Mooners and Shakers: ‘You are all platforms. We are all platforms’ – Animoca Brands talks up a decentralised future

A human platform, yesterday. (Pic via Getty Images.)

Good arvo. Just a quick update for you today, as Stockhead finds somewhere relatively quiet to sit and bash out some words amid the BUSTLING THRONG of a bear-market crypto conference event.

That (actually bustling) event, by the way, is the Animoca Brands Investor Day being held in Sydney right now.

The Hong Kong based outfit Animoca Brands, strangely enough ever since being delisted from the ASX back in March 2020, has become one of web3’s biggest company success stories, growing from 200 employees to more than 1,000, with a peaking valuation of close to US$6bn about a year ago.

Understandably, the ongoing crypto bear market may have pared back the company’s market capitalisation somewhat, but you wouldn’t know it judging by the firm’s bookings success over the past year and strong expansion into emerging global markets.

‘Bookings’, by the way, is a measure of sales activity and includes, for example, token sales, NFT sales, and various other activities.

More on that elsewhere, but very quickly, I can tell you the company is still very much a firm believer that the “open metaverse”, particularly via web3 gaming and digital ownership is the path to mass adoption within the crypto/blockchain space. Animoca also foresees a decentralised-dominant future where we can all have control over our data.

“You are all platforms. We are all platforms,” said Animoca Brands CEO Yat Siu on a panel of execs to a well-attended Ivy Ballroom… room.

Extrapolating on that… in the digital realm, our own data, our own activity online is part and parcel of who we are and what we represent, and that has power, but it has greater power for individuals within a decentralised onchain world of digital-asset ownership that pulls control away from web2 beasts such as Meta/Facebook et al.

“Web2 behemoths such as Facebook rely, in a sense, on our digital servitude – they’ve been getting a lot from us – our time, our data – for nothing,” Jared Shaw, the company’s CFO, told Stockhead in a separate chat.

It’s a generational mindset shift that will take some time yet, believes the company, but the blockchain industry’s “scope is massive and the next 12 to 18 months will see the space evolve tremendously,” added Shaw.

Also, we can tell you that the slow-cooked lamb at the event’s lunch buffet was well worth getting out of bed, putting on a half-decent pair of pants, and jumping on a bus into town for.

More on this (not the lamb) to come.

