Mooners and Shakers: Uptober lifts Bitcoin and crypto towards a star-spangled Moonvember

Pic via Getty Images

Stockhead’s monthly crypto wrap, Mooners and Shakers, is brought to you by

- Crypto gets an ‘Uptober’ after all as November moon mission prepares for lift-off (possibly)

- Some of the best-performing cryptos in October? Erm… memecoins. Yep

- All eyes on: the US election and US economy… and Microsoft. Strap in, we could be in for a ride

Historically, October is a kick-arse month for Bitcoin and the wider crypto market. Just a handful of days ago, however, it was shaping up as decidedly more Octo-meh than the ‘Uptober’ it’s playfully referred to in crypto circles.

But, those who know… knew something. They knew we were also heading into what’s, on average, the most bullish week of the crypto calendar year.

And wouldn’t you know it – like clockwork, Bitcoin rocketed up over US$73k for the first time since March, notching an 8% gain over the seven days leading up to this article being published.

Update: As of 6pm on Friday Nov 1, BTC has since pulled back to just over US$69k on the back of a sell-off on Wall Street. No, this doesn’t mean the November moon mission has been aborted.

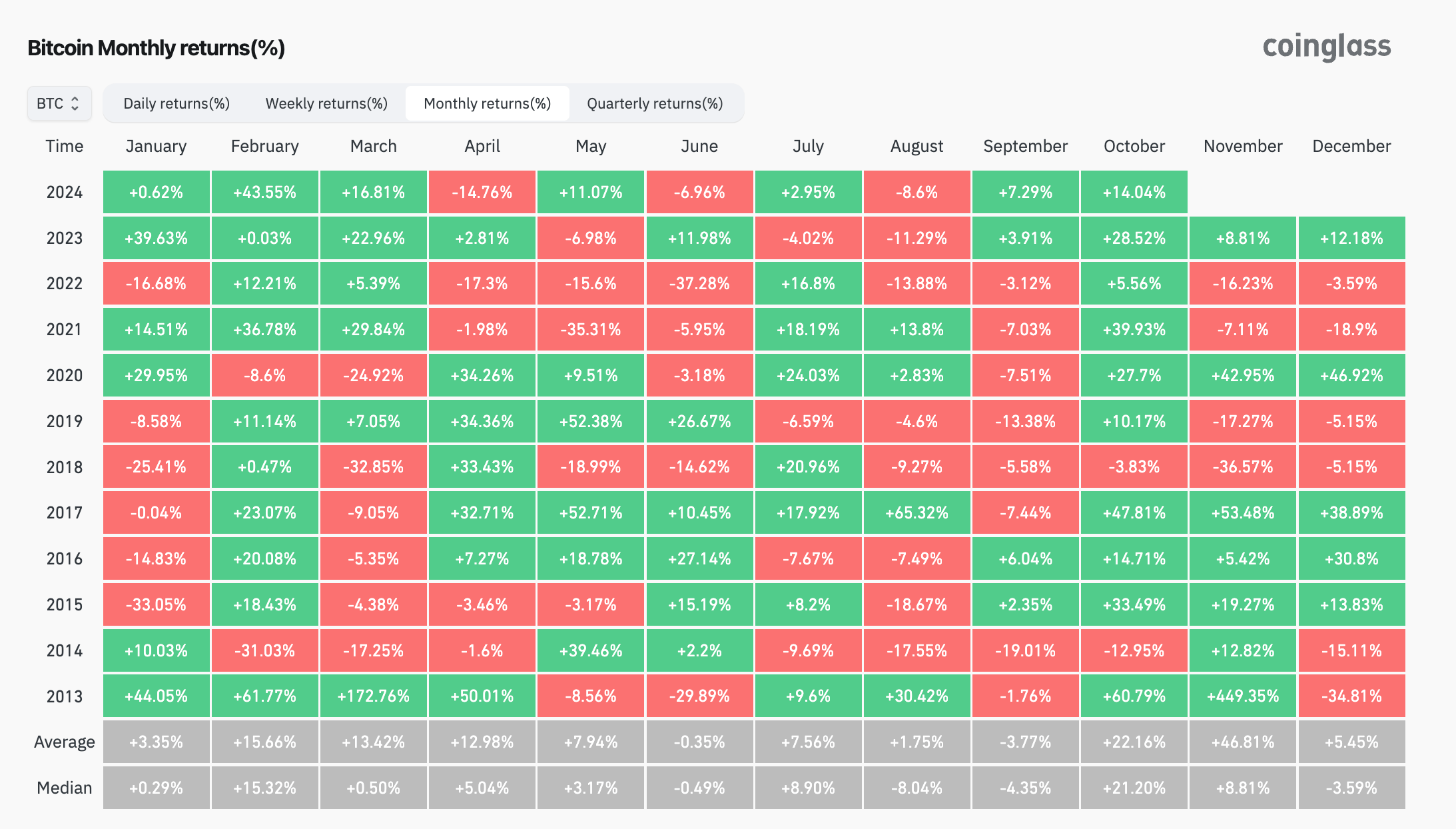

Below, you can see the OG crytpo’s October 2024 percentage return, courtesy of the blockchain data gurus at Coinglass…

A 14% monthly return is not a personal best by any means, but it is at least leading us with some form on the board into what’s, on average, the most fruitful crypto month of them all… Nov Moonvember.

Before we examine which coins mooned in October, and maybe a conspicuously big one that didn’t, let’s get a quick…

