Mooners and Shakers: Ethereum finds its mojo… (checks watch) looks like ‘ETH season’ is here

Ooh! Is it time to ape in again? Pic via Getty Images

- BTC reached all-time high after high in July. Can it repeat the action in August?

- Not to be outdone, capital has rotated into ETH, which has outshone just about everything of late

- Binance Australia’s latest market insights report has been released. We pull out some virtual nuggets

About this time last month in this column we talked up some pretty bullish Bitcoin and crypto sentiment. It was amid fresh all-time highs for BTC, so we stand by that exuberance.

Has Bitcoin rocketed since? Is the broader crypto froth (read: retail investor; read: random cab driver; read: mainstream talking heads; read: your mum) here yet? The answer is kinda, for the first part… and nope for the second.

If we’d posted our last Mooners and Shakers update a few days later last time around, we’d have been mentioning Bitcoin price altitudes of around US$122k rather than US$116k. It’s been flirting somewhere between ever since.

Solid performance, that. And yet it feels like there’s a fair bit more room to run yet in this “cycle” for Bitcoin and well-chosen alts. Especially well-chosen alts, led by Ethereum. We’ll get to that below, by way of sourced expert analysis, including our friends over at the globe’s biggest crypto exchange by users and trading volume, Binance.

Actually, here’s a quick taster from the latest Binance Australia Monthly Crypto Market Insights Report, released today:

