Mooners and Shakers: Miami’s Bitcoin 2022 event begins but market sinks as macro factors weigh in

The good ship Metaphor on its way to Bitcoin 2022 in Miami, earlier (Getty Images)

Mirroring the US stock market’s movements (as per), Bitcoin (BTC) is continuing to stumble today, losing some strong support at US$44k at the time of writing.

Wait a sec… isn’t this supposed to be a huge month for crypto, bolstered by the biggest Bitcoin event yet – Bitcoin 2022 in Miami? (Which is kicking off its first day of four as we type.) A lot of influencer chatter has been leaning pretty bullish lately – a fair few analysts, too.

The #Bitcoin Bull 🚀 pic.twitter.com/lFUo01UlEX

— Bitcoin Archive (@BTC_Archive) April 6, 2022

And there have been no shortage of extremely positive stories and rumours stoking the fire, not to mention a seemingly never-ending flood of major VC capital gushing into various sectors of the space. (How’s that for some metaphor mixing?)

So why the dip?

April’s got a long way to go, and so does Bitcoin Miami 2022, for that matter. So maybe this is just the “shakeout before the breakout” some have been anticipating. But are there any particular flies in the ointment sending things lower so far this week?

Some technical analysts (such as Roman Trading, below) have been continually citing weak volume for Bitcoin, which hasn’t been inspiring much confidence for sustained price strength.

$BTC Daily

We are considerably below the 50 WMA – respecting the death cross.

I’ve said before that the volume on this move signaled yet again another dead cat bounce within a macro bear market. 44.1k is the final support within demand zone.#bitcoin #cryptocurrency pic.twitter.com/UeVGWzZBap

— Roman (@Roman_Trading) April 6, 2022

Here’s the generally pretty bullish Rekt Capital’s take, though…

#BTC is retesting two Bull Market EMAs as support on this dip$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) April 6, 2022

#BTC could retrace much deeper than it has thus far and still remain macro bullish$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) April 6, 2022

But technical analysis is only a fraction of the story – macro, fundamental factors are, of course, having their say.

Needless to say, there’s an increasingly horrific war in Eastern Europe that doesn’t look like ending any time soon, and there’s also the not-insignificant matter of surging inflation coupled with looming recession fears.

Yesterday, two prominent US Federal Reserve officials – Lael Brainard and Mary Daly – made some pretty “hawkish” comments regarding higher inflation-combatting interest rates to come this year.

While that’s not necessarily shock news, it did seem to catch the markets by surprise, as, according to Market Rebellion, these two have historically leaned towards more dovish, less hardline economic policy. Both are now, however, signalling an “aggressive drawdown” of the US central bank’s balance sheet.

18 OF 29 ANALYSTS POLLED EXPECT THE OVERNIGHT RATE TO RISE 50 BASIS POINTS TO 1.0 % IN APRIL; THE REST EXPECT IT TO RISE 25 BASIS POINTS TO 0.75%. – SURVEY.

— FinancialJuice (@financialjuice) April 6, 2022

Watch out for the next US Consumer Price Index figures update, due out next week, too. US inflation is already running at a 40-year-high level at the moment, and the only predictions being bandied about are for it to rise further.

