Mooners and Shakers: Was $25k the Bitcoin bottom? Former BitMEX CEO Arthur Hayes thinks it’s… possible

Not mooning, bottoming? (Getty Images)

Bitcoin is moving down, up and around US$30k today, as a prominent bottom speculator – BitMEX co-founder and former CEO Arthur Hayes – throws the market his latest analysis.

An OG in the space, Hayes is currently serving two years of probation with home detention for six months, handed down by a New York federal courthouse a couple of weeks ago. His crime? Wilfully failing to implement an anti-money laundering program at the Seychelles-based BitMEX crypto exchange.

Annyyyway… pushing that misdemeanour aside, and like him or hate him, he still seems to be a go-to within the crypto space for his searing market analysis.

And in his latest blog post released today, Hayes indicated that last month’s Bitcoin bottom could well be THE bottom.

Using data from blockchain analytics firm Glassnode, Hayes pointed to Bitcoin’s price drawdowns from all-time highs from two other Bitcoin four-year halving cycles.

While stressing that reaching the figures presented is “not an exact science”, Hayes noted:

“The point is to be generally correct, and with a bit of fudging around the edges we can approximate a range that corresponds to what we believe is the local bottom. For Bitcoin, that’s $25,000 to $27,000. For Ether, that’s $1,700 to $1,800.”

A bottom-picking checklist

Interestingly, Hayes’ “bottom checklist” includes:

• a decreasing correlation between Bitcoin and the tech-heavy Nasdaq 100,

• BTC trading at price levels close to the peak of the previous bull market cycle,

• and mainstream media gloating about “greedy plebs” who crashed and burned investing in crypto.

Hayes did caveat, however, that if Bitcoin has already bottomed out, it doesn’t mean it’s likely to slingshot straight back to new all-time highs. Something to do with macro puppeteer central bankers? Yep…

“The bull market can only begin once the Fed and its sycophantic cadre of other central bankers reverse course, which at the very least requires pausing rate hikes and keeping the size of their balance sheets constant.” — Arthur Hayes https://t.co/MPm5TpXXo8

