Mooners and Shakers: STEPN kicks on with Coinbase listing; Bitcoin steady as US dollar pumps

Getty Images

Another day, another dollar… pump. The US dollar index (DXY) is still rising, which means the inversely correlated crypto market is either chopping sideways or dumping. It’s more the former at the time of writing.

This column might be going on about it a lot lately, but the US dollar’s strength right now is considered a major factor for the current dipping and/or suppression of Bitcoin and the crypto market (and quite a few other asset classes).

In fact, Wall Street trading opened to 20-year highs for US dollar strength today, throwing a wet blanket over Bitcoin’s attempt at cracking the US$40k mark a bit earlier. Denied. Again. For now.

#DXY parabolic rally continues…

— Benjamin Cowen (@intocryptoverse) April 28, 2022

“The parabolic rally by DXY does not bode well for risk-on assets like stocks and Bitcoin,” tweeted renowned US crypto analyst Benjamin Cowen. “Until the rally cools off, playing defense is the way to go.”

Cowen, incidentally, is pretty much a rocket scientist. The crypto-focused, YouTubing brainiac has a PhD in nuclear engineering and was a NASA undergraduate research assistant. Not saying that’s the perfect background for good crypto analysis, but we can definitely think of worse YouTubers to follow.

Meanwhile another popular go-to crypto charts watcher, Michaël van de Poppe is expecting a USD reversal and change in Bitcoin’s fortunes very soon…

Let's reverse the $DXY and then #Bitcoin is going to do really well. pic.twitter.com/pIgfAOp5du

— Michaël van de Poppe (@CryptoMichNL) April 28, 2022

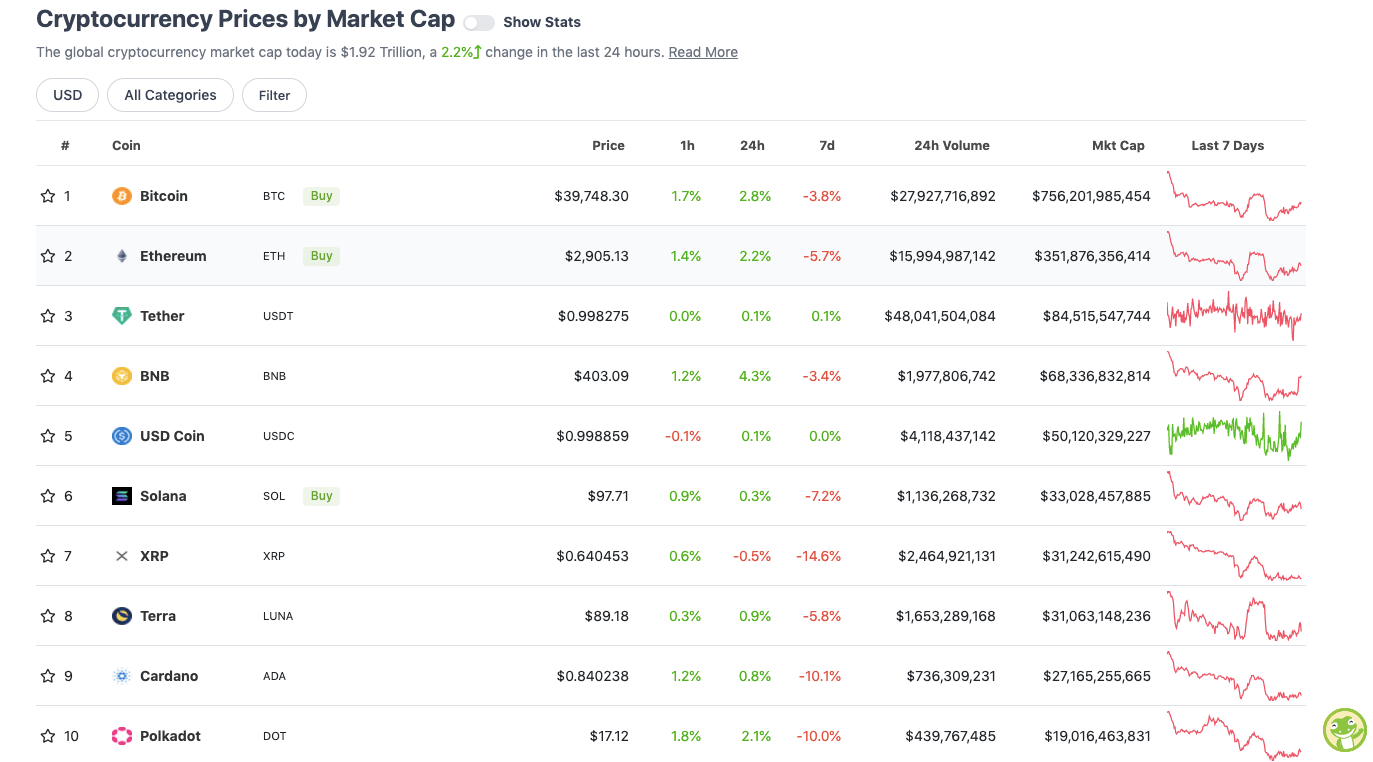

Top 10 overview

With the overall crypto market cap at roughly US$1.92 trillion, up about 2.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

As usual, it’s tricky to predict what Bitcoin might do next. Yep, the “greenback” is having another exuberant day, but BTC isn’t faring too badly here.

