Mooners and Shakers: ‘The bears are back in town’ as Bitcoin tries to break fall; Also, what’s Friend.tech?

Pic via Getty Images

‘The bears are back in town, the bears are back in town”, reckons Raoul Pal, an ex-Wall Street trader turned crypto investor and CEO of financial media group Real Vision.

And he’s not wrong, given the amount of doom and gloom we’re seeing around the cryptoverse, and very obviously, given the Bitcoin and market sell-off in general over the past handful of days.

Somewhere further towards $20k appears to be the new target for some/many a trader – for instance, pseudonym ‘Skew’, who seems to think if BTC can’t reclaim US$26.3k by the weekly close (imminent any minute now), then things are likely heading further south…

$BTC 1D

Weekly close tomorrow, probably going to lead the next move given fridays selloffReclaim $26.3K with spot buyers chasing = decent R:R to long towards $28.5K

Break below $25.3K probably target $24K – $23K for stronger buyback reaction else continuation towards $20K… pic.twitter.com/6iokSApCfG

— Skew Δ (@52kskew) August 20, 2023

“A deep sweep below $20k is the extreme end in which would look to be swing long there,” the trader added.

Likewise, also noted by Cointelegraph, Keith Alan, co-founder of blockchain/crypto data gurus Material Indicators, was also talking about a $20k revisit for the leading digital asset, noting:

“I think $25k will eventually breakdown and clear a path to retest support at the 2017 Bull Market Top which was just under $20k, but I don’t think we go there in a straight line.”

He did, however, add that he’s “looking for a retest of $25k support to potentially print a double bottom and provide a good foundation for another exit rally. If that setup presents itself, $28k-29k range is realistic.”

A lot of analysts were caught off guard this week. Many of us expected a big downside move was coming, but there were a number of reasons I thought it wasn't coming yet, but as I said to @MBRichardson87 on this week episode of #BlockchainBanter, those moves tend to come when you… pic.twitter.com/yAuXPyaCPX

— Keith Alan (@KAProductions) August 19, 2023

But let’s go back to the market’s old pal Pal for a sec, because he’s seeing things through a more bullish lens, which hopefully isn’t BS.

In his latest newsletter titled: “The GMI Top 5 Weekly Charts that Make You Go Hmmm”, Pal cites a handful of his research team’s “Global Macro Investor” charts that he believes proves the bearish case may not necessarily be as strong as some believe it to be right now.

US Equity Put/Call Ratio is back above +2 standard deviations for the first time since March of this year. We've only been at these levels 11 times since 2012…

Here's the top 5 charts @BittelJulien and I are watching at GMI this week.

Read it here: https://t.co/yRHo0T5qK6 pic.twitter.com/WjcToC9Olt

— Raoul Pal (@RaoulGMI) August 20, 2023

He cuts to the chase at the end of his newsletter with these words:

“All said, we think that while in the short-term there’s potential for more downside as markets realign with liquidity conditions and unwind the overbought sentiment, it’s going to be very difficult for this to be anything more than just a short-term correction.

“Remember, retail money has been long this year but the pros (i.e. big banks) have not and they will very likely use this correction in equities to cover their deeply underwater shorts and get long.

“This should provide a floor as to how far equities can fall and we think we can already get there in the next week or two as September seasonality starts to improve. Let’s see…”

JPow warms up for Jackson Hole

Meanwhile, just a quick check in with the macro environment, which our very own non-fungible Eddy Sunarto covers better than this columnist, over at his Market Highlights roundup. His words, then, not mine, noting a flat Friday on Wall Street…

“US traders mainly kept to the sidelines as they awaited Jerome Powell’s speech at the Jackson Hole gathering this week, August 24-26.

“Nigel Green of the deVere Group says he expects ‘central banks, including the Fed Reserve, the Bank of England and the ECB, to start cutting interest rates within the next 12 months.’

“’Investors should consider now the prospect of inflation falling faster than many have anticipated, to seize the opportunities and mitigate risks,’ he said.”

What’s all the fuss about Friend.tech?

Meanwhile, don’t know if you’ve caught this buzz, but (as reported by Cointelegraph), Friend.tech, a “recently released decentralised social (DeSo) network, generated over $1 million in fees in 24 hours on Aug 19, outperforming established players in the crypto ecosystem, including Uniswap and the Bitcoin network”.

Built on Coinbase’s new layer-2 Base blockchain, the platform has seen been getting a lot of traction across the crypto twitterverse/X-verse, and generated $1.12 million in fees in 24 hours, and US$2.11 million since its launch, according to DeFiLlama data.

It also boasts more than 67,000 unique traders and nearly 762,000 transactions, at the time of writing.

But what the hell is it? What does it do? Good question.

According to Cointelegraph, launched in beta on Aug 11, Friend.tech is designed to allow users to tokenise their social network by buying and selling “shares” of their connections.

Essentially, you can think of it like a messaging platform that allows you to text your favourite crypto creators and influencers, but with a paywall around that interaction that makes you buy “shares” in the individual you’re hoping to contact.

The Friend.tech protocol reportedly makes its money by charging a 5% fee on transactions.

1/6 Curious about @friendtech's share pricing model?

Here's the scoop: Fees? 5% flat for the protocol, the buy/sell spread is the owner's profit.

But here's where it gets interesting: As outstanding shares grow, the pricing skyrockets exponentially. 🚀

— Lux Moreau ✨ (@MentionLux) August 12, 2023

Pretty much every second crypto creator and influencer we see around the traps appears to have jumped on board.

