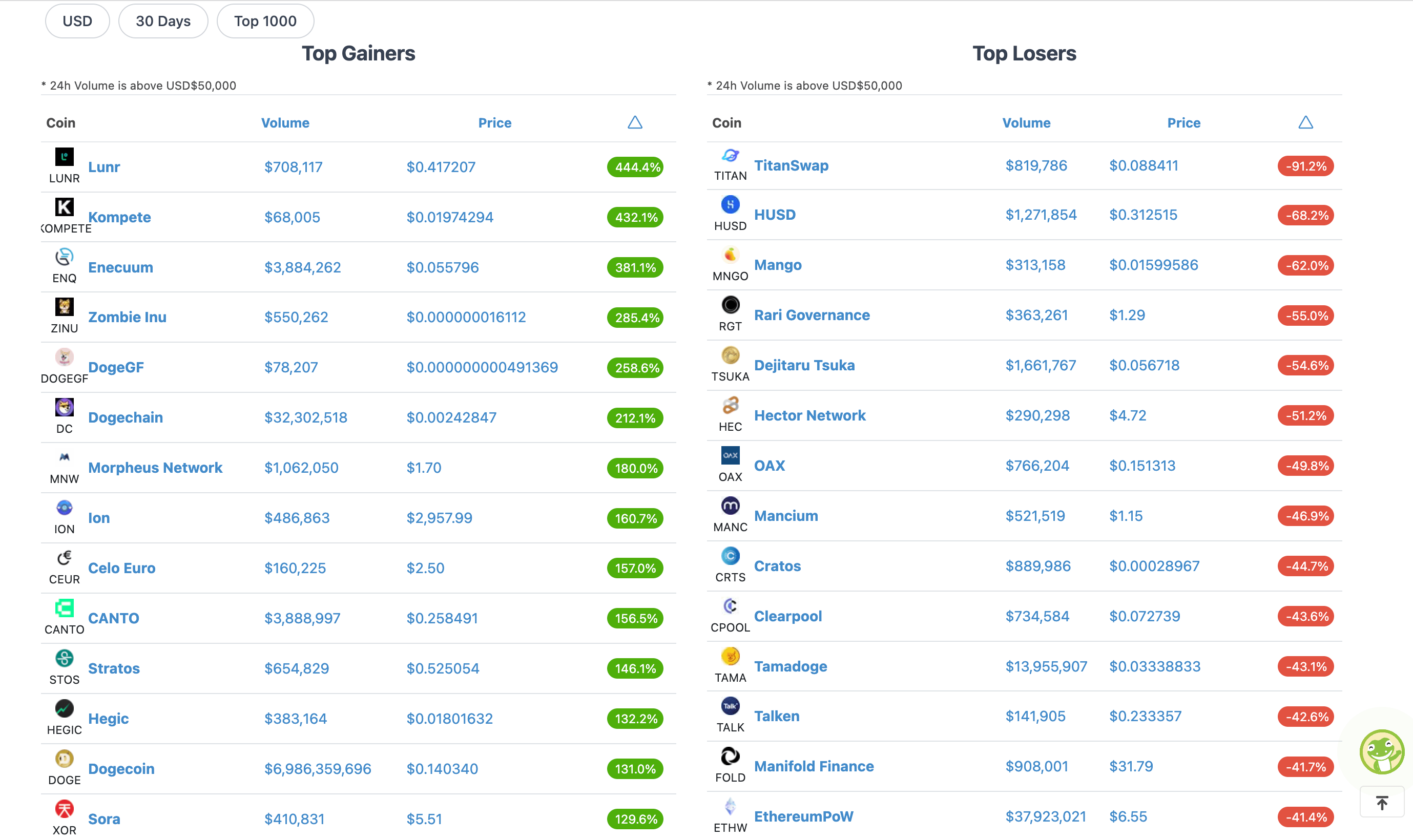

Top 10 gainers and losers in the top 1,000

Oh and just for good measure… October’s winners and losers in the top 1,000 cryptos by market cap.

Dogechain (DC), the layer 2 scaling project for Dogecoin, was an interesting performer this month.

Meanwhile, keep an eye on Lunr (LUNR) (crypto social-media data analyser LunarCrush’s utility token); KOMPETE (a team-based multiplayer gaming project using Unreal Engine); and Morpheus Network (MNW) – making some waves in the high-potential supply-chain blockchain solution narrative.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.