Mooners and Shakers: Help us, JPow… you’re our only hope (for the bull run)

Obi-Wan Coin-obi, yesterday. Pic via Getty Images

- August saw crypto markets react to a wave of Fed-cut hopes and pro-crypto Trump admin moves

- Bitcoin was on fire, hitting fresh records, then cooled off – as it tends to, the big tease

- Now, as we move further into September, the question is, who holds the keys to the next pump? (The answer’s pretty obvious)

Annnd… we’re back. Never mind gold and gold stonks for one minute, Bitcoin and the broader crypto market are still here, in case you hadn’t noticed – and the Force is pretty strong, too.

That said, we can’t speak for the multitudes of dog, frog and rando flog coins exactly, but certainly the top coins have generally been in decent nick.

You may well not have noticed crypto of late, though, and that’s because retail mania of bull runs of yore is still absolutely not here. It may also because you’re too busy rueing the recent performance of some of those large-cap lithium investments.

Will mania return? Or is a slow grind up better as a sign of market maturity anyway? Both options are possible, as is something worse, of course. But enough paper-thin conjecture, “let’s get down to brass tacks” as absolutely no-one we know says, and delve into some August and September-related facts…

What happened in August, what now, and what next?

August saw crypto markets test new highs before cooling, as traders weighed Fed rate-cut hopes against signs of market maturity, a la ye olde gold.

With Trump’s administration leaning hard into crypto of late, and capital rotating into DeFi, stablecoins and real-world-asset-facilitating altcoins like Chainlink, late September/October could be set up for some crypto-market fireworks.

Well, that is… if Jerome Bowel (sub-editor… check the spelling on that, would you?) and his Fed mates play ball, the world doesn’t descend into WW3, and every story ending I wrote as a kid (maybe some as an adult, too) doesn’t come true.

… And then I woke up and it was ALL a dream.

With the help of some fresh Binance analysis, we’ll get a little more granular on some recent highlights and upcoming catalysts in a sec, but first, have a gander at…