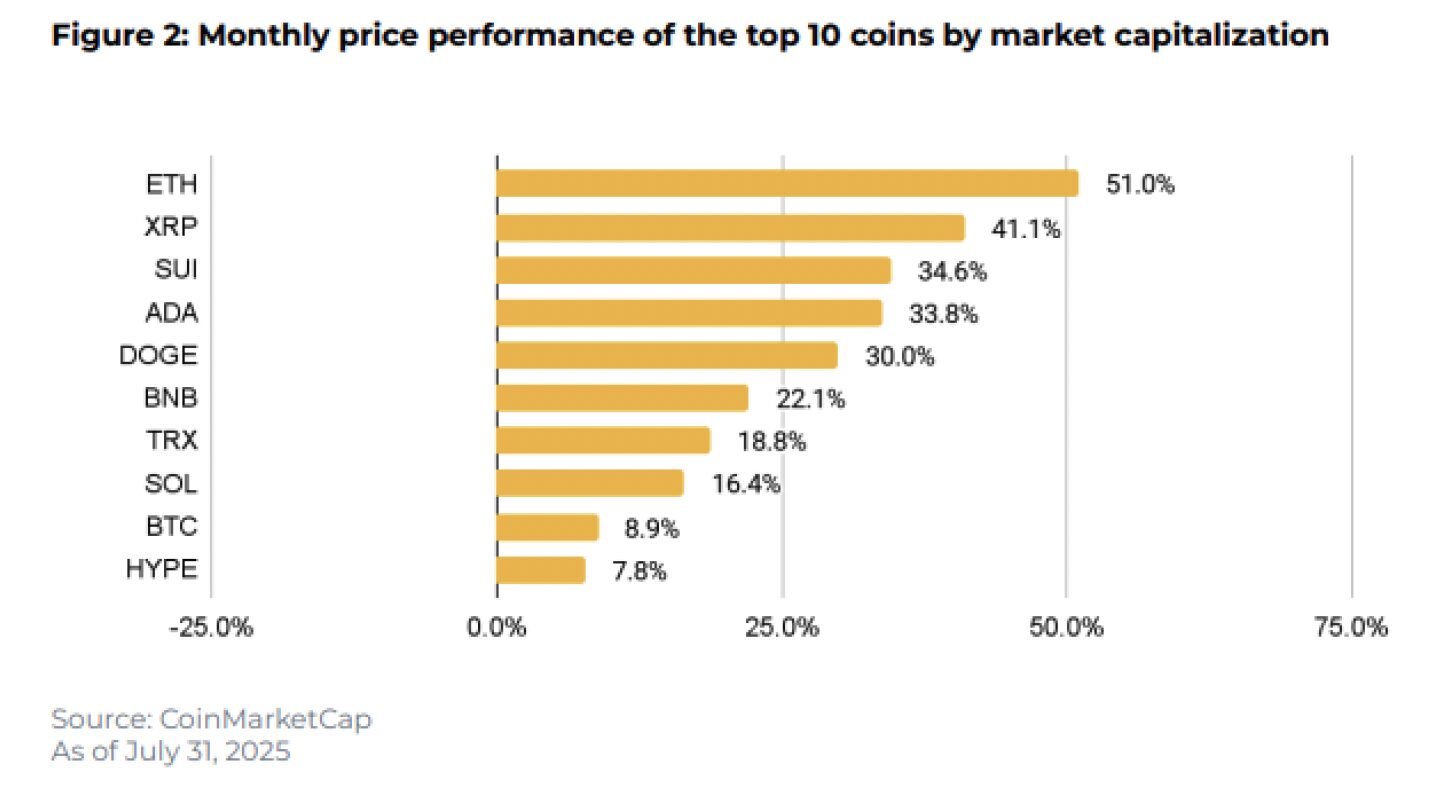

The cryptocurrency market experienced a powerful surge in July, with total market capitalisation growing by 13.3%.

Strong market growth was fuelled by improving macro conditions, renewed risk appetite, and rising institutional demand. Alongside this, regulatory clarity and growing digital asset treasury adoption pushed Bitcoin to repeated all-time highs, buoyed altcoin investment, and drove continued positive sentiment for stablecoins.

Before we delve deeper for nuggets from that report, let’s recap what BTC and ETH achieved by way of monthly percentage returns in July…

Bitcoin and Ethereum’s July returns

A more than 8% gain for the orange one, then. Not Trump coin – this thing…

Not too shabby at all for a US$2.36 TRILLION market capper that’s still decried as a tulip bubble here and there after all these years.

(Reminder: Bitcoin has been in existence since 2008, roughly 17 years. Dutch tulips experienced their famed boom and bust somewhere between 1634 and 1637. The tulip mania bubbled, burst and never came back.

Bitcoin, a peer-to-peer decentralised, theoretically unhackable digital currency with mathematically inbuilt increasing scarcity and immutability – a completely unique financial achievement – has had numerous bubbles and loud pops, certainly, but it’s come back and ultimately kept on going up and to the right. Every. Single. Time.

Also, Bitcoin has been the best-performing asset, among ALL assets, in eight of the past 11 years, with a fair chance for a ninth in 12 the way things are tracking. Even Michael Jordan and his Bulls couldn’t pull off that level of sustained success.)

But we digress… because, as the article’s headline suggests, we probably should get on to talking about the no.2 slot, the bull goose “altcoin” (that’s any crypto that isn’t Bitcoin) – Ethereum.

While BTC still had a great July, here’s how the dial has shifted to the US$531.5 billion market-capped ETH…

The king of altcoins, and still highly likely to be the layer 1 (the base blockchain on which other crypto applications are built) of choice for the mainstream, had a cracking July (+48.77% according to Coinglass above, but about +51% per Binance research). This came after a lacklustre, macro-turmoil-affected June.

This is potentially very exciting if the historical patterns of post-halving-year bull runs are to follow the four-year-cycle norm. (“Halving” – huh? What? We have no time to explain everything here… so we’ll point you here for that.)

IF that holds true again (and note it’s not a small if), then “altcoin season” might be just around the corner once again as crypto capital inflows shift from Bitcoin, to Ethereum, then to other large cap altcoins (top 10 to 20 or so) and on to… pretty much throw-a-dart time for sick gainz in myriad lower to micro caps.

That’s dangerous talk right there, so take it with a massive bag of salt and without any sense of being financially advised. The thing is, there are few signs of retail froth and FOMO at the moment, which is either exciting (room to run) or a little concerning (will they ever come back to pump the crypto faithful’s bags of 💩 coins?).

