Mooners and Shakers: ‘We’re STILL early?’ Why crypto’s moon mission might be just getting started

Send it. Bitcoin could be set for another big month. Pic via Getty Images

Stockhead’s monthly crypto wrap, Mooners and Shakers, is brought to you by

- Last month we called for a ‘Moonvember’ – and moon, Bitcoin certainly did

- BTC hit high after high in a great month for crypto broadly, fading just shy of US$100k

- What’s been happening and what’s (potentially) in store for December? Plenty. Read on…

As you no doubt are aware by now, Bitcoin and crypto has been one of (if not the) strongest market sector recipients of the ‘Trump trade’ so far.

Never mind which side of ‘the aisle’ you might lean towards politically speaking – like it or not, Donald “I Will Fire Gary Gensler on Day One” Trump winning the US election was, and is, extremely bullish for crypto. Just cold, hard, apolitical crypto coin facts.

The world is about to get its first ever pro-Bitcoin, pro-crypto superpower leader, coming after a torrid few years of fear, uncertainty and doubt for the sector amid the current US administration and its at-times openly hostile, “anti-crypto” rhetoric led by the likes of Senator Elizabeth Warren among others.

We’ll cover off some of the potential outcomes that could take place post Trump’s inauguration in late January, further below – but clarity on regulations for the industry in the US and further afield, at long last, should certainly be chief among them.

Despite a bit of a pullback for the market-leading crypto (that’d be Bitcoin) in the past week, the election result has indeed given the sector quite a lift ever since the Harris/Walz campaign very swiftly lost its “joy” sometime around November 6.

Stockhead chatted with Binance’s global chief marketing officer Rachel Conlan recently, who was out here in Australia for the AusCryptoCon conference in Sydney last weekend, and she noted that “no matter who won the election, it was always likely to be a good result for crypto”.

And that, the Irish Binance exec noted, was partly due to the market moving past a period of uncertainty over the result, adding that “with Trump winning what we have is something more like a sprint for the market as opposed to perhaps the more steady increase we might’ve seen from a Harris administration.”

Things have certainly ticked up very quickly in the space of a month since we last checked in with this column. Let’s take a look at Bitcoin’s November performance…

Bitcoin’s November monthly return

Below, you can see the OG crytpo’s November 2024 percentage return (and indeed all its other monthly returns to date), courtesy of the blockchain data gurus at Coinglass.

At the time of writing, on November 29, BTC had made a +35.88% gain for the month, marking its best November since 2020.

That’s a strong number, despite being about 10% below the November average as a whole. Bearing in mind, however, that the ridiculous gains of 2013 throw things out a wee bit.

The crypto sector kicked off November in a pretty positive state, albeit with election result trepidation, with BTC sitting around US$70k.

Post election result, Bitcoin shot as high as US$99,645, retracing on profit taking to about US$90,500 and bouncing back to where it is at the time of writing – back above US$96,500.

As ever, the crypto market moves heavily based on sentiment, but, dare we say it, that seems pretty heavily bolstered right now. Here’s a quick vibe check, courtesy of the…

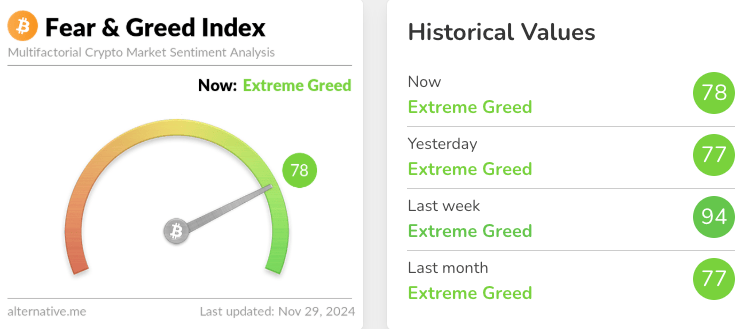

Crypto Fear and Greed Index

This sentiment tool is based on a number of metrics, including volatility, market momentum, social media, surveys and more.

Last month, the value ticked over into ‘Extreme Greed’ for the first time since early June. And with all the memecoin froth in the market lately, it should be no surprise to any crypto holder or follower that this is where the market sentiment seems to be settling at the moment.

One thing to be wary of, naturally, is that ‘Extreme Greed’ factor overextending, but there are certainly positive catalysts abounding for crypto right now to suggest that we could stay in positive sentiment territory for a while yet.

To understand the Fear & Greed Index further, the Binance Academy has a good explainer > here.

Sentiment aside for half a minute, however, here’s an interesting chart from a prominent fundie/analyst in the space, Charles Edwards of Capriole Investments.

