Mooners and Shakers: Crypto survived March okay but April looks tariffying

April Fool's is a whole month this year? Because these prices are surely a joke. Pic via Getty Images

- We’re not going to sugarcoat it, the crypto market is in the gutter right now. Thanks, Donald

- Then again… it’s hardly the Lone Ranger among Trump-roiled markets and sectors, is it

- In fact, let’s sugar it after all… there are some silver linings to be found. Read on…

About this time last month we pondered whether March would be any better for the crypto market than what turned out to be a particularly brutal February.

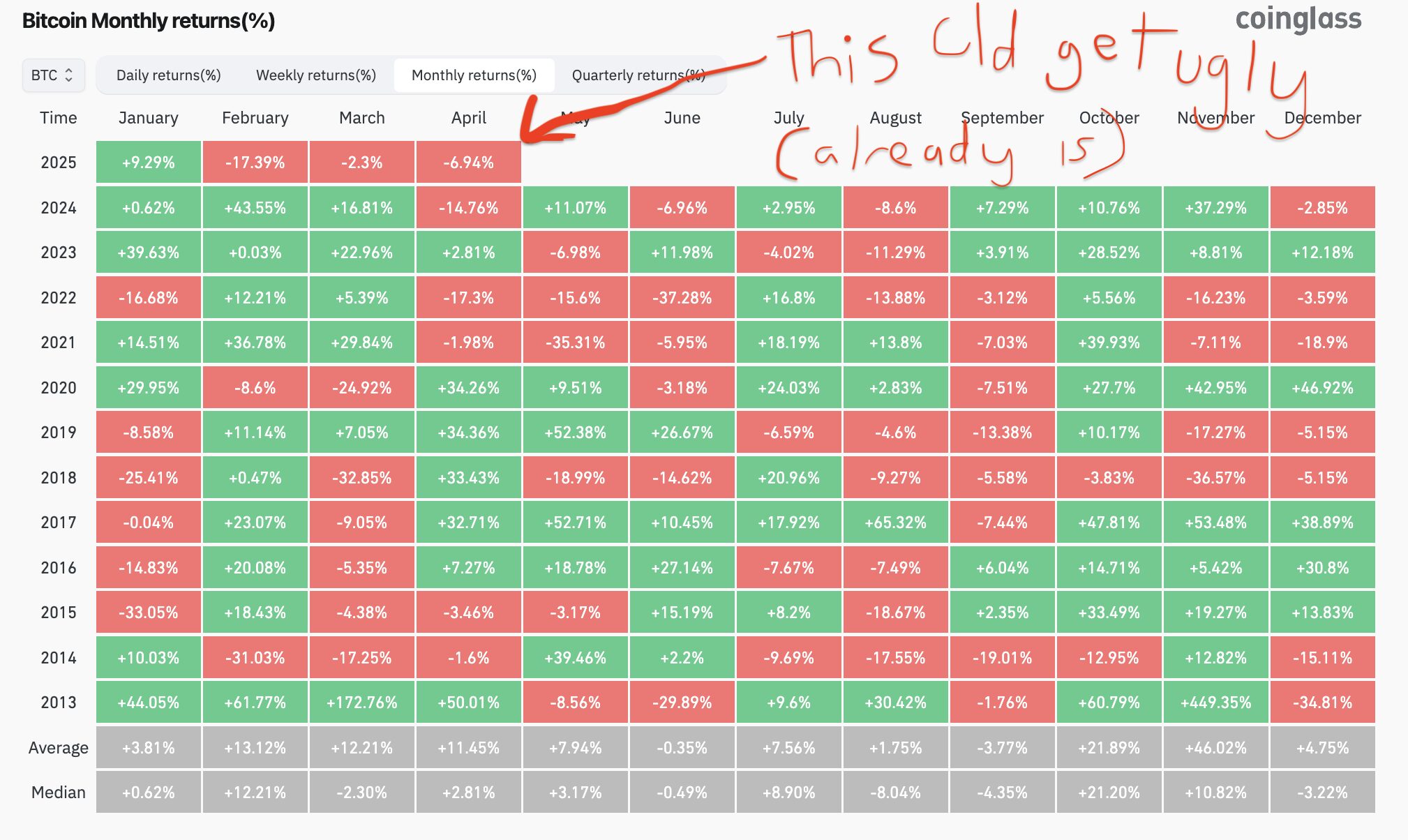

As you probably very well know, the Cryptoverse fared a tad bit better in March. It did, however, end just in negative territory (-2.3%) for Bitcoin and, as we type – especially after a markets-rocking Monday this week – crypto sentiment is still unfortunately floating somewhere around the S-bend as April already threatens to spiral the market much lower once again.

So where has the fabled crypto bull run gone, then? And just what on earth is Trump playing at? Is there ANY method to the madness stemming from the tariff-ingly obstinate White House? Is there ANY hope for some good old-fashioned crypto hopium in Q2, let alone 2025?

Absolutely valid questions, which, with the help of some variously sourced expert opinions, we’ll attempt to answer in this article.

