Mooners and Shakers: US regulatory oversight fears swirl round crypto (again), as Bitcoin hangs in there

Coinhead

Coinhead

Bitcoin and crypto is hanging in there by a thread today, amid fresh fears of regulatory oversight in the US.

A new, sweeping tax proposal in the United States has been pushed front and centre by the marionette known as Joe Biden and the people unconvincingly (it crumples in a heap unreasonably often) pulling the strings.

Biden and the US Treasury’s proposal (and at this stage it’s just a proposal with no guarantee of successfully passing through the US halls of power and circling back to Biden’s shaky signing hand) is being highly criticised today across the cryptoverse.

It details the US government’s idea of how to handle digital asset “brokers” in the country – a word that appears to be given a hell of a lot of creative licence.

A broker in the crypto industry, you would think, might simply apply to exchanges. This proposal, however, would see it applied with far greater scope across the industry in the US, with many entities favouring a decentralised model likely to find tax compliance under the guidelines virtually impossible to carry out.

Here’s Miller Whitehouse-Levine, CEO of DeFi lobbying group DeFi Education Fund, who noted that the proposal is “overbroad” and seeks to capture all sorts of crypto entities, including self-hosted, or unhosted, wallets as one example – such as Metamask.

Treasury just released a confusing and self-refuting proposal pursuant to a new definition of "broker" passed in August 2021.

As feared, it strains to find non-existent financial intermediaries in crypto—including DAOs and certain wallet providers—or to create them… https://t.co/6D3NJ1UpGJ

— Miller (@millercwl) August 25, 2023

So then, has crypto in the US become a polarising, partisan issue in the US? Short answer is probably yes.

It’s certainly looking more and more like that every day as the Biden administration appears to be ramping up attempts to curb the crypto industry’s enthusiasm, in fact, worse, render it virtually inoperable in the United States.

Here’s a take from the generally pro-digital-innovation Republican Congressman Patrick McHenry, who noted in a statement that the proposed rulemaking fails on numerous counts.

“Following the passage of the Infrastructure Investment and Jobs Act, numerous lawmakers of both parties made clear that any proposed rule must be narrow, tailored, and clear,” he said.

“However, it fails on numerous other counts. Any additional rulemakings related to the other sections from the law must adhere to Congressional intent.”

Most pro-crypto commentators we see on our ‘X’ feed attempt to leave political preferences out of their analytical equation, but it’s becoming increasingly apparent the majority of the crypto industry in the US believes it will be a disaster if the incumbent administration is reelected to power in the 2024 election.

“The Dems have become an authoritarian monstrosity and must lose,” posted the founder and CEO of the Messari blockchain and data company, Ryan Selkis.

https://twitter.com/twobitidiot/status/1695173624456532347?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1695173624456532347%7Ctwgr%5E70c28564a77efe2e82fafb70e39fcfd6923a7ada%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fcointelegraph.com%2Fnews%2Fronaldinho-fails-testify-crypto-scam-probe-faces-possible-arrest-brazil

The founder of the decentralised crypto exchange dYdX, Antonio Juliano, meanwhile takes this sentiment a step further with a hot take of his own which is essentially that: crypto industry ‘builders’ should forget about operating in the United States altogether for the next five to 10 years, suggesting it’s not worth the hassle or compromises involved.

[Serious tweet / hot take 🌶️]

Crypto builders should just give up serving US customers for now and try to re enter in 5-10 years

It’s not really worth the hassle / compromises. Most of the market is overseas anyways. Innovate there, find PMF, then come back with more leverage

— Antonio | dYdX (@AntonioMJuliano) August 25, 2023

Presumably he’s of the opinion the current Democrats will sweep back into power, which is certainly a strong possibility when you consider other key options in opposition.

Juliano says it would be better for crypto developers to focus on their operations in other countries, where he believes “most of the market” lies anyway. He thinks they should find PMF (product market fit) and then come back to the US in a stronger position when America is ready to more readily adopt the tech.

“The only thing that matters for all of us is crypto finding 10x stronger product market fit,” he adds. “*You don’t need to have perfect distribution to iterate and find a strong product-market fit.* There is a plenty big overseas markets to experiment in.”

