Mooners and Shakers: ‘You shall not pass!’ Australian crypto regs bill rejected; Stake.com hacked for $41m

Pic via Getty Images

Afternoon, heads of coin. It’s a mixed bag of news today in the cryptoverse. Unfortunately, it’s mostly a mixed bag of negativity. That’s not to say the future’s not necessarily bright, mind.

Making a couple of headlines then, and we’ll start locally…

Australian crypto regulation bill blocked

A bill on digital asset market regulation largely led by the Liberal senator Andrew Bragg and backed by strong local industry input and clout, has met another roadblock – specifically from the Senate Committee on Economics Legislation.

The bill, known as The Digital Assets (Market Regulation) Bill 2023, was not passed by the committee as it stands. But it’s not an out and out shutdown – it seems some minor amendments are required before the Senate is willing to reconsider.

Among the amendments, the lawmakers asked the bill to be adjusted to exclude various asset-based tokens – possibly the Gold and Silver Standard and BetaCarbon Token, for example – from the definition of a stablecoin.

The committee also advised that the bill’s proposed transition period be extended from three to nine months.

Bragg introduced this draft bill in March this year, with an aim to “protect consumers and promote investors”. It focuses on regulatory recommendations for stablecoins, licensing of exchanges and custody requirements.

Bragg heavily criticised the bill’s rejection in a statement, which he also posted to Twitter/X (see below).

“If Labor hadn’t abandoned our legislative agenda, these proposed regulations would be the law,” noted Bragg, referring to a lengthy review process and set of legislative recommendations stretching back to 2021 and conducted with local blockchain peak bodies and industry participants.

“By restarting the consultation process, Financial Services Minister, Stephen Jones, has shown that Labor has no plan to regulate crypto,” Bragg continued.

He emphatically concluded with: “Labor’s approach will damage existing and new investments designed to bring competition to Australia. The failure to legislate is driving investment offshore.”

The @AuSenate report on my digital asset market regulation bill has just been tabled. Statement & report 👇https://t.co/YVq4md3bDX pic.twitter.com/LGGaNK8fzH

— Senator Andrew Bragg (@ajamesbragg) September 4, 2023

Seconding the thanks Senator.

— Caroline Bowler (@CaroBowler) September 4, 2023

Crypto casino Stake.com hacked for $41m

What’s known as the “world’s largest crypto casino”, Stake.com, has reportedly been hacked for more than US$41 million.

At the time of writing, the platform has suspended all deposits and withdrawals, leaving many users unable to access their funds.

A blockchain security-analysis firm called Cyvers was quick to highlight “multiple suspicious transactions” linked to Stake.com’s hot (online) digital wallet.

🚨ALERT🚨Our AI-powered system has detected multiple suspicious transactions with @Stake.https://t.co/0ZoMITOyF5 address received about $16M in $ETH $USDC $USDT and $DAI

All the stable coins are converted to $ETH and distributed to different EOAs.

FYI: @tayvano_ @zachxbt pic.twitter.com/CSGwRHEiVm

— 🚨 Cyvers Alerts 🚨 (@CyversAlerts) September 4, 2023

Cyvers noted that US$16 million had been withdrawn on the Ethereum network following a “private key leak”, and this was backed up by a well-known blockchain sleuth called ZachXBT, who addded that another $25.6 million had been lost across Polygon and the Binance Smart Chain.

Stake.com, also a sports-betting platform, has taken in more than US$2.17 cumulative customer deposits since August 2022.

The firm has not disclosed much about the hack as yet, although it revealed that “user funds are safe”.

Three hours ago, unauthorised tx’s were made from Stake’s ETH/BSC hot wallets.

We are investigating and will get the wallets up as soon as they’re completely re-secured.

User funds are safe.

BTC, LTC, XRP, EOS, TRX + all other wallets remain fully operational.