It indicates the latest month’s performance – breaking up with strength – could well see a very bullish continuation pattern about to form that has historically so far been in play with regularity. We could be “just warming up” here…

This is where we are in the Bitcoin cycle. Every time a monthly ATH has been broken with strength we have seen at least 4 massive monthly candles over the following months. Just warming up… pic.twitter.com/lgBgMYccjv

— Charles Edwards (@caprioleio) November 28, 2024

November gainers: ‘Boomer coins’ resurgent

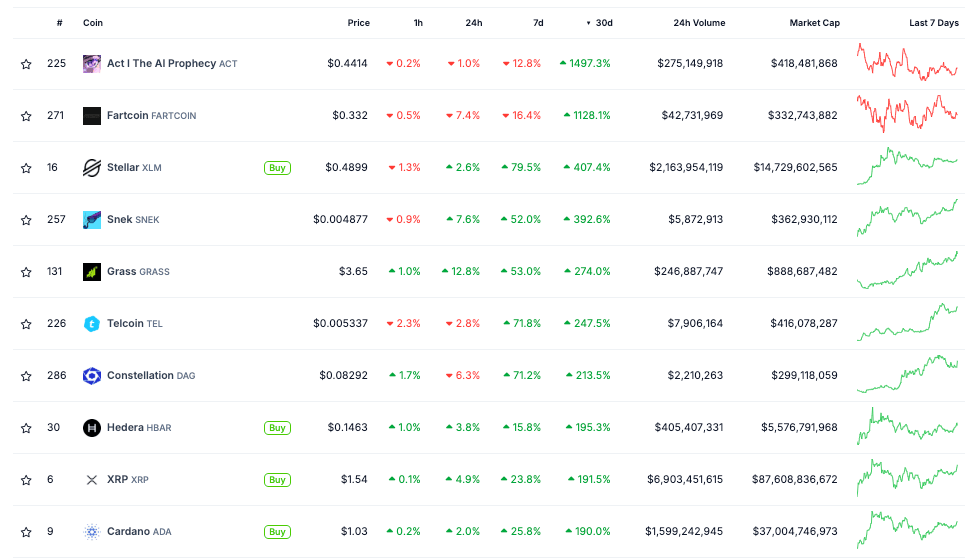

The top 10 from the top 300 coins list, according to CoinGecko data.

We could go deeper, because there are more than 15,000 cryptocurrencies jostling for degenerate attention, but we figure a 300 sample size is playing with fire well enough.

So, what did we learn from specific November crypto sector performances?

In October, memecoins stole the show as well-known and influential crypto investors, such as ‘Murad‘ called for a ‘memecoin supercycle’.

This month, we’ve certainly seen some continuation of that, however, with an unexpected trend stealing the limelight – ‘Boomer coins’.

This is a playful cryptoverse reference to ‘coins’ that were big movers in previous crypto bullrun cycles and have been largely looked over by crypto influencers looking to chase new, shiny narratives. For instance, older coins such as Stellar (XLM), Hedera (HBAR) and most certainly Cardano (ADA).

The memecoin froth isn’t exactly abating, however, as you can see from performers such as ACT, erm Fartcoin and Snek (which is a Cardano-based memecoin).

Perhaps the ‘Boomer coin’ run here is almost meme-like in itself.

Crypto… we never said it all completely makes sense.

But as much as it is sentiment driven, it’s also extremely story/narrative driven, and it can definitely pay to stay on top of these two factors as much as possible, unless… you’re an investor aiming to “set and forget” with just a few high-conviction plays, such as Bitcoin, Ethereum and Solana (for example).

The latter option is probably the most stress-free way to invest in crypto – not financial advice.

Around the blocks: talking points and catalysts

Let’s bullet point these for maximum ease and then get on outta here so you can get back to checking your portfolio every five minutes…

• The Trump crypto trade. We’ve mentioned that. But what could his pro-crypto government actually do for the crypto industry in the US (and the rest of the world)? We’re already starting to see the benefits manifesting, case in point…

On January 20, 2025 I will be stepping down as @SECGov Chair.

A thread ⬇️

— Gary Gensler (@GaryGensler) November 21, 2024

• Gary Gensler to resign. Is it a mere coincidence the current SEC boss and most hated man by the crypto industry (after perhaps only Sam Bankman Fried) has chosen the date of Trump’s inauguration to clear out and go play golf with his Goldman Sachs buddies? Doubt it.

Veteran US financial regulator Paul Atkins, who is very pro crypto, is rumoured to be Trump’s pick to replace Gensler. Whoever takes over, though, expect a far friendlier stance on crypto, and clearer, fairer rules and regulations for the industry to ensue.

