Mooners and Shakers: The crypto market remains in the palm of the Fed’s hand; Elon Musk causes Bored Ape stir

Today's central bank metaphor is brought to you by Getty Images

It’s the US Federal Reserve’s latest rate-hiking announcement day*, and you can likely cut the tension on Wall Street with a recently price-inflated knife. You pretty much can on Crypto Twitter.

Not that new Twitter owner Elon Musk necessarily cares one way or another. He presently seems more concerned with stirring up debate about the value of ape-themed NFTs…

I dunno … seems kinda fungible

— Elon Musk (@elonmusk) May 4, 2022

The Tesla and SpaceX CEO’s profile pic often causes a bit of intrigue, and his new one – a collage of Bored Ape Yacht Club images – has certainly got the NFT world buzzing. (Update: he’s actually already changed it to something else since this was first published.)

While the floor price of BAYC NFTs surged by as much as an extra 13 ETH (about US$28,500) on the news, indicating some sort of validation from Musk, many actually view it as a typical bit of trolling from the world’s most loaded bloke.

Prominent NFT advocate, creator and American internet entrepreneur Gary Vaynerchuk suggested Musk doesn’t exactly have his “finger on the pulse” when it comes to non-fungible tokens, which seems about right…

.@garyvee's response to @elonmusk's tweet on NFTs pic.twitter.com/606mPUUZma

— Blockworks (@Blockworks_) May 4, 2022

Meanwhile Michael Bouhanna, co-head of digital art at Sotheby’s, responded to Musk’s new profile pic reveal with his own Twitter post. He politely asked the Tesla CEO to delete the avatar, which he actually designed for a Sotheby’s sale, inferring the multi-billionaire doesn’t have ownership of the NFTs.

— Patel Meet 𝕏 (@mn_google) May 4, 2022

The BAYC floor price right now is sitting just under 120 ETH (about $US339k). Earlier in the day it was “languishing” around the 107 ETH mark (about US$306.4k).

And the Bored Ape ecosystem governance and utility token ApeCoin (APE)? It spiked on the news, too, with a quick 20% hourly burst, settling back down again almost as quickly thereafter. It’s still up a few percentage points over the past 24 hours at the time of writing.