… vibe check

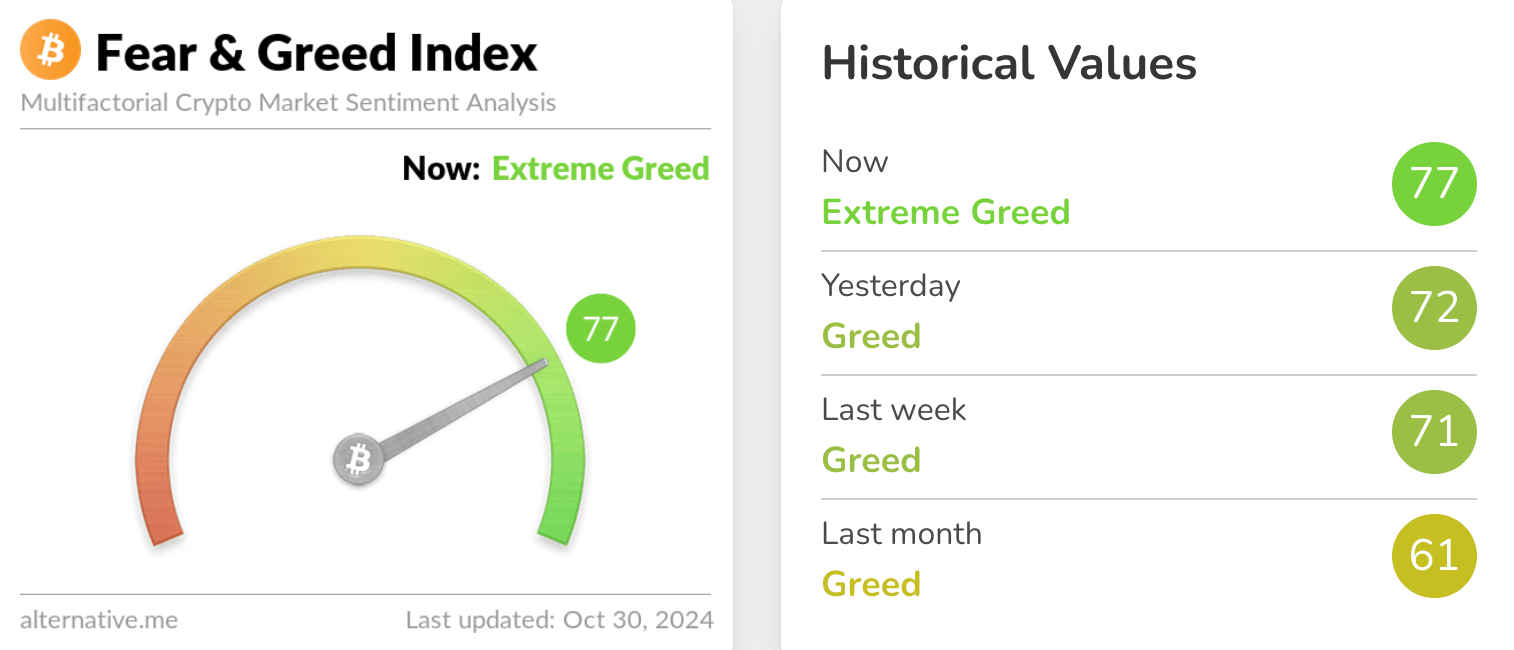

And we can do that via the leading crypto market sentiment tool – the Fear and Greed Index.

This sentiment tool is based on a number of metrics, including volatility, market momentum, social media, surveys and more.

What’s striking about it ticking up into ‘Extreme Greed’ is that it’s the first time it’s done so since early June.

There’s not been a lot of ‘retail’ excitement in the market for months post Bitcoin halving – which is fairly typical – but very clearly, the site’s data is showing market sentiment is beginning to pick up again.

Google searches for the term Bitcoin, however, as seen in the tweet by crypto market watcher Miles Deutscher below, may not reflect that just yet.

#Bitcoin is on the verge of breaking all-time highs, and retail interest is still almost non-existent.

Higher. pic.twitter.com/EH4fWnjIvG

— Miles Deutscher (@milesdeutscher) October 29, 2024

One thing to consider is that if the needle is spent too long in the extremest of greed categories, it could be a sign of the market overheating, which is usually followed by a correction.

That said, this may also be the start of some market froth and potentially useful (for traders) volatility beginning to form.

