Mooners and Shakers: Crypto market reclaims US$2 trillion; ADA leads top-coin gains… and here are some reasons why

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Cryptocurrencies have been rallying today, with Bitcoin closing in on US$43k again at the time of writing and several top projects, including Cardano (ADA), posting strong gains.

The crypto market has currently added more than 3% to its entire market cap in the past 24 hours. Is there a catalyst for this? It’s not necessarily one thing – there have been several strong narratives forming just lately. Here are some of them:

• The Terra blockchain’s founder Do Kwon has been frothing the market at the prospect of a whopping US$10 billion worth of Bitcoin being acquired (in stages) by his project as part of a new forex-style reserve for the UST stablecoin. You can read more about that on Stockhead here.

Even the Fed is excited about Do buying a few yards worth of corn! https://t.co/QSgEr963Yt

— Rob Paone (@crypto_bobby) March 22, 2022

• Ethereum is moving closer to staking with “Kiln“, now deployed, expected to be the protocol’s final testnet before the network is “merged” to a proof-of-stake consensus mechanism from the proof-of-work model it currently employs.

Meanwhile, fresh data and reports suggest that major crypto fund Three Arrows Capital has staked more than US$110 million worth of ETH into the Lido ETH 2.0 liquidity pools, before buying another US$22.5 million worth of ETH tokens from FTX and Deribit.

• Goldman Sachs, the investment-banking titan, has initiated a Bitcoin options trade with the help of Mike Novogratz’s Galaxy Digital. It’s an over-the-counter (OTC) options contract that’s cash-settled and tied to the price of BTC.

This is seen as a significant, further institutional step into the crypto space, as Goldman Sachs becomes the first Wall Street bank to make an OTC crypto transaction. Perhaps, as former Goldman banker Anthony Scaramucci (founder of Skybridge Capital) suggests below, it won’t be long before others follow that lead.

https://twitter.com/BitcoinMagazine/status/1506238427049701385

• Malaysia’s deputy minister of communications and multimedia has reportedly suggested that the country should adopt cryptocurrencies as legal tender. He also said that the ministry is looking to increase crypto adoption among younger generations of Malaysians.

• Honduras is possibly shaping to beat Malaysia to that punch and be the next country to adopt Bitcoin as a form of legal tender after El Salvador. That’s an unsubstantiated story at the time of writing, although noted “Bitcoin maxi” Max Keiser, who’s currently in Honduras, seems to think it’s definitely happening.

🇭🇳 Honduran president Xiomara Castro is expected to declare #bitcoin legal tender in the country.

"We must not allow El Salvador to be the only country escaping dollar hegemony. Honduras has the right to move towards the First World countries.”

~ President Castro pic.twitter.com/16sOmdTJie— Lightning Network+⚡️ (@BTC_LN) March 21, 2022

