Mooners and Shakers: Lido DAO shuffles up charts; Bitcoin clings on; Michael Saylor sued for tax evasion

Getty Images

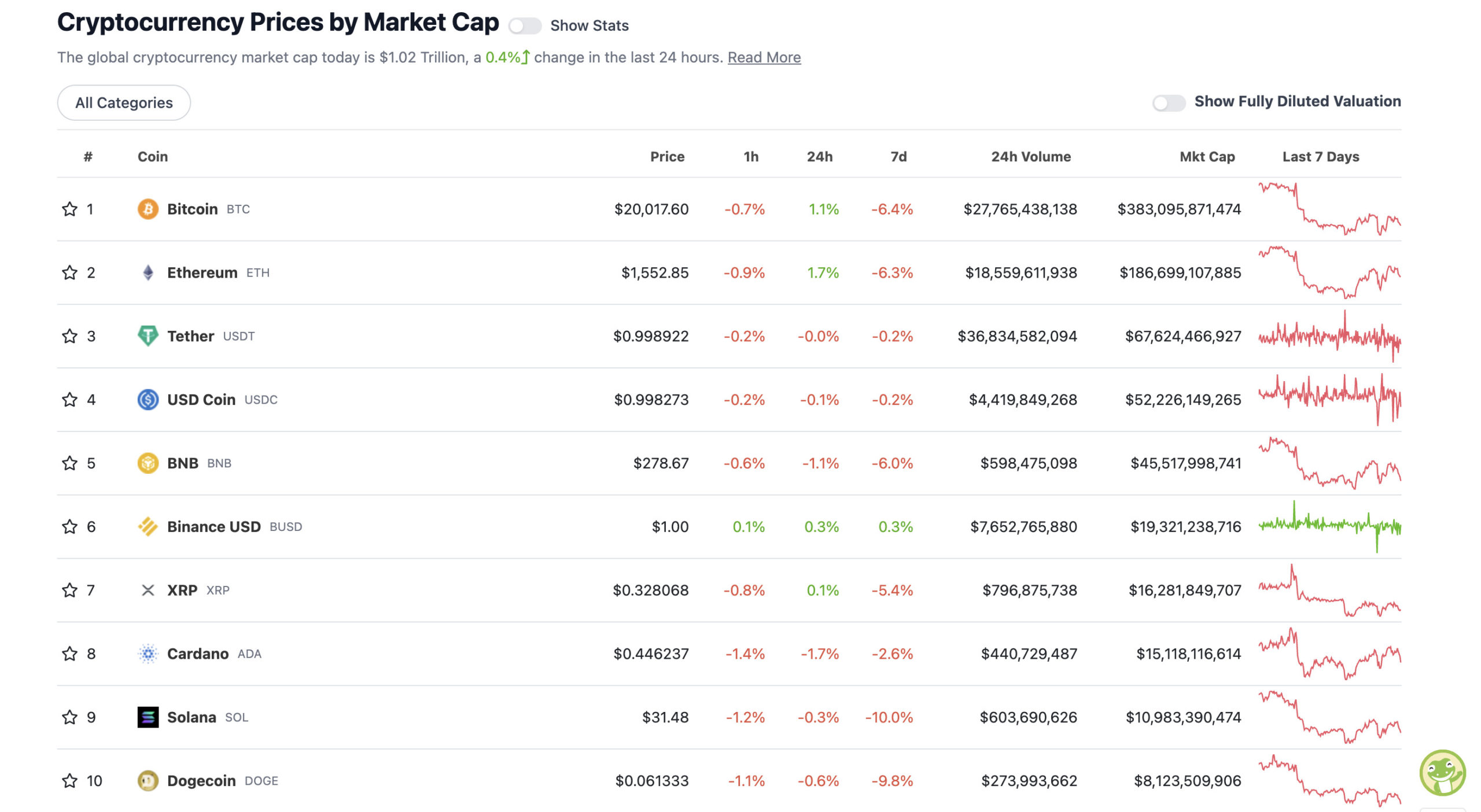

Top 10 overview

With the overall crypto market cap at US$1.02 trillion and up about 0.4% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The crypto majors are looking a bit bored today. Flat as a PancakeSwap. (If you’re familiar with that particular BNB-chain decentralised exchange, that is. It’s also sliding sideways down at #81 on the CoinGecko list.)

Let’s check in with the market-sentiment-dominant crowd…

One of our go-to bearish Twitter-dwelling crypto analysts right now is a US trader by the name of Roman. He’s a bit of a broken record, but for good reason, because so is the crypto market. And can’t deny he’s got a fair bit right this year. If the volume ain’t there, he reckons, it’s hard to be too bullish on BTC right now…

$BTC 1D

These are the only two options I see happening with red more likely than white.

