Mooners and Shakers: ‘The final descent’ – analysts target November crypto bear market bottom

Getty Images

We’re approaching a pivotal point in yet another pivotal week, in a pivotal month for Bitcoin and crypto. And yep, it all pivots around the US Federal Reserve – which markets are dearly hoping will pivot some time before 2023.

It’s irritating that so very much rides on the words from one grey-haired geezer (Fed boss Jerome Powell) every month. Maybe some time next year we’ll start to see the Crypto Circus roll back into town with all-new, exciting, high-wire acts and showmanship.

But in the meantime it’s the Fed’s Greatest Macro Show on Earth in 2022, and it’s got the calendar pretty much booked up till the end of the year.

Yes I do by any means necessarily 😂 https://t.co/FJo0t2k18b

— James Bang (@PRHacks) September 19, 2022

On Wednesday afternoon EST (it’ll be in the early hours of Thursday morning AEST), Ringmaster Powell will deliver the influential US central bank’s latest monetary policy statements stemming from its two-day Federal Open Market Committee (FOMC) meet.

A 75 basis points rate hike is widely expected, and some say the most recent stocks and crypto dippage has this target “priced in”. But this announcement will be a little different from past months, as Powell is expected to deliver the Fed’s general plan for the rest of the year as well.

Markets will be paying super close attention to his tone for any hints of easing up on the hiking, or maintaining a super-strict, ring-tightening course until the Fed’s inflation lion-taming is done.

Right now, it’s a nervy, forehead-dabbing waiting game, but markets will hopefully get some decent clarity in the next 48 hours, one way or another.

Bottom picking

Meanwhile, is there any hopium for short-term thinkers? Probably not much, to be frank. Unless the Fed shows a hint of scaling back its assault.

There’s always longer-term hopium floating about in the market that’s pretty much a hopium-gas planet, though, and US analyst Bob Loukas (198k Twitter followers can’t be wrong, right?) has some. If you can remain patient till November.

The final descent.

The first big 4Year #bitcoin cycle low opportunity is 6 weeks away. Around Nov 10th.

Patience. Accumulate.

— Bob Loukas 🗽 (@BobLoukas) September 19, 2022

Because that’s about when he’s predicting a bottom for Bitcoin and the crypto market. “The final descent,” he’s calling it.

Loukas is a huge proponent of the importance of the Bitcoin halving cycles when it comes to the health of the market. And he’s not the only one – Finder’s Fred Schebesta reiterated that event’s significance to Stockhead in a recent chat.

Very basically, if you didn’t know, Bitcoin halvings are what happens when the rate of new Bitcoins entering circulation is cut in half. It’s built in to the protocol, and it occurs roughly every four years, with the next one due in May 2024.

For Bitcoin fans, it’s a beautiful thing and it historically precipitates the start (although not necessarily immediately) of an extremely bullish crypto cycle. Before that, though, there has always been a BTC bottoming-out process that begins about a year and a half out. It’s potentially the perfect time for accumulators to further ramp up their dollar-cost-averaging strategies.

Popular pseudonymous European (we think) crypto analyst Rekt Capital is also thinking along the same lines…

In 2015, #BTC bottomed 547 days before the Halving

In 2018, $BTC bottomed 517 days before the Halving (discount March 2020 crash)

If Bitcoin is going to bottom 517-547 days before the upcoming April 2024 Halving…

Then the bottom will occur in Q4 this year#Crypto #Bitcoin

— Rekt Capital (@rektcapital) September 19, 2022

Upshot: let the Fed do its thing, remain patient, keep reading Stockhead and Coinhead for spurts of market positivity here and there and the odd potentially strong narrative… and just ride out the storm(s)?

Just a thought. You might have a better plan than that. (If you do, let us know.)

The equity market correction is not over—not based on the 2-year yield, certainly. 🧵 pic.twitter.com/yOfkGXbqMU