Top 10 overview: plus news just in from the Fed

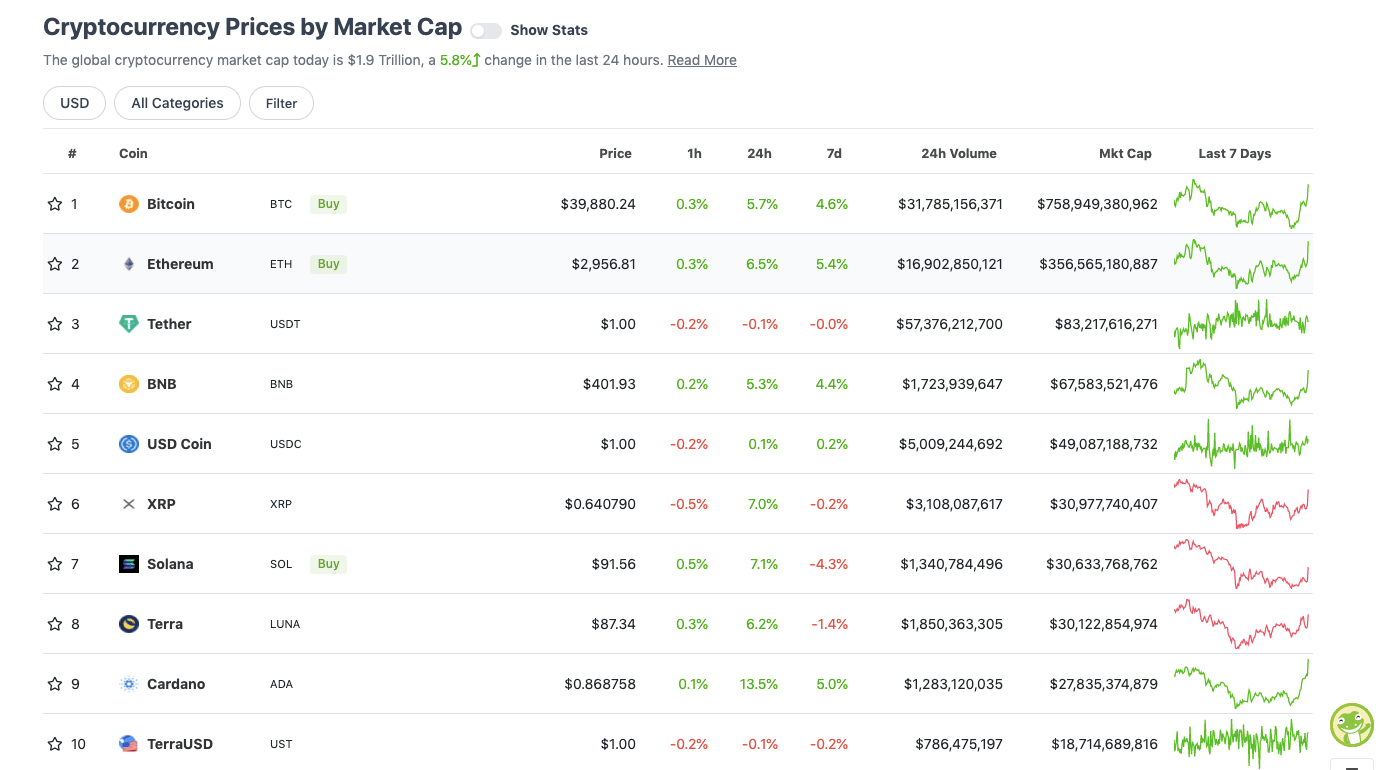

With the overall crypto market cap at roughly US$1.9 trillion, up about 5.8% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Sorry for the cliché, but looking through the crypto majors hours before the Fed announcement, which is when this article was first published, we gave it the old calm-before-the-storm quick-take analysis.

* But fresh news just in… Fed chair Jerome Powell has delivered a somewhat “dovish” speech to the press in Washington, summarising the decisions made at the two-day FOMC meeting. Here’s the hot take from CNBC’s Scott Wapner…

There ya go. Powell tells the market 75bps not on table. Stocks up, yields down on that comment from the Fed Chair

— Scott Wapner (@ScottWapnerCNBC) May 4, 2022

So, the 50 basis points rate hike just about everyone and their DOGE was expecting, has come to pass. And the never-resting crypto market is reacting favourably so far as we type.

Crypto’s go-to sentiment indicator, the Fear & Greed Index (below) might even be touching a different shade of citrus tomorrow if this keeps up.

As for Cardano (ADA), it’s a bit of a polarising layer 1 project (many tribal ETH Heads seem to hate it), but it’s rebounding the hardest in the top 10 right now (+13.5%) after a steady decline over the past month.

Total number of projects building on #Cardano?

Over 900!!! pic.twitter.com/ctI0Ff373F

— Altcoin Daily (@AltcoinDailyio) May 4, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$17.9 billion to about US$923 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Curve DAO Token (CRV), (market cap: US$948 million) 11%

• Zilliqa (ZIL), (mc: US$1.1 billion) +11%

• Frax Share (FXS), (mc: US$1.65 billion) +9%

• Waves (WAVES), (mc: US$1.37 billion) +8%

• TRON (TRX), (mc: US$7.78 billion) +7%

DAILY SLUMPERS

• STEPN (GMT), (mc: US$1.95 billion) -5%

• IOTA (MIOTA), (mc: US$1.44 billion) -4%

• NEXO (NEXO), (mc: US$1.2 billion) -3%

• Maker (MKR), (mc: US$1.28 million) -2%

• Axie Infinity (AXS), (mc: US$2.3 billion) -2%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Silent Notary (UBSN), (market cap: US$61 million) +39%

• Step App (FITFI), (mc: US$154m) +31%

• X2Y2 (X2Y2), (mc: US$80m) +20%

• Injective Protocol (INJ), (mc: US$242m) +19%

• Everdome (DOME), (mc: US$446m) +19%

DAILY SLUMPERS

• Pluton (PLU), (mc: US$17m) -18%

• Vertcoin (VTC), (mc: US$18m) -15%

• Tidal Finance (TIDAL), (mc: US$6m) -12%

• Kyber Network Crystal (KNC), (mc: US$344m) -11%

• Ethereum Name Service (ENS), (mc: US$532m) -10%

Around the blocks

https://twitter.com/VailshireCap/status/1521940587556966400

Still holding onto a selection of altcoin bags with white knuckles at this point? Here’s some mild hopium from experienced crypto trader and analyst Michaël van de Poppe…

Overall, I'd rather want to say that the market is in the accumulation phase.

Many #altcoins are down and have corrected their entire move from the impulse in 2021.

Rather accumulate than short.

— Michaël van de Poppe (@CryptoMichNL) May 4, 2022

On the other altcoin-HODLing hand, here’s a sobering reminder from nuclear engineer turned “crypto quant”/data analyst Benjamin Cowen…

#Altcoins are not great during bear markets. Not only do their #USD valuations get crushed, but also their #ALT / #BTC valuations.

— Benjamin Cowen (@intocryptoverse) May 4, 2022

And a slightly different, opportunist trader’s take from the popular Crypto Twitter account belonging to Ryan “Cantering” Clark…

I don't really care what happens today from a direction standpoint. My only goal is to catch the meat of the second move.

That being said I am really excited to see one side of the market get absolutely torched as always. pic.twitter.com/stp9hX1n8h

— HORSE (@TheFlowHorse) May 4, 2022

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.