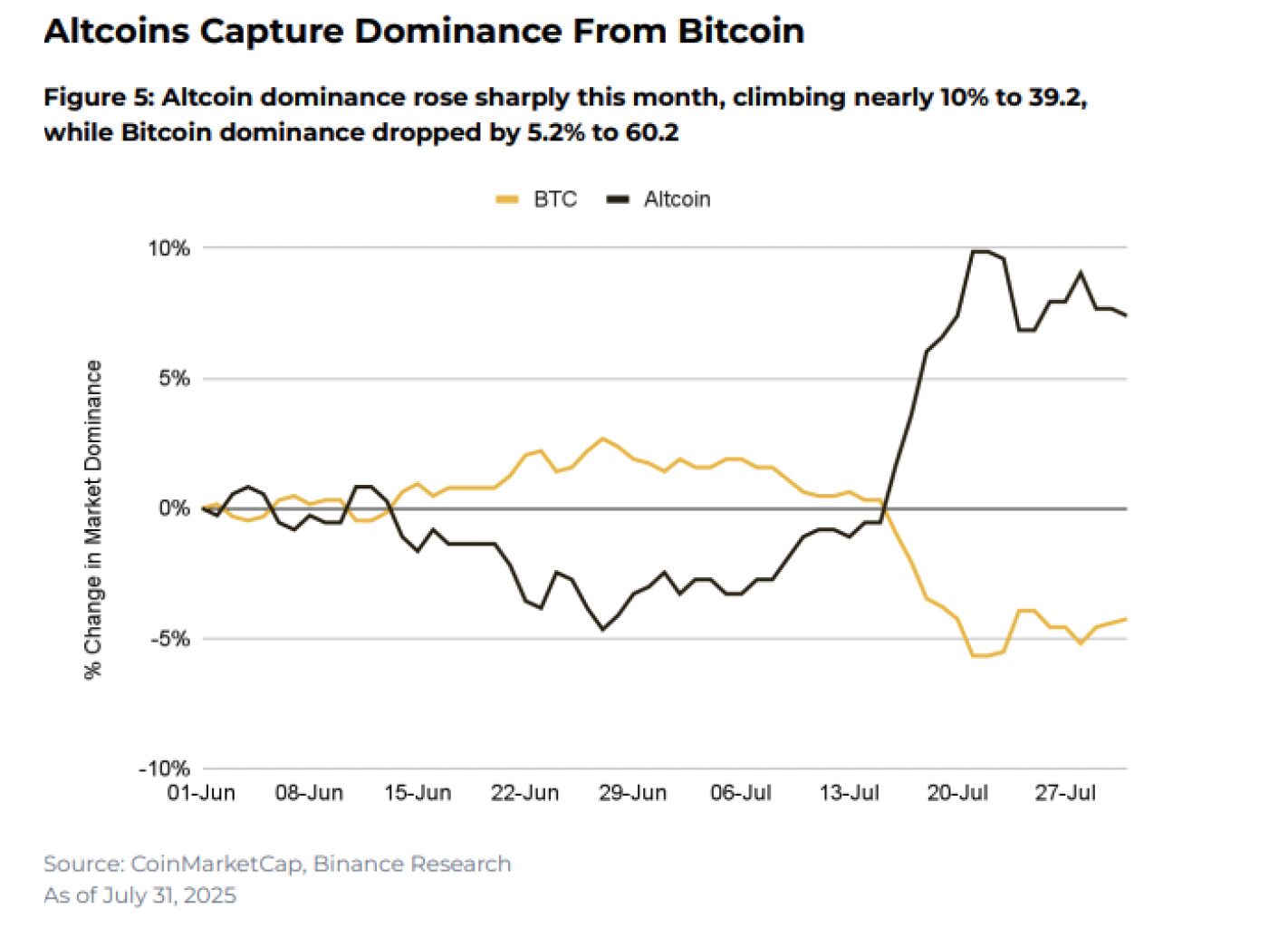

This Trading View chart, however, does suit past bull run narratives, showing the dip (more than 5%) in Bitcoin dominance (BTC.D) from July to where we are now in August. It definitely fits in with the idea of capital rotation into ETH then alts.

Altcoin dominance meanwhile rose in July according to Binance – about 10% to 39.2%.

James Quinn-Kumar, Director of Community Engagement for Binance Australia and New Zealand, said July signalled a growing rotation from Bitcoin into the broader crypto market as the asset class matures and mainstream adoption thrives.

“Investors are no longer just focused on Bitcoin as a singular hedge. We’re seeing them explore the broader market, driven by improved macroeconomic conditions, rising consumer confidence, and increased regulatory clarity globally.