No signs of reversal & we have recently broken our larger bear flag. Volume is validating the bearish breakdowns.#bitcoin #cryptocurrency #cryptotrading #cryptonews pic.twitter.com/8hgrbpHrXe

— Roman (@Roman_Trading) August 31, 2022

The macro picture certainly backs up the gloom in that tweet. Referring to inflation, recession and US Fed boss Jerome Powell’s recent speech, for instance, KPMG chief economist Diane Swonk, had this to say to Bloomberg today:

“[The Fed has] buried the concept of a soft landing… The Fed’s goal is to grind inflation down by slowing growth below its potential… It’s a bit like dripping water torture. It is a torturous process but less torturous and less painful than an abrupt recession.”

With this in mind, and with more rhetoric from the US Federal Reserve to come later this month, maybe much of Septembear needs to play out before any thought of “piling on in”. October is, historically a much better month for crypto traders and investors. That’s one school of thought anyway. Not advising that strategy, of course. It’s all one big pile of risk right now…

Speechless 😶 pic.twitter.com/O86UZTn4at

— Supriya Sahu IAS (@supriyasahuias) August 30, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8 billion to about US$412 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Lido DAO (LDO), (market cap: US$1.65 billion) +11%

• LEO Token (LEO), (mc: US$5.4 billion) +7%

• Chiliz (CHZ), (mc: US$1.13 billion) +6%

• BitDAO (BIT), (mc: US$663 million) +6%

• NEXO (NEXO), (mc: US$605 million) +5%

LDO was a standout surger overnight in the top 100 cryptos by market cap. Unfamiliar with this one? Lido DAO is a “liquid staking” solution for proof-of-stake blockchains, namely Ethereum at this point. Very simply, liquid staking means you can retain your tokens’ liquidity while they’re being staked for passive yield.

The LDO token, like just about everything in crypto is down considerably this year in general, and at US$1.98 is sitting about 73% lower than it’s all-time high price of $7.30.

The fact it’s not actually down 80% or 90% or more from all-time-highs (like many alts) is due to a huge, 340% spike in the token’s price between mid July and mid August. Last month ultimately proved particularly voaltile for LDO, however, with the token losing about 45% of its value since August 14.

The project that we will be highlighting today is Lido DAO ($LIDO) 💠

If you are an ETH bull, you should be bullish on Lido DAO!

They allow users to stake their ETH for yield! They currently have 6B in TLV at 1B mcap so it's screaming 'undervalued'

Check them out: @LidoFinance pic.twitter.com/LjmHZ8lZuW

— Crypto Times (@bsctimes) August 30, 2022

Part of the reason it may be seeing some love as we head into September, and draw closer to Ethereum’s near-mythological proof-of-stake “Merge” is that Lido DAO’S (decentralised autonomous organisation) is one of the largest holders of “ETH 2.0” staking contracts.

Perhaps not many investors and speculators yet realise that other altcoins, such as this one, are closely tied to the Merge narrative. Lido DAO, for instance will apparently become one of the biggest staking players in the new era of Ethereum.

DAILY SLUMPERS

• Helium (HNT), (market cap: US$663 million) -8%

• Elrond (EGLD), (mc: US$1.19 billion) -6%

• Maker (MKR), (mc: US$681 million) -5%

• Dash (DASH), (mc: US$480 million) -4%

• IOTA (MIOTA), (mc: US$776 million) -4%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Uh-oh, looks like MicroStrategy’s Michael “Bitcoin Forever” Saylor has the DC attorney general on his case…

We’re also suing his company, MicroStrategy, for conspiring to help him evade taxes he legally owes on hundreds of millions of dollars he’s earned while living in DC.

— Archive: AG Karl A. Racine (@AGKarlRacine) August 31, 2022

He must be a bit concerned, so let’s check in with our laser-eyed chum, shall we? See how he’s holding up…

#Bitcoin is a miracle happening right before our eyes.

— Michael Saylor⚡️ (@saylor) August 31, 2022

Fair enough. Psst… wanna buy a Bitcoin watch? It’ll only set you back a Bored Ape or three. Saylor’s probably already got one.

JUST IN: Luxury watchmaker Jacob & Co launches limited edition #Bitcoin watch 😍 pic.twitter.com/4mryymqe5c

— Bitcoin Magazine (@BitcoinMagazine) August 31, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.