Mooners and Shakers: Crypto rally stalls as US government takes down Russian exchange Bitzlato

Getty Images

Bitcoin and the crypto market is down today on a few pieces of negative news, including the US Department of Justice (DOJ) suddenly shutting down the Bitzlato crypto exchange, Genesis preparing for bankruptcy, and stock market volatility related to macro/recession concerns.

Bitz…what?

Never heard of Bitzlato before today? That’d be because you don’t buy, sell and store your crypto on a dodgy Russian crypto exchange. Well done – you passed the first test in Crypto Safety 101.

I’ve covered crypto for 6 years and have never heard of Bitzlato

I’m sure the mainstream press will cover it like it’s a death knell for the industry

— Frank Chaparro (@fintechfrank) January 18, 2023

Might go to Starbucks and order a Bitzlato

— Erika Lee (@erikaleetv) January 18, 2023

So why would something like this – a seemingly extremely insignificant exchange being shuttered – contribute to dipping the crypto market?

It’s stirred up uncertain feelings with crypto traders partly because it’s a stark reminder of exactly how much power the DOJ wields and partly because it might’ve hinted it’s not finished yet with the rest of the crypto industry.

Considering the scam/fraud/hack-filled year in crypto just passed, the Cryptosphere can probably rightly expect the US government to crack down hard on perceived bad actors in the sector. And who better (in their minds) than a bunch of Russkis, eh?

The DOJ had earlier gone for maximum anticipation, announcing on Twitter in the wee hours (AEDT) that it was all set to make an “international enforcement action” within the crypto space.

DOJ caught a big one today, excellent work 🫡 pic.twitter.com/JtijSbk9MA

— db (@tier10k) January 18, 2023

The upshot is that the DOJ has shut down the Bitzlato exchange, which the government agency refers to as a “global cybercrime organisation” that it alleges has laundered US$700 million in illicit funds.

According to a press release, too, a federal court in Brooklyn has charged Anatoly Legkodymov, a Russian national and senior executive of Bitzlato, with “conducting a money transmitting business that transported and transmitted illicit funds and that failed to meet U.S. regulatory safeguards, including anti-money laundering requirements.”

And in other news…

Some other things rocking the crypto market today:

• Other markets. The S&P 500 and Nasdaq both retraced a bit overnight – possibly on the back of the dim outlook for the US and global economy that’s a constant, bad-smelling elephant dominating the room.

Goldman Sach’s less-than-good earning’s report, announced in Davos overnight hasn’t helped. Neither has the continuance of big tech companies announcing layoffs. Microsoft, for instance, revealed yesterday that it’s sending another 10k employees packing.

• Bad news regarding Genesis – the crypto-trading brokerage arm of the massive crypto venture capital and asset management firm Digital Currency Group (DCG) – is intensifying, with rumours abounding it may be set to file for a Chapter 11 bankruptcy.

• DCG itself, too, by the way, just sent an extra shiver through the market, telling its shareholders in a letter that it’s halting its quarterly dividend payments until further notice as it attempts to preserve liquidity.

The bear market crypto contagion? Yeah, it ain’t over yet.

