Mooners and Shakers: Solana leads losses among top coins as crypto market slumps lower

Pic: Getty

As the US stock markets kick off the week in limp fashion, the crypto market continues to slump today, too, with Solana leading the top-10 daily losers.

The mood on Crypto Twitter right now generally reflects the industry’s leading sentiment indicator, which appears to be locked in at “extreme fear” levels.

This is a lights out level for the S&P. No hold, and everything is gonna catch a haircut faster than your 200ms connection can close out. pic.twitter.com/rddWngV8eM

— HORSE (@TheFlowHorse) January 24, 2022

The charts and analysis make for pretty horrendous viewing right now, but at least some hardcore HODLers are retaining a sense of humour…

#NewProfilePic pic.twitter.com/YVDlBoA2Cq

— Nayib Bukele (@nayibbukele) January 22, 2022

— Crypto Rand (@crypto_rand) January 24, 2022

Next level candle painting pic.twitter.com/j9AheptGOg

— PlanB (@100trillionUSD) January 24, 2022

Top 10 overview

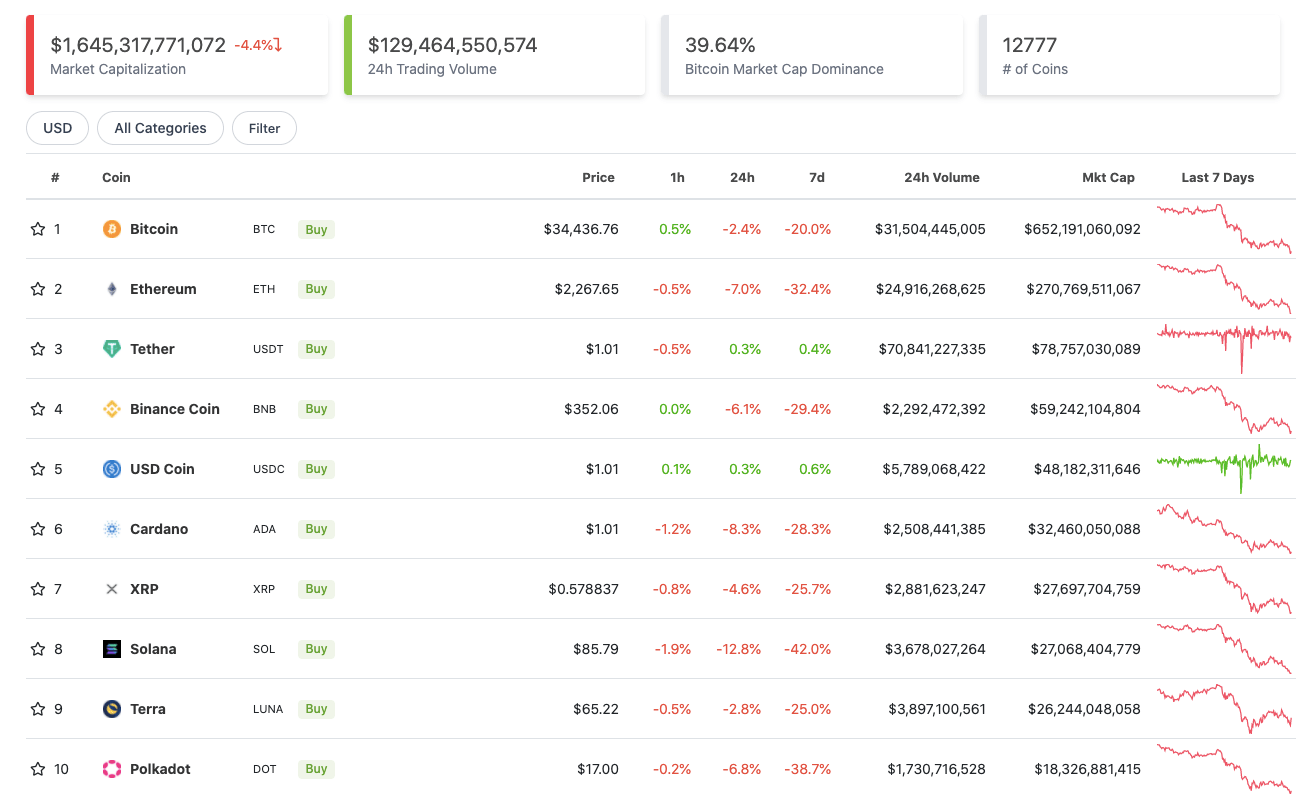

With the overall crypto market cap down about 4.5% over the past 24 hours, here’s the state of play in the top 10 by market cap at the time of writing – according to CoinGecko data.

