Mooners and Shakers: There are reasons why the crypto faithful are still bullish on 2025. Here they are

Pic via Getty Images

Stockhead’s monthly crypto wrap, Mooners and Shakers, is brought to you by

- The crypto bull run (if you’re a believer) hasn’t exactly been firing on all (or any) cylinders so far in February

- But… several bullish fundamentals have emerged in the crypto plotline ever since Donald Trump began signing big pieces of paper in the White House

- Here, we list some of the biggest reasons to maintain hope for a strong 2025 for Bitcoin AND altcoins

Perhaps, to quote Axl Rose and co… all we need is just a little patience.

This time last year, in the midst of a particularly hostile environment for crypto in the US, Bitcoin ETF approvals aside, it’s reasonable to say virtually no one would have predicted the stance the US government has on crypto that we’re seeing right now.

Biden’s administration, still smarting from the embarrassment of accepting a hefty donation from now-jailed founder of the collapsed FTX exchange Sam Bankman-Fried, appeared hell-bent on killing the crypto industry in America.

Fast-forward to today and the turnaround in US government sentiment from Trump Mark II and co, is nothing short of staggering.

And, yes, any stubborn altcoin “bag holders” reading this, you might well be thinking “gains… so where the bloody hell are they?” Wasn’t the fabled altcoin season of yore meant to have kicked in by now?

Well, yeeeahhhssssss… but also not necessarily. It’s been a topsy-turvy ride for the crypto market ever since Trump took power, to say the least, and there are probably a few macro concerns (tariff troubles, inflation concerns, Fed plans) still looming, still to be ironed out, before pumpage can be reasonably entertained again.

Crypto investing and trading in 2025 might need far more patience then, but there are certainly some big reasons to make a case for, at the very least, keeping a bullish mindset on ice and close to hand as we head further into the year.

We’ll outline the most eye-popping of those for you a bit further below, but first, a bit of a recap on what the crypto pace-setter (that’d be Bitcoin) did in January, courtesy of Coinglass data…

Bitcoin’s January monthly return

So then, it was a bullish January on the whole for Bitcoin (and by proxy the rest of crypto), peaking on, wouldn’t you know it, Trump’s inauguration day of January 20, with an all-time high for BTC of US$108,786. (It’s currently trading around $US97,700.)

Altcoins were in a much better state at that time, too, with the recently under-performing but still second-most-valuable crypto Ethereum changing hands for about US$3,700 – far higher than its price at the time of writing: US$2,726.

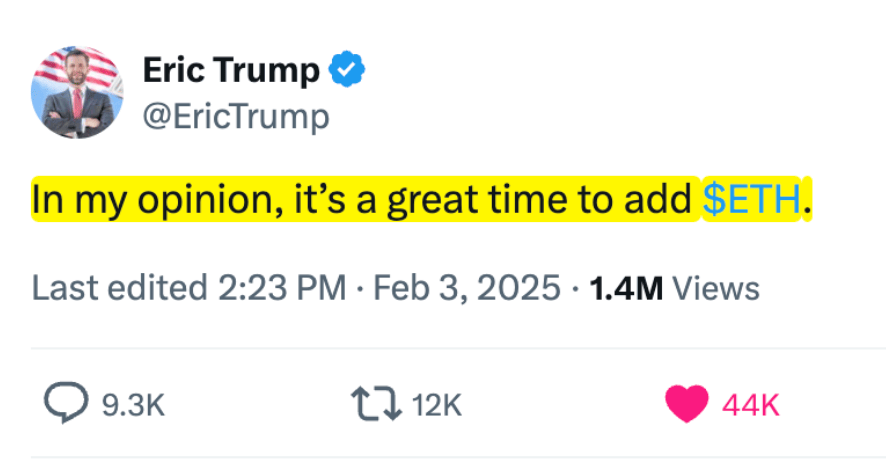

Eric Trump certainly likes the look of Ethereum at these current price levels, though, for what that’s worth…

It’s been a ‘sea of red’ for most altcoins over the past couple of weeks, although that seems to have largely arrested to something of a holding pattern for the moment. The same goes for Bitcoin, too, which has been lurking around the mid-90k range for the past few days at the time of writing.

