Mooners and Shakers: It’s big, it’s beautiful… it’s orange. Bitcoin smashes to new high

A 'bit' like the Karate Kid, BTC's "the best… arou-ouunnd… nothing's ever gonna keep it down." Pic via Getty Images

- The big, beautiful, orange one looks to be in solid shape. And we ain’t talking about the blow-hard in the White House

- After a muted June, Bitcoin’s star appears to be rising in July, hitting a new all-time high this week

- What does this mean for the crypto industry more broadly? Good question. Maybe someone from Binance can field that for us…

Bitcoin (BTC) passed the US$115k mark overnight for the first time ever, but it’s not the only techie thing hitting all-time highs in the past few days.

AI beast Nvidia’s also looking pretty, er, chipper, becoming the first publicly traded company to reach the US$4 trillion market cap.

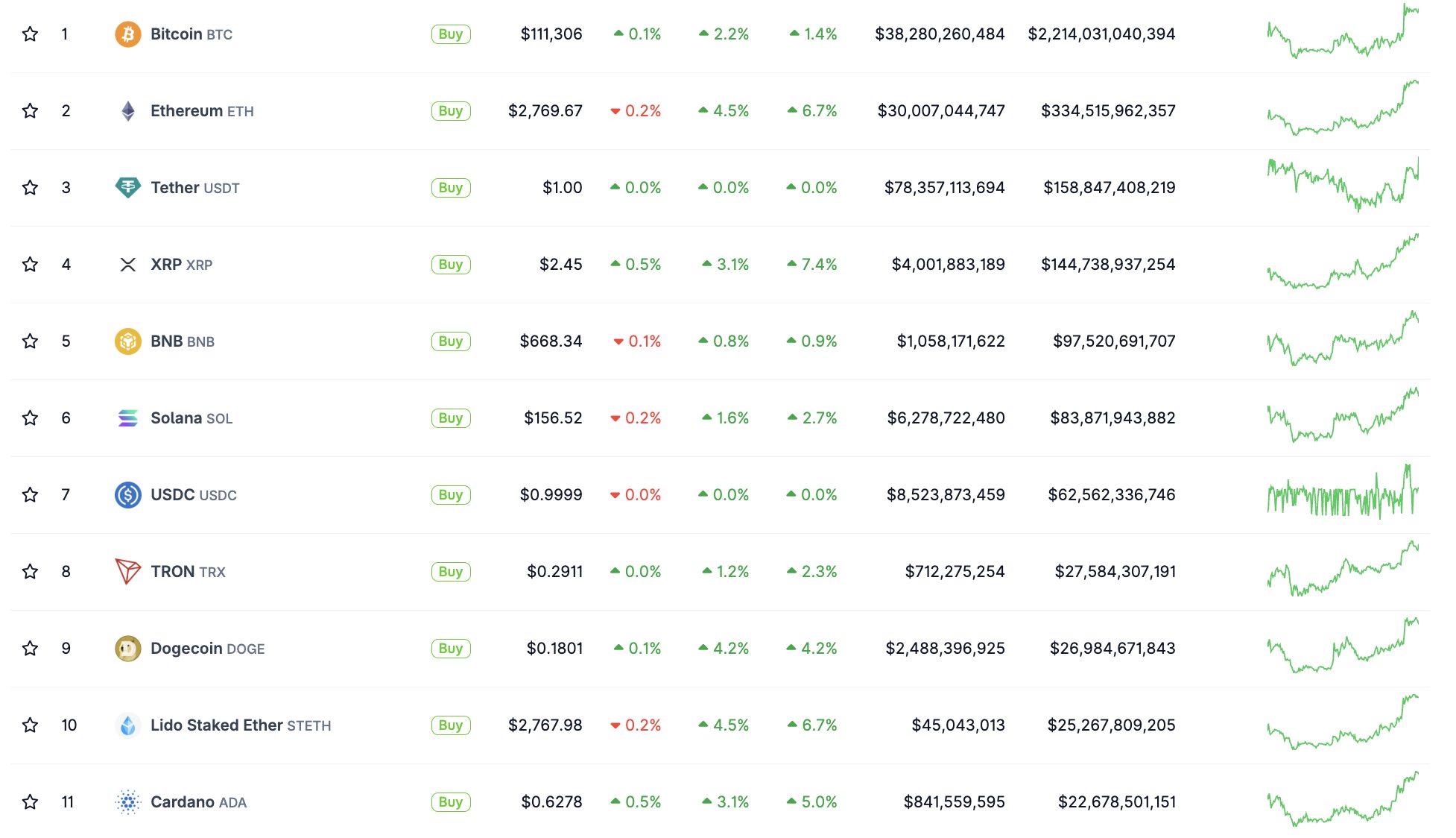

But you know what – while Nvidia, with its harder-to-say name and complete lack of orange-ness, steals much of the spotlight with Wall Street types, Bitcoin’s also having a sky-high, market-cap-bolstering moment. It’s been extraordinarily resilient of late, pretty much maintaining above a US$2 trillion market cap for the past two months.

