Mooners and Shakers: Fed talks, crypto market climbs; Oasis, Polygon, Near surge

Pic: Getty

When the US Federal Reserve boss speaks, the markets listen and react – Bitcoin and the wider crypto market included. Today, he spoke, and the survey says… “So, you’re telling me there’s a chance…”

CoinDesk did a live blog on Jerome Powell’s Q&A session with the US Senate Banking Committee today and we sifted through it to figure out what might have caused a positive spike in sentiment (and crypto prices).

The TLDR on it, is basically this…

Jay Powell right now: pic.twitter.com/ni6qTz52I3

— LilMoonLambo (@LilMoonLambo) January 11, 2022

In other words, Powell’s messaging was relatively neutral, and not punctuated with tough talk on accelerated and hefty interest-rate hikes. He did, however, still pledge the Fed will do what’s necessary to contain inflation.

“If we have to raise interest rates more over time, we will,” said Powell. “We will use our tools to get inflation back.”

But, in possibly his key sentence, the Fed chair also seemed to hint that low interest rates aren’t likely to disappear any time soon… “We have been and probably remain in an era of very low interest rates.”

Periods of high and accelerated interest rates, by the way, can lead to suppressed stock and crypto markets.

The crypto industry has also been highly anticipating the US Federal Reserve’s digital currencies report, and Powell updated with: “The report really is ready to go and I expect we will drop it — I hate to say this again — in coming weeks.”

So… it’s not actually quite ready, then. Oh, and it won’t contain too many definitive positions. It’ll, sorta, you know, be posing more questions to be answered by the industry.

Powell on #crypto – report on digital currencies in the coming weeks will be more on "exercise in asking questions and seeking input from the public, rather than taking a lot of positions."

— Benjamin Cowen (@intocryptoverse) January 11, 2022

Righto then – cheers Jerome. So, all in all… we refer you back to the image in the tweet further above. Meanwhile, no particularly strong news from the Fed is good short-term news for the crypto market…

