More Australian ‘mature-wealth’ investors are taking the crypto plunge: report

Pic: d3sign / Moment via Getty Images

New data revealed by Australian crypto exchange BTC Markets (BTCM) shows that the platform is increasingly attracting an older demographic to the mix, with female investors on the rise as well.

Crypto has a reputation for being overrun with meme-loving male Millennial and Gen Z investors and traders, sometimes disparagingly generalised as “crypto bros”.

While it’s true this age group and gender is the dominant crypto-investing species, judging by the latest BTC Markets Investor Study Report, the asset class is beginning to see more diversity.

The report’s findings are based on data on the BTCM exchange for 2021 and is compared with figures from the previous year. The Melbourne-based exchange’s 325,000 client base was demographically categorised (age, gender, investor type) in order to anonymously analyse their crypto-investment behaviours.

More ‘mature wealth’ flowing in

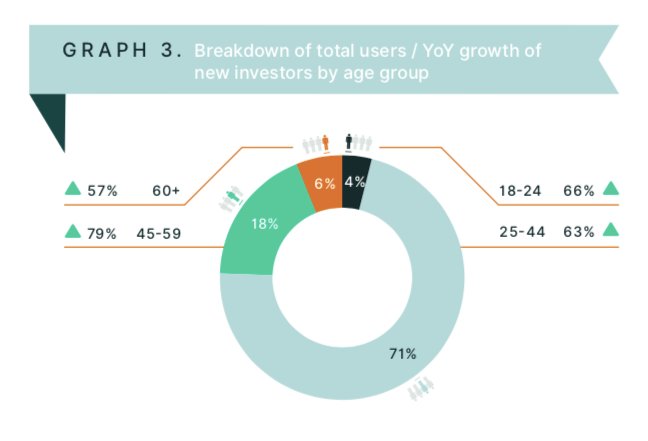

According to the study, the largest inflow of BTCM’s new clients in 2021 came from Australia’s ‘mature wealth accumulators’. It’s a category aged 45-to 59 and is showing a striking, 79 per cent year-on-year increase.

BTC Markets CEO Caroline Bowler said she finds the trend encouraging due to the comparatively more conservative risk appetite of this age group as they look ahead to retirement.

“They bring a wealth of experience in traditional investment markets and their decision to invest in crypto is not driven by the fear of missing out (FOMO) but on strategic research and information,” said Bowler.

Additionally, the average portfolio sizes on the exchange continued to remain highest for the 60-plus year-old age bracket. This can be put down to generally higher disposable incomes suggests the report, and apparently a higher amount of comfort in leaving crypto on the exchange.

And more women are investing, too

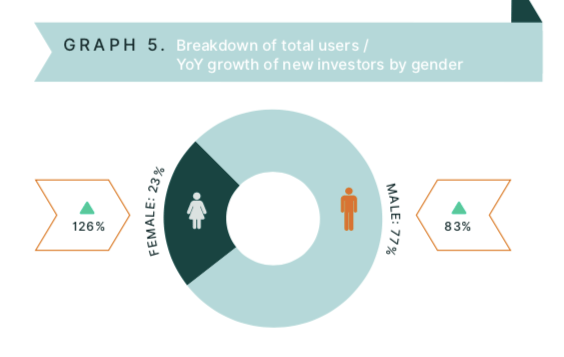

The BTCM data also shows a continuing trend of a diminishing gender gap when it comes to crypto investing.

The amount of female investors on the platform have apparently grown at a much faster than their male counterparts (126 per cent vs 83 per cent).

And in 2021, their average initial deposits on the platform were higher ($2,218 vs $1,978 for males), while average female portfolio sizes have moved closer to that of male investors ($6,761 vs $7,028).

This is despite female investors trading less frequently on a daily basis (two times vs three times for males).

The report suggests that this behaviour reflects traditional female investment patterns in other asset classes, with women typically taking longer, doing more research, and therefore investing larger amounts.

“As our platform shows, women have done their research and are now committing to investment – with a long-term, considered view,” Bowler added.

Some other key findings: more SMSF crypto activity

• In 2021, the BTCM platform saw a spike in the average value (+48%) and volume of trades executed (+118%), with the average daily orders increasing by 42%.

• Bitcoin (BTC) and Ethereum (ETH) continued to be the most popular tokens, with Tether (USDT) emerging as a new entrant in the top five traded cryptos.

• Despite a market correction at the end of 2021, young investors (18–24-year-olds) clearly “bought the dip” in the second half of the year, showing distinct growth in the “highest average initial deposit” stat ($1611 vs $882, 83% YoY).

• While individual investors make up the majority of users on BTCM, sole traders (196%), companies (79%) and SMSFs (74%), grew faster than retail (66%) in 2021.

• The size of the SMSF investment also saw a 15% increase with initial deposits now in the hundreds of thousands compared to earlier investments in the tens of thousands.

“This increased commitment from SMSF investors, with their lengthier investment outlook, illustrates a long-term bullish point of view,” said Bowler, adding:

“Institutional investors and superannuation funds are now in a similar position to where the banks were, and it can only be a matter of time before market developments give them the confidence to embrace crypto.”

Keep an eye out for the full report on the BTC Markets website.

At the time of writing, the, erm… “mature-wealth” author holds several crypto assets, including Bitcoin and Ethereum.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.