Mooners and Shakers: Stockhead wins Coinbase fanny pack; ETF buzz keeps Bitcoin near $30k

Getty Images

Almost another working week in crypto done and dusted. And unless things very suddenly turn pear shaped (which is never out of the question with the asset class Jerome Powell reckons has staying power), then it’s been a pretty damn good one. All things considered.

And when we say all things, we’re really just referring to the positive swell of sentiment surrounding the increased/renewed institutional interest in crypto/Bitcoin amid all the regulatory heat being levelled at big industry players in the US.

And we’re talking huge, MASSIVE, institutional interest – headlined by BlackRock and Fidelity BTC spot ETF filings chatter. There are others, too, including Valykrie, Charles Schwab, Citadel Securities, Deutsche Bank and further dark-suited financial puppeteers.

Here’s what Bitcoin proponent Preston Pysh and economist Lawrence Lepard think about that…

not to mention their denial of the GBTC conversion to ETF

— Lawrence Lepard, "fix the money, fix the world" (@LawrenceLepard) June 20, 2023

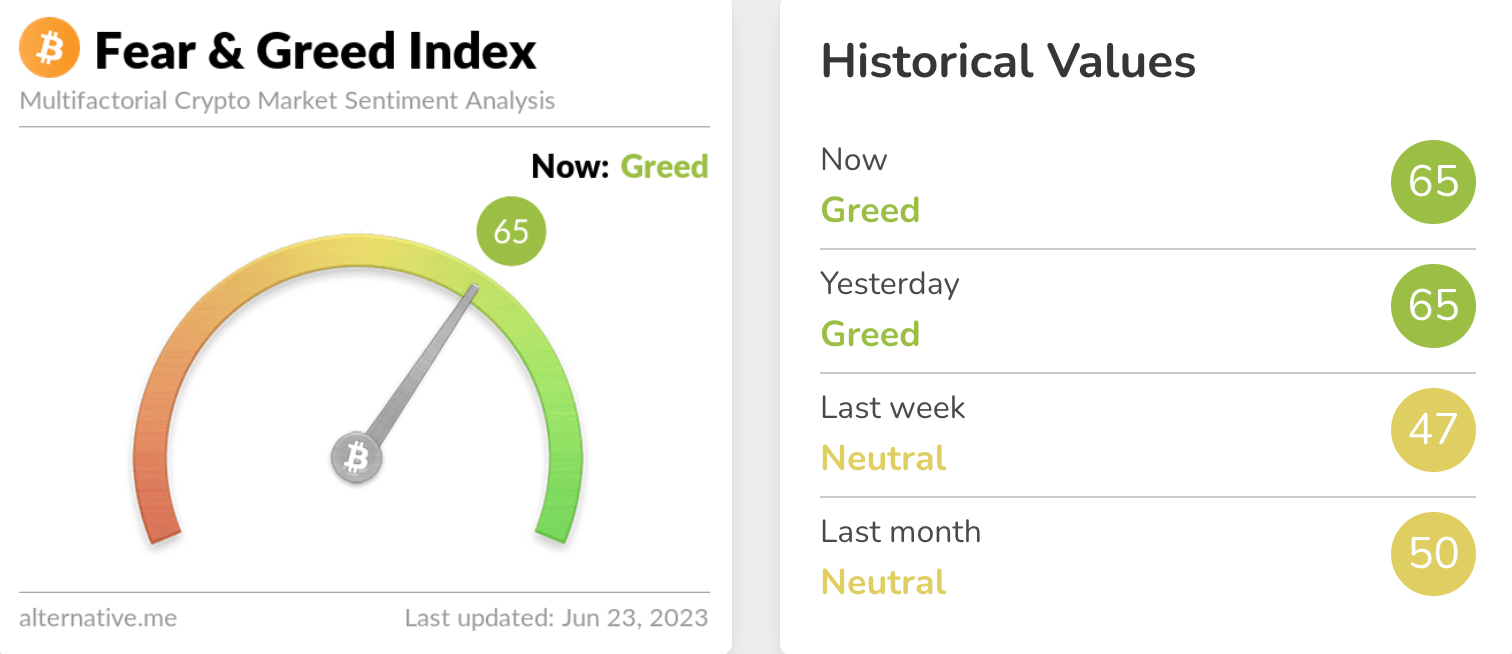

Meanwhile, how’s the market sentiment tracking in general? If only there was some sort of easily digestible visual aid based on social media sentiment and a series of market momentum data…

Well, there you have it, the market has given itself a fresh lick of paint, ditching the can of Meh Olive and opting for Morning FOMO – a lovely, citrussy shade of envy and avarice that ought to go well on the walls of your home office study or “Mom’s” basement.

Didn’t Warren “Bitcoin is Rat Poison Squared” Buffett once say something about greed and financial markets? “Be fearful when othe… ooh, look, $PEPE is bursting up the charts again. Let’s move on to some HOT CRYPTO GAINERZ, shall we?

