Mooners and Shakers: Crypto market stagnates amid macro uncertainty; Bitcoin 2023 kicks off in Miami

Getty Images

The crypto market is looking a little stagnant today. Perhaps investors and traders are remaining cautious about the macroeconomic landscape in the US of A right now.

Either that, or the memecoin froth is reaching exhaustion and the market’s feeling jaded. (For the record, though, we’re still seeing the odd ridiculous memecoin spring up out of nowhere and absolutely rocket.)

Bitcoin has dipped back below US$27k again, in this instance not following a surge overnight from Wall Street, in which major indices all closed in the green.

The latter, notes Eddy “Market Highlights” Sunarto, can be put down to “hopes that the debt ceiling crisis would be resolved as early as this weekend”.

Wanted #Bitcoin to hold above $27,000-27,200.

Didn’t happen, stopped out on my longs and in the waiting game now.

Reclaim that range, we’ll try again, or now we’ll be waiting for $26,400 sweep and/or $25,000.

— Michaël van de Poppe (@CryptoMichNL) May 18, 2023

The crypto market, however, is open 24/7 for trading and perhaps reacted to the news that the latest US jobs data has come in and it’s not particularly favourable for the Fed interest-rate-hike pause narrative.

The jobless claims are lower than expected this time around, which might be good for allaying a few recession fears, but holders of a few too many risk assets might not be particularly enjoying the news – if they’re banking on the Fed pivoting or pausing at its next FOMC meeting, that is.

Meanwhile, the Fed Reserve board is mulling over whether they should skip a meeting in June, Eddy reports, but that doesn’t necessarily mean Jerome Powell and pals will be done raising rates, according to somebody who might know – Atlanta Fed President Raphael Bostic.

