Mooners and Shakers: Crypto market quiet; Bloomberg analyst predicts $100k Bitcoin

Getty Images

Although it’s teased a couple of times today with small bounces up to about US$42,500, Bitcoin can’t seem to get any momentum to bust out of its current range. At least not at the time of writing.

Generally speaking, the rest of the crypto market, too, is in a similarly choppy space.

That said, there are plenty of bullish crypto-related stories to be found, including a potentially massive metaverse move from Microsoft and further mainstream adoption for NFTs from Mastercard.

And then there’s Bloomberg’s senior commodity strategist Mike McGlone, who still very much believes Bitcoin (BTC) is on track to hit US$100k this year.

Speaking with Cointelegraph, McGlone also said: “Bitcoin is in a unique phase, I think, of transitioning from a risk-on to risk-off global digital store of value, replacing gold and becoming global collateral. So I think that’s going to be happening this year.”

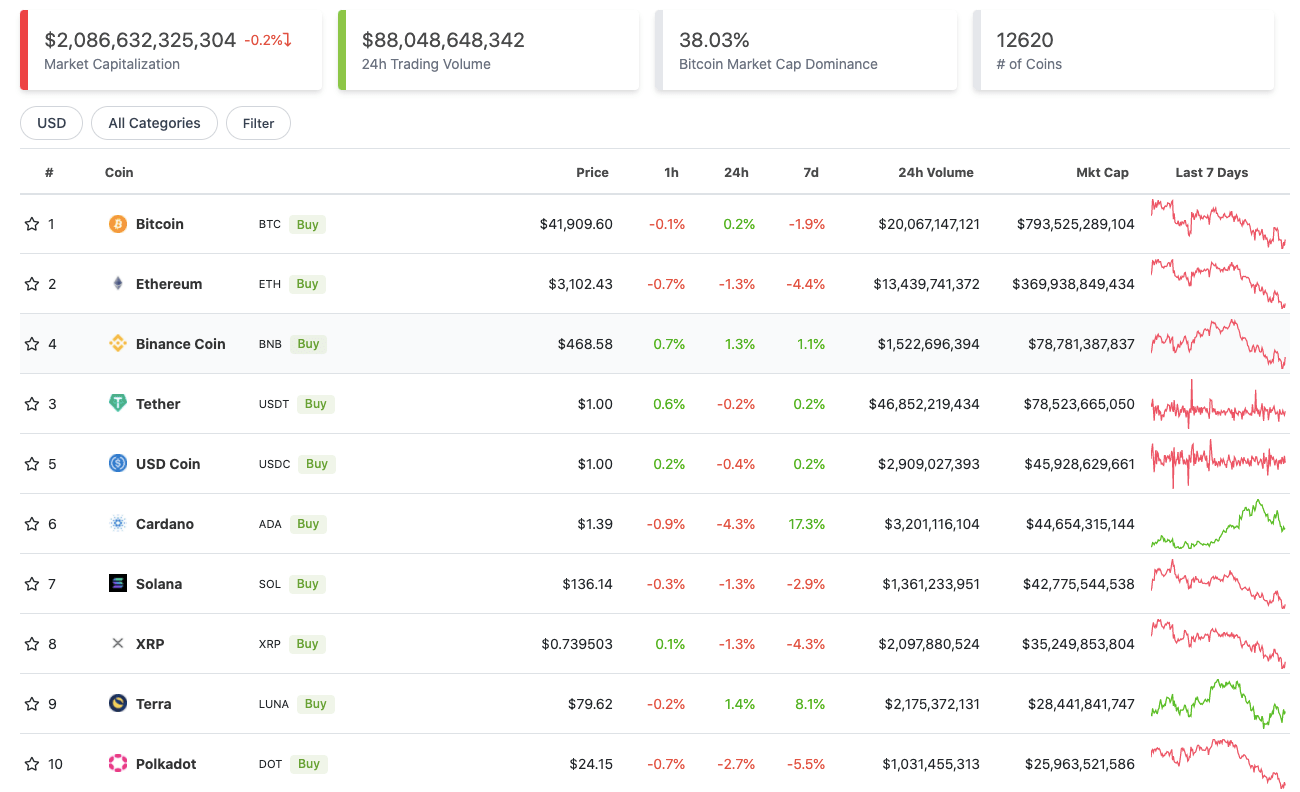

Top 10 overview

With the overall crypto market cap down about 0.2% over the past 24 hours, here’s the state of play in the top 10 by market cap at the time of writing – according to CoinGecko data.

