Mooners and Shakers: Mr Novogratz says a spot BTC ETF will be approved this year. (Bitcoin pls go to moon)

Coinhead

Coinhead

“Bitcoin pls go to moon… stop going sideways now… Mr Tone Vays say we’re going down to 1k but Mr Novogratz say we have baaaaaaa-ttttooooo-med out…”

What’s… all that about? They’re lyrics from an amusingly terrible (yet annoyingly catchy) crypto-famous song from about 2019, and funnily enough, it still more or less applies today. Here, you can watch it on a loop for an hour if you like:

Right, finished watching that? Good, let’s get on with some of the latest Bitcoin and crypto news.

Mike Novogratz is a well-known former Wall Street hedge fund manager now the boss of crypto investment management company Galaxy Digital. He’s a bit of a go-to talking head quote machine for the likes of US financial media outlet CNBC.

That established, what’s his latest take on the great American hunt for a Bitcoin spot ETF?

Yesterday, while speaking with Andrew Ross Sorkin on CNBC’s “Squawk Box” show, Novogratz said that one is likely to be approved in 2023. Back in August, he said he believed the SEC would approve one within four to six months, so he’s accelerated the timeline.

Galaxy Digital is one of several large players seeking approval of a spot BTC ETF, with its Invesco-partnered application sitting in the SEC’s in-tray among others including BlackRock’s Fidelity’s Van Eck’s, Ark Invest’s and more.

“WE THINK A BITCOIN SPOT ETF GETS APPROVED IN 2023” – MIKE NOVOGRATZ

— Daniel Sempere Pico (@BTCGandalf) October 18, 2023

“It’s going to get approved, we think it happens this year in 2023,” said Novogratz, adding that all the indications he’s seeing and hearing, including public commentary and filings, suggest it will occur this year.

“People’s comments are much more constructive… [The SEC is] no longer talking about how [Bitcoin] works or why it’s important. It’s just a recognised macro asset and that’s a huge psychological shift,” said Novogratz.

The Galaxy Digital CEO (who once sported a massive tattoo of a Terra Luna wolf on his arm, but that’s another story entirely) also mentioned BlackRock CEO Larry Fink’s recent bullish remarks on Bitcoin, stating:

“BlackRock, the world’s largest asset manager is out there publicly saying we’re gonna get this done… and talking with other people it just seems the dialogue with the SEC is heading in the right direction.”

And regarding an inaccurate and quickly deleted Twitter/X posting earlier this week (by a prominent US crypto media outlet) that indicated a Bitcoin spot ETF had been approved, Novogratz said:

“What it does tell you is, the market will head higher on any positive news… I think the most bullish thing that happened was Larry Fink on TV saying ‘don’t worry about that report, Bitcoin’s going up because people see it as a store of value, and as a flight-to-quality asset’.”

Meanwhile… did SEC chair Gary Gensler (someone please sit on him), a massive thorn in the side for the US crypto industry this year, just “drop a bombshell” regarding potential approval for BTC ETFs?

In this video posted by “Good Morning Crypto” GG lets slip the following words…

“Just so the viewing public understands, we have not one, but multiple, I think it’s eight or 10 filings that the staff and ultimately the commissioners are considering for what’s called exchange traded products… for Bitcoin to be a security… so the Bitcoin would be held… and then there’d be something called an exchange traded product… and that would trade on various stock exchanges.”

🚨🚀 MUST WATCH: #GaryGensler Drops a Bombshell on #BitcoinETF 💥

SEC Chair Today: "Yes, that’s right. We didn't appeal last week. We are reviewing all the applications for ETF products. When approved, it will trade on Stock Exchanges"

With 8-10 filings under consideration,… pic.twitter.com/iYV3g6mCyO

— Good Morning Crypto (@AbsGMCrypto) October 18, 2023

Thanks Gary for explaining to us, twice, that there are things called exchange traded products. In any case… so you’re telling us… there’s a chance?

But hang on, you’re now saying Bitcoin’s a security? Thought you’d said fairly recently it was a commodity? Sort it out, would you. Confused, dude. Confused.

