Mooners and Shakers: Visa proposes auto-payments of bills through crypto wallets; market ticks up

Not a self-custodied crypto wallet, yesterday. (Getty Images)

While the trad markets are in a tizz about a shock policy shift from the Bank of Japan, crypto assets quietly ticked up a fraction or two overnight. Meanwhile, Visa has proposed something potentially significant for mainstream crypto adoption.

In a blog post yesterday, the payments giant proposed the enabling of auto-payments for recurring bills, using Ethereum-enabled, self-custodied crypto wallets.

On the surface, that might seem unremarkable as it’s a common service provided in the traditional banking world – for example paying for your electricity bill or streaming service through an automated bank account set-up.

But at the moment, Ethereum doesn’t allow this function as automated smart contracts can’t request transactions and so user accounts need to initiate and send transactions manually. Self-custodied wallets only currently allow the user control of the wallet’s private keys, meaning that person has to manually sign off on each and every transaction.

Self-custodied crypto, however, is appealing to those who wish to divorce themselves from centralised financial control. And in the wake of recent crypto-market-roiling events, the rallying cry: “Not your keys, not your crypto” – in reference to avoiding holding (and losing in the case of FTX, Celsius, et al) assets through centralised entities – has intensified.

Visa said that automatic recurring payments via the Ethereum blockchain could be made possible through a self-custodial wallet called a “delegable account” – which is based on something known as the “Account Abstraction” (AA) concept that Ethereum co-founder Vitalik Buterin first proposed in 2015.

People that are betting against crypto, underestimate the incentive mechanisms baked into corporations

The young & hungry employees at @Visa are working on the blockchain projects, because they know the fastest way to climb the corporate ladder is by working on the moon shots pic.twitter.com/eyPkzLgWmC

— Alex Valaitis (@alex_valaitis) December 20, 2022

Through such a system, Visa says that user accounts can “function like smart contracts,” which means that transactions can be scheduled in by crypto users, without signing off to initiate each transaction.