This end of the crypto list doesn’t make for particularly exciting reading right now (e.g. BTC +0.2%; ETH -1.3%). That said, a relatively boring, stable day in the market… could always be a lot worse.

Of all the multiple Bitcoin/crypto analysts floating about the Twittersphere, sharing their thoughts and trades, Roman Trading particularly catches the eye today. And that’s because he’s been pretty accurate, and also pretty consistently bearish in recent weeks… months even.

But here he is anticipating a possible “double bottom” (bullish) formation for Bitcoin on both the four-hour and daily charts…

This is what I’m anticipating for $BTC. Both H4 and 1D have the ability to create a double bottom. PA on H4-H12 is looking more bullish. MACD is squeezing with slight bull div.

RSI has bull div H4-H12

Trading is anticipating and forming a plan.#bitcoin #cryptocurrency pic.twitter.com/46uU9qKtqU

— Roman (@Roman_Trading) January 19, 2022

Let’s not get too carried away, though, he did caveat with the fact the stock market looks like it’s “about to take a beating”. And we’ve seen how tightly correlated Bitcoin and crypto is to the S&P 500 in recent memory.

Winners and losers: 11–100

Sweeping a market-cap range of about US$22 billion to about US$1.1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Loopring (LRC), (mc: US$1.5b) +9.6%

• Theta Fuel (TFUEL), (mc: US$1.2b) +9.4%

• FTX Token (FTT), (mc: US$6.45b) +7.5%

• Theta Network (THETA), (mc: US$4.4b) +7%

• Ecomi (OMI), (mc: US$1.9b) +7%

DAILY SLUMPERS

• Stacks (STX), (mc: US$2.35b) -10%

• Aave (AAVE), (mc: US$2.9b) -7.5%

• Quant (QNT), (mc: US$1.9b) -7%

• Kadena (KDA), (market cap: US$1.2b) -6.5%

• Harmony (ONE), (mc: US$3.5b) -5.8%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• PlotX (PLOT), (market cap: US$7.5m) +118%

• Blank (BLANK), (mc: US$19m) +36%

• Hydra (HYDRA), (mc: US$93m) +33%

• LooksRare (LOOKS), (mc: US$844m) +30%

• Redacted Cartel (BTRFLY), (mc: US$329m) +27%

Super pumped to announce our $𝟓𝐦 𝐩𝐫𝐞-𝐒𝐞𝐫𝐢𝐞𝐬 𝐀 𝐟𝐮𝐧𝐝𝐢𝐧𝐠 + 𝐠𝐫𝐚𝐧𝐭!

Welcome aboard @_PolygonStudios, @hashed_official, @AnimocaBrands, Alpha Wave Global, @sandeepnailwal & Brevan Howard

Details here👉 https://t.co/3GN81zSceo

A Thread 🧵 pic.twitter.com/vmwQPfp55D

— PlotX (@TryPlotX) January 18, 2022

DAILY SLUMPERS

• Pivx (PIVX), (market cap: US$29.5m) -23%

• Tomb Shares (TSHARE), (market cap: US$584m) -15%

• Maple Finance (MPL), (mc: US$39m) -13%

• Charli3 (C3), (mc: US$17.8m) -12%

• Convergence (CONV), (mc: US$13.3m) -12%

Final word(s)…

Looks like the Melbourne-based crypto brokerage firm Caleb & Brown is getting in on the Bored Ape Yacht Club action…

Who knows what you'll see walking the streets of Melbourne! #BAYC #NFT https://t.co/nBJ1BGlRJL

— Collective Shift (@cshift_io) January 18, 2022

And… a (very) quick peek at what’s going on with gold (+1.43%) through the lens of Crypto Twitter…

If Gold is going to go up, Bitcoin is going to go up.

I don't make the rules.

— HORSE (@TheFlowHorse) January 19, 2022

You've been advocating hard money for decades, and now the hardest money in the history of the human species comes along and you say it's pointless. I really don't understand it.

— Spencer Schiff (@SpencerKSchiff) January 19, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.