“Adoption narratives around tokenization and stablecoin infrastructure have also helped strengthen broader sentiment – particularly benefiting Ethereum and related DeFi assets, which rely heavily on stablecoin liquidity.”

HOWEVER (again)… with Wall Street and institutional investment well and truly in the Bitcoin/crypto game now (Blackrock, Fidelity, Bank of America, even JP Morgan and more), the waters are well and truly muddied for the chuck-a-dart-and-win altcoin narrative of yore.

Maybe this time really is different or somewhat different. Maybe it’s time for crypto bros and broettes trading off past altcoin glories – or the opposite: full cycle rides up and down without taking profit – to think a little more strategically within the cryptosphere.

With regularity clarity and the SEC no longer standing in the way, though, Solana and XRP and other top altcoin ETFs are likely coming before too long to join the raft of institutional BTC and ETH ETFs – offering potential for rocket fuel catalysts yet… but with eyes wide open for the right subplots best mentioned.

One thing’s for sure, it’s still an exciting space in which to invest and trade. July and August have typically been positive months in post-halving years for crypto, and that appears to be playing out again. (Watch out for sneaky September, though.)

Admittedly, there is a lot going on with this chart.

But if you look carefully at it, you’ll see that #Bitcoin prints the same pattern each post-halving year.

Up in July-Aug

Down in Sep

Up into the market cycle top in Q4

Bear Market pic.twitter.com/k2VmXW0vJx— Benjamin Cowen (@intocryptoverse) August 11, 2025

Meanwhile, the news for Bitcoin and crypto – in the US, in particular – has never been more bullish. Here’s a reminder of a few things that have transpired lately to back up that statement…

It’s Good News Week Month…

• Per the newly released Binance Australia Monthly Crypto Market Insights Report mentioned earlier, one of the very biggest news events to occur in July was this…