October’s top gainers

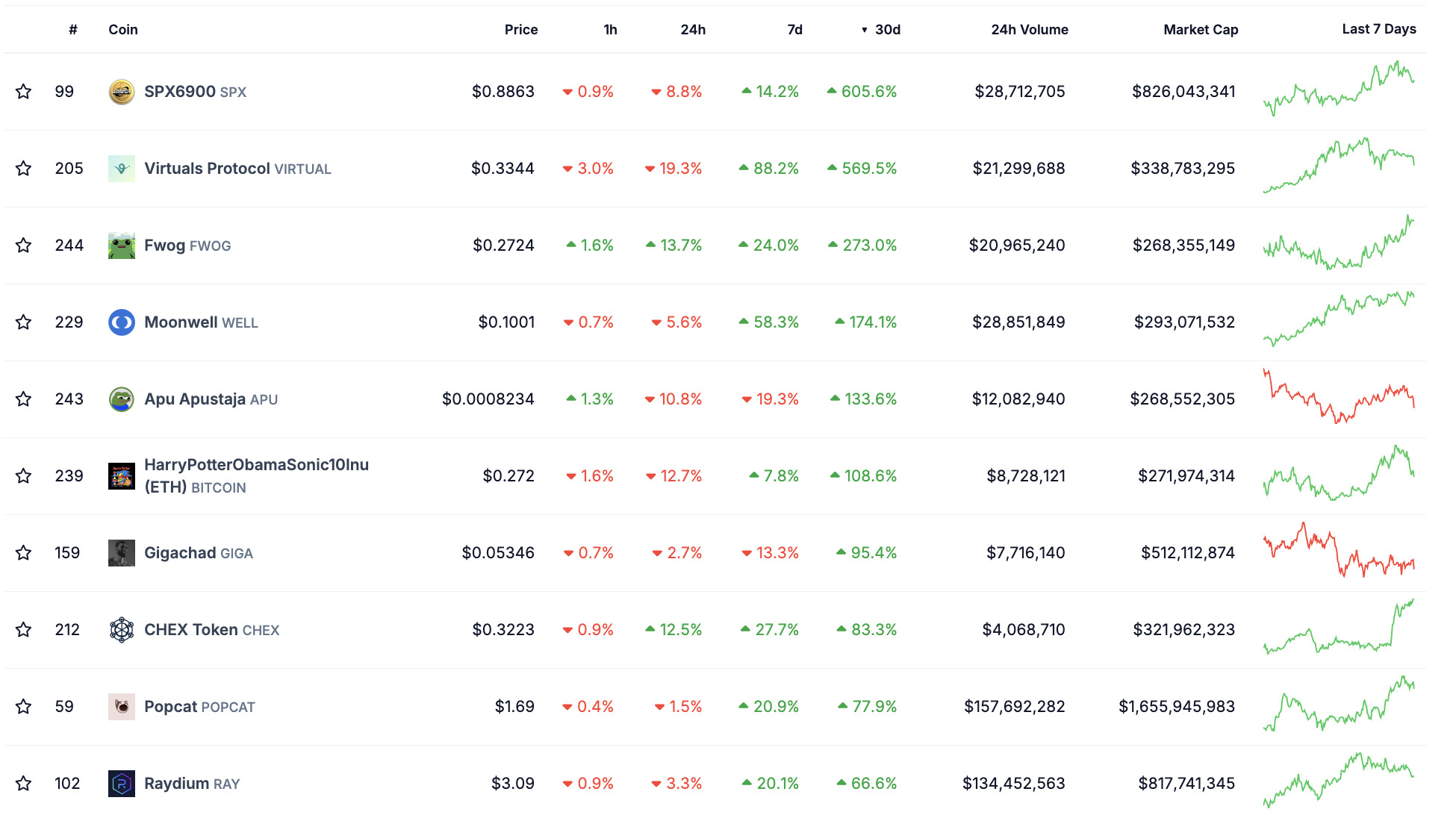

The top 10 from the top 300 coins list, according to CoinGecko data.

We could go deeper, because there are more than 15,000 cryptocurrencies jostling for degenerate attention, but we figure a 300 sample size is playing with fire well enough.

So, what did we learn from specific October crypto sector performances? ‘Memecoins’ stole the show, with something called, erm, S&P6900 leading the charge with a 605% gain.

Forget the S&P 500, this thing’s an index apparently 6,900 strong. Of what, exactly, isn’t too clear from its piss-taking website, but it’s been going gangbusters nevertheless.

Amid the other standout gainers there was an AI agent (autonomous intelligent system) coin, a frog or two, a wide-mouthed cat, a Gigachad and even Harry Potter magicking his way in there.

There is no doubt some serious money to be made by the savvy on the memecoin merry-go-round, but it’s, for reals, a dangerous game to play.

That said, highly influential trader Murad Mahmudov is of the opinion that this cycle/bullrun’s main narrative is, and will remain, memecoins.

This cycle’s main narrative is Memecoins.

To the majority this still sounds crazy.

To those paying attention, this is obvious. pic.twitter.com/X0Vbodv9Pf

— Murad (@MustStopMurad) October 28, 2024

