Mooners and Shakers: Bitcoin defies Fedspeak, macro fears; XRP up after SEC drops charges against Ripple leaders

Pic via Getty Images

Bitcoin is holding up remarkably well this week (+7%) amid macroeconomic and geopolitical uncertainty, helped by sentiment around increased spot ETF approval chances and positive comments from BlackRock CEO Larry Fink earlier in the week.

Meanwhile altcoins XRP and Solana have also recorded decent gains this week in the crypto majors (top 10 by market cap).

In terms of news attribution to price rise, XRP’s is the most obvious as news has dropped that the US Securities and Exchange Commission (SEC) has dropped its lawsuit against the top executives of Ripple Labs, the creators of XRP.

XRP, which has a US$26.1 billion market cap, surged by as much as 6% overnight as the SEC walked away from its charges against Ripple Labs chief executive Brad Garlinghouse and chairman Chris Larsen.

JUST IN: 🇺🇸 SEC drops lawsuit against Ripple XRP executives. pic.twitter.com/sfTVfl3KU2

— Watcher.Guru (@WatcherGuru) October 19, 2023

Today was an even better day.

Ripple: 3

SEC: 0In all seriousness, Chris and I (in a case involving no claims of fraud or misrepresentations) were targeted by the SEC in a ruthless attempt to personally ruin us and the company so many have worked hard to build for over a… https://t.co/YsQxewFnj9

— Brad Garlinghouse (@bgarlinghouse) October 19, 2023

This doesn’t mean the SEC has give up its entire, near-three-years-long lawsuit against Ripple, which is based around alleged securities violations in the public sale of XRP.

The legal tussle is regarded as an important line in the sand for both sides with the result potentially going a long way towards how cryptocurrencies in general are treated and defined (ie. for example as securities or commodities).

And in other news

• Bitcoin, often correlated to the fortunes of the US stock markets – which sold off again overnight (AEDT) – has actually risen another 1.4% at the time of writing and is up more than 7% for the week.

• Fed boss Jerome Powell spoke last night at the fancy-pants, no riff-raff-allowed Economic Club of New York, where he delivered a somewhat mixed tone. Hawkish, dovish? A little bit of column A and B, actually, so ultimately a bit useless, but Wall Street didn’t seem to enjoy it too much.

In a nutshell, which is actually where we like to imagine him, Powell noted that inflation is still too high but rising long-term bond yields could lower the Fed’s need to keep hiking interest rates hikes. The Fed will likely keep rates unchanged in November but, hey, JPow’s a swinging kinda cat and is keeping his options open for December.

• Fresh legal drama is about to hit the crypto industry. The state of New York has filed a lawsuit against Digital Currency Group, its subsidiary Genesis Global Capital and the Winklevoss twins’ crypto exchange Gemini, reportedly alleging more than $1 billion worth of fraud.

Per US crypto media site CoinDesk, which broke news of the FTX scandal last year…

“New York Attorney General Letitia James filed a lawsuit on Thursday against cryptocurrency companies Gemini Trust, Genesis Global Capital and Digital Currency Group (DCG) for allegedly defrauding more than 230,000 investors, including at least 29,000 New Yorkers, of more than $1 billion.

“Gemini lent funds to Genesis, which is owned by DCG, as part of its Earn program, the suit said. The funds were later lent to counterparties such as trading firms Three Arrows Capital and Alameda Research, which ultimately went bankrupt. This left Genesis with a $1.1 billion hole. DCG also owns CoinDesk.”

“Today’s lawsuit is the latest action taken by Attorney General James to rein in the cryptocurrency industry and protect investors,” read a statement from the AG’s office.