At the time of writing, Bitcoin has surged forth again, soaring to an altitude above US$116.3k as it seeks to establish a new range in uncharted territory

After its double-figure upside months of April and May, however, when all was said and done, Bitcoin was something less than whelming in June…

Bitcoin’s June return

We’ll make a hefty caveat here, though, and use that word resilient again. Which is not nothing, as June was a month of asset-affecting, runny-bottomed macro concerns – Middle Eastern conflict escalation, Trump’s Tariff Trauma, Australia losing the World Test Cricket championship…

It wasn’t pretty and the sooner we forget about June, the better, but suffice to say, well played Bitcoin. Despite a hefty dip on a bloody June 22 in which more than US$1.5 billion was liquidated, you generally showed a stiff upper lip and did just fine all things considered, maintaining a platform from which to still potentially launch much higher in H2.

That’s not to say the macro turmoil is over – we’re still deep in those woods. But maybe, as Binance Australia’s latest Monthly Market Crypto Wrap suggests, this is why cryptocurrency investors have been favouring stability and credibility of late, reflected in the ongoing strength of BTC.

Some of the better news from June (and July so far)

While the world bit its nails in June, searching Google for things like “nuclear bomb blast radius”, the cryptoverse did produce some stupendously positive news bites, which have probably contributed to the steady performance of its bull-goose asset. (That’d be Bitcoin). Here’s just a sample…

• The GENIUS Act was passed in the US Senate on June 17, which a LOT of people in the crypto sector are quietly frothing about. Why is it seen as a win? The bill aims to regulate crypto “stablecoins” and, at long last, establish clear frameworks for stablecoin issuance and compliance in the world’s biggest economy.

It’s important for the industry to see the GENIUS Act carried through, as it can make it possible for crypto and TradFi companies to announce utilities such as stablecoin payments, tokenised RWAs (real-world assets), various kinds of DeFi (decentralised finance) yields and the launch of new tokens and use cases. All essentially helping to pave the way for mass crypto adoption.

As Binance Australia and New Zealand’s director of community engagement James Quinn-Kumar points out, “With the continued growth of Bitcoin, alongside the increasing scale of stablecoins, we’re seeing a clear shift by investors toward more stable, proven assets.

“The growth in stablecoins was bolstered by progress on the US GENIUS Act, alongside broader acceptance of these assets as essential infrastructure that bridges traditional finance and crypto.”

• The CLARITY Act is also another US bill in the works, which is focused on defining the roles of key regulators (namely the SEC and CFTC) with regard to crypto market structure and rules and regulations. Pro-crypto politicians in the US, of which there are now many, have dubbed the decision timeframe for this dynamic bill duo ‘Crypto Week’, to begin on July 14. Many are predicting these bills will be passed into law.

• Spot BTC ETFs have pulled in an eye-popping US$15bn since mid-April.