Looking at that Coinglass chart, however, while February is currently trending red with a -5% dip, it’s early days for this usually bullish Bitcoin month. The last time it closed red, by the way, was in 2020. As you will 100% recall, that was the beginning of a particularly turbulent time in the macro landscape, too.

Recent reasons to be crypto cheerful…

The US ‘Strategic Bitcoin Reserve’ concept is still on the table.

In December, the incoming president appointed former PayPal exec and venture capitalist David Sacks to the newly created role of White House AI & Crypto Czar and to help lead a US crypto working group/committee. Sacks is a huge Bitcoin and crypto bull.

Are we living in a simulation? Look, nothing’s off the table at this stage. Did you see that Luka Dončić trade from the Mavericks to the Lakers the other day? The NBA is almost as wild as crypto. Almost. We digress…

Earlier this week, in a presser Czar Sacks revealed that the much-hoped-for Strategic Bitcoin Reserve is “one of the first things we’re going to look at” in the first 100 days of the Trump 2.0 era, which indicates that at, although disappointing to moon boys/girls that it wasn’t signed off within the first minute of January 20, it is at least still on the agenda.

The signs are positive, though – here’s something Sacks had this to say this week – “Bitcoin is an excellent store of value”. Here he is chatting with CNBC…

U.S. President Trump’s ‘AI and Crypto Czar’ @DavidSacks says, “Bitcoin is the original digital currency and the strongest one…and has been around for over a dozen years now. No one has ever hacked it, no one has ever cracked the security, and so it’s an excellent store of value” pic.twitter.com/PhhbeXgQ27

— Documenting ₿itcoin (@DocumentingBTC) February 6, 2025

Trump has signed off on a Sovereign Wealth Fund…

… and Bitcoin (and possibly other cryptos) again have a strong chance to be included at some point, along with various other assets and equities.

The reason this is a better than even shot? Consider the two men standing behind him as he signed the order (see tweet below).

Like Sacks, Treasury Secretary Scott Bessent and the incoming Commerce Department chief Howard Lutnick (the billionaire chairman of Wall Street firm Cantor Fitzgerald) are pro crypto and have both spoken at length about the benefits of Bitcoin and crypto innovation, the positive role stablecoins can play in the economy, and regulating the asset class to help it thrive.

You’ve got to think the chances of Bitcoin being added to either a strategic reserve, and/or a basket of top cryptos being included, even at a small percentage, to a Sovereign Wealth Fund are looking pretty decent right about now.

While courting the crypto dollar on his campaign trail, Trump did say that he was going to be the first “crypto president”. He has stuck true to that.

Is there any chance Trump’s US sovereign wealth fund doesn’t contain crypto coins/companies?

Trump, Bessent, & Lutnick all own Bitcoin & have given lengthy interviews/speeches about how much they believe in and want to support crypto. https://t.co/MWr6Yv14gZ pic.twitter.com/oRIDKdaSrv

— Altcoin Daily (@AltcoinDailyio) February 3, 2025

Positive crypto regulations for crypto in the US are finally coming.

This, according to Trump’s crypto committee, will focus on, among other things over the next 100 days: prioritising US stablecoin and market structure legislation, a new bipartisan stablecoin bill, and overall helping to set up an environment that creates “a golden age” for Bitcoin and digital assets in the US.

Oh, and the US Securities and Exchange Commission (SEC) now has a crypto ‘task force’… a positive crypto task force.

We won’t go into all the methods and reasons the no. 1 attack dog of the Biden admin – the SEC – used to bring the US crypto industry to its knees, but the fact is, former chief Gary “I AM THE LAW” Gensler has left town, and “Crypto Mom” (as she’s known to the cryptoverse) Hester Peirce has been tapped to head up a new SEC crypto working group/ ‘Task Force’ to cover the asset class from a regulatory POV.

