NFTs dip as cryptos surge to three-month high, with FTX hitting $68

Getty Images

Cryptos are surging, with Ethereum hitting its highest level since May 16 following this week’s launch of layer two scaling solution Arbitrum One. But NFTs are showing signs of weakness as traders circle out of the red-hot sector and back into fungible tokens.

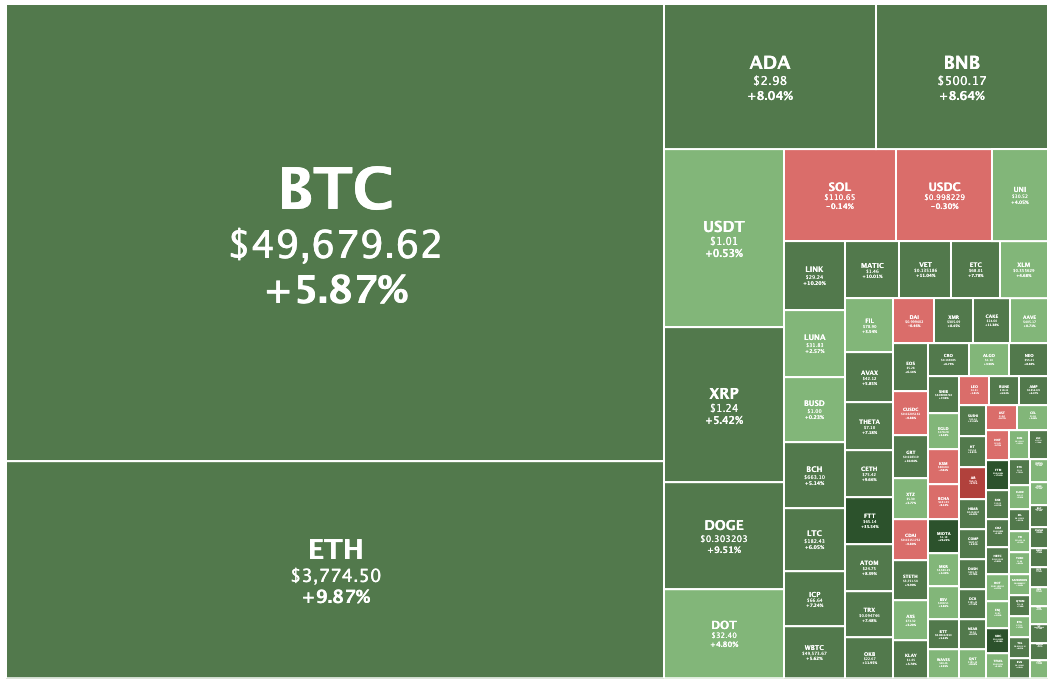

At 10.51am AEST, Ether was changing hands at US$3,780, up 11.3 per cent from 24 hours ago. Bitcoin was up 4.1 per cent to US$48,776.

Delphi Digital said in a report that “ETH perpetuals [futures] have low funding rates, and at the current price, there’s optimism that this breakout has legs and trend continuation should ensue.”

The EIP-1559 upgrade implemented on August 5 has cut Ethereum’s annualised daily inflation rate from around 2.7 to 3 per cent to around 0.6 per cent.

“Although it’s unlikely that this sustains until the [Proof of Stake] merge, EIP-1559’s impact on ETH’s inflation is the equivalent of two BTC halvings (using 3% as pre-London inflation). Significant, to say the least,” wrote analysts Jeremy Ong, Joo Kian and Genevieve Yeoh.

Sydney-based City Index analyst Tony Sycamore, who suggested yesterday opening Ethereum long positions, noted Ether had hit his first profit target of US$3,700. “The next objectives are $4000 and then a retest of the $4380 high,” he wrote.

Bitcoin meanwhile was trading at US$49,450, up 6.0 per cent from 24 hours ago. The original crypto appeared ready to soon retest the $50,000 barrier, last crossed 10 days ago.