Top 10 overview

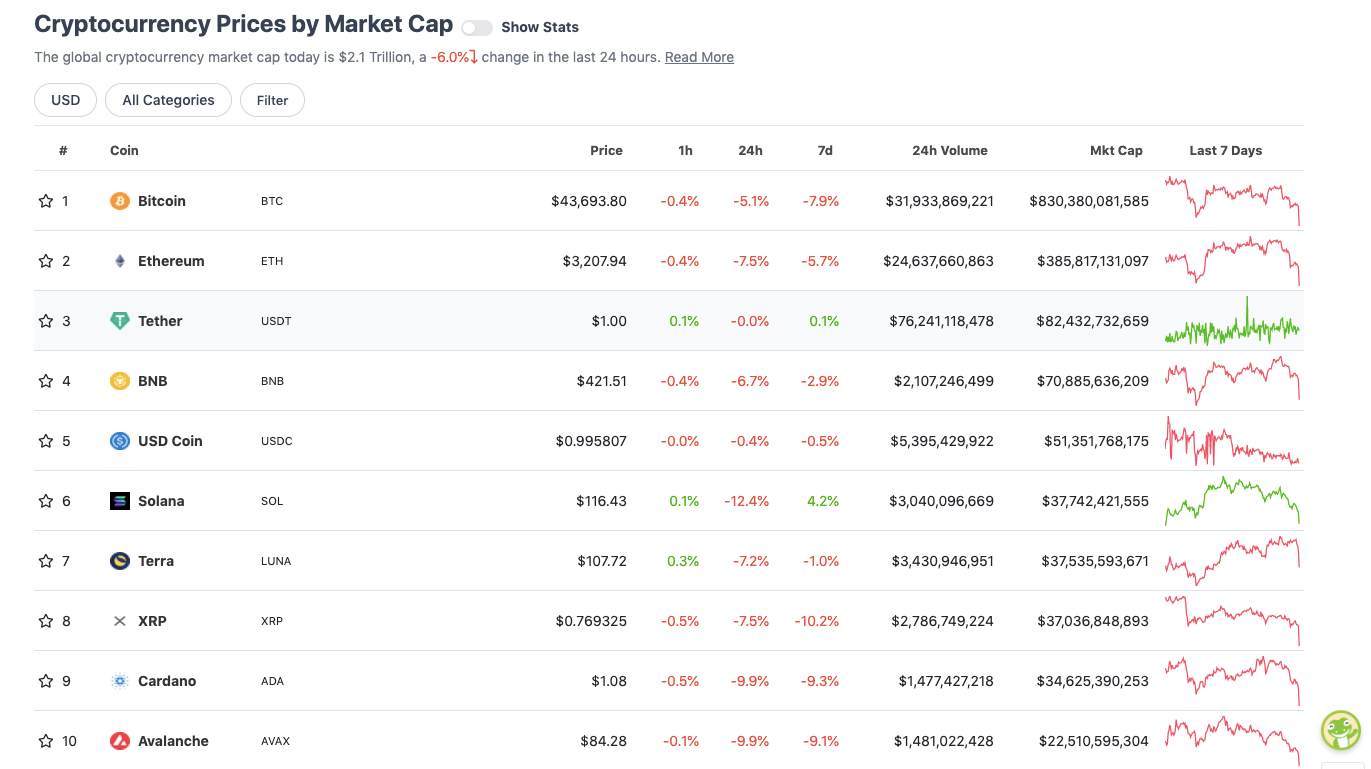

With the overall crypto market cap at about US$2.1 trillion, down roughly 6% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Everything in the top 10 is taking a beating today, but particularly the high-speed layer 1 protocol Solana (SOL) right now (-12.4%).

Maybe there’s some added “sell-the-news” or sell-the-event” action happening, as Solana NFTs have now just gone gone live for the first time on OpenSea.

Fuck, ok pic.twitter.com/Xl7S3eusfp

— Degenerate Ape Academy (@DegenApeAcademy) April 6, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$22.3 billion to about US$1.15 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Zilliqa (ZIL), (market cap: US$1.93 billion) +8%

• Leo Token (LEO), (mc: US$5.6 billion) +2%

• STEPN (GMT), (market cap: US$1.3 billion) +1%

DAILY SLUMPERS

• THORChain (RUNE), (mc: US$2.8 billion) -17%

• Synthetix (SNX), (mc: US$1.19 billion) -15%

• Dogecoin (DOGE), (mc: US$19.54 billion) -15%

• Aave (AAVE), (mc: US$2.65 billion) -14%

• Harmony (ONE), (market cap: US$1.63 billion) -13%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• TitanSwap (TITAN), (market cap: US$563 million) +120%

• Unifty (NIF), (mc: US$50.6m) +53%

• Vectorspace AI (VXV), (mc: US$99m) +24%

• Multichain (MULTI), (mc: US$333m) +18%

• Boba Network (BOBA), (mc: US$260m) +13%

DAILY SLUMPERS

• Strong (STRONG), (mc: US$28m) -31%

• DeFi Kingdoms (JEWEL), (mc: US$531m) -25%

• TrueFi (TRU), (mc: US$149m) -19%

• SKALE (SKL), (mc: US$744m) -19%

• Mobox (MBOX), (mc: US$394m) -18%

Around the blocks

The Blockchain Week videos are live.

5 days, 250+ speakers from Australia and around the world.

A free resource. Enjoy 🙂 https://t.co/FxWfDEkfUv https://t.co/8Odh5W7guB

— Steve Vallas (@stevevallas) April 5, 2022

We’re sharing a letter from President @nayibbukele who is unfortunately no longer able to attend Bitcoin 2022 due to unforeseen circumstances in El Salvador which require his urgent attention. We stand in solidarity with the Salvadorian people during these difficult times. READ: pic.twitter.com/wbFXMY60c0

— The Bitcoin Conference (@TheBitcoinConf) April 6, 2022

https://t.co/B6Xw8qMxi6 VALUED AT $4.5 BILLION IN SEED ROUND

RAISED OVER $200 MLN IN ITS SEED ROUND || https://t.co/B6Xw8qMxi6 – FIRST EXTERNAL FUNDING INCLUDED PARTICIPATION FROM RRE VENTURES, FOUNDATION CAPITAL, ORIGINAL CAPITAL, VANECK, AND CIRCLE VENTURES

— First Squawk (@FirstSquawk) April 6, 2022

There's a new scam going around that tries playing off of your fear in order to trick you into signing away your valuable assets. Expect these to become more popular in the future. This is how it works 1/🧵

— Quit (@0xQuit) April 6, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.