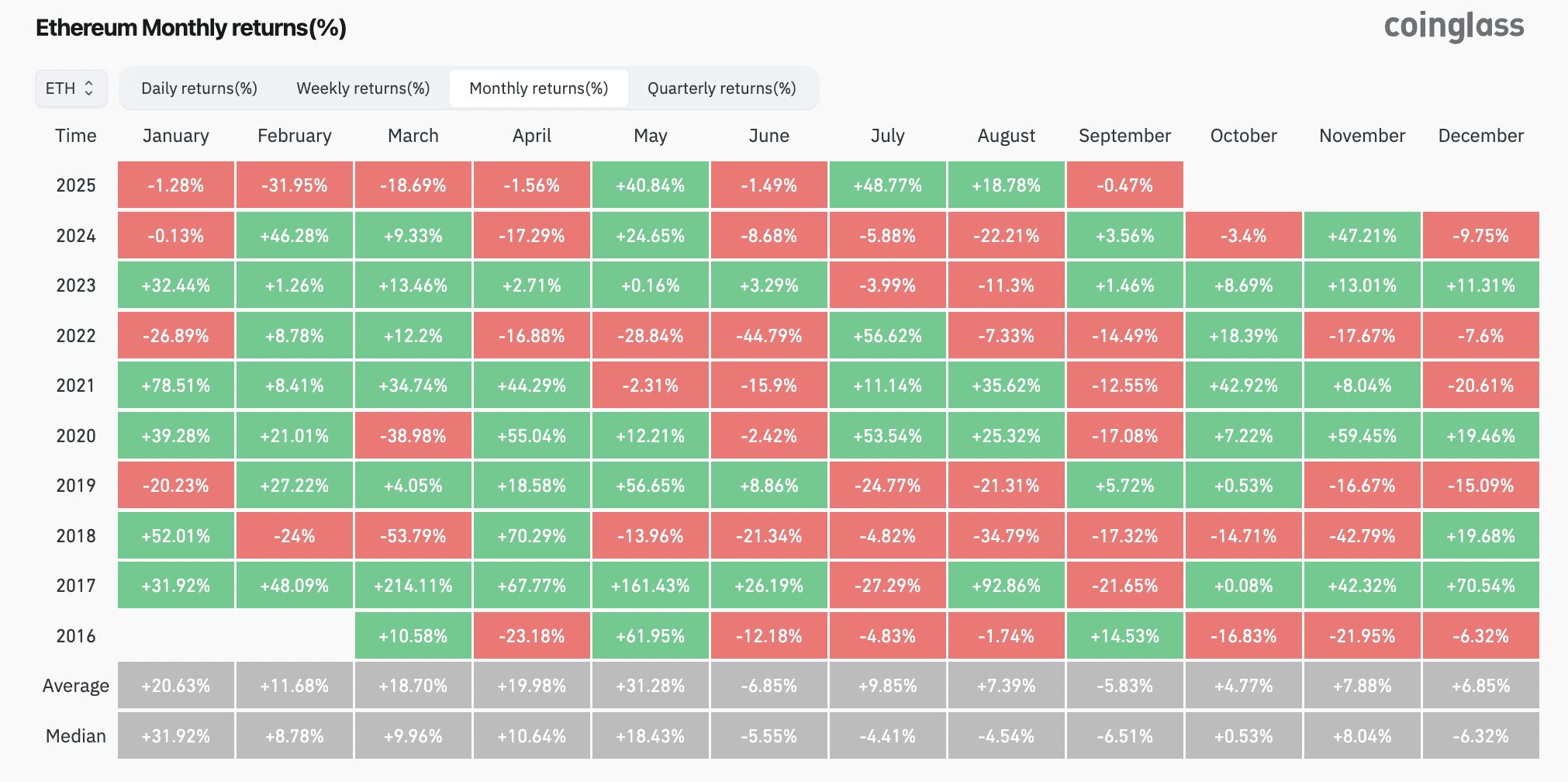

Bitcoin and Ethereum’s August returns

Hang on, didn’t we say Bitcoin rose in August? Hit fresh all-time highs? Yeah, it did: US$124,128 on August 14. We also said it cooled off, though, hence the underwhelming monthly return there of -6.49%. But September, not always the greatest month for BTC either, is off to a promising start. At the time of writing, BTC is changing hands for US$114,148 and making a strong move on a 24-hour timeframe.

Here’s the main reason crypto didn’t descend into an August toilet on the whole, however…

Last month we boldly called for an “Ethereum season“. In hindsight we’ll need a bit more data on that, but… the second-top crypto did make its own personal best on August 24, hitting US$4,946.

Having cooled off since, too, at the time of writing, ETH is pushing on up to US$4,429, a daily gain of 2.7%.

Recent key highlights

• Bitcoin’s record highs, then consolidation – BTC spiked to a fresh all-time high of US$124k on August 14 before easing back, as macro caution and profit-taking kicked in.

• Fed uncertainty rules – Powell’s Jackson Hole speech tempered hopes of imminent cuts, but markets still placed a reasonably strong bet on easing in September.

• Trump administration’s crypto push – From a Strategic Bitcoin Reserve to retirement fund access and blockchain-based GDP reporting, Washington is doubling down on digital assets.

• Capital rotation signals maturity – Binance says August’s 1.7% total crypto market slip masked a more important trend: investors funnelling capital into DeFi and yield-bearing stablecoins, not just Bitcoin.

Macro meets maturity

The August rally was driven by Fed cut hopes and Trump’s policy fireworks – but the latest Binance Australia Market Insights Report, released this morning, suggests something deeper is at play.

While Bitcoin dominance slipped to 57.3%, Ethereum (+18.6%), Solana (+15.5%), and Chainlink (+35.9%) gained strongly as money flowed toward projects with utility and institutional traction.

Binance Australia and New Zealand general manager Matt Poblocki summed it up:

“The idea that rate cuts automatically drive Bitcoin higher oversimplifies today’s reality. What’s really moving capital now are innovations across altcoins, DeFi, and stablecoins.”

Indeed, DeFi lending TVL has surged 72% this year, with the cryptos Maple and Euler exploding in August, while yield-bearing stablecoin USDe leapt 43.5% to US$12.2b. That makes it the fastest to break the US$10b mark, now 4% of the US$280b stablecoin market. This evolution, argues Binance, reflects an ecosystem less tied to macro whims and more to structural adoption.

Trump, Chainlink and on-chain GDP

August’s other big mover was Chainlink (LINK), riding the Commerce Department’s surprise move to publish US GDP and PCE data directly on-chain. Commerce Secretary Howard Lutnick called it “a leap in economic transparency”, and markets agreed – LINK rallied hard. It’s now up more than 11% over the past 30 days, which isn’t too shabby for a +US$16bn market capper.

Meanwhile, Trump signed an executive order allowing 401(k) retirement funds to hold crypto, potentially opening trillions in fresh inflows.

Whatever you think about Trump (and there’s a lot to think about him), when you combine his Strategic Bitcoin Reserve agenda and deregulatory push, the “Crypto President” label he pretty much gave himself is looking increasingly apt.

September outlook: all eyes on the Fed (jeez, what else is new?)

For September, one catalyst looms above all: the Fed’s September 17 meeting. If Jerome Powell signals cuts – or his potential 2026 successor hints dovish – expect another surge.

But even if rate relief stalls, the maturation theme could keep the market steady. Rotation into DeFi, stablecoins, and altcoins is building a base less fragile than prior cycles.

“The surge in DeFi lending and the rise of yield-bearing assets like USDe prove that crypto is building a new, more efficient financial infrastructure,” Poblocki noted.

“Investors are seeking returns and new ways to generate value within the ecosystem. This growth confirms that the demand for productive assets is a durable, long-term trend.”

Aussies are still bullish

News just in …

Just as we were wondering how to end this article with some sort of punch, a brand new Binance Australia survey of nearly 1,900 users landed with a satisfactory thud in our inbox.

And it shows local sentiment for crypto remains upbeat despite some volatility in August.

One in four expect Bitcoin to surge past US$150k within six months, while almost half see it consolidating between US$100k-150k.

Nearly half (49.4%) plan to buy more BTC, and close to two-thirds identify as long-term ‘HODLers’.

Altcoins are also on the rise, now making up nearly 40% of the market, with Ethereum consistently out-trading Bitcoin.

And speaking of ETH again, here’s a tasty adoption-news morsel to leave you with.

MASSIVE:

🇦🇪 EMIRATES AIRLINES WILL ACCEPT PAYMENTS IN ETHEREUM! pic.twitter.com/EsF6NpIymi

— Coinvo (@ByCoinvo) September 9, 2025

And it is pretty massive, too … as long as people actually do end up buying flights with it.

Binance Australia sponsored this article. Nothing in this article should be construed as financial advice. At the time of writing, the author held Bitcoin and a handful of other cryptocurrencies.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.