Actually, before that… this…

Stockhead wins fanny pack at BASE L2 meet

You know the market’s picking up when…

… You win a branded “To the Moon” fanny pack at a Coinbase-hosted blockchain developers event – for asking the fourth or possibly even fifth-best question of the evening.

Here’s the prize…

And here was the question…

“You mentioned Polygon, earlier. Is the increasingly crowded Layer 2 sector a race to supremacy? Or does Coinbase and Base view it as something more collegiate than that?”

We’re yet to transcribe the soundbites from the event, but the answer was along the lines of being “for the most part, all in this together”.

Coinbase’s developing layer 2 (L2) chain, called Base, will absolutely be one of the biggest blockchain launches of the year. Big funding, top developers, smart branding (“onchain is the new online”) – Coinbase, the only publicly listed crypto firm, is still a force to be reckoned with in this industry.

What is Base? It’s an Ethereum-based L2 that aims “to bring the first billion users onchain” – and is a hub/building block for decentralised apps.

We’ll cover it in greater depth in a separate article – Base shapes as a significant mainnet launch for the industry, later this year.

3/ The upgrade also brings us one step closer to Base mainnet, enabling us to launch mainnet on the latest version of the codebase.

✅ With a successful Bedrock release on OP Mainnet we have now completed 3/5 criteriahttps://t.co/eRarQ4QzK8

— Base (@base) June 8, 2023

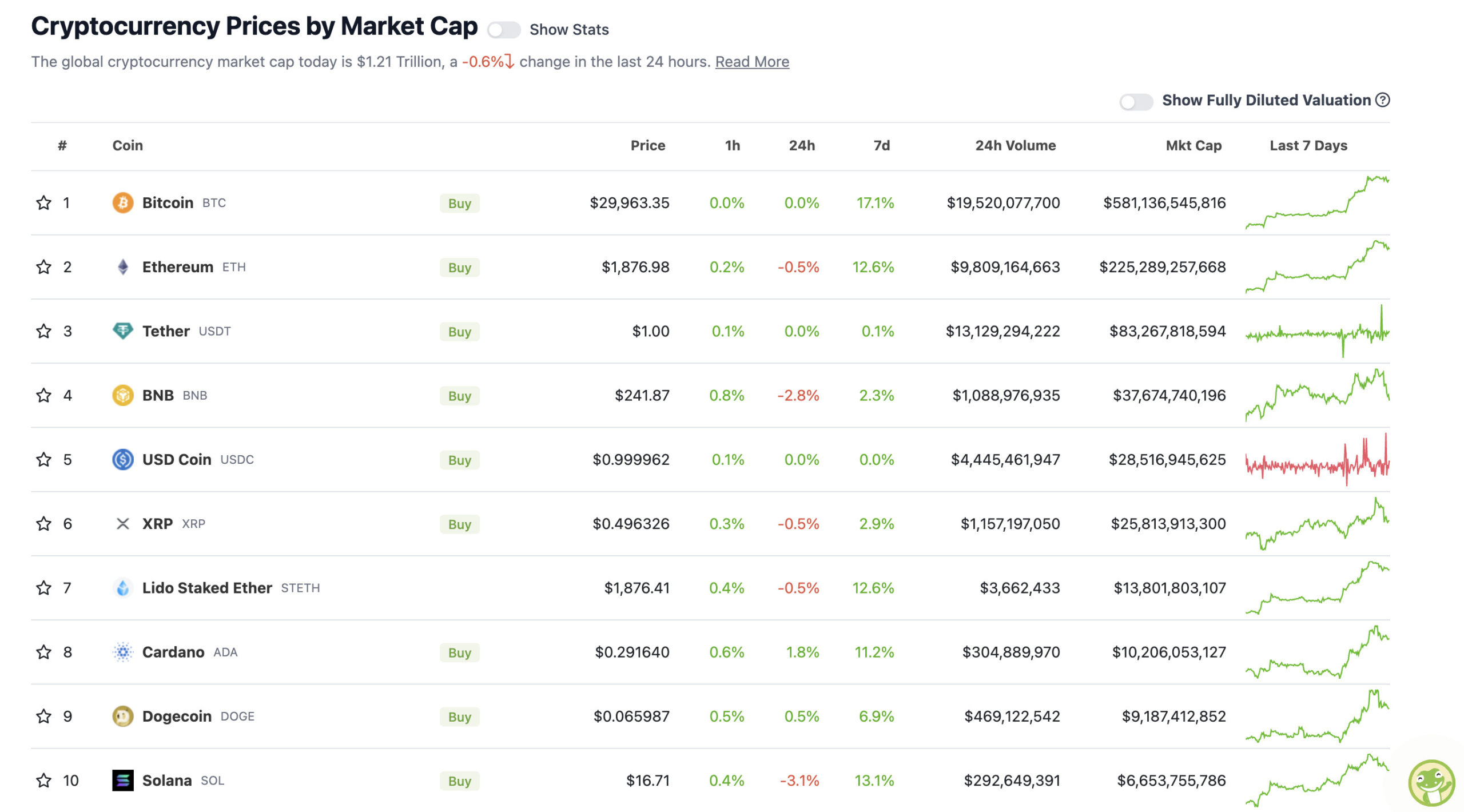

Top 10 overview

With the overall crypto market cap at US$1.21 trillion, down about 0.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Ah, bummer. BTC has dipped below $30k again. It’s SO OVER. “F**k this crypto sh*t. I’m done.”

