Mooners and Shakers: Market pulls back as European Parliament votes for privacy-targeting crypto restrictions

Getty Images

Bitcoin and the crypto market in general are taking a dip at the time of writing, after the European Parliament voted in favour of a controversial bill that seeks to outlaw anonymous crypto transactions.

It’s a move the blockchain industry in Europe fears will not only threaten financial privacy but stifle crypto-based innovation and growth.

Brian Armstrong, the American CEO of crypto-exchange giant Coinbase, tweeted about the bill yesterday, describing it as: “anti-innovation, anti-privacy and anti-law enforcement”, adding that it “disproportionately punishes crypto holders and erodes their individual rights in deeply concerning ways”.

1/ Unfortunately, the EP committees have voted in favor of the TFR passages that crack down on indiv. privacy & wallets.

The amendments are a huge setback for crypto in the EU & should be repealed in the trilogues.

Here are some examples of worrisome real-world consequences 👇 https://t.co/e8yUUkKV2V

— Ultimate Wallet (@UltimateApp) March 31, 2022

Patrick Hansen, head of strategy at Berlin-headquartered Unstoppable Finance, breaks it all down in the Twitter thread above. But the TLDR is: two European law-making committees voted in favour of amendments that extend anti-money laundering requirements and take aim at “unhosted wallets”.

“Unhosted” is the regulation’s definition of what’s more commonly known in crypto as “self-hosted” wallets, in which individuals own their private keys.

A system-wide application of this rule threatens to restrict EU-based exchanges and crypto services from interacting with self-hosted wallets across European nations. Fun times.

As Hansen and Unstoppable Finance says, this isn’t the end of the legislation process, and there’s still hope to contest this and help usher in less restrictive changes, but this does seem like quite a blow for the moment.