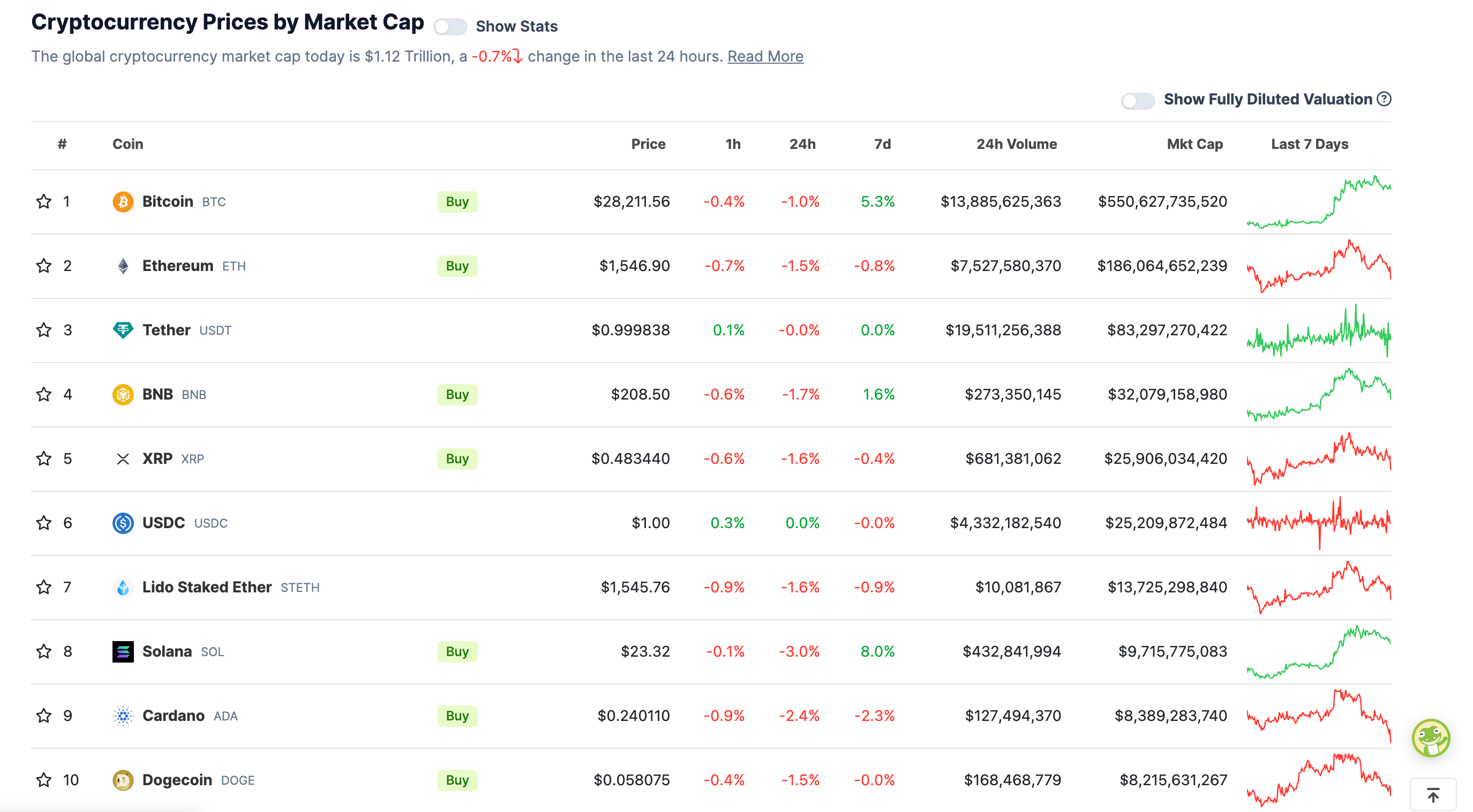

With the overall crypto market cap at US$1.12 trillion, down a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Alts may have some nice gains over the next few weeks if this weekly closes this way on $BTC.D. Big bear divs and a failure to breakout at resistance.

This would be overall bullish and I’d expect $BTC to pump after alts catch up a bit.#bitcoin #cryptocurrency #cryptonews pic.twitter.com/2yrTxTEoid

— Roman (@Roman_Trading) October 18, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• CryptoPawCoin (CPRC), (market cap: US$746 million) +250%

• Rollbit Coin (RLB), (market cap: US$526 million) +12%

• Mantle (MNT), (market cap: US$1 billion) +5%

• Radix (XRD), (market cap: US$422 million) +5%

Uh-oh… CryptoPawCoin? Is crypto about to be inundated with a fresh bout of dog-themed memecoin froth? Apparently this one has something to do with animal welfare.

SLUMPERS

• Conflux (CFX), (market cap: US$338 million) -8%

• Toncoin (TON), (market cap: US$6.9 billion) -5%

• GALA (GALA), (market cap: US$339 million) -4%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Cathie Wood on CNBC: We've seen "change in the SEC’s behavior" toward our spot #Bitcoin ETF application.

"Progress" 👀 pic.twitter.com/CYBzacN2B9

— Bitcoin Magazine (@BitcoinMagazine) October 18, 2023

BlackRock CEO Larry Fink has said #Bitcoin will transcend every international currency due to broad-based worldwide demand. pic.twitter.com/URZ7chBHaZ

— Bitcoin Archive (@BTC_Archive) October 18, 2023

2 year yield now at the peak levels of 2006.

What happened then?

The Fed ended its rate hike cycle in June of that year & the 2 year began to retreat.

What did markets do?$SPX rallied 29% from the June 2006 lows to new all time highs by October 2007 & then the recession hit. pic.twitter.com/JGQAZDa8BG— Sven Henrich (@NorthmanTrader) October 18, 2023