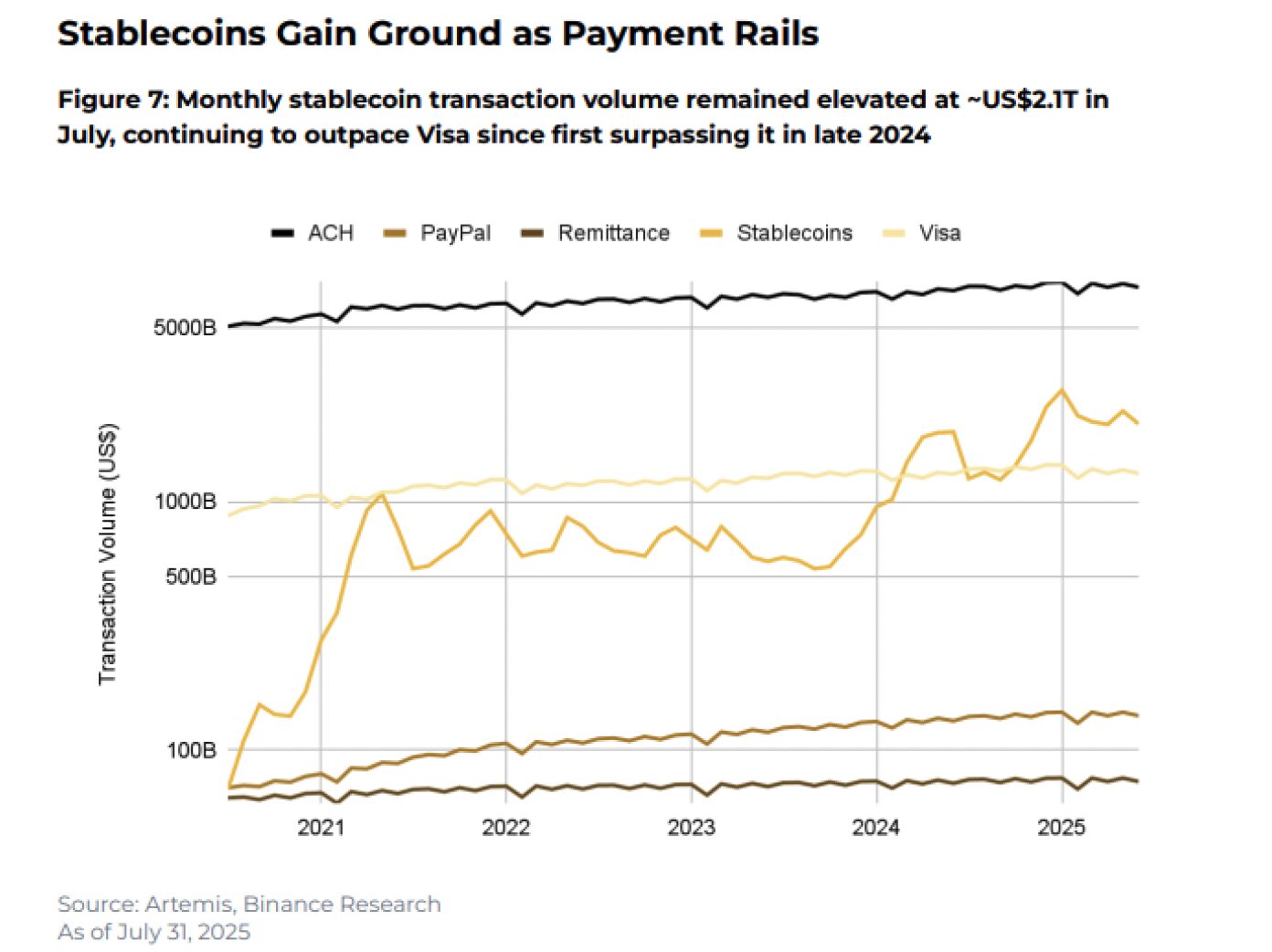

“The landmark GENIUS Act become US law, creating the first federal framework for fully reserved, AML-compliant stablecoins backed 1:1 by cash or short-term Treasuries.”

A massive win, then, at long last, for crypto regulatory clarity in the US, which looked like being nothing more than a fairytale in the Biden/Gensler/Warren era. (Jeez, they sure did their best to kill off crypto, didn’t they? Gave it a red hot go. Well… “suffer in your jocks” now, I guess.)

Sorry, where were we?

Binance notes that this clarity already helped accelerate institutional adoption, “with JPMorgan expanding its deposit-token pilot and Citi exploring tokenized deposits for cross-border payments… Visa also highlighted stablecoins as complementary to its network and plans to expand support.”

Stablecoins, the exchange notes, have a growing role in global finance as payment rails and mainstream payment infrastructure.

• President Trump has now signed an Executive Order allowing crypto to be bought in US 401(k) retirement accounts.

Wait… what? Hang on a sec – we probably shouldn’t be burying this down here. So let’s write it again… in caps, italics and in bold*.

TRUMP HAS SIGNED AN EXEC ORDER ALLOWING CRYPTO TO BE BOUGHT IN US RETIREMENT ACCOUNTS!

(*But not using more than one exclamation point. Because that’d be stupid. And annoying.)

If you’ve read this far, you will hopefully appreciate how MASSIVE this news actually is. And it’s probably flown under the radar a tad.

The US retirement market has a defined-contribution (DC) base of US$12 TRILLION. And the EO Trump signed just last week means there is potential for a pretty much perpetual substantial base bid for crypto.

Even tiny percentages of US$12 trillion flowed into crypto as retirement fund allocations should have a significant impact on the market. That’s not to say it’ll all burst in through the floodgates, of course, but it sure is promising.

Wow. He’s a GREAT guy, that Trump… (SFX: crickets). Okay, swiftly moving on.