In times like these for crypto investors, if you’re not heavily in stablecoins, then Bitcoin’s usually the next best bet. The altcoins are suffering badly right now, and with a 12.8% hit on the daily and 42% damage on a weekly timeframe, layer 1 protocol and major Ethereum rival Solana is copping it big time.

What’s the story there? Unfortunately it’s partly down to yet another system outage, this time putting the network out of action for about 72 hours, and its critics have been quick to swoop.

#Solana has been down and out for about 72 hours. There are reasons for this. It is highly centralized, controlled by a superminority of 19 nodes/validators. It's fundamental design doesn't scale. I breakdown it's TPS, scaling, and consensus issues here:https://t.co/UqvIbxW2yQ

— Ed n' Stuff (@EdnStuff) January 24, 2022

Solana has suffered multiple issues like this within the past few months, but this is the second such incident in January alone. Still, it didn’t become a top five (now eight) crypto with a huge and loyal community for nothing.

And it was only a couple of weeks ago that the Bank of America was singing its praises extremely publicly. Perhaps it will be one of the hardest-rebounding layer 1s when a market bounce eventually comes.

.@solana issued a patch to its network faster than @bloomberg could report on the bug.

Let that sink in.

So remind me what the future of finance looks like? pic.twitter.com/GOFtUNkn2B

— ◢ J◎e McCann 🧊 (@joemccann) January 23, 2022

The highly tribal and competitive layer 1 communities may be enjoying seeing Solana stumble, but for the vast majority of cryptocurrencies there isn’t a lot to crow about right now in terms of price action.

Still, as the popular analyst Rekt Capital points out, a contrarian view can sometimes pay off in markets like this. Echoes of Warren Buffet’s most famous quote here… but less concise…

Whenever #BTC Bulls get euphoric, it's usually a good time to critically question such sentiment

Same goes for bearish sentiment

Whenever $BTC Bears are experiencing Bearish Euphoria, it's usually a good time to critically question such sentiment#Crypto #Bitcoin

— Rekt Capital (@rektcapital) January 24, 2022

Winners and losers: 11–100

Sweeping a market-cap range of about US$17.2 billion to about US$796 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY ‘PUMPERS’

This is pretty piss-poor pumpage by the standards the crypto market likes to judge itself, but here we are…

• Cosmos (ATOM), (mc: US$9.8b) +3.1%

• GateToken (GT), (mc: US$954.5m) +2%

• Bitcoin SV (BSV), (mc: US$1.7b) +1.2%

• Osmosis (OSMO), (mc: US$2.4b) +0.5%

DAILY SLUMPERS

• Celsius (CEL), (mc: US$897.7m) -15.5%

• Arweave (AR), (mc: US$1.46b) -15%

• Curve (CRV), (mc: US$994.5m) -14.5%

• THORChain (RUNE), (mc: US$1b) -13%

• Polygon (MATIC), (mc: US$9.5b) -13%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Throne (THN), (market cap: US$11m) +70%

• Magic (MAGIC), (mc: US$80m) +60%

• Decentralized Social (DESO), (mc: US$648m) +46%

• BonFida (FIDA), (mc: US$98m) +28%

• Gods Unchained (GODS), (mc: US$85m) +23%

DAILY SLUMPERS

• Tenset (10SET), (market cap: US$129m) -36%

• Lido DAO (LDO), (mc: US$98m) -29%

• Decentral Games (DG), (mc: US$92m) -28%

• Router Protocol (ROUTE), (mc: US$40m) -28%

• Popsicle Finance (ICE), (mc: US$87m) -24%

Final words…

https://twitter.com/mskvsk/status/1485594083506728962

https://twitter.com/mcshane_writes/status/1485383797520670729

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.