Top 10 overview

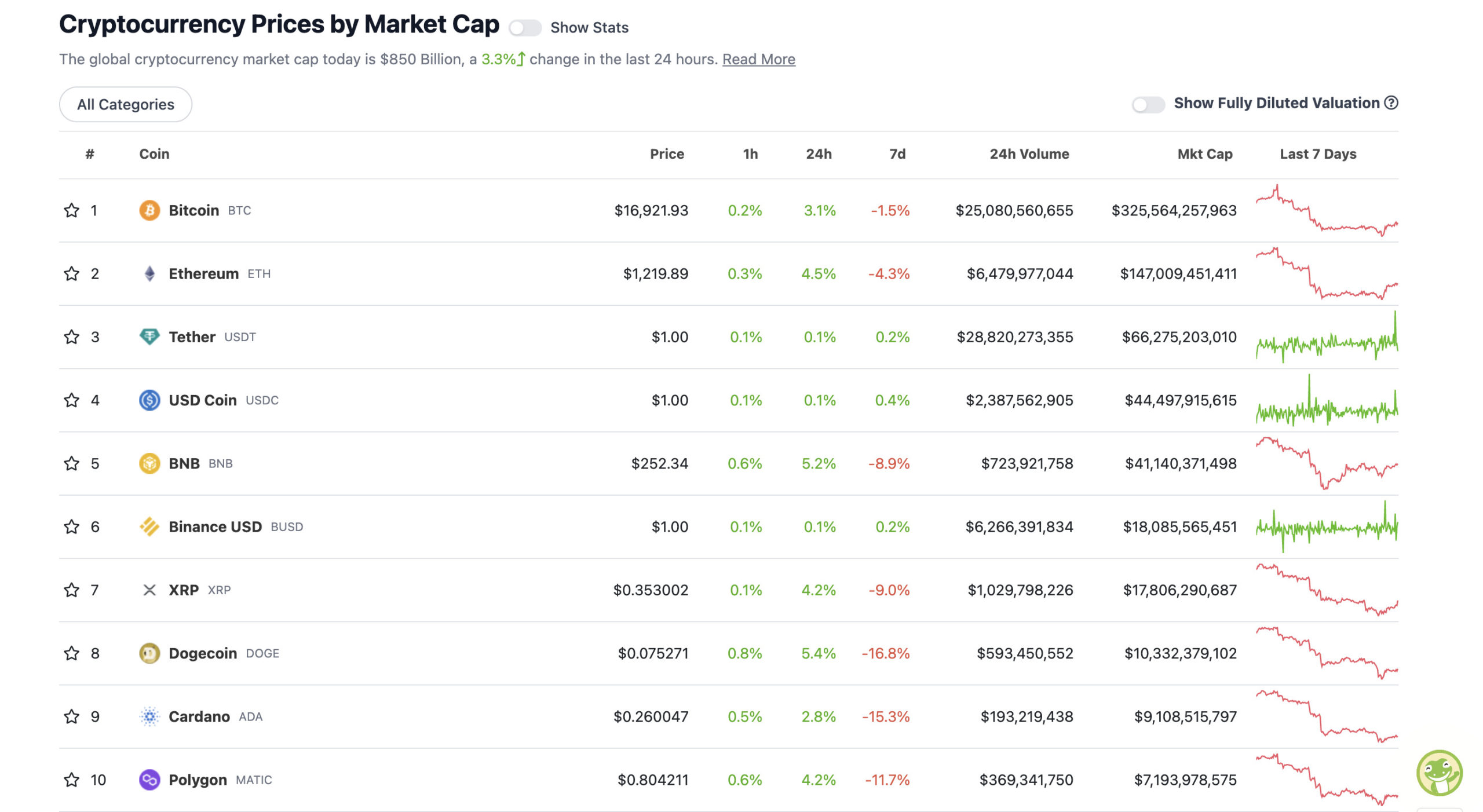

With the overall crypto market cap at US$850 billion, up 3.3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Ethereum (ETH) is actually one of the best performers over the past 24 hours. Any effect from the Visa proposal may be coincidental, however, as it’s green across the board.

Bitcoin (BTC), meanwhile, looks like it might want to have another crack at breaching the US$17k mark. According to at least one technical analyst, though, US$17,150 is the level to hit and stay above at year’s end, lest we see another breakdown. If you’re a firm believer in the direction of price candles and moving-average lines on charts, that is.

There is still time for #BTC to perform a Monthly Close above the ~$17150 level later this month, to retain this level as support just like in November

But a Monthly Close below ~$17150 would confirm the beginnings of a breakdown from here$BTC #Crypto #Bitcoin pic.twitter.com/woCY662gQv

— Rekt Capital (@rektcapital) December 19, 2022

Here’s Bloomberg’s Senior Commodity Strategist Mike McGlone again, though, with some positive thoughts about the OG crypto asset, reiterating his recent thesis that BTC will outperform Tesla and is set to “resume its propensity to outperform“, given the right macro conditions.

Bitcoin Crosses, the Crypto Looks to Regain Upper Hand Over Tesla — The near certainty of declining #Bitcoin supply vs. the rising amount of #Tesla shares outstanding favors outperformance by the crypto, if the rules of economics apply. pic.twitter.com/JNQVpOB6za

— Mike McGlone (@mikemcglone11) December 19, 2022

And speaking about “outperforming”, McGlone also believes Ethereum will remain the top candidate to do just that to the “first born crypto” itself.

Bitcoin crosses series; Ethereum may be top candidate to continue outperforming the first born crypto –#Ethereum's advances vs. #Bitcoin have been unshaken by 2022 deflation in most risk assets and may be gaining underpinnings. pic.twitter.com/mLRMO4vpQr

— Mike McGlone (@mikemcglone11) December 20, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$5.8 billion to about US$306 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• OKC (OKT), (market cap: US$433 million) +10%

• Trust Wallet (TWT), (mc: US$678 million) +10%

• Flow (FLOW), (mc: US$808 million) +8%

• ImmutableX (IMX), (mc: US$334 million) +7%

• NEAR Protocol (NEAR), (mc: US$1.13 billion) +7%

DAILY SLUMPERS

• Chain (XCN), (market cap: US$493 million) -3%

• WhiteBIT Token (WBT), (market cap: US$547 million) -3%

• LEO Token (LEO), (mc: US$3.45 billion) -2%

Around the blocks

Some randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

FTX founder Sam Bankman-Fried has agreed to be extradited to the US, according to reports. We’ll see, but it looks like this could happen this week, although in the meantime, he’s enduring time in the Bahamian hell hole that is Fox Hill prison.

Photo of SBF in court today.

He was “visibly shaking” during the hearing, before being sent back to the Bahamas Jail. pic.twitter.com/ZCbLqGEZpL

— Miles Deutscher (@milesdeutscher) December 20, 2022

JUST IN 🇷🇺 Bank of Russia Deputy Chairman: We are looking for opportunities to use #Bitcoin and crypto in cross-border payments 👀

— Bitcoin Magazine (@BitcoinMagazine) December 19, 2022

BREAKING: Elon Musk hints that yesterday’s poll about him stepping down as Twitter CEO was a trick to catch bots.

Stay tuned…

— Collin Rugg (@CollinRugg) December 20, 2022

JUST IN: FTX new management says the company has located over $1 billion in assets, including $720 million in cash.

— Watcher.Guru (@WatcherGuru) December 20, 2022

And apropos nothing to do with crypto… but just ‘cos…

https://twitter.com/fasc1nate/status/1605173416721530884

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.