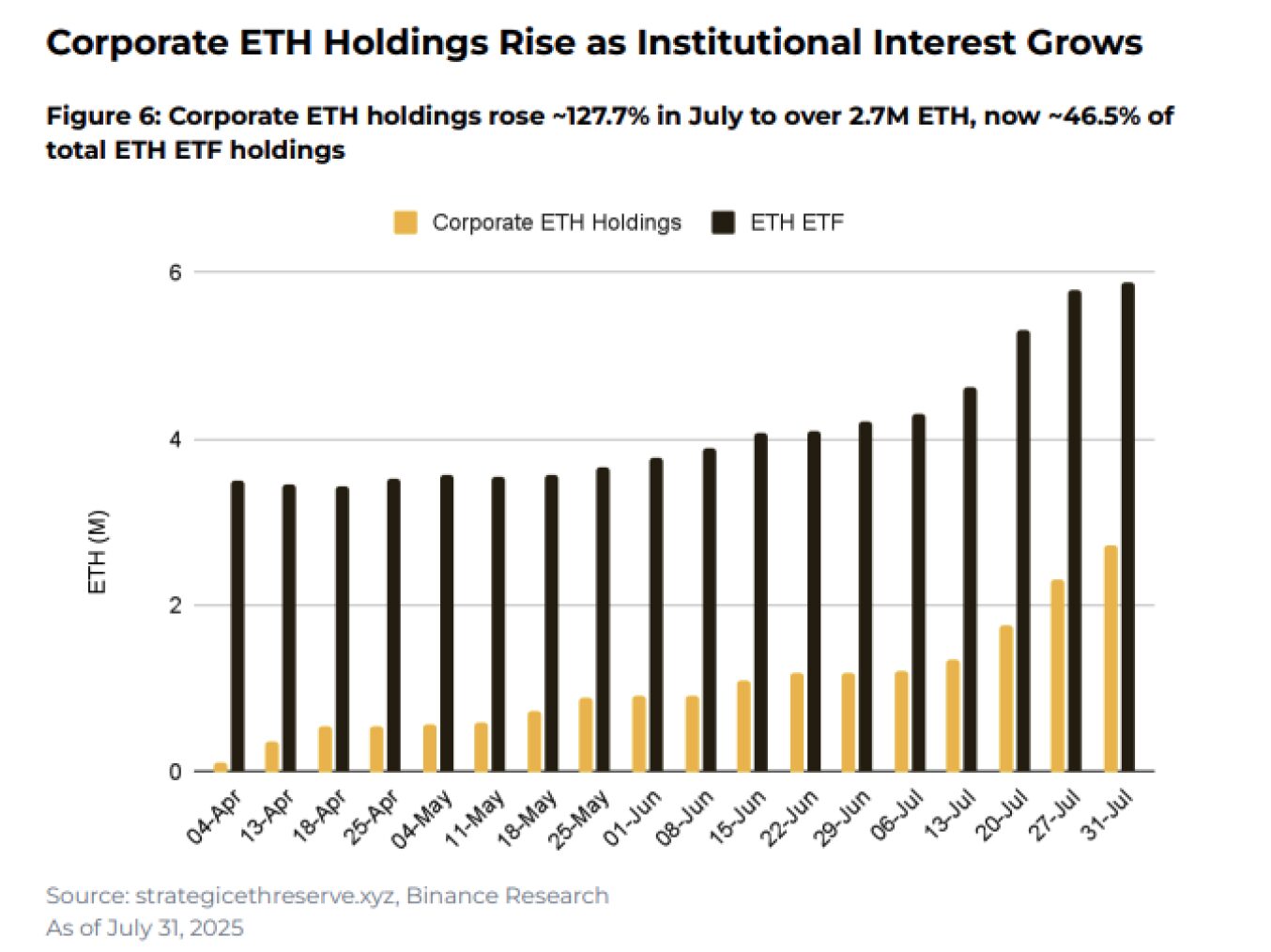

• Backing up the ‘ETH season‘ narrative, the Binance Australia report also noted significant digital treasury adoption in the business world, with corporate ETH holdings rising ~127.7% in July to over 2.7M ETH, now ~46.5% of ETF-held ETH. Some 24 new companies added ETH to their balance sheets in July.

Companies like Bitmine and Sharplink now hold 625K and 438.2K ETH, respectively – both surpassing the holdings of the Ethereum Foundation.

“This marks the strongest month on record for institutional treasury adoption,” reads the report, “driven by staking yield, ETH’s deflationary mechanism, and growing preference for direct exposure over passive ETF vehicles.”

Adding to this, Quinn-Kumar noted:

“The extraordinary corporate adoption of Ethereum in July signals a fundamental shift in how institutions view digital assets.

“Companies are now moving beyond a ‘store of value’ mindset and are actively leveraging Ethereum’s unique utility.”

• Summarising then, the overall crypto scene includes the following macro-influenced bullish undertones with conditions showing “supportive economic indicators, expectations of an approaching Fed rate-cut cycle, and growing regulatory clarity”.