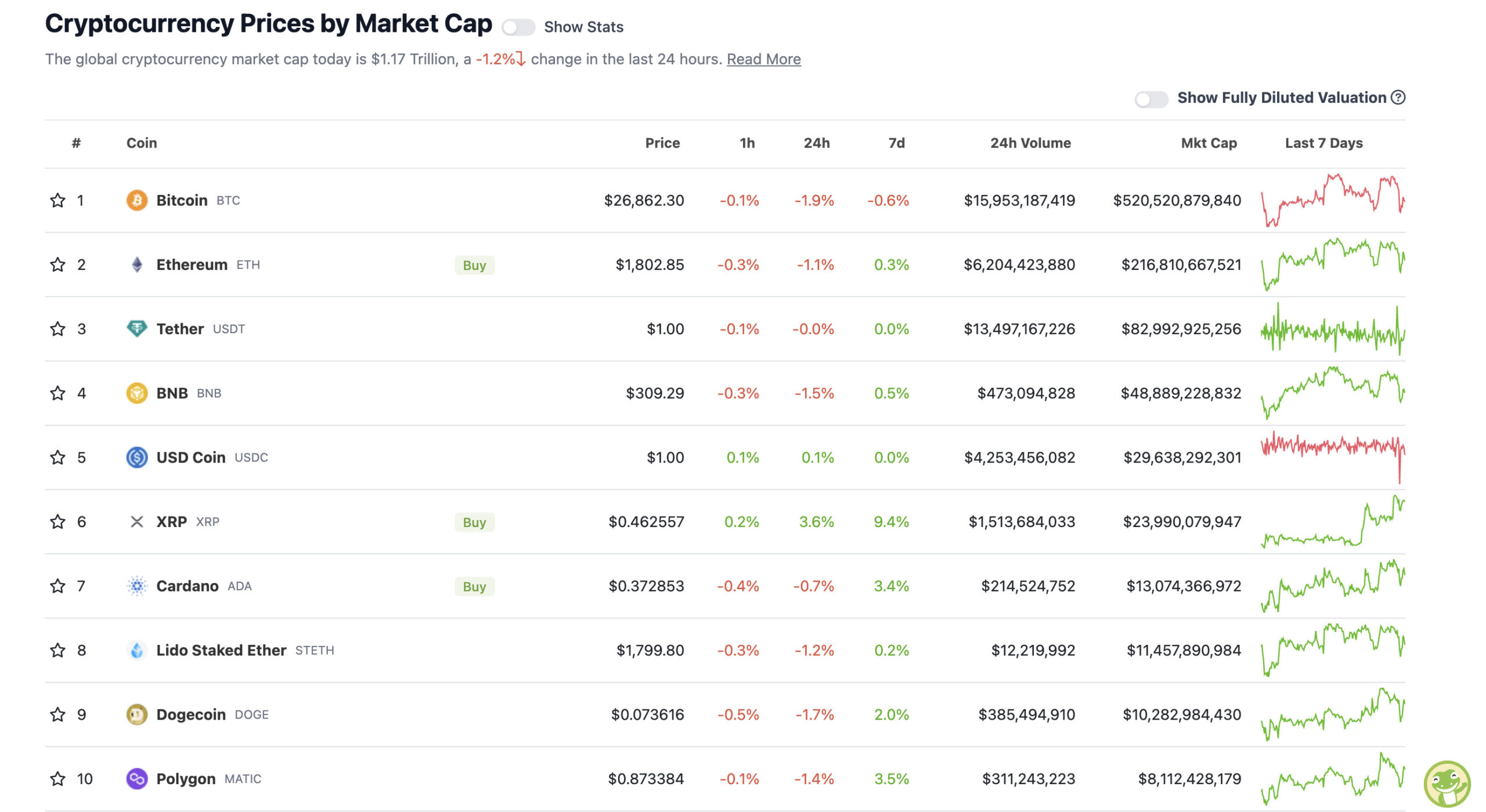

Top 10 overview

With the overall crypto market cap at US$1.17 trillion, down about 1.2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Not the most exciting chart to look at today, overall. A couple of things to note, however: Polygon (MATIC) has once again supplanted Solana (SOL) in the top 10 cryptos by market cap. And XRP has made further decent gains over the past 24 hours.

That might have something to do with the fact Ripple (the creators of the XRP token) have acquired Swiss-based crypto custody provider Metaco in a US$250 million deal, according to reports.

Ripple’s aim with the acquisition is to see it gain a further foothold into the growing, global institutional crypto-custody market.

The deal comes amid Ripple’s long-winding lawsuit defence against the SEC, the US regulatory body accusing the blockchain firm of securities violations.

💥 JUST IN 💥

Brad Garlinghouse tells CNBC that Ripple has bought the Swiss crypto-custody firm Metaco to continue building in countries where there is actual regulatory clarity and that the SEC "can't do shit about it." pic.twitter.com/tTatCJeFZb

— XRPP (@XRP_Productions) May 18, 2023

Uppers and downers

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Render (RNDR), (market cap: US$866 million) +4%

• Bitget Token (BGB), (market cap: US$657 billion) +3%

• Injective (INJ), (market cap: US$540 million) +2%

PUMPERS (lower, lower caps)

• AirSwap (AST), (market cap: US$30 million) +59%

• Conic (CNC), (market cap: US$23 million) +39%

• Mask Network (MASK), (market cap: US$378 million) +11%

SLUMPERS

• Lido DAO (LDO), (market cap: US$1.87 billion) -9%

• Sui (SUI), (mc: US$602 million) -5%

• Axie Infinity (AXS), (mc: US$818 million) -4%

• Fantom (FTM), (mc: US$1 billion) -4%

• Optimism (OP), (mc: US$580 million) -4%

SLUMPERS (lower, lower caps)

• Bob Token (BOB), (market cap: US$38 million) -19%

• Ben (BEN), (mc: US$27 million) -17%

• Turbo (TURBO), (mc: US$43 million) -16%

Around the blocks: Bitcoin 2023 kicks off

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

The big Bitcoin 2023 conference is on – the industry’s biggest annual event, which goes down in Miami, Florida each year.

However, unfortunately what has gone down (along with the price of BTC today) is the amount of attendees.

The estimation is about 15,000 this time around, as opposed to 35,000 last year. This CoinDesk article is putting that slump in attendance down to lower enthusiasm due to the ongoing “crypto winter”.

Is crypto still in a “winter”, though? Bitcoin is still up around 65% so far this year. In any case, conference organisers are clearly hoping the event ignites a market spark.

“Bitcoin winter is heating up in Miami,” reads a banner on the conference website.

The good old $BTC conference dump strikes again.

— Miles Deutscher (@milesdeutscher) May 18, 2023

JUST IN – 🇺🇸 Mayor of Miami Beach Dan Gelber: We want Bitcoiners to move here "permanently." pic.twitter.com/kxY4dI7g1g

— Bitcoin Magazine (@BitcoinMagazine) May 18, 2023

JUST IN – Former PayPal President: "I've decided to dedicate the rest of my life in building on #Bitcoin and specifically on Lightning" 🙌 pic.twitter.com/MnjO8oJpQw

— Bitcoin Magazine (@BitcoinMagazine) May 18, 2023

all my friends are here #Bitcoin2023 pic.twitter.com/kuoCnXEpAZ

— Sheikh Roberto (@roberto_saudi) May 18, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.