— Jurrien Timmer (@TimmerFidelity) September 19, 2022

Let’s take a look at some daily price action…

Top 10 overview

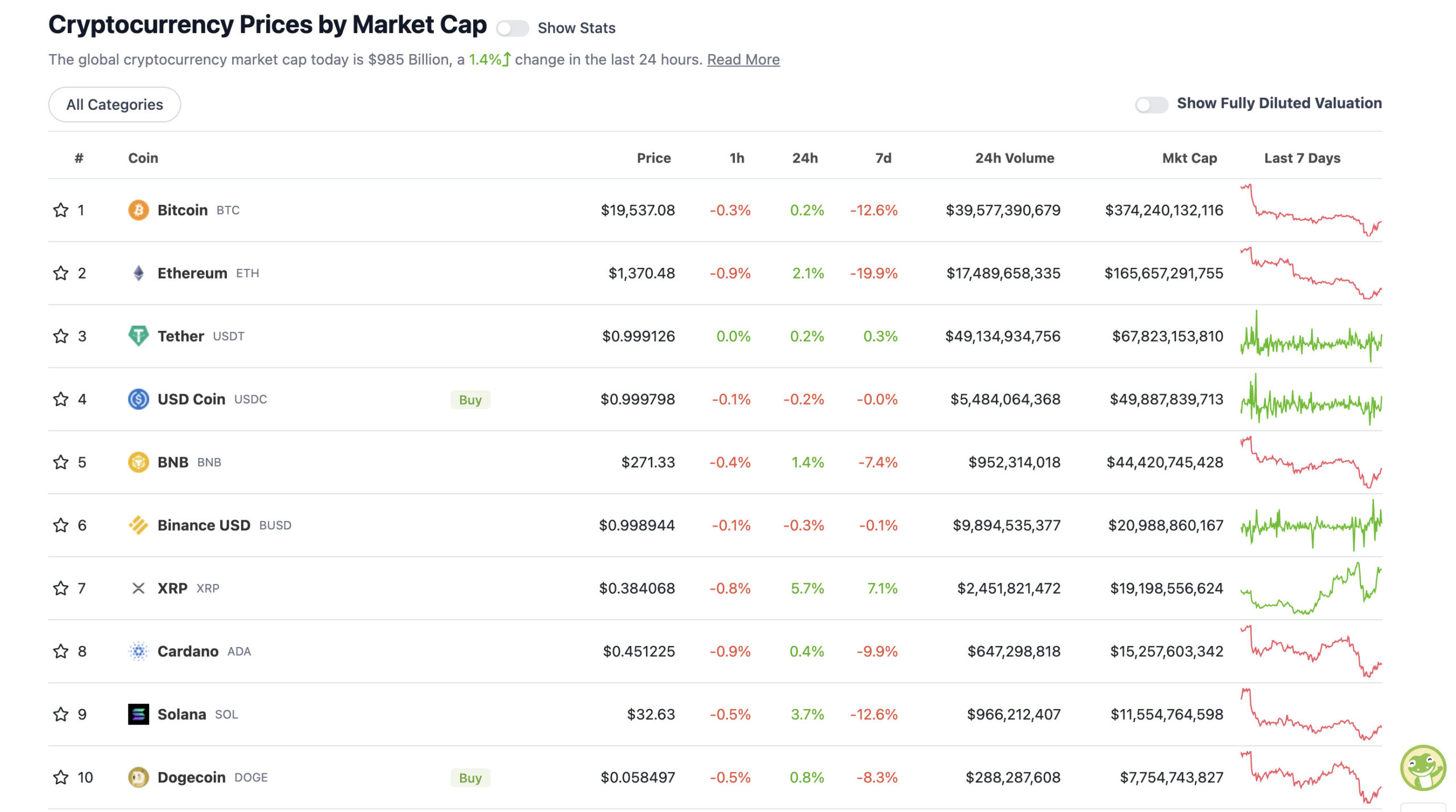

With the overall crypto market cap at US$985 billion and up about 1.4% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s been pretty ugly stuff for Bitcoin and, in particular, Post-Merge Ethereum over the past day or so.

That said, both these top crypto dogs (no, nothing to do with you, DOGE) managed to bounce back up overnight. BTC plummeted to a daily low around US$18,450 but somehow found a bit over US$1,000 down the back of the couch.

While ETH has emerged back out of the US$1,290 doldrums and is at least changing hands about 80 bucks higher than that, at the time of writing.

#Ethereum looking at weakness here, as it lost upwards trending structure.

Expecting a response from the region between $1,200-1,300.

Not sure whether we'll get a bounce towards $1,425 as FED on Wednesday is most important as a decider of a trend. pic.twitter.com/BZ7RaaEdqT

— Michaël van de Poppe (@CryptoMichNL) September 19, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.7 billion to about US$409 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Helium (HNT), (market cap: US$595 million) +15%

• ApeCoin (APE), (mc: US$1.83 billion) +14%

• Algorand (ALGO), (mc: US$2.2 billion) +11%

• Chiliz (CHZ), (mc: US$1.35 billion) +8%

• Celsius (CEL), (mc: US$642 million) +7%

DAILY SLUMPERS

• Evmos (EVMOS), (market cap: US$801 million) -12%

• Chainlink (LINK), (mc: US$3.4 billion) -5%

• Ravencoin (LTC), (mc: US$475 million) -4%

• Chain (XCN), (mc: US$1.34 million) -3%

• BitDAO (BIT), (mc: US$520 million) -2%

Around the blocks: ‘a rip your face off rally’?

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Hmm, we’ve just seen this, from Josh Brown, CEO of Ritholtz Wealth Management, a US registered investment adviser (RIA). It’s another take on what might happen after Jerome Powell speaks this week.

He’s actually calling for a “rip your face off rally” partly based on potential “blow-off top for short-term Treasury yields” and other factors involving volatility tracking.

Well, it’s perhaps one for the hopium crack pipe, but something else to consider.

Why @downtown is predicting a "rip your face off rally" going into Wednesday's FOMC meeting pic.twitter.com/KcPbkgk4SL

— CNBCOvertime (@CNBCOvertime) September 19, 2022

https://twitter.com/Breaking911/status/1571655925076987904

Holy crap! SEC trying to claim jurisdiction over all #ethereum transactions since about 45% of the nodes are in the USA. Thus all transactions globally should be considered of US origin! YIKES!!! Scary precedent.

— Lark Davis (@TheCryptoLark) September 19, 2022

Bitcoin just getting ready for Uptober 😉

— Bitcoin Archive (@BTC_Archive) September 19, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.