Further, per the Binance Australia report:

“Key drivers such as the passage of three crypto bills [including the GENIUS act noted above], progress on ETF approvals, and rising institutional interest in altcoin futures and corporate treasury allocations further fuelled the rotation. Adoption narratives around tokenization and stablecoins also contributed to the strengthening sentiment.”

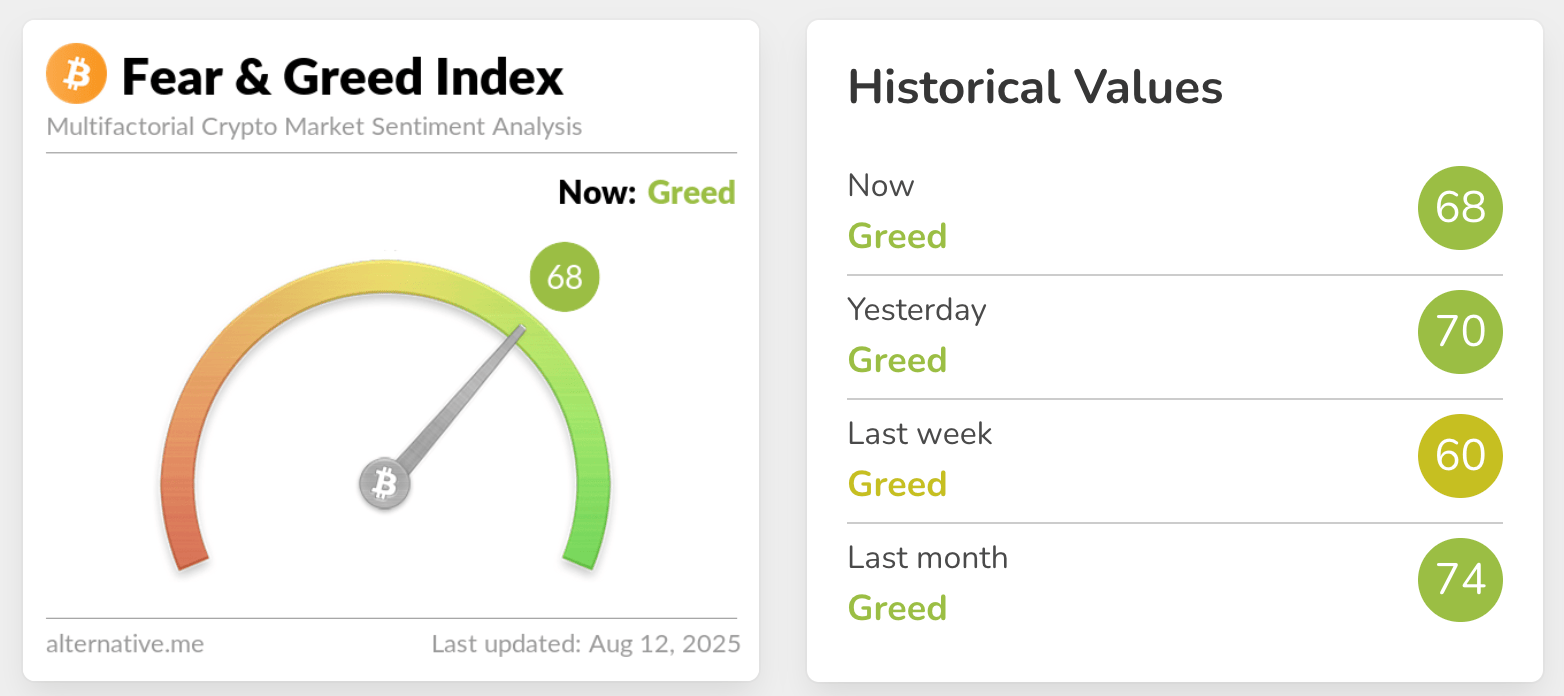

Sentiment that currently looks like this, by the way…

Hmm… what was it Warren “All You Can Eat” Buffett said we should be when others are greedy? Never mind, can’t recall. Probably not important right now. (Might be in a couple of months or so, though.)

Binance Australia sponsored this article. Nothing in this article should be construed as financial advice. At the time of writing, the author held Bitcoin and a handful of other cryptocurrencies.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.