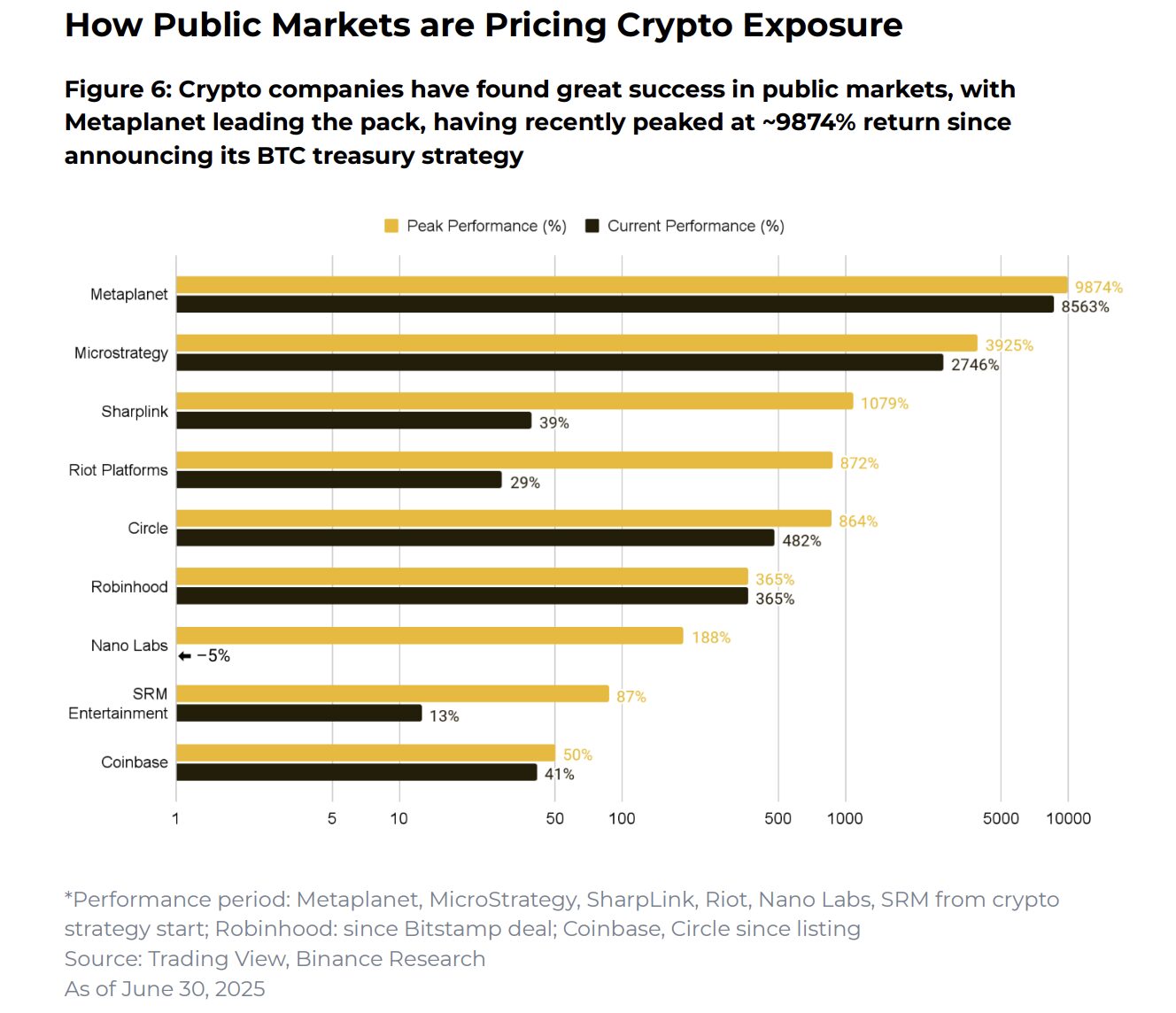

• Investors gravitated to established platforms. We’re stealing this bullet point from Binance Australia’s monthly market wrap info. Binance notes that “investors are increasingly backing crypto businesses with long-term strategies, robust infrastructure, and proven models”.

The crypto platform giant notes that public companies with long-term crypto strategies, like MicroStrategy and Metaplanet, which integrated Bitcoin into their treasuries, “continue to outperform short-term trend chasers”.

• “Meanwhile, Circle, issuer of USDC, completed a successful IPO in June, highlighting strong investor appetite for regulated, revenue-generating fintech,” added Binance Australia.

• And exchange platforms such as Robinhood and Coinbase showed sustained investor interest in June, with Robinhood reaching all-time highs and Coinbase approaching its previous peak. As Binance Research notes, “Robinhood’s acquisition of Bitstamp further highlights how TradFi players are increasingly willing to pay a premium for a more established crypto infrastructure – a sign that mainstream finance is deepening its stake in crypto rails beyond treasury strategies alone.”

• Locally, there’s been continuous signs of a high-level shift in attitude to the cryptocurrency industry, albeit with some focus on a central bank digital currency. Make of that what you will, but the news is still significant. The Reserve Bank of Australia has advanced to the trial phase of its digital currency initiative, Project Acacia, which explores stablecoins and RWAs in the form of bank deposit tokens – not just its pilot of a wholesale CBDC.

Australian traders anchored…

On Binance Australia, Bitcoin and Ethereum remained the top-traded cryptocurrencies in June, reinforcing Quinn-Kumar’s view that investors are preferring assets with scale and credibility at present.

(Note: fellow top 10 cryptos Solana and XRP are also showing solid performance so far this month.)

“Australian investors are sticking with blue-chip assets, like Bitcoin and Ethereum,” the Binance Australia exec notes.

“[It’s] a clear sign the market is maturing and focusing on long-term stability.”

… and looking ahead

“As regulation advances and stablecoins scale, the foundations for the next phase of crypto growth appear to be solidifying, with Bitcoin’s new all-time high illustrating the momentum already underway,” Quinn-Kumar continues.

In summary then, with institutional adoption ramping up, a pro-crypto US government in play, regulatory clarity forming, publicly traded companies scrambling to add BTC to their treasuries, and a Bitcoin-halving induced supply shock… not to mention a potentially favourable macro environment with Fed rate cuts on the horizon, you might say we really are swirling about amid a perfect storm of crypto catalysts.

All we need now is an outlandish-sounding price prediction to finish on…

Ah good – here’s one, from the creator of the famous Bitcoin “Stock to Flow” chart, PlanB…

FYI: I still believe that bitcoin average price will be ~$0.5m this halving cycle (2024-2028).

Note that S2F prediction is very rough (obviously because the prediction is made only using scarcity/S2F-ratio) with a $0.25m-$1m range (so $0.3m or $0.6m average would also be fine). https://t.co/XLxAEYn4Im

— PlanB (@100trillionUSD) July 2, 2025

Binance Australia sponsored this article. Nothing in this article should be construed as financial advice. At the time of writing, the author held Bitcoin and a handful of other cryptocurrencies.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.