The dYdX founder also believes, however, that crypto and blockchain tech aligns perfectly for traditional American principles.

“Crypto is aligned with American values. What could be more American & capitalist than a financial system of the people, by the people, and for the people That is literally what we’re building here.”

Crypto is aligned with American values. What could be more American & capitalist than a financial system of the people, by the people, and for the people

That is literally what we’re building here. America will realize that eventually

— Antonio | dYdX (@AntonioMJuliano) August 25, 2023

In other news, rather enormous asset management bigwig JP Morgan has released a report in which it said it envisions the crypto market experiencing “limited downside” in the near term, adding that liquidations on crypto startups are “largely behind us”.

However, as our very own non-fungible Eddy Sunarto noted in his Market Highlights roundup this morn, the bank warned that a “new round of legal uncertainty” for crypto market awaits, making it sensitive to future developments.

Yep, see above for those “legal uncertanties”. It’s certainly treacherous waters right now for short-term players. Are you playing the long game?

Two days ago JPMorgan said: ''the bottom of this #Bitcoin crash is nearing''

Honestly, this only makes me bearish… pic.twitter.com/mIAjjatrDG

— Crypto Rover (@rovercrc) August 27, 2023

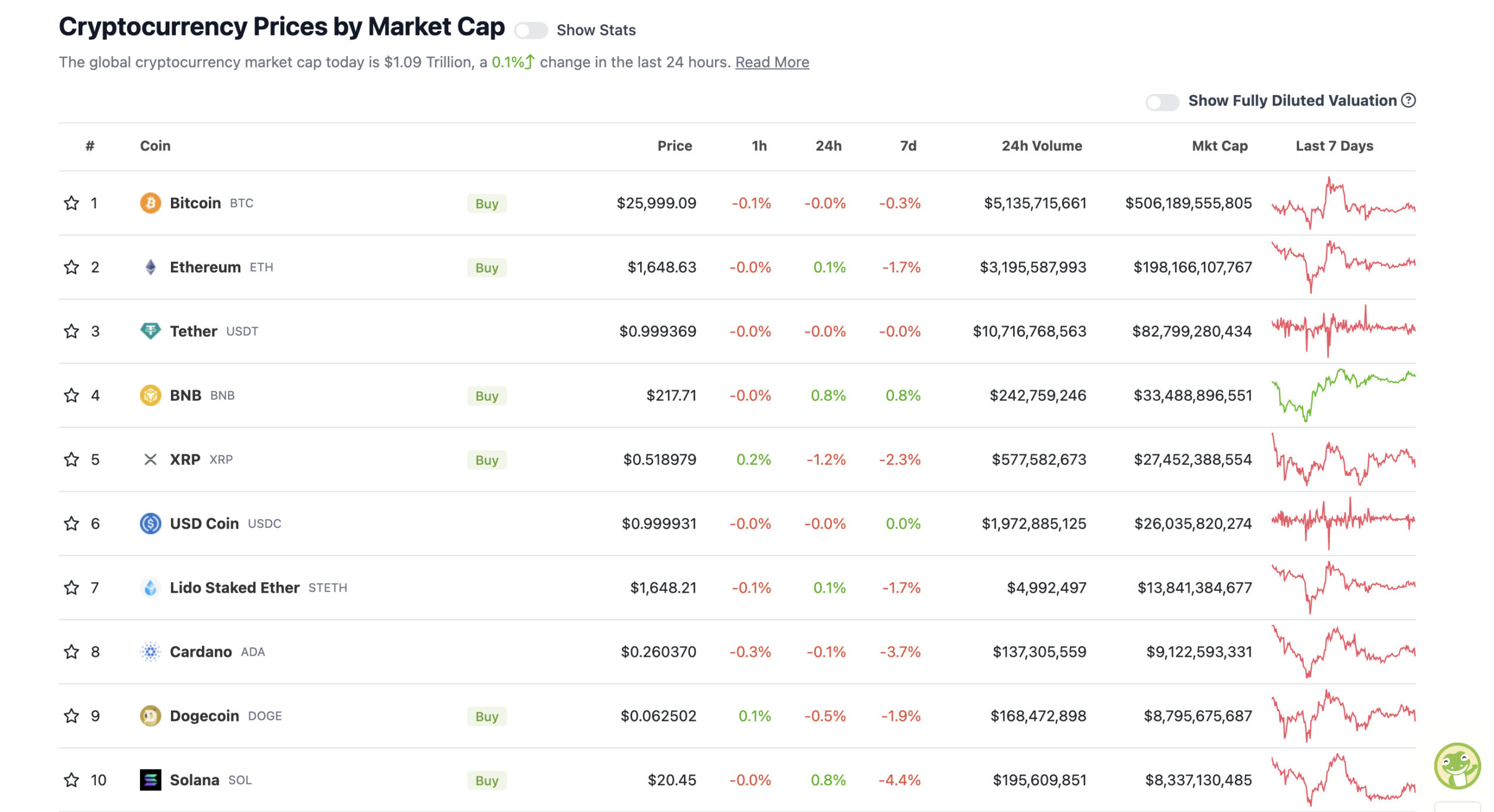

With the overall crypto market cap at US$1.09 trillion, pretty flat since last time we checked in, here’s the current state of play among top 10 tokens – according to CoinGecko.

On Friday, markets had squeaky bottoms regarding the impending outcome of reactions to US Fed boss Jerome Powell’s likely dour verbage.

His hawkishness regarding inflation came to pass at the meet-up in Jackson Hole, Wyoming, where he told a group of the world’s central bankers in attendance that the US fight against inflation isn’t over, and that the Fed could return to hiking rates.

“Although inflation has moved down from its peak, a welcome development, it remains too high,” Powell said.

“We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

In any case, markets didn’t quite crap the bed, including crypto, which is largely holding itself together… for now – in “the longest bear market in history for Bitcoin”.