• Bitcoin Treasury stockpile chatter grows. Although following through on pre-election promises is hardly a given from any elected president, there are strong signs that this is being taken seriously by key Republicans, bearing in mind, too that the GOP will have the majority in both House and Senate.

Trump had promised, by the way, that he would “keep (senator) Elizabeth Warren and her goons away from your Bitcoin” and that he would initiate an order for the government’s substantial amount of Bitcoin (207,189, worth about US$20bn) to be stockpiled as a strategic asset, and not to be sold. Other Republicans, including Senator Cynthia Lummis (through her Bitcoin ACT bill) and Robert Kennedy Jr have expressed they’d like their government to go further, buying the asset regularly to accumulate… (Dr Evil music) ONE MILLION Bitcoin over a five-year period.

Here’s former CFTC chair Chris Giancarlo talking to Fox Business about the stockpiling idea, noting that the state of Pennsylvania recently added Bitcoin to its own strategic balance sheet, and calling it “a very forward-looking idea”…

JUST IN: ‘Crypto dad’ Chris Giancarlo shares his view on states putting Bitcoin on their balance sheet and says, “I think it makes a lot of sense…I think it’s a very forward-looking idea.” pic.twitter.com/dRSbAr5cif

— Cointelegraph (@Cointelegraph) November 27, 2024

• Brazil lawmaker Eros Biondini has proposed an US$18 billion sovereign Bitcoin reserve for the country, with an allocation of up to 5% of Brazil’s $355 billion reserves to the digital asset, and with central bank management utilising blockchain and AI technologies. Yep, that’s just a bill proposal at this stage, but… could these sorts of ideas be gaining steam in a possible sovereign wealth arms race to frontrun the US?

“There is a global race for Bitcoin going on right now,” said asset manager and investor Anthony Pompliano in mid November. “Pomp” is a well-known figure in the US crypto space and was speaking with Yahoo Finance.

“Whether you are a local, state, or federal government official, you should be figuring out how to get as much Bitcoin onto the balance sheet as possible. This is not like gold where we can just go dig up more of it out of the ground,” he added.

• Institutions keep stacking. And the 12 spot Bitcoin ETFs have now resumed their inflows amid the growing sentiment, reaching a daily high of US$4.59 billion total trading volume on November 27.

BIG INSTITUTIONS KEEP STACKING!!!

Marathon Digital has added 703 $BTC, which brings their total holdings to 34,794.

Quick math – that’s $3.3 billion worth of #Bitcoin!!!

SO BULLISH!!! pic.twitter.com/XcDNFwvikd

— Kyle Chassé / DD (@kyle_chasse) November 28, 2024

And looking beyond Bitcoin and Ethereum spot ETFs, it looks like we can expect more crypto diversity from the institutional-buying side with Solana, XRP and Litecoin ETFs possibly just around the corner – and that could just be the start of broader crypto-themed ETF offerings.

Four Solanas, 3 XRPs, 2 conversions and a Litecoin in a pear tree.. nice look at the coming ‘twelve months of alt coin ETFs’ Barring monster crash, its about to get pretty wild for this young category. Don’t be surprised if this list is triple in size by end of Jan via @JSeyff pic.twitter.com/TxzLFT2BiX

— Eric Balchunas (@EricBalchunas) November 27, 2024

• Pantera Capital CEO Dan Morehead noted the other day on America’s CNBC that the crypto market is “still in its early days”, and that Bitcoin has “reached escape velocity”, suggesting the asset at about US$96k might look “cheap” in hindsight.

“Bitcoin has reached escape velocity,” says @PanteraCapital’s @dan_pantera. “We don’t have another currency to save our reserves in so to save it in Bitcoin would be a great strategic move.” https://t.co/cJW4fyGedL

— Squawk Box (@SquawkCNBC) November 26, 2024

• What else do we need to watch out for coming up? Michael Saylor’s Microstrategy continuing to buy Bitcoin like it’s in incredibly short supply? (Which it is, obvs.) More nation states FOMOing in? China continuing to ease its previously draconian stance on crypto trading/ownership? Russia escalating its Bitcoin mining operations? Signs of Bitcoin dominance decreasing, signalling a frothy “altcoin season” boom (and then bust)?

All of the above, yes.

But perhaps most of all, let’s hope US financial analyst Jim Cramer stops calling out Bitcoin as a buy…

JUST IN: #Bitcoin is down 8.2% from it’s all-time high since Jim Cramer said “all I can tell you is, own #Bitcoin. That’s a winner.”pic.twitter.com/7tRfDbuq1f

— Watcher.Guru (@WatcherGuru) November 26, 2024

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.