Mooners and Shakers: Crypto market pulls back while Fed prepares its minutes

Pic: Getty

The crypto market has dipped a bit over the past few hours at the time of writing, taking its cues from the performance of the US stock markets. (As per usual just lately.)

And today’s market jitters are once again brought to you by the US Federal Reserve, and ongoing Russia/Ukraine border tensions.

The Fed is getting ready to announce the minutes from its big meeting in January, which might be reason for at least some of today’s slight sell-off. That said, some crypto-market participants are under the belief anything chair Jerome Powell and mates reveal is already “priced in”.

Honest question, do the minutes today even matter?

Fed has already jawboned the shit out of the market, January already seems like it was a year ago.

— HORSE (@TheFlowHorse) February 16, 2022

Investors are looking for more clues on the central bank’s plans to trim its massive balance sheet and hike interest rates. Guess we’ll wait and see if we get a dump, a pump, or a whole load of nothing at around 2pm, Eastern Standard Time. (Your crypto portfolio, if you have one, might well already be reflecting the market sentiment by the time you read this.)

I just recovered all the losses in my trading account by transferring more money from my savings account

— Not Jerome Powell (@alifarhat79) February 16, 2022

As Sydney-based City Index analyst Tony Sycamore told Stockhead yesterday, however, the market is mainly waiting to see what will happen at the next big Fed meeting happening on March 15-16. That’s when it’s expected US interest-rate hikes will actually begin. The questions are: how heavy handed will the Fed be? And how many rate hikes are they planning?

Meanwhile, keeping bottoms squeaky in the world of geopolitics, US Secretary of State Antony Blinken has reportedly said that Russia has actually been moving “critical units” closer to Ukraine’s border.

For now, the US is refuting any idea of a pullback of Moscow’s forces in the area, which seemed to appease markets somewhat yesterday. Reuters has more on that here.

Whether the Russia/Ukraine situation is actually affecting the NFT and meme-focused crypto market too much, or at all, is another matter…

Listen son there’s gonna be these things called NFTs. When you hear about them go all in on CryptoDickButts. I know it sounds weird but trust me, these mfs are a store of value in the new world.