The longest bear market in history for #Bitcoin

It might feel like a ghost town in crypto. It might feel like there's not even going to be a bull cycle anymore and I understand why these thoughts are there.

But why?

Well, people base their decisions on history. 👇… pic.twitter.com/Ljtv9wmw12

— Michaël van de Poppe (@CryptoMichNL) August 27, 2023

$BTC H4

Forming a classic bear flag after a large move downward. Expecting continuation into support which will form bullish divergence.

I wouldn’t look for swing shorts here but a quick shirt is optional.

Ultimately looking for a big long play.#bitcoin #cryptocurrency pic.twitter.com/r1QaeqJgVd

— Roman (@Roman_Trading) August 28, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Kaspa (KAS), (market cap: US$731 million) +5%

• Cronos (CRO), (market cap: US$1.4 billion) +5%

• dYdX (DYDX), (market cap: US$373 million) +3%

• Filecoin (FIL), (market cap: US$1.48 billion) +3%

• Curve DAO (CRV), (market cap: US$400 million) +3%

SLUMPERS

• Theta Network (THETA), (market cap: US$598 million) -5%

• Sui (SUI), (market cap: US$398 million) -5%

• Injective (INJ), (market cap: US$581 million) -4%

• Optimism (OP), (market cap: US$1 billion) -3%

• Hedera (HBAR), (market cap: US$1.86 billion) -2%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Hmm… what’s up with the crypto-famous blowhard YouTuber and influencer Ben “BitBoy” Armstrong now, eh?

Not sure exactly and we don’t wish to speculate at this point until we perhaps look into it ourselves, but here are some of the rumours circulating on X…

I used to be a chat mod for ol’ BitBoy Crypto . My GUESS is irreconcilable differences between Ben and his former partners at Hit Network/Around the Blockchain. This is putting it kindly. If you want my more juicy insider knowledge, feel free to DM me.

— cryptosteveo.sol (@CryptoSteveO1) August 27, 2023

There are apparently rumors that Bitboy (Ben) is leaving the Bitboy channel and transferring the IP to others because of some sort of investigation; and the Bitboy Twitter account removed his face from the pfp.

I don’t know if it’s true, but I sure as fuck hope it is! 😁

— Adam Cochran (adamscochran.eth) (@adamscochran) August 27, 2023