Top 10 overview

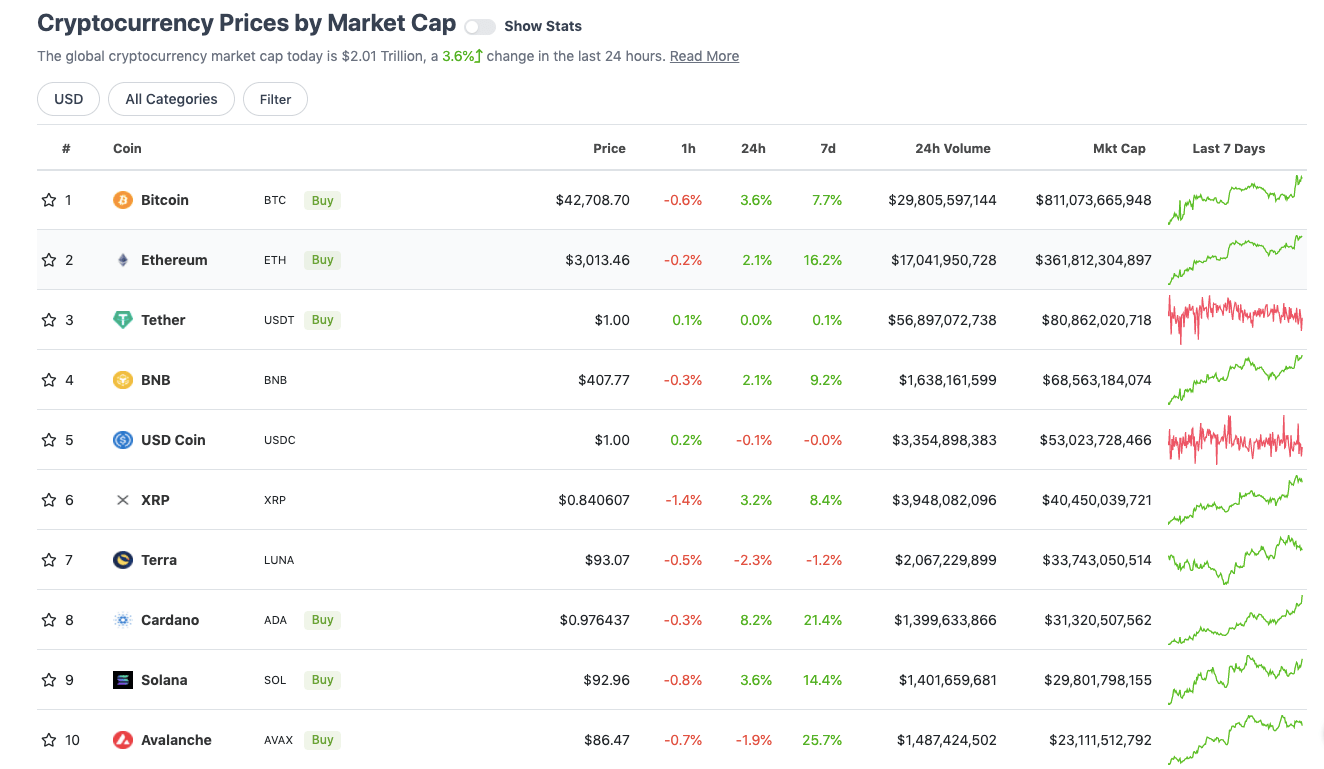

With the overall crypto market cap at about US$2.01 trillion, up roughly 3.6% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

The OG crypto (that’s Bitcoin, BTC) actually poked its head above US$43k about half a day ago at the time of writing, and has been hovering around the low to mid $42ks ever since.

It’s currently up about 3.6% since this time yesterday and, along with Ethereum (ETH), has spurred the rest of the market into some life. ETH is now back above US$3,000 again for the first time in about three weeks.

The biggest mover in the top 10 right now, though, is layer 1 blockchain and Ethereum rival Cardano (ADA), which has currently gained about 8% in the past 24 hours and is pushing closer to the US$1 mark it lost on February 19.

IOG, the lead development arm behind Cardano, has fuelled some speculation that a token-burning mechanism similar to Ethereum’s EIP-1559 protocol could be introduced into the project’s roadmap. Though whether this ultimately means an actual ADA-token supply reduction, like some excited Cardano fans are suggesting, is a little unclear at this point.

Here are some other possible reasons for Cardano positivity right now, though – an increase in active users and holders, according to on-chain data compiled by Cardano Daily…

$ADA @Cardano has reached 5M wallet addresses 🔥

What's else? The number of long-term $ADA holders has increased while short-term ones have decreased past 30 days 🚀

Good signs that people are believing in $ADA, right?#Cardano #ADA pic.twitter.com/19cF3GHqeb

— Cardano 5PC (@cardano_5pc) March 22, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$21.9 billion to about US$969 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Radix (XRD), (mc: US$1.44 billion) +15%

• EOS (EOS), (mc: US$2.5 billion) +13.5%

• Bitcoin Cash (BCH), (mc: US$12.5 billion) +12.5%

• Helium (HNT), (mc: US$2.51 billion) +12%

• Ethereum Classic (ETC), (mc: US$5.75 billion) +9%

DAILY SLUMPERS

• Aave (AAVE), (market cap: US$2.1 billion) -3%

• Synthetix (SNX), (mc: US$1.1 billion) -2.5%

• Osmosis (OSMO), (mc: US$2.87b) -2.5%

• Convex Finance (CVX), (mc: US$1.13b) -2%

• NEXO (NEXO), (mc: US$1.23b) -1.5%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Rebel Bots (RBLS), (market cap: US$13.6m) +116%

• OriginTrail (TRAC), (mc: US$273m) +60%

• Gemma Extending Tech (GXT), (mc: US$31.5m) +37%

• SingularityDAO (SDAO), (mc: US$64m) +33%

• Boson Protocol (BOSON), (mc: US$93m) +32%

DAILY SLUMPERS

• MovieBloc (MBL), (market cap: US$52 million) -22%

• Hector Finance (HEC), (mc: US$65m) -19%

• Biswap (BSW), (mc: US$186m) -18%

• Vader Protocol (VADER), (mc: US$66m) -14%

• Platypus Finance (PTP), (mc: US$65m) -14%

Around the blocks

— Mr. Observation (@realobseever) March 22, 2022

Meanwhile, more and more companies are exploring the potential of #crypto.

Corporates I mean.

But also investment funds like Bridgewater from Ray Dalio wants to seek investment opportunities in crypto.

If you think that the markets are over, think again.

— Michaël van de Poppe (@CryptoMichNL) March 22, 2022

Australian Blockchain Week is moving on to Melbourne from Sydney for the third day of the event, which will have a metaverse and NFTs focus.

Speakers include FTX.US president Brett Harrison; co-founder of Dapper Labs Mik Naayem; co-founder of NFT Fest Australia Greg Oakford; MD of Animoca Brands, Yat Siu; and BTC Markets CEO Caroline Bowler, among many other high-profile crypto-industry identities.

Sydney done. Melbourne here we come @BlockchainAUS #BlockchainWeek2022

WOOT WOOT @im_jacksonzeng @ChloeWhiteAus @CaroBowler @jacklennonausAwks Clo was wearing the same outfit tho. pic.twitter.com/5XmCXiCRwD

— Steve Vallas (@stevevallas) March 22, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.