But before I sell out of everything again, let’s just check in with some analytical regulars. Here’s Roman Trading, who honestly, has been very hard to fault on his trading calls this year so far, from what we’ve seen. He’s spotting potential short-term bullish signs for a US$31k move, but with an even shorter short-term dip possible first.

And you know what? That might actually be playing out as we type, but we shall see.

$BTC H4

1D and 1W are bullish so I’m expecting something like this per LTF.

Will add to my existing positions if we consolidate/break 31k.

H4 is overbought and needs to return to mean before continuation.#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/76AQPrJ466

— Roman (@Roman_Trading) June 22, 2023

Rekt… what you got, pal?

This #BTC move to $30,000 looks impressive on the lower timeframes

But it’s just a blip on the Monthly timeframe

So much more to come but with time$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) June 22, 2023

Van de Poppe? Whoa, whoa, WHOA! Settle down there, buddy. That’s some hopium overload there on the altcoins.

#Chainlink to $18-22 #Avalanche📷 to $55-65 #Litecoin to $220-260 #Ethereum to $2,700-3,000 #Bitcoin to $38,000-42,000 #Cosmos to $25-35

And then we'll correct.

— Michaël van de Poppe (@CryptoMichNL) June 22, 2023

We like it, we just won’t believe till we see it. Fed hawkishness and all that. Likely more heavy shots to be fired in the US regulatory war against crypto and all that.

News just in

BTC just hit $30k again! For the first time since 10 minutes ago when we posted the section above! You bewdy, I’m buying.

Or maybe I should wait till it hits $69k again – when everyone from your grandma to your postperson is FOMOing again into dog and amphibian-themed memecoins. Yeah, that seems more sensible.

Once again, a friendly reminder: none of the contents of this column represent anything remotely resembling financial advice. But you already know that. And this is crypto – the riskiest corner of Risk-On Alley. But maybe, just maybe, BTC and ETH and a handful of others really do have a big role to play in the future of finance.

Uppers and downers: Even $PEPE is surging again

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Kaspa (KAS), (market cap: US$523 million) +15%

• Pepe (PEPE), (market cap: US$668 million) +12%

• Radix (XRD), (market cap: US$717 million) +6%

• Shiba Inu (SHIB), (market cap: US$4.6 billion) +3%

• VeChain (VET), (market cap: US$1.25 billion) +2%

SLUMPERS

• Flow (FLOW), (market cap: US$553 million) -8%

• NEO (NEO), (market cap: US$610 million) -7%

• Render (RNDR), (market cap: US$799 million) -7%

• Stacks (STX), (market cap: US$1.08 billion) -7%

• Bitcoin Cash (BCH), (market cap: US$2.6 billion) -6%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Hmm, a big $PEPE call here from Crypto Banter’s Miles Deutscher…

I think $PEPE outperforms $DOGE next cycle.

Why?

• The Underwater Thesis: Less PEPE holders underwater vs DOGE, meaning less sell pressure on the way up + lower multiples to reach previous ATH (2.8x vs 12x).

• People are more fatigued with the DOGE meme, Pepe feels fresher…

— Miles Deutscher (@milesdeutscher) June 23, 2023

For the record, this news from @Ripple is fairly significant. Less than 20 companies have received such a license in Singapore 🇸🇬 and XRP will be utilized. Yet, #XRP doesn’t move up, even a little. If all XRP holders in the 🌎 are in a common enterprise with Ripple and relying on… https://t.co/TIakLamh0c

— John E Deaton (@JohnEDeaton1) June 22, 2023

In an aggressive move, @Binance has gone on offense against the SEC in the federal court case.

Lawyers for the @Binance defendants have filed a motion accusing the SEC of engaging in unethical conduct.

This is a big deal.

Let me explain…

— MetaLawMan (@MetaLawMan) June 22, 2023

Musk vs Zuckerberg CAGE FIGHT: How I Accidentally Caused It

Two days ago, I tweeted about META’s competitor to Twitter called ‘Threads’.

I took a few jabs at Meta, then referenced their Chief Product Officer saying how they’ve "been hearing from creators and public figures who… pic.twitter.com/SuSNAOCwOm

— Mario Nawfal (@MarioNawfal) June 22, 2023

🤝 @mavprotocol @foundersfund @PanteraCapital @coinbase https://t.co/9UMdCFHL2b

— Apollo Crypto (@ApolloCryptoAu) June 22, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.