We don’t make the rules, and neither does Murad, but, per this Binance article, there’s no getting around the fact he’s made a stupendous amount of dollars trading the things. (Absolutely not financial advice.)

Other October notables

Bitcoin (BTC) – The bull goose crypto rose an impressive (for its enormous market cap of more than US$1.4 trillion) 12%.

Dogecoin (DOGE) – Speaking of memecoin mania, though, Elon Musk favourite and memecoin OG Dogecoin gained by 41% over the month.

Solana (SOL) – With a 12% rise in October, Solana has been steadily grabbing market share from Ethereum. The layer 1 blockchain was a huge pumper last bullrun (about four years ago). And many a crypto influencer/analyst – such as former Goldman Sachs man Raoul Pal – believes it’s poised to have a good run again this time around. In fact, Pal has predicted SOL could see as much as 600% upside this cycle.

Ethereum (ETH) – See above, really. The second-most valuable by market cap crypto had a torrid time in October, although it has still turned out in the green with a 2% gain. Nevertheless, along with Bitcoin, ETH is one of the main crypto ETF market drawcards for big institutional players.

Sui (SUI) – The “Solana killer”. Also playing in the layer 1 blockchain space, like ETH and SOL, SUI is a high-speed, high-performance blockchain that’s built some very solid momentum over the past few months and sits a bit further down the market cap list than its larger rivals. SUI made a 14.6% gain in October.