But first, a look back at some of what happened in March of relevance. We’ll start with the performance of the most important digital asset of them all (if you believe the “maxis”) and that is, of course, Bitcoin.

Bitcoin’s March monthly return

Does 2025’s Bitcoin playbook so far remind you of anything? A particular year punctuated by a black swan, global health-scare event, perhaps? A year that actually ended up becoming one of the most bullish for assets on record after said initial scare faded from markets and the money printers went beserk?

2025’s corresponding April has a lot of work to do if it wants to emulate 2020’s, of course, and macro conditions aren’t quite the same, or as unique, as they were back then. But… maybe, just maybe, the only way out of this hole is for another burst of “quantitative easing”. Will the money printer go “brrrrr” once more? You can probably just about bet your bottom token on it but you might need to remain patient a while yet.

We’re certainly seeing more than enough “blood in the streets” right now, which could spell the opportunity of a lifetime (another one) for investors named Warren Buffett, or indeed those with nothing much to lose.

We asked James Quinn-Kumar, director of community engagement at Binance for some observations about the market and how investors have been reacting over the past few months.

He noted a prudent trend among investors in February… “Many had shifted liquidity into stablecoins, reflecting a cautious yet strategic approach during a period of heightened uncertainty.

“The cryptocurrency market saw a 4.4% decline in total market capitalisation in March, as macroeconomic uncertainties continued, including interest rate fluctuations and tariff policies, which triggered a US$1B liquidation in derivatives markets.”

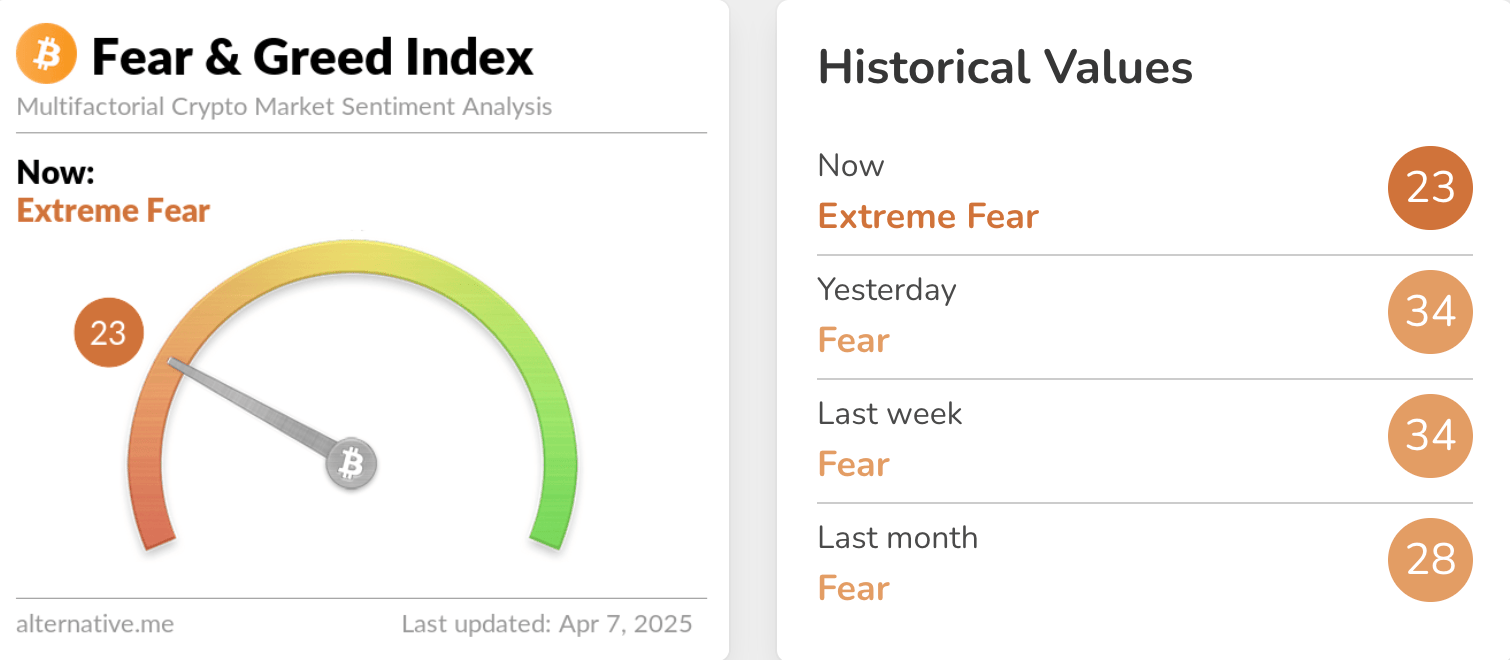

What’s the Fear & Greed Index about to tell us (as if we didn’t already know)?

What’s been making news?

• Trump’s so-called “Liberation Day“, chiefly. Obviously.