— Stake.com (@Stake) September 4, 2023

Top 10 overview

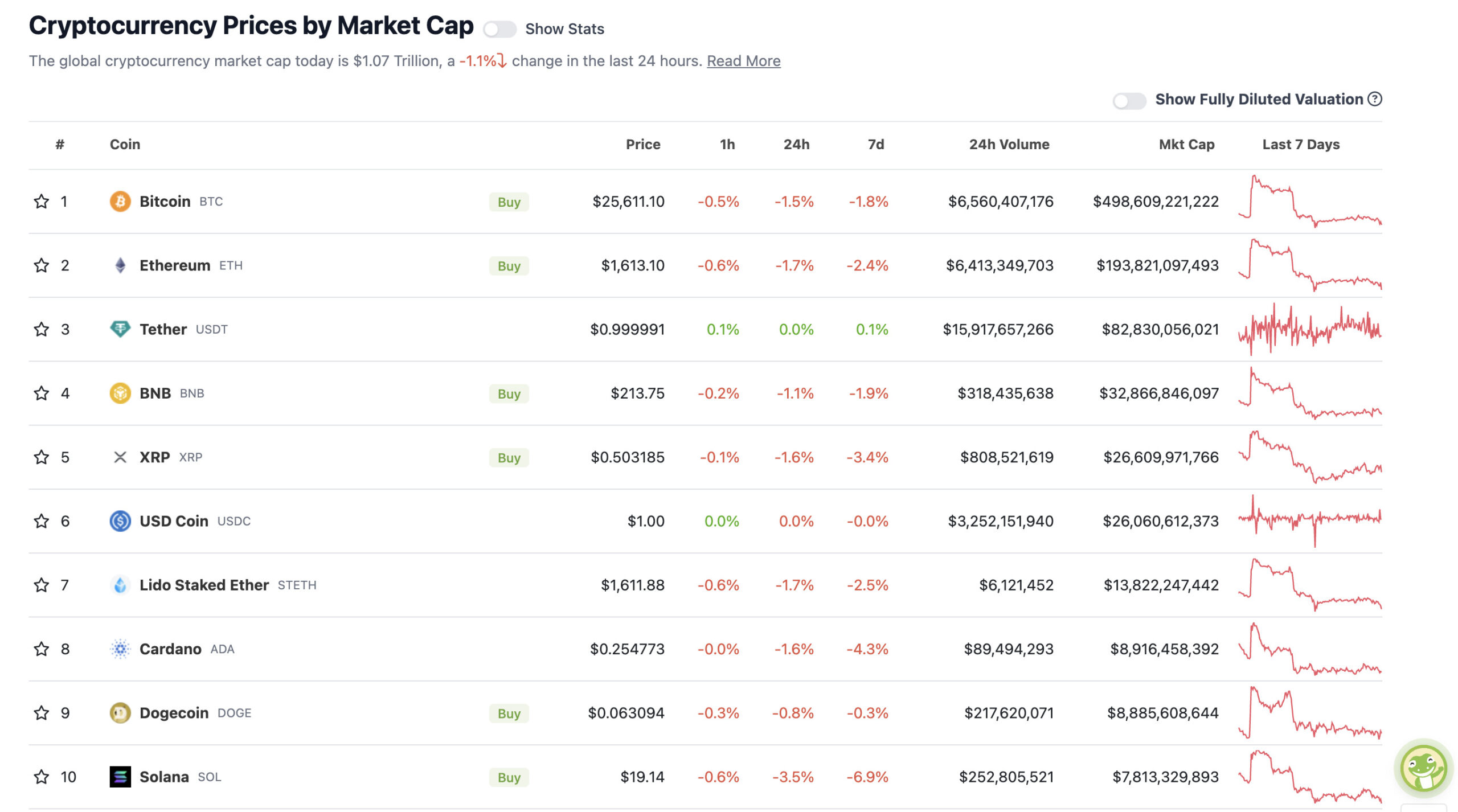

With the overall crypto market cap at US$1.07 trillion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s charts like these where you say “ok, even if we go a little lower, now is a good time to look for longs or DCA”.

I think many new traders miss this concept & it’s why it takes a cycle to “get rich”. They see red & think sell. Think opposite.#bitcoin #cryptocurrency pic.twitter.com/UFlI7gA8gV

— Roman (@Roman_Trading) September 4, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Stellar (XLM), (market cap: US$3.4 billion) +3%

• Rocket Pool (RPL), (market cap: US$463 million) +3%

• Rollbit Coin (RLB), (market cap: US$537 million) +1%

SLUMPERS: GALA FOUNDERS IN A FLAP

• Gala (GALA), (market cap: US$402 million) -6%

• Sui (SUI), (market cap: US$372 million) -3%

• Shiba Inu (SHIB), (market cap: US$4.4 billion) -3%

• KuCoin (KCS), (market cap: US$376 million) -3%

• Arbitrum (ARB), (market cap: US$1.13 billion) -3%

• Optimism (OP), (market cap: US$1.05 billion) -3%

It’s full-scale drama at one of the leading web3 gaming projects, Gala, with the founders now reportedly suing each other. They’re apparently feuding over the alleged theft of US$130 million worth of tokens and corporate misappropriation of funds.

Sigh… just another day in crypto, eh?

The fall-out is specifically between co-founders Wright Thurston and Eric Schiermeyer. Each controlled 50% of the company, and they’re now in a battle of survival, with each seeking to boot the other from the company’s board of directors.

A Twitter/X account called The Bitcoin Express picks up the finer details for you nicely here…

I'm done with GALA GAMES. Sold it all.

Still bullish on crypto gaming, just not this token. pic.twitter.com/iXGBMsNxpv

— The Bitcoin Express (@The_BTC_Express) September 3, 2023

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

CATHIE WOOD: #Bitcoin and AI could transform the way companies organise, causing a collapse in costs and an explosion in productivity. 🔥 pic.twitter.com/XOR4nypCdp

— Bitcoin Archive (@BTC_Archive) September 4, 2023

BlackRock got Bullish on #Bitcoin at the EXACT top. pic.twitter.com/E005eVE56h

— Mister Crypto (@misterrcrypto) September 4, 2023

✨ The Father of Cybersecurity on the unstoppable power of #Bitcoin at $500, exactly 9 years ago pic.twitter.com/YSW4Y4Vmw9

— The Bitcoin Historian (@pete_rizzo_) September 4, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.