Around the blocks: talking points and catalysts

• The US election

Is the market already pricing in a win by polarising (okay, who isn’t in US politics?) Republican leader Donald Trump?

It depends which polls you’re looking at and which media you consume. Certainly the crypto-centric media, which is very much Elon Musk’s X, and the crypto-fuelled polling site Polymarket, is leaning heavily in the orange one’s favour (and that means both Bitcoin and Trump in this instance).

Take this for what you will, given the cryptoverse’s bias for Trump after he gave the industry his endorsement in July at Bitcoin 2024 in Nashville… but here is Polymarket’s latest polling/forecast for the US election.

Note, non-betting-based polling figures show the election race as still neck and neck, with Vice President Kamala Harris maintaining a slender lead over a gaining Trump.

Whoever wins, in only about a week’s time, it’s being widely predicted that Bitcoin and crypto ought to benefit from newfound certainty. The crypto market has historically performed well in the immediate months post US elections.

• The US economy

To a fair degree, macroeconomic factors have sway on the crypto market. None of this stuff lives in a total bubble.

This week on Wall Street, investors have been paying close attention to earnings reports from big companies, including Tesla, Boeing, Verizon, and industrial leaders like GE Aerospace and Honeywell.

There is also important economic data being released this week. This includes flash PMI numbers for the manufacturing and services sectors, durable goods orders, and some housing market statistics. While that doesn’t seem related to crypto, the figures could move all markets.

And the September jobs report is due Friday, with the Federal Reserve once again eyeing the labour market ahead of its next big meeting.

Are market-fuelling rate cuts on the horizon again? Probably, but according to BlackRock CEO Larry Fink, the Fed may not cut rates as much as the market hopes before the end of the year.

• Microsoft and BlackRock

Microsoft shareholders have begun a vote to determine whether the company should buy and hold Bitcoin for its corporate treasury. This will be massive news if they vote yes. And obviously a complete fizzer if not.

JUST IN:

Microsoft shareholders have started voting on whether to buy #Bitcoin for its corporate treasury. pic.twitter.com/qNDmD7ZyUK

— Radar (@RadarHits) October 30, 2024

So where does BlackRock fit in here? Because you know it does.

According to PANews, cryptocurrency trader Fred Krueger revealed on the X platform that BlackRock holds a 7% stake in Microsoft (MSFT), second only to Vanguard. Additionally, BlackRock owns an 8% stake in the Bitcoin-hoarding firm MicroStrategy (MSTR).

BlackRock, an extremely crypto-positive, asset-management titan, could be about to have some meaningful sway here.

• Record ETF inflows

News just in… US spot Bitcoin and Ethereum exchange-traded funds are soaring as funds net almost a billion in net inflows (US$870m for BTC ETFs and about US$7.6m for ETH), with BlackRock seeing its largest gains since March.

BlackRock’s iShares Bitcoin Trust (IBIT) takes the top spot amongst the ETF funds, bringing in a whopping US$642.87 million in net inflows, raising the fund’s cumulative net inflow to US$24.94 billion.

Follow the money?

Ok we gonna need to move up our predictions as yest alone the btc ETFs gobbled up over 12k coins like Pac-Man on a bender, now hold 996k btc- good chance to pass 1 million today (as the ridic volume yest likely to translate to big flows tonight). Legit shot to get to Satoshi by… https://t.co/Ua9GzhsBwE pic.twitter.com/84bBprhi6I

— Eric Balchunas (@EricBalchunas) October 30, 2024

• Bitcoin to the moon… eventually

JUST IN: VanEck predicts #Bitcoin will become global reserve asset worth $3m and central banks will make a 2% allocation by 2050.

+16% compounding return for 26 years.

There is no second best. pic.twitter.com/Yn9WM54I25

— Bitcoin Archive (@BTC_Archive) October 28, 2024

For kicks, we’re leaving you with yet another bullish price prediction (above).

It’s one with an extremely long timeline, though – about 25 years. In fact, perhaps investment manager VanEck’s US$3 million BTC target for 2050 isn’t bullish enough…

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.