— abd≡N (@abdenourbouhali) June 2, 2022

Top 10 overview

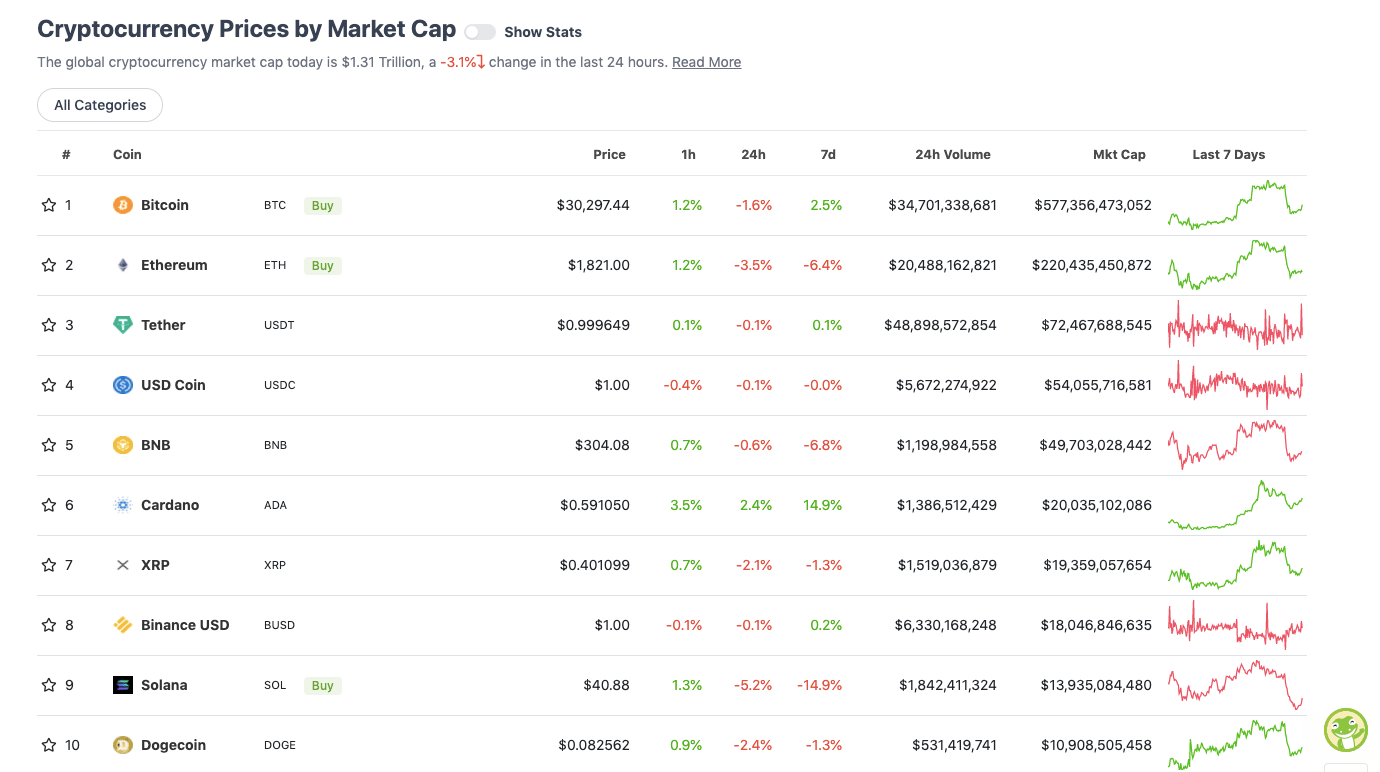

With the overall crypto market cap at roughly US$1.31 trillion, down about 3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

While Solana (SOL) is still comparatively bleeding out (it had a bad day, yesterday), most other crypto majors aren’t too drama-filled over the past 24 hours.

However, according to another well known (in the crypto space) analyst, Rekt Capital, Bitcoin may well be putting Arthur Hayes’ US$25k Bitcoin bottom call to the test over the coming weeks…

#BTC has performed weak Monthly Close below ~$35000

Technically there is scope for a relief move into the ~$35K to confirm it as new resistance

Whatever the move from here it's likely we'll find out over the coming weeks that orange ($29K) is weakening as support$BTC #Bitcoin https://t.co/Gdz7h6hRMt pic.twitter.com/U8o5f4Y1oa

— Rekt Capital (@rektcapital) June 1, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$10.7 billion to about US$539 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Terra Luna Classic (LUNC), (mc: US$808.7 million) +9%

• Evmos (EVMOS), (market cap: US$752 million) +7%

• Chilliz (CHZ), (mc: US$677 million) 5%

• Internet Computer (ICP), (mc: US$1.94 billion) 4%

• Loopring (LRC), (mc: US$685 million) 3%

DAILY SLUMPERS

• BitDAO (BIT), (mc: US$596 million) -13%

• Convex Finance (CVX), (mc: US$551 million) -9%

• Arweave (AR), (market cap: US$656 million) -6%

• Aave (AAVE), (market cap: US$1.48 billion) -6%

• Synthetix (SNX), (market cap: US$633 million) -5%

Around the blocks

Cardano (ADA) has a vast community of supporters, stakers and developers, but it certainly cops a lot of grief from its rivals and various detractors spread across Crypto Twitter. It’s probably partly because founder Charles Hoskinson is so vocal in his defence of the project…

So the primary criticism is that Cardano writes software carefully when billions of dollars are at stake from millions of users and thousands of businesses rely upon the infrastructure for their livelihood? I'd love to see these guys build a hospital. https://t.co/xjAmF7HPiu

— Charles Hoskinson (@IOHK_Charles) June 2, 2022

Meanwhile, the three-day Illuvium digital land sale has kicked off, and Melbourne-based YouTuber “Scoriox” seems a tiny bit keen…

Lets do this 24 Hour Stream!! https://t.co/xgBrJZtOaY

— Scoriox $LIZ 🌿🔥 ♊️ (@kingscoriox) June 2, 2022

You can read more about the ins and outs of the sale and all things Illuvium in our latest interview with the project’s co-founder Kieran Warwick.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.