Mooners and Shakers: Investment firm giant Franklin Templeton joins US spot Bitcoin ETF queue

Pic via Getty Images

Huge news! Bitcoin is hovering around, actually just a bit under, US$26k! Again. Oh, and US$1.45 trillion asset manager Franklin Templeton has just filed for a spot Bitcoin ETF in the US and A.

The global investment firm titan is the latest to lob its paperwork at Gary Gensler’s United States Securities and Exchange Commission, aka the SEC, aka the biggest party pooper on the cryptoverse both before and since Charlie Munger called Bitcoin a “venereal disease or something” in February 2022 – back when he was a really, really, really old man and not an undead, 18th-level spellcasting lich.

Franklin Templeton joins BlackRock, VanEck, Fidelity, Ark Invest/21Shares and Grayscale, among other pretty big hitters, in the thus far elusive hunt for the great white whale of institutional crypto investment.

That is, the spot BTC ETF, which, when eventually approved as it surely one day will be (r… right?) is believed to be a major catalyst for the financial-liquidity floodgate to burst into the space and pave the way for other types of spot crypto ETFs, such as Ethereum for example.

Some other key things to note here:

• Publicly listed leading global crypto exchange Coinbase (NASDAQ: COIN) is the chosen custodian for the BTC that the Franklin Templeton fund intends to hold.

• The fund would be structured as a trust and the Bank of New York Mellon will be the cash custodian and administrator.

• A reference rate from the Chicago Mercantile Exchange (CME) will be used for pricing.

• The SEC’s next deadline for deciding on the raft of BTC ETF applications is October 16.

NEXT DATES TO WATCH:

Middle of October are the next major days to watch. Namely October 16th. (& @GlobalXETFs' Oct 7)

Also, reminder that we fully expected delays on this round of spot #Bitcoin ETF filings. Would have been a shock if they were approved this week. pic.twitter.com/i14fg8FWun

— James Seyffart (@JSeyff) August 31, 2023

Here’s some reaction…

BREAKING‼️ $1.5 Trillion Asset Manager Franklin Templeton has filed for a spot #Bitcoin ETF.

BlackRock, Fidelity, Franklin Templeton…

You are not bullish enough! 🔥 🚀 pic.twitter.com/dpgmqiTUee— Bitcoin Archive (@BTC_Archive) September 12, 2023

#bitcoin Spot ETF applications:

– BlackRock ($10T AUM)

– Fidelity ($4.5T)

– Franklin Templeton ($1.5T)

– Invesco Galaxy ($1.5T)

– WisdomTree ($87B)

– VanEck ($61B)

– GlobalX ($40B)

– ARK Invest ($14B)

– Bitwise ($1B)

– Valkyrie ($1B)Total: $17.7T

Probably nothing…

— Bitcoin for Freedom (@BTC_for_Freedom) September 12, 2023

Just penciled #FranklinTempleton into my Master Sheet and the numbers are electric🚀! Modeling a modest 0.5% allocation to #Bitcoin it goes up a whopping 407% to a dazzling $152,100! 1% allocation, we could see a staggering $300K! Brace yourselves #SupplyCrunch https://t.co/BpxyTIpW89 pic.twitter.com/4Sq2R4kd9I

— InvestAnswers (@invest_answers) September 12, 2023

And here’s one of CNBC’s hosts, Joe Kernen, who’s made it reasonably clear in the past he’s a bit of a Bitcoin fan…

CNBC‼️ Bitcoin “outperformed every asset on the 1 year, 5 year, and 10 year.”

“BlackRock and all the folks we thought were never going to do this are doing it”

“It’s becoming institutionalised”

BlackRock, Fidelity… and today Franklin Templeton

— Bitcoin Archive (@BTC_Archive) September 12, 2023

Meanwhile, the Genz…

SEC Chair Gary Gensler was asked by the Senate Banking Committee overnight what he needs to see before approving a spot Bitcoin ETF.

Unsurprisingly, Gensler continued to slam the crypto market, saying that it was a Wild West of non-compliance.

“It’s a field which is rife with fraud, abuse, and misconduct,” he told lawmakers.

Regarding the spot Bitcoin applications and specifically the SEC’s recent legal loss to Grayscale in the latter’s fight to turn its GBTC product into an ETF, he told Republican senator Bill Hagerty that: “We’re reviewing that decision”.

As one of Bloomberg’s ETF experts, Eric Balchunas notes, however, Gensler added: “There are multiple spot ETP filings that we’re also reviewing and I’m looking forward to the staff’s recommendation.”

looking fwd to Staff's recommendation? Like it's not pretty much completely up to him in end? Seems like he's hedging again like when he said "I'm just one of five commissioners" Again not sure there's much to takeaway from this beyond he seems to be downplaying his power.