Top 10 overview

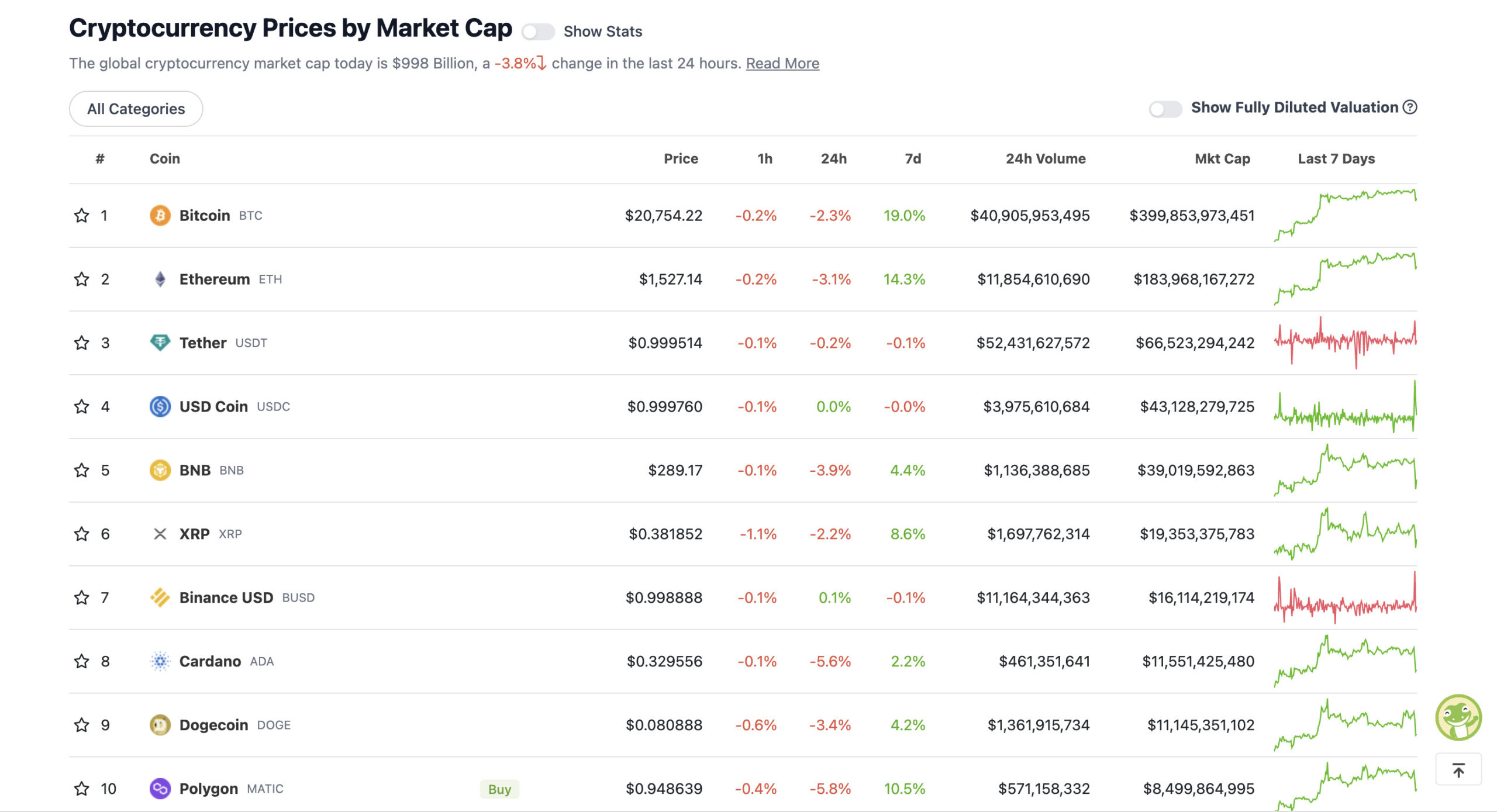

With the overall crypto market cap at US$998 trillion, down near 4% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Ah, bummer. That overall crypto trillion-dollar market cap? Goneski. Hopefully just temporarily, but things are shaping as a gloomy end to the crypto week, so maybe we’re set for some more suppression.

Mike McGlone – the senior commodity strategist over at Bloomberg – has certainly been calling for some caution regarding the broader macro outlook and stance of the Fed, even though he’s certainly “big picture bullish” on Bitcoin.

Bitcoin $20,000 vs. $5,000 in 2019: A Base or Fighting the Fed. One of the best-performing assets in 2023 – #Bitcoin – may have reached a bottom or is a bouncing bear and our bias is both, with a big difference from a similar pattern at the start of 2019: The #Fed is tightening pic.twitter.com/DDbyVMIXe2

— Mike McGlone (@mikemcglone11) January 18, 2023

Uppers and downers: 11–100 – Coinbase lists Kava

Sweeping a market-cap range of about US$7.8 billion to about US$370 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Kava (KAVA), (market cap: US$395 million) +10%

• Shiba Inu (SHIB), (mc: US$6.6 billion) +6%

• Aptos (APT), (mc: US$1.3 million) +5%

• Enjin (ENJ), (mc: US$372 million) +3%

• Rocket Pool (RPL), (mc: US$615 million) +1%

Ethereum staking protocol Rocket Pool was soaring late last night on the back of a Binance listing. It’s actually up about 30% when you zoom out to a seven-day timeframe.

Rocket Pool Token $RPL gains 24% following Binance's listing. 🚀 pic.twitter.com/m7Jfuxy4Fj

— GeckoTerminal (@GeckoTerminal) January 18, 2023

Meanwhile Shiba Inu is also up about 20% over the past week as anticipation for its Shibarium layer 2 network builds. Or maybe it’s anticipation for this Surfers Paradise, SHIB-themed diner…

Our Shiba Wings vision and brand coming to life! 🙌🚀

Counting down the days ⏰️

Location: Cavill Avenue, Surfers Paradise#Shibarium #ShibaArmy #shibainucoin #ShibaInu #cryptocurrency #Ethereum #Bitcoin #Binance #Crypto #chicken #WINGS #beer #ToTheMoon pic.twitter.com/aDIP7CM6CV— ShibaWings (@shiba_wings) January 16, 2023

As for Kava… that’d be the Coinbase-listing effect.

JUST IN: @Coinbase to list #KAVA! 💥 https://t.co/SRaX0CxGvU

— Kava (@KAVA_CHAIN) January 18, 2023

DAILY SLUMPERS

• Solana (SOL), (market cap: US$7.82 billion) -10%

• Cronos (CRO), (market cap: US$1.81 billion) -9%

• Algorand (ALGO), (mc: US$1.52 billion) -9%

• Zilliqa (ZIL), (mc: US$402 million) -9%

• Theta Network (THETA), (mc: US$879 million) -9%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse…

Just for sh*ts and giggles, let’s keep that Tucker Carlson-fuelled Bitcoin ransom conspiracy theory rolling a little longer, shall we?

— NICO⚡️ (@BITVOLT) January 18, 2023

Let's repeat history:

* Strong breakout after sideways/accumulation

* consolidation after the bounce, flash correction

* new ATH's pic.twitter.com/PgTfPu98CW— Ed_NL (@Crypto_Ed_NL) January 18, 2023

JUST IN: 🇺🇸 Texas Government proposes allowing #Bitcoin as an authorized investment for the state.

— Watcher.Guru (@WatcherGuru) January 18, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.