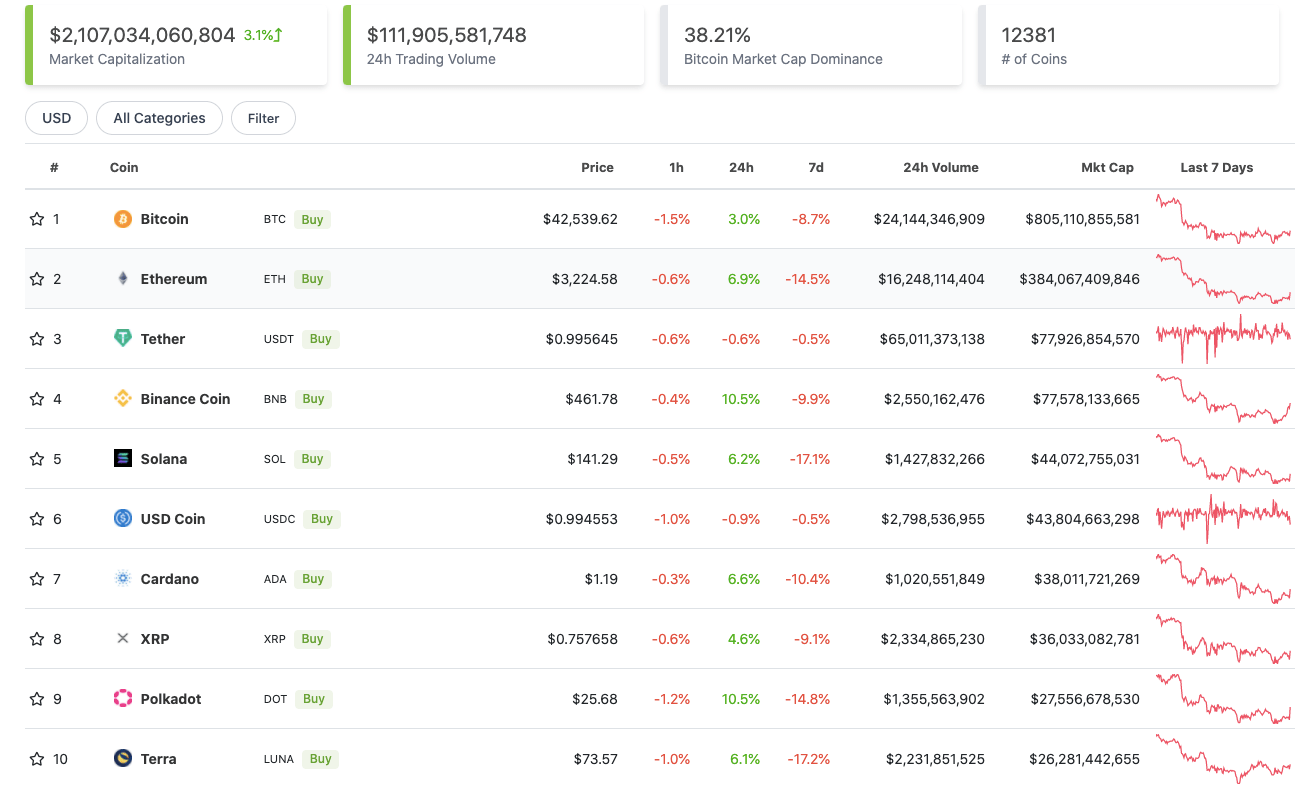

Top 10 overview

With the overall crypto market cap up 4.6% since being in the sub-two-trillion doldrums this time yesterday, here’s the state of play in the top 10 by market cap at the time of writing – according to CoinGecko data.

Daily winners across the board here, with the altcoins leading the way – in particular, Polkadot (DOT) and Binance Coin (BNB).

It feels like a long time between drinks for DOT and double-digit gains. Today the layer 1 blockchain’s “first fully operational” parachain, Moonbeam, went live – becoming all set to bring smart contracts capability and interoperability with Ethereum to the Polkadot network.

GLMR, the Moonbeam token, is currently up about 32% since hitting the markets (including Binance and Kucoin) about six or seven hours ago at the time of writing.

1/ 🚀 Moonbeam is LIVE on @Polkadot! 🔥 We are excited to announce that Moonbeam is the first fully operational parachain on Polkadot. Moonbeam will bring many new integrations, activity & users to light up Polkadot’s ecosystem. ⚡ #MoonbeamLightsUphttps://t.co/yBhgyWwaRn

— Moonbeam Network (@MoonbeamNetwork) January 11, 2022

Winners and losers: 11–100

Sweeping a market-cap range of about US$21.7 billion to about US$1.2 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Oasis Network (ROSE), (mc: US$1.4b) +25%

• Near Protocol (NEAR), (mc: US$10.6b) +18%

• Polygon (MATIC), (mc: US$15.3b) +16%

• Fantom (FTM), (mc: US$6.4b) +14%

• Ecomi (OMI), (mc: US$1.4b) +13%

Sleeping giant layer 1 blockchain Oasis Network (perhaps not exactly sleeping any more) has been going from strength to strength lately. And big venture capitalists in the space, including Binance Labs, Hashed and Jump Capital, clearly like what they see.

Binance Labs has joined other prominent VC firms in backing Oasis Network's massive development fund. https://t.co/dKlJLc5Kvl

— Cointelegraph (@Cointelegraph) January 11, 2022

DAILY SLUMPERS

• Olympus (OHM), (mc: US$1.47b) -10%

• Frax Share (FXS), (mc: US$1.25b) -4%

• Chainlink (LINK), (mc: US$12.5b) -2%

• Leo Token (LEO), (market cap: US$3.5b) -1%

• Quant (QNT), (mc: US$2.3b) -0.5%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Scream (SCREAM), (mc: US$14m) +65%

• Tomb Shares (TSHARE), (mc: US$696m) +45%

• LooksRare (LOOKS), (market cap: US$269m) +37%

Since being airdropped to eligible OpenSea NFT traders the other day, LooksRare (a new OpenSea competitor in the NFT marketplace sector) is bouncing its way up pretty steadily and seems to be gaining some traction with the decentralisation-loving crypto community.

While I realise this is satire, I guess it’s still important to point out that the only actual members of the team on Twitter are @GutsLooksRare and @ZoddLooksRare.

Much love all the same.

— LooksRare (@LooksRare) January 11, 2022

DAILY SLUMPERS

• Gods Unchained (GODS), (market cap: US$95m) -15%

• OpenDAO (SOS), (mc: US$143m) -8%

• Steem (STEEM), (mc: US$167m) -7%

Final word(s)…

https://twitter.com/naiiveclub/status/1480897898300645376

Oh, and just for fun, this pretty much sums up the banter between crypto bulls and bears on Twitter right about now…

Twitter, explained in 15 seconds pic.twitter.com/4dp4qytgwf

— David Hobby 📷🌏 (@strobist) January 10, 2022

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.