Peirce has regularly, publicly disagreed with Gensler’s regulatory standpoints when it comes to crypto and is likely to take on this role with a largely pro-crypto lens.

Crypto in the US – and Australia and most other countries for that matter – have been sorely lacking clear regulations and a fair playing field ever since they came into existence.

Clearly understood ground rules could see a resurgence of innovation in the sector in the US.

As Sacks noted:

“I’ve talked to many [crypto] founders over the past few years, and they’ve told me repeatedly that the number one thing they need from Washington is regulatory clarity. They just want to know what the rules of the road are so they can abide by them.

“We’re coming off, frankly, four years of arbitrary prosecution and persecution of crypto companies where the SEC wouldn’t tell founders what the rules were, but then they would prosecute them…

“All of this was driving this important technology of the future offshore, and we want to keep that innovation on shore, in the US.

“Financial assets are destined to become digital, just like every analog in history and we want that value creation to happen in the United States.

BlackRock just bought a shedload of Bitcoin and Ethereum…

… re-lighting the fire for institutional investor interest.

Per a blog posting on the Binance Square chat, and confirmed by various media sources:

“Big news today – BlackRock, one of the largest asset management firms in the world, has just made a massive purchase of 276 million worth of Ethereum (ETH)! This could have huge implications for the price and adoption of Ethereum.”

On January 29, it was also confirmed that BlackRock had acquired an additional US$1 billion worth of Bitcoin in the week leading up to that date, which brings the asset manager’s holdings to 2.7% of the total Bitcoin supply.

In other words, while much of the crypto market was panic selling, master of the universe Larry Fink was buying. What’d Warren Buffett say about being greedy when others are fearful? Oh… exactly that.

Trump has also bought the crypto dip…

… Well his family’s World Liberty Finance side hustle has at any rate, making an $86,000 ETH purchase earlier this week. That group’s total holdings, earlier in the week, represented about US$422 million with an Ethereum allocation of 65%.

Final word

Stockhead contacted Binance last week for some commentary – the exchange’s take on what the pro-crypto Trump administration means for the industry globally, and the market, too.

If you needed further confirmation about the industry’s sentiment regarding the new US government’s crypto embrace, here’s what James Quinn-Kumar, director of community engagement, for Binance Australia and New Zealand had to say on the matter…

“The inauguration of Donald Trump will be a gamechanger for the cryptocurrency sector, with early indications showing it will have seismic changes across the industry.

“The pro-crypto stance of this new US administration is expected to catalyse further regulatory clarity, encouraging broader participation and demand for crypto assets from traditional financial institutions.

“This regulatory momentum will likely set the stage for other countries to follow suit, creating a more cohesive global framework for crypto. While it will take time, current circumstances suggest these developments could happen at an accelerated pace in 2025.

“A pivot to a strong pro-crypto stance will almost certainly have a domino-effect and drive changes to crypto policies and approaches around the world as governments race to keep up.

“In Australia, progress is advancing with ASIC recently releasing its proposed updates to its digital asset guidance INFO sheet 225 for industry feedback, for which Binance looks forward to contributing to.

“The much-touted establishment of a Strategic Bitcoin Reserve in the US signals a new level of institutional confidence and commitment in digital assets. Beyond the US, there are many governments and central banks that are engaged in discussions on the role of Bitcoin and other cryptocurrencies in national reserves.”

And to round things off on something vaguely related to Quinn-Kumar’s last point, check this out…

BREAKING: CZECH HODLERS WIN: No Bitcoin Taxes After 3 Years!

It’s official! The Czech president @prezidentpavel has signed the new law, bringing huge benefits for Bitcoin holders in the country.

✅ No capital gains tax on BTC after 3+ years of holding

✅ A time & value… pic.twitter.com/SAgsd3qKeT— BTC Prague (@BTCPrague) February 6, 2025

Come on Australia… take a leaf… just saying…

Nothing in this article should be construed as financial advice.

At the time of writing, Binance is a Stockhead advertiser.

The author holds Bitcoin, Ethereum and a handful of other “altcoins”.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.