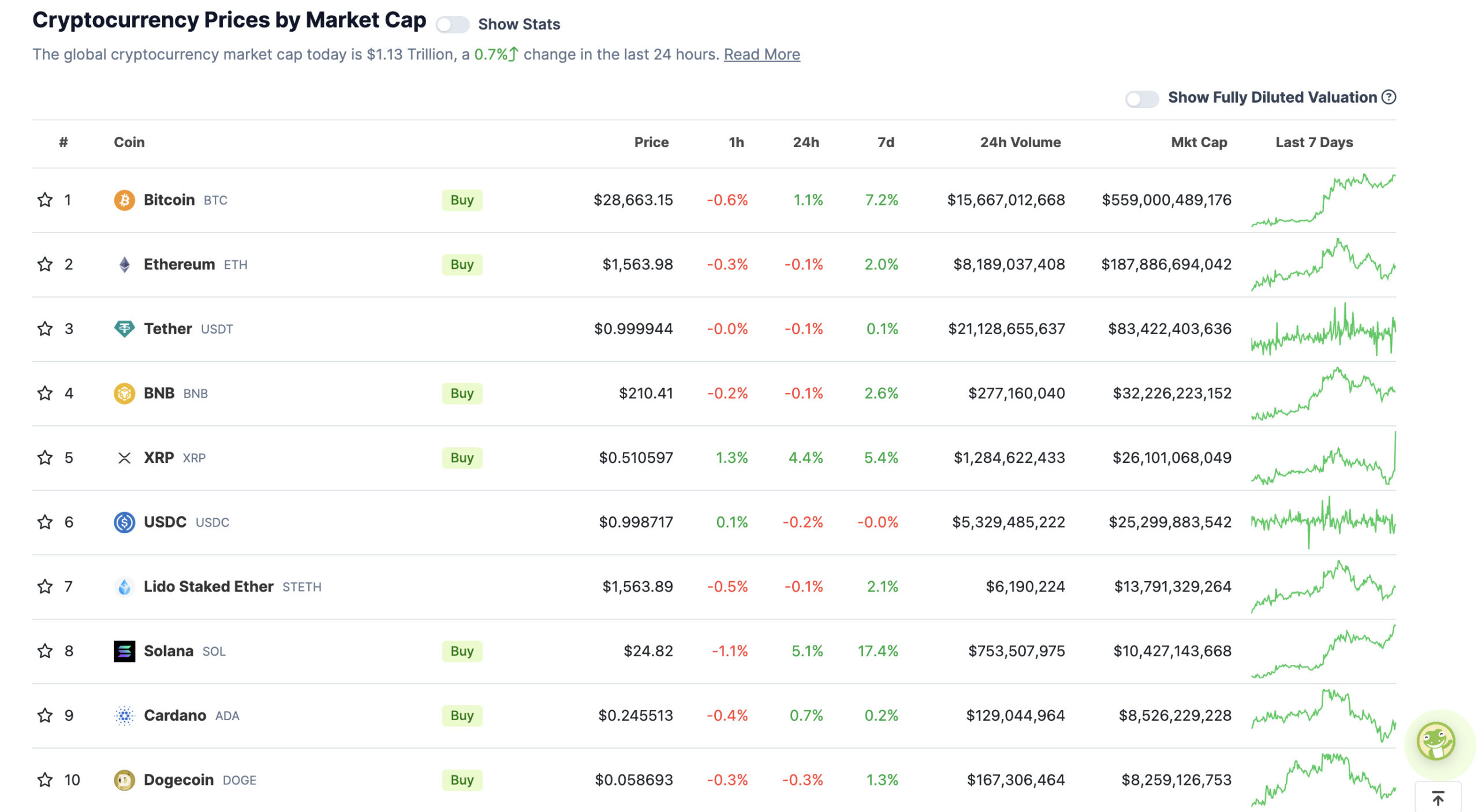

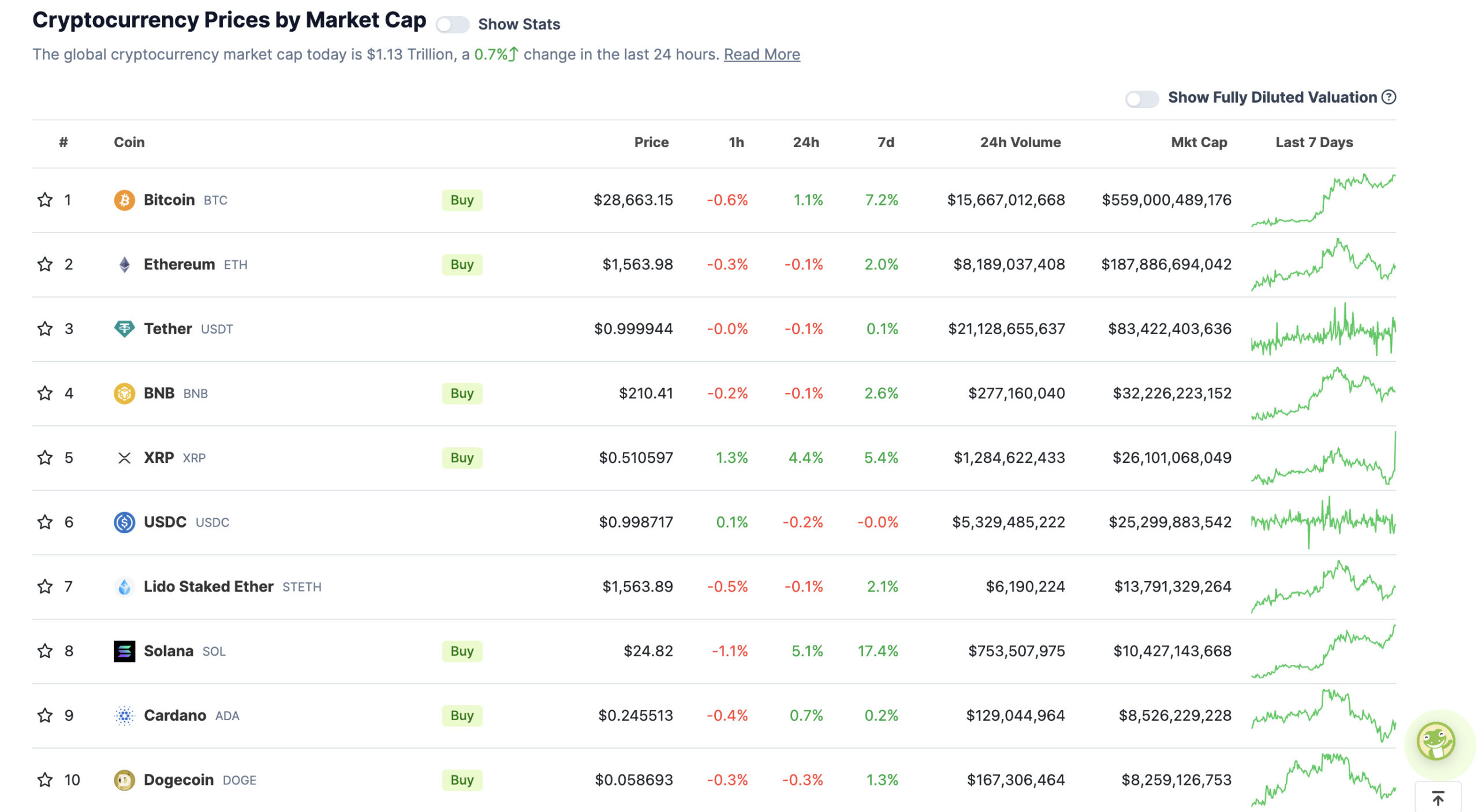

Top 10 overview

With the overall crypto market cap at US$1.13 trillion, up a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Why’s Ethereum rival Solana (SOL) performing so well lately? Good question. A quick round-trip through Twitter/X doesn’t reveal too much, but we did learn that the volume of trading activity on the crypto is well up compared with September…

In the first 19 days of October, Solana already had more DEX Volume than all of September. pic.twitter.com/tb9JhcOzB8

— Step Data Insights (@StepDevInsights) October 19, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• CryptoPawCoin (CPRC), (market cap: US$742 million) +302%

• LEO Token (LEO), (market cap: US$3.59 billion) +14%

• Injective (INJ), (market cap: US$712 million) +4%

• Stacks (STX), (market cap: US$803 million) +4%

• Mantle (MNT), (market cap: US$1.02 billion) +3%

CryptoPawCoin? We mentioned this one in passing yesterday, but… things that make you go hmmm… and we’ll leave that one there for now.

SLUMPERS

• ApeCoin (APE), (market cap: US$383 million) -6%

• Hedera (HBAR), (market cap: US$1.54 billion) -4%

• Theta Network (THETA), (market cap: US$564 million) -3%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Hmm… a slightly different nuance on the Ripple/XRP news here…

below is likely the correct read of the Ripple dismissal–instead of the bull signal it might appear, it's really the SEC wanting to appeal the "programmatic sales" and 'service grants' holdings immediately

nice job by @kkirkbos reading between the lines here https://t.co/JrItFc66zF

— _gabrielShapir0 (@lex_node) October 19, 2023

Meanwhile…

JUST IN – JPMorgan expects a spot #Bitcoin ETF to be approved "within months" 👀 pic.twitter.com/THyspv26Cf

— Bitcoin Magazine (@BitcoinMagazine) October 19, 2023

… and…

NEWS: Mark Cuban and Elon Musk filed a joint legal brief with the Supreme Court against the SEC for its practice of using of in-house judges in cases brought by the agency

Both have been staunch supporters of Doge, and now they're teaming up to fight the feds

DogeArmy ftw! pic.twitter.com/E65tcXOyhw

— 💸💸💸 (@itsALLrisky) October 18, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.