The US Federal Reserve’s next big meeting to decide interest-rate-increasing moves is happening in the first week of May, but could the crypto market already be pricing in an expected 50 basis points hike? Maybe.

Yet more analysts are spotting some other things going on with BTC, which certainly seem to indicate more HODLing action from whales (large holders) than selling…

The number of unique addresses holding at least 10,000 #BTC has been increasing mid-February 2022$BTC #Crypto #Bitcoin pic.twitter.com/FgaFsrxR1G

— Rekt Capital (@rektcapital) April 28, 2022

… as well as signs of increasing interest/adoption in general…

#Bitcoin is dead… 👇🤡 pic.twitter.com/vRsJHFcejN

— Crypto Rover (@rovercrc) April 28, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$18.5 billion to about US$994 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• STEPN (GMT), (mc: US$2.37 billion) +19%

• ApeCoin (APE), (market cap: US$6.16 billion) 14%

• The Graph (GRT), (mc: US$2.7 billion) +12%

• Lido DAO (LIDO), (mc: US$1.1 billion) +11%

• PancakeSwap (CAKE), (mc: US$2.35 billion) +7%

Aussie-founded “move-to-earn” token STEPN (GMT) keeps on stepping up, and today’s pump can be put down to the following news…

Coinbase will add support for GMT and GST. GST will be listed with the Experimental label. Learn more about the experimental label here: https://t.co/MBMBbYyZ7S pic.twitter.com/oJUYMSFDVO

— Coinbase Assets 🛡️ (@CoinbaseAssets) April 27, 2022

There’s been a lot of hype for STEPN and its “Green Metaverse Token” lately, even before this exchange listing. Up 252% since hitting the market in early March, the project’s rise has been pretty impressive so far. Watch out for the old post-Coinbase sell-off, though. Might not happen, but it’s been a known phenomenon in the past.

Meanwhile, ApeCoin (APE), the governance token formed from the Bored Ape Yacht Club ecosystem, is also on a bit of a tear, hitting all time highs ahead of Yuga Labs’s “Otherside” NFT mint happening this weekend.

Otherside is the BAYC metaverse project, and the NFT mint is suspected to be a digital land sale, which will be using APE as the purchasing currency.

Some in the space are speculating this could cause a huge ripple effect across NFT land, potentially acting as a catalyst for growth, interest and sales volume broadly across quality projects.

In a detailed thread, this Twitter account certainly thinks it could play out that way, while also speculating on the more bearish consequences if it doesn’t…

https://twitter.com/osf_nft/status/1519617799706009604

DAILY SLUMPERS

• Synthetix (SNX), (mc: US$1.23 billion) -5%

• Helium (HNT), (mc: US$1.6 billion) -4%

• Osmosis (OSMO), (mc: US$1.59 billion) -4%

• Cosmos Hub (ATOM), (mc: US$6 billion) -4%

• Frax Share (FXS), (mc: US$1.6 billion) -3%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Propy (PRO), (market cap: US$115 million) +25%

• Velas (VLX), (mc: US$352m) +24%

• League of Kingdoms (LOKA), (mc: US$161m) +24%

• Spool DAO Token (SPOOL), (mc: US$42m) +23%

• SKALE (SKL), (mc: US$691m) +22%

DAILY SLUMPERS

• Step App (FITFI), (mc: US$42m) -25%

• Meerkat Share7 (MSHARE), (mc: US$194m) -19%

• Everdome (DOME), (mc: US$288m) -16%

• ZoidPay (ZPAY), (mc: US$329m) -14%

• JPEG’d (JPEG), (mc: US$84m) -13%

Around the blocks

Tomorrow's headline: Elon Musk advocates for the use of cocaine 🤣

— Joe Pompliano (@JoePompliano) April 28, 2022

https://twitter.com/VailshireCap/status/1519681239132688386

One of the most promising projects in GameFi, Aussie-founded Illuvium is currently being tested by various selected gamers and influencers in its private beta round.

Melbourne YouTuber Scoriox, who spoke in depth with Stockhead about Illuvium recently, has been getting right into the Survival Mode gameplay…

Check out my first impressions of the Illuvium Survival Mode Private Beta 1!!@illuviumio @TigerWillson @AwallCrypto @KieranWarwick @VonNeumannILV @aaron_warwick @emergentDAO pic.twitter.com/hmh2JCIkmA

— Scoriox $LIZ 🌿🔥 ♊️ (@kingscoriox) April 26, 2022

Feeling pretty accomplished rn 🙂

Wave 26 is a struggle no doubt

@ShinyShards @illuviumio @Illuviumnaut

Huge shout out to @ILVTactician for all their assistance in helping me understand the ins and outs of Illuvium.Video will be on the way as soon as possible 🙂 pic.twitter.com/6XJvYQIDKr

— Scoriox $LIZ 🌿🔥 ♊️ (@kingscoriox) April 28, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.