Top 10 overview

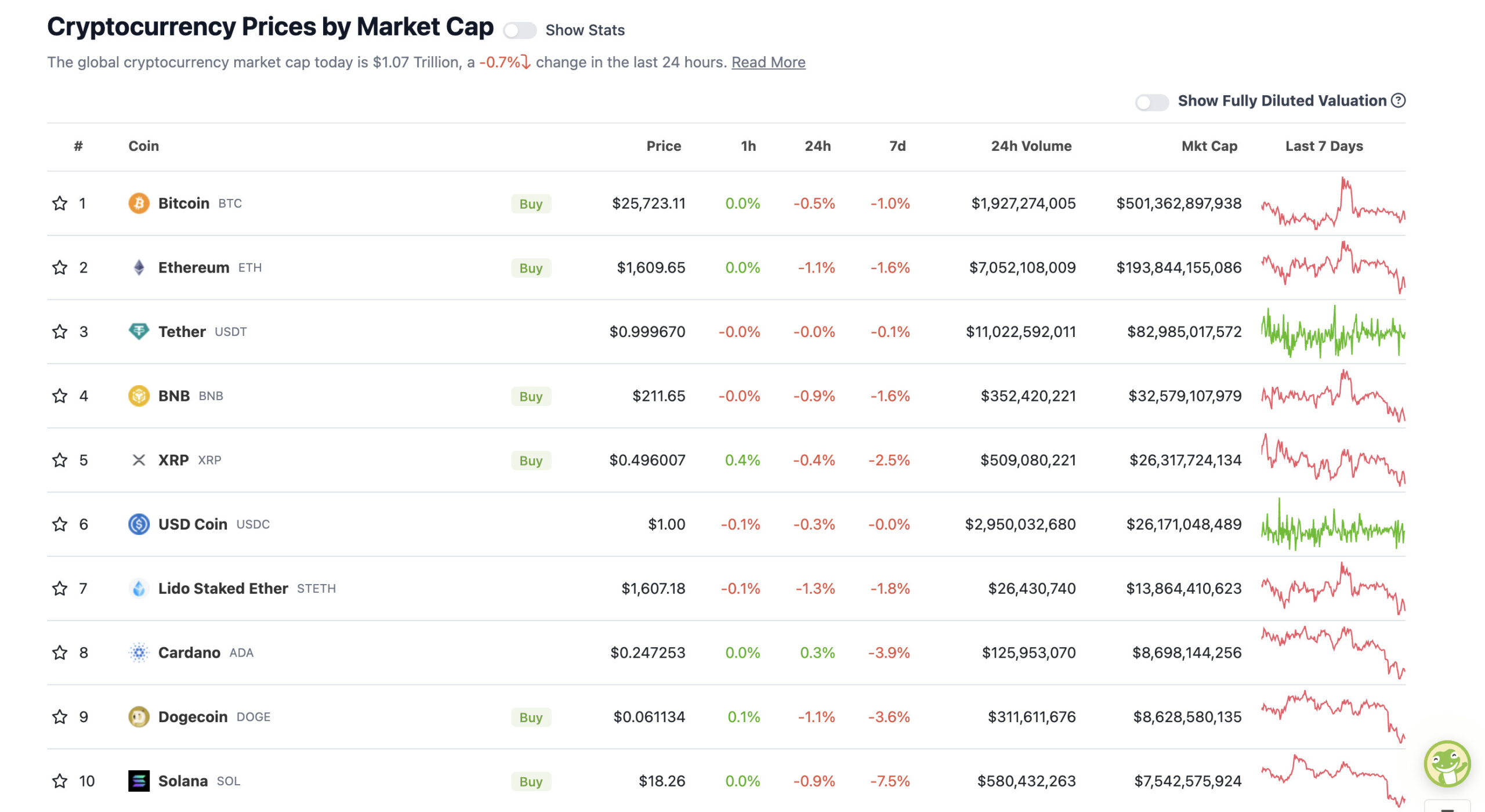

With the overall crypto market cap at US$1.07 trillion, down a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Stellar (XLM), (market cap: US$3.68 billion) +4%

• Tokenize Xchange (TKX), (market cap: US$424 million) +2%

• Render (RNDR), (market cap: US$560 million) +2%

SLUMPERS

• Radix (XRD), (market cap: US$589 million) -8%

• Arbitrum (ARB), (market cap: US$1.06 billion) -5%

• ApeCoin (APE), (market cap: US$447 million) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Bitcoin is looking pretty bearish in the short term, believe various well known traders and analysts in the space, such as Rekt Capital – spying a likely double-top breakdown…

Only a few hours until the new Weekly Close for #BTC

Weekly close below ~$26,000 likely confirms the Double Top breakdown$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) September 10, 2023

Then again…

In quiet apathy, great adoption is occurring. Full Bitcoin wallets are approaching all-time-highs, while price is still -60% down. The number of addresses with a balance of over $1000 is back at the 2021 peak. pic.twitter.com/Ul4Abnq8mL

— Charles Edwards (@caprioleio) September 9, 2023

Green Dots -> Bitcoin Bull Market

Every. Single. Time. 👀 https://t.co/js1KRlgt6C— Bitcoin Archive (@BTC_Archive) September 10, 2023

🇲🇽 Mexican billionaire Ricardo Salinas: "#Bitcoin is better" than gold. pic.twitter.com/sMBgLeu5wa

— Bitcoin Magazine (@BitcoinMagazine) September 10, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.