— Eric Balchunas (@EricBalchunas) September 12, 2023

Video: pic.twitter.com/JOcvrihZ6b

— Scott🍁Trades (@Scottrades) September 12, 2023

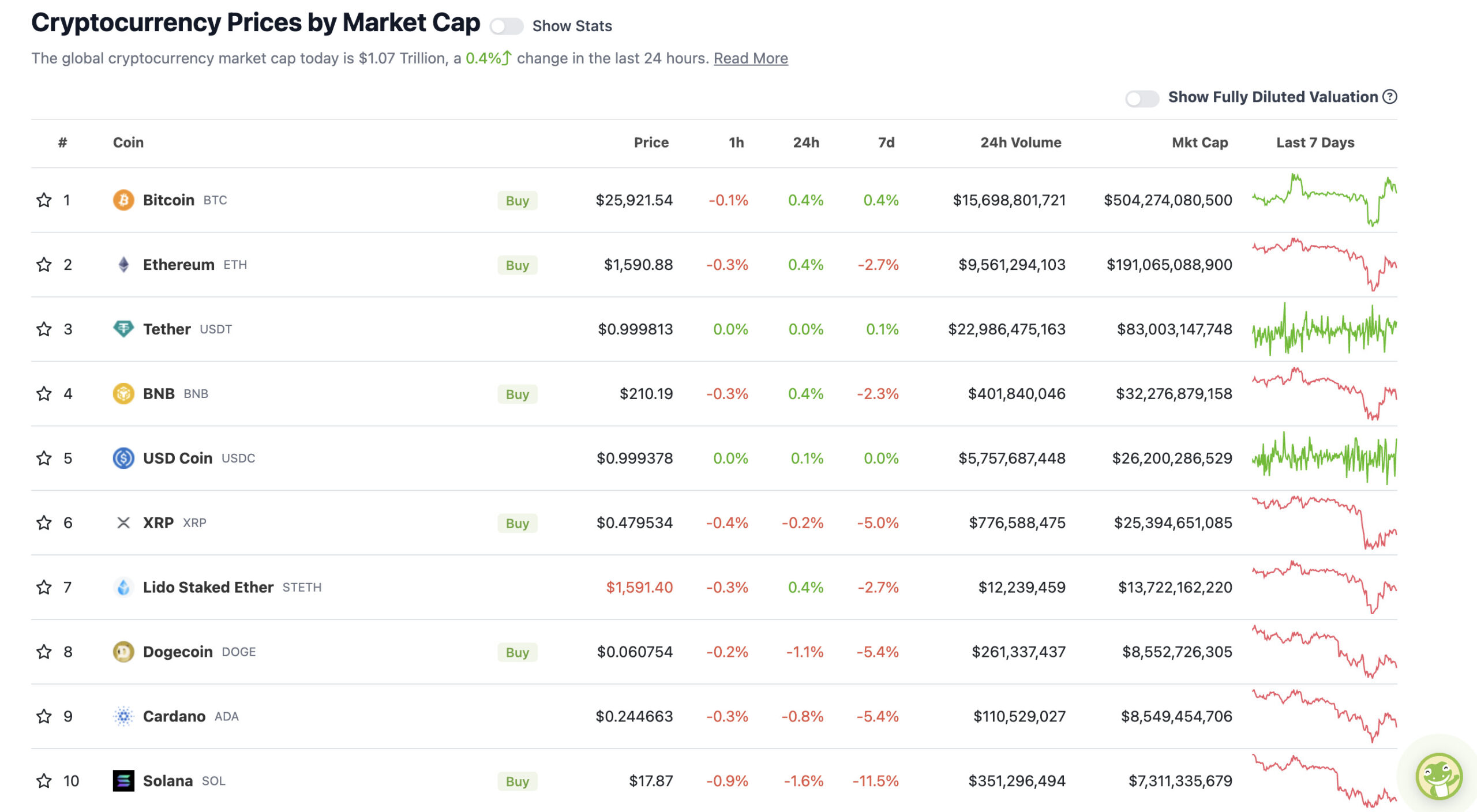

Top 10 overview

With the overall crypto market cap at US$1.07 trillion, up a fraction since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Rollbit Coin (RLB), (market cap: US$473 million) +13%

• VeChain (VET), (market cap: US$1.16 billion) +8%

• Toncoin (TON), (market cap: US$6.15 billion) +8%

SLUMPERS

• Stellar (XLM), (market cap: US$3.3 billion) -8%

• Sui (SUI), (market cap: US$336 million) -4%

• Near Protocol (NEAR), (market cap: US$1 billion) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Blackrock, Fidelity, Invesco and now Franklin are all gathering together for #Bitcoin spot ETFs.

This can be the catalyst of a bull cycle for #Bitcoin to perhaps $200,000 or $300,000 a piece.

Yet, you'd like to sell here after these two years for $12,000.

— Michaël van de Poppe (@CryptoMichNL) September 12, 2023

https://twitter.com/BitcoinMagazine/status/1701629897330901349

Hang on, what’s this? New York-based crypto custody firm Fireblocks has teamed up with the London-based HSBC, one of the largest banks in the world, according to a CoinDesk report that cites “two people familiar with the matter”.

More things that make you go hmm… in a bullish kind of way.

SCOOP: London-headquartered banking giant @HSBC is working with crypto custody firm @FireblocksHQ.@IanAllison123 reportshttps://t.co/QHbUSlMapC

— CoinDesk (@CoinDesk) September 12, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.