Over the last 24 hours, Friend Tech has generated more fees than #Bitcoin, Uniswap and BSC.

Specifics aside, what excites me is how quick market penetration occurs when a product has a strong market fit.

The next killer dApp can gain traction much quicker than you think. pic.twitter.com/jwUsV7l9QN

— Miles Deutscher (@milesdeutscher) August 20, 2023

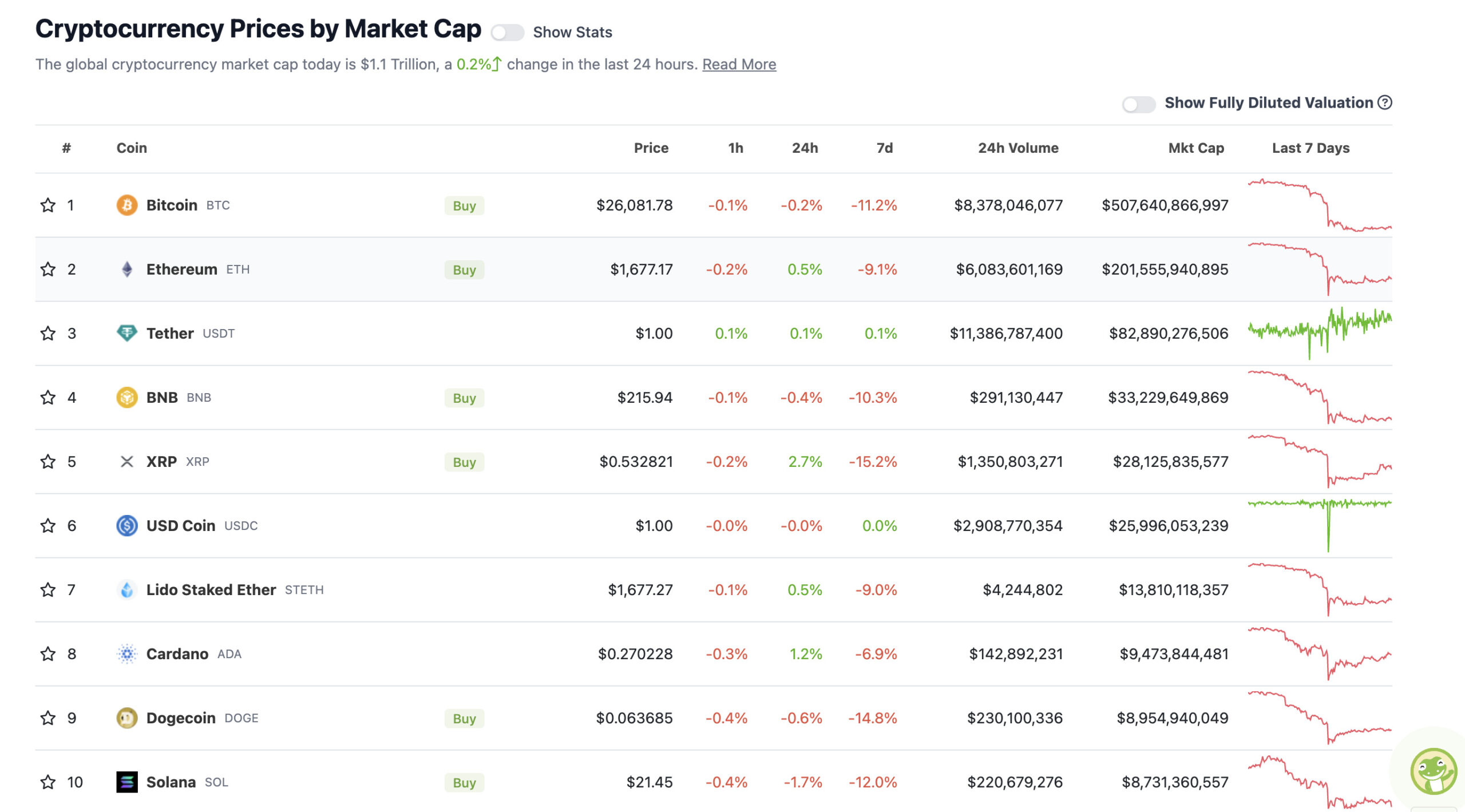

Top 10 overview

With the overall crypto market cap at US$1.1 trillion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Rollbit Coin (RLB), (market cap: US$521 million) +14%

• Kaspa (KAS), (market cap: US$858 million) +4%

• Stellar (XLM), (market cap: US$3.5 billion) +3%

• Litecoin (LTC), (market cap: US$4.87 billion) +3%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

#Bitcoin illustrates the true cost of capital. pic.twitter.com/cWmH5yHYd6

— Michael Saylor⚡️ (@saylor) August 19, 2023

Now that #BTC has completed its Double Top…

It needs to Weekly Close below ~$26000 and turn it into new resistance to confirm the breakdown

A Measured Move for this Double Top breakdown would see Bitcoin drop to ~$22,000$BTC #Crypto #Bitcoin #BitcoinCrash https://t.co/ctzC46ykEk pic.twitter.com/nXQkEowzh7

— Rekt Capital (@rektcapital) August 20, 2023

My TA 😂🙏 #BTC $btc pic.twitter.com/FyjCrujhFJ

— Mr. Denmark 🇩🇰 (@blockchainDK) August 20, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.