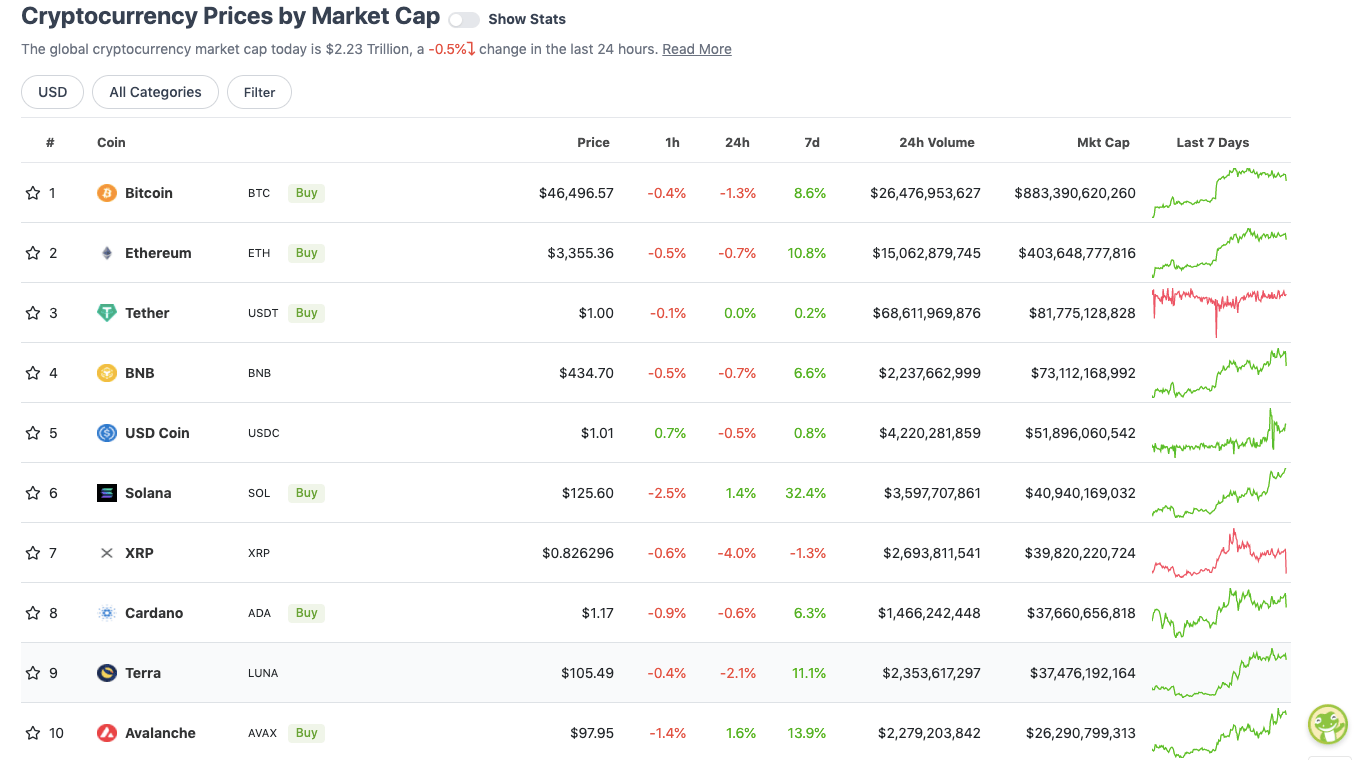

Top 10 overview

With the overall crypto market cap at about US$2.23 trillion, down roughly 0.5% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Apart from layer 1s Solana (SOL) and Avalanche (AVAX), it’s dip city in the majors today, although not drastically just yet.

It seems like Dutch trader Michaël van de Poppe might’ve made a decent call earlier in the day…

Maybe the odds of a short term correction are starting to increase.

— Michaël van de Poppe (@CryptoMichNL) March 31, 2022

Still, there will always be those who can put a positive spin on anything…

the price action today isn't a dip, it's bullish selling

— Luke Martin (@VentureCoinist) March 31, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$23.8 billion to about US$1.1 billion in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Zilliqa (ZIL), (market cap: US$2.56 billion) +19%

• Waves (WAVES), (mc: US$5.87 billion) +14%

• STEPN (GMT), (mc: US$1.39 billion) +14%

• Theta Fuel (TFUEL), (mc: US$1.3 billion) +8%

• Fantom (FTM), (mc: US$3.8 billion) +6%

STEPN and Zilliqa are continuing their strong recent runs even on this reddish day in the market. Waves, too.

Zilliqa is a layer 1 that aims to be the blockchain of choice for large-scale enterprises and it’s moving up this week on the back of positivity surrounding the upcoming April 2 launch of its “metaverse-as-a-service” initiative – Metapolis.

DAILY SLUMPERS

• Helium (HNT), (market cap: US$2.4 billion) -11%

• ApeCoin (APE), (mc: US$2.18 billion) -7%

• Chiliz (CHZ), (mc: US$1.52 billion) -7%

• Litecoin (LTC), (mc: US$8.6 billion) -6%

• Arweave (AR), (mc: US$1.83 billion) -5.5%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Cult DAO (CULT), (market cap: US$41 million) +61%

• Crypterium (CRPT), (mc: US$65m) +48%

• BakerySwap (BAKE), (mc: US$233m) +38%

• IOST (IOST), (mc: US$1 billion) +33%

• DEUS Finance (DEUS), (mc: US$141m) +32%

DAILY SLUMPERS

• League of Kingdoms (LOKA), (market cap: US$203 million) -20%

• CoW Protocol (COW), (mc: US$70m) -20%

• DigitalBits (XDB), (mc: US$305m) -15%

• Dopex Rebate Token (RDPX), (mc: US$201m) -12%

• Crypto Raiders (RAIDER), (mc: US$44m) -12%

Around the blocks

As Bitcoin Archive alludes… if you were hoping for a better entry point on BTC (although that applies to any crypto), you might have that opportunity today. Professional financial advice, it ain’t.

#Bitcoin https://t.co/dal6GF11sT

— naiive (@naiivememe) March 31, 2022

And as for these thoughts from The Defiant podcast/channel’s Camilla Russo, they reference the mega $US600m+ Axie Infinity hack this week. It was an exploit of a blockchain bridge connected to Ronin, which is the underlying blockchain that supports the Axie game…

Trust in blockchain bridges is crumbling.

By extension, that should mean the multi-chain thesis is also crumbling.

So, will consensus start to form around a single-chain view for the future?

If yes, crypto is about to get even more competitive / maxi.

— Camila Russo (@CamiRusso) March 31, 2022

Meanwhile, in NFT land, Ethlizards – a project Illuvium’s Kieran Warwick alerted us to last week – has been on absolute tear today…

https://twitter.com/magee85/status/1509522446444994563

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.