The fallout from the US president’s long list of tariffs on imports ranging from 10-50% has been… bloody to say the least.

The S&P 500 fell almost 5% in its biggest single day drop since the 2020 pandemic, while last Thursday saw the 500 biggest public companies in the US lose a total of about $2.5 trillion in value.

The still-much-smaller crypto market, meanwhile saw some US$1.37 billion wiped out in about 24 hours on Monday after China hit back with a 34% tariff of its own on Friday – on all goods imported from the US. An escalating trade war? Yeah, markets aren’t digging the thought as thoughts turn to recession as the most obvious repercussion.

🚨 CRYPTO BLOODBATH: $1.37 BILLION LIQUIDATED IN 24 HOURS! 🚨

The cryptocurrency market faces massive losses as over $1.37 billion gets wiped out in a single day. What’s next for investors? #CryptoCrash #marketcrash #Bitcoin #Altcoins #ElonMusk pic.twitter.com/GFltUWTm19

— 0xMrRobot (@0xMrRobot) April 7, 2025

JP Morgan has now placed its bets on a global recession as a 60% likelihood up from 40% not so long ago (with the caveat of the tariffs being sustained over a longer term than first feared).

But… as we asked earlier in this article, what is the method to all this madness? Trump has some smart, Bitcoin-invested people around him. Very smart. Secretary of the Treasury Scott Bessent for one. Secretary of Commerce Howard Lutnick another.

And what’s perhaps being overlooked in the stated Chinese tariff retaliations is that they don’t come into force until April 10. Okay, it’s the smallest of wiggle room, but keep an eye out for news of negotiations in the coming day or two.

• As for the White House… The people occupying it have never been more bullish on Bitcoin and crypto. An announcement made recently, which you may have missed, focused on Bitcoin bonds.

The Bitcoin Policy Institute published a policy outline indicating the US Treasury could allocate $200 billion to Bitcoin purchases through a proposed $2 trillion issuance of “Bit Bonds”.

These would refinance some of the US$14 trillion in federal debt that matures over the next three years. Each bond would allocate 90% of proceeds to government financing and 10% toward BTC acquisition. It would essentially see the US government stack Bitcoin into its planned Strategic Bitcoin Reserve, without the need for taxpayer involvement – something not on the cards for the reserve in any case.

• Also pretty big, a bill dubbed the STABLE Act was passed by the House Committee in the US on April 2, with a 32-17 vote, including six Democrats voting in favour. The bill/legislation, if approved, would help define the rules of engagement around one of the most important pieces of crypto infrastructure – stablecoins (in the US and globally, these are cryptos largely pegged to the US dollar).

The STABLE Act is actually one of two competing stablecoin bills currently being considered for the final draft of the US’ stablecoin legislation. The other bill is the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, and was passed in early March by the Senate Banking Committee in an 18-6 vote.

Both bills are now set to be moved through Congress for approval.

• And some adoption news for you… Sony Electronics Singapore is now accepting USDC (stablecoin) crypto payments for its online store through a partnership with the crypto exchange, Crypto.Com.

Binance looks ahead

Binance’s James Quinn-Kumar also noted that the world’s biggest crypto exchange remains “confident in the long-term fundamentals of the crypto industry”.

“Regulatory progress, such as the GENIUS Act and OCC guidance, suggests continued mainstream adoption.

“Further, after bottoming in February this year, the supply of BTC held by long-term holders has started to rise again. This accumulation by HODLers aligns with a significant period of adoption for Bitcoin, marked by the establishment of a US strategic Bitcoin and crypto reserve and widespread reports of companies and governments purchasing Bitcoin for their own reserves.”

Quinn-Kumar emphasised, too, that significant growth in the Bitcoin DeFi (BTCFi) ecosystem is “reinforcing Bitcoin’s evolving role as a yield-generating asset”.

“While near-term market challenges persist, we also see major shifts in the decentralised exchange (DEX) landscape.

“As users increasingly favour more seamless on-chain trading experiences, Binance Wallet’s swap volume rose significantly from ~5% to over 50% market share in March. This surge was driven in part by broader shifts in the DEX ecosystem and increased activity on BNB Chain. In just one week, volume jumped from ~US$43.6M to ~US$351.7M.”

And he pointed to the likelihood, too, of further interest rate cuts by the Fed contributing to what he believes is a more optimistic sentiment toward Bitcoin’s medium and long-term prospects.

“We believe there are meaningful indicators that point toward continued maturation and integration of crypto into the broader financial landscape,” concluded Quinn-Kumar.

One more thing

Here’s a quote that caught our attention from last week:

“If America can’t get its debt under control… the dollar could lose its crown – to Bitcoin.”

This didn’t come from a specific crypto industry stalwart or known “Bitcoiner”, it was uttered by none other Larry Fink, CEO of the world’s biggest asset manager, BlackRock.

Nothing in this article should be construed as financial advice.

As noted above, Binance Australia sponsored this article.

At the time of writing, the author held Bitcoin and a handful of other cryptocurrencies.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.