Remember Crypto-Dick-Butt pic.twitter.com/4EbpIPeIil

— threadguy 👑 (@notthreadguy) February 16, 2022

Top 10 overview

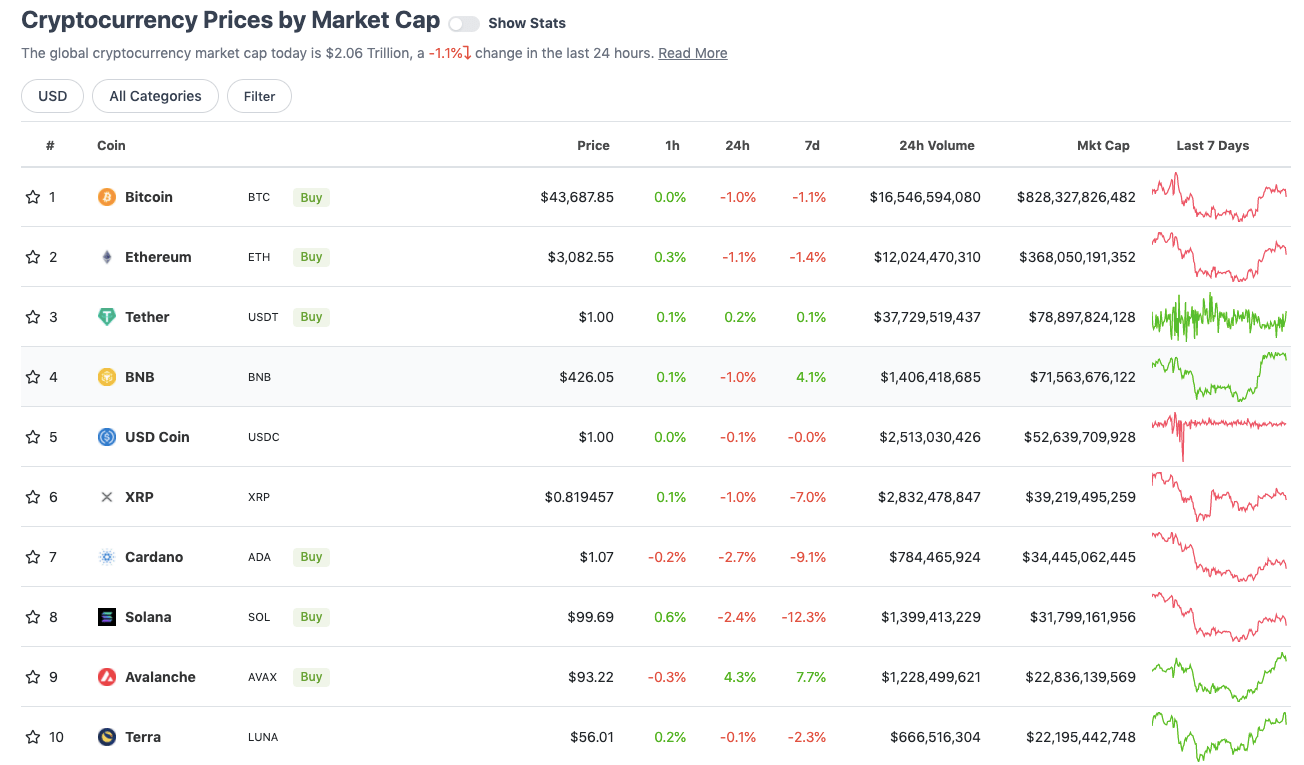

With the overall crypto market cap down about 1% over the past 24 hours, here’s the state of play in the top 10 by market cap right now – according to CoinGecko data.

At the time of writing, Bitcoin has lost the US$44k level it’s been chopping above for much of the past 24 hours, but seems to have hit some short-term support at about US$43.5k.

Popular layer 1 protocol Avalanche (AVAX) meanwhile is the clear performer in the top 10 on the daily timeframe, with a 4.3% gain.

It’s hard to spot an exact reason for that, although the network appears to still be gaining traction according to the TVL (total value locked) metric, which measures the overall value of crypto assets deposited in DeFi (decentralised finance) protocols.

The journey of $AVAX flipping $BNB in TVL pic.twitter.com/7sToCeMTKG

— Gojo (@Gojo_Crypto) February 14, 2022

Winners and losers: 11–100

Sweeping a market-cap range of about US$20.9 billion to about US$1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• NEO (NEO), (market cap: US$1.74 billion) +10%

• Theta Fuel (TFUEL), (mc: US$1.26b) +7.5%

• The Graph (GRT), (mc: US$3.1b) +5%

• Algorand (ALGO), (mc: US$6.5b) +4%

• Axie Infinity (AXS), (mc: US$4.5b) +3.5%

DAILY SLUMPERS

• JUNO (JUNO), (market cap: US$1.25 billion) -6.5%

• Celo (CELO), (mc: US$1.21b) -4.5%

• Helium (HNT), (mc: US$2.65b) -4.5%

• Zcash (ZEC), (mc: US$1.46b) -4%

• The Sandbox (SAND), (mc: US$4.5b) -3.8%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Rally (RLY), (market cap: US$930m) +60%

• Everdome (DOME), (mc: US$408m) +34%

• BlockWallet (BLANK), (mc: US$18.5m) +25%

• New Order (NEWO), (mc: US$22m) +24%

• Alchemy Pay (ACH), (mc: US$254m) +24%

DAILY SLUMPERS

• Lisk (LSK), (market cap: US$263 million) -22%

• Zignaly (ZIG), (mc: US$42m) -16%

• Feg Token (FEG), (mc: US$222m) -13%

• LiquidDriver (LQDR), (mc: US$28m) -12.5%

• Qredo (QRDO), (mc: US$144.5m) -11%

Final words

For those who don’t know, that’s the influential US Securities and Exchange Commission (SEC) boss Gary Gensler pictured bottom right in the tweet below. He has a huge say in which exchange-traded funds (ETFs) are approved for trading in the US.

The crypto market has been calling for a “spot” Bitcoin ETF for yonks now, and it doesn’t look like one’s coming any time soon. Still, at least Europe’s getting in on that action. Fidelity International is listing its first Bitcoin exchange-traded product (ETP) on the Deutsche Börse in Frankfurt and SIX Swiss Exchange in Zurich, which you can read a little bit more about here.

https://twitter.com/cobie/status/1494043601034166283

The other fella is, of course, Charlie Munger – Warren Buffett’s 98-year-old right-hand man over at Berkshire Hathaway.

“The safe assumption for an investor is that over the next hundred years the (fiat) currency is going to zero.” – Charlie Munger on #Bitcoin pic.twitter.com/7PMFg9hQBt

— Michael Saylor⚡️ (@saylor) February 16, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.