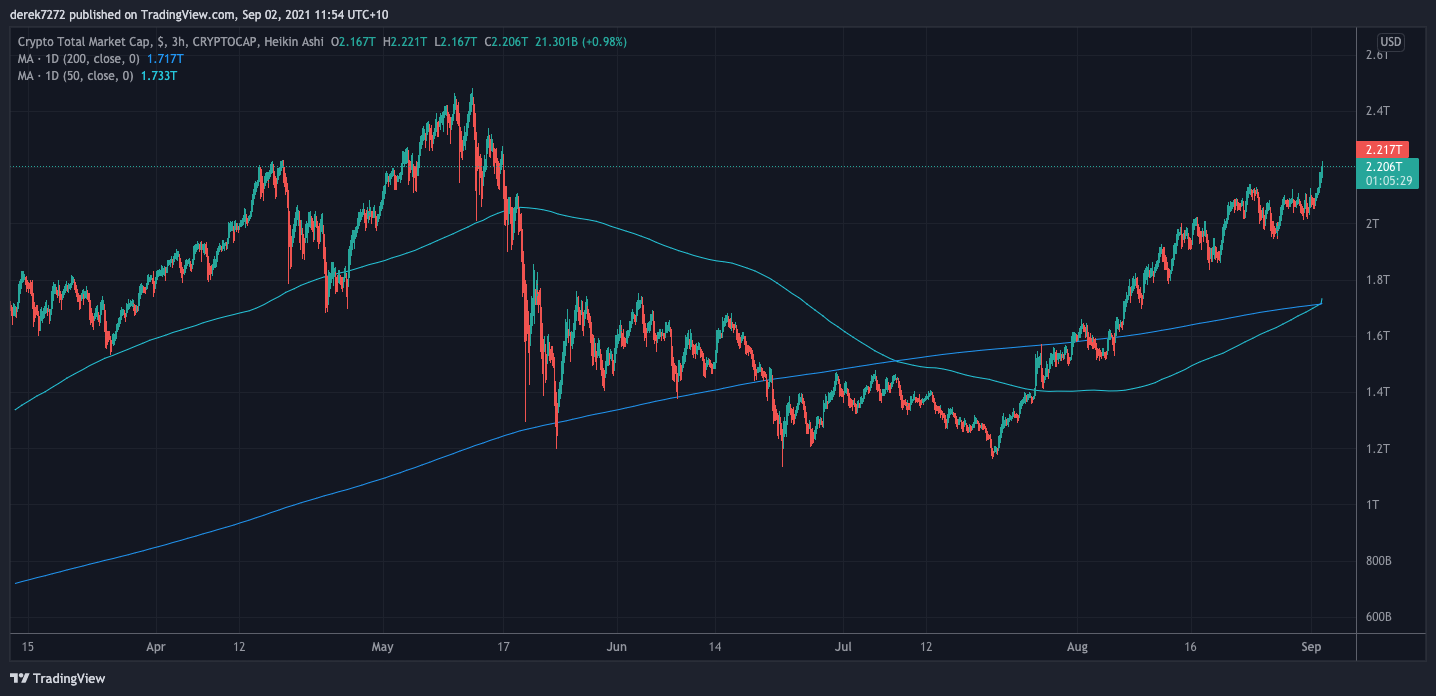

Crypto market up 6.4%

The total crypto market was up 6.4 per cent to US$2.31 trillion, its highest level since May 17, and had experienced a bullish golden cross as its 50-day moving average crossed over its 200-day MA.

Of the top 100 cryptos, Arweave and Kusama were the only ones in the red, consolidating after a strong recent run.

Twenty of the top 100 coins had posted double-digit gains, with crypto billionaire Sam Bankman-Fried’s FTX Token (FTT) leading the way with a 38.8 per cent gain to an all-time high of US$66.

On Tuesday, FTX agreed to buy LedgerX, a regulated derivatives exchange and clearinghouse, for an undisclosed sum. If completed the deal will pave the way for the exchange to offer US customers options and futures contracts.

Iota, Fantom and Sushi were also pumping, with gains from 22 to 15 per cent.

NFTs dip as cryptos surge

Meanwhile NFTs had dipped modestly after days of red-hot gains.

Of the floor (minimum) prices of 20 projects tracked by the NFT Floor price update bot, 10 had declined and just five had risen, with the rest flat.

A Bored Ape could be picked up for 36.8 Ether, down from 39 yesterday, while the cheapest Meebit was priced at 5.2 Eth, down from 5.9.

I’m losing stupid money in my NFT purchases

But even if they go to zero, I still have a picture!

It’s basic maths:$ETH go parabolic=

Noobs sell their art for huge loss pic.twitter.com/HyvEjv7caG— Crypto ฿itlord (@crypto_bitlord7) September 1, 2021

Still there had been some eye-popping sales, with Tyler Hobbs’ Fidenza #6 from the Art Block Curated collection changing hands yesterday for 458.88 Ether (US$1.58 million).

An art collector known as Angel #888 was the buyer.

I tweeted about this last night but I have to do it again as I am just so happy to have finally added a Fidenza to my collection. I have been waiting for one to come up that I truly connect with and I am blessed to have what to me is the most beautiful Fidenza there is ✨ pic.twitter.com/rRG6Xl2nyt

— ✨888✨ (@crypto888crypto) September 1, 2021

The seller had purchased it on June 11 for just 1.75 Ether, less than US$7,000 at the time.

The collection of artwork that’s algorithmically generated from data on the blockchain has been setting multimillion-dollar prices, with Digg founder Kevin Rose making $2.5 million flipping one last week.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.