Just quietly, wouldn’t mind seeing a mixed martial arts fight (or even better a Mad Max-style Thunderdome-style battle) between Rostin and Gary, with a winner-takes-all prize of regulating the crypto market in the US. Can someone please make that happen?

Mooners and Shakers: Crypto market dumps amid macro pressures, Silvergate fallout and a lawsuit against KuCoin

Getty Images

The crypto market dumped pretty hard this morning (AEDT). Why? For reasons mainly macroeconomic but it’s also caught in a swirling crap storm brought about by negative Nellies pretty much all residing in the good ol’ US of A.

The Fed, Senator Elizabeth Warren, the NYAG turning on the KuCoin exchange… and that’s just for starters. Concerns around fallout surrounding the Silvergate Bank’s impending demise seems to have caught up with the market, too.

Regarding the Fed, hawkish comments from its chair, Jerome Powell, this week have shoved a 50 basis point rate hike later this month firmly back into the conversation. Ah well, it’s been nice knowing you, cushy 25bp rate-hiking level.

Also, investors are preparing for the US jobs data report, set to hit just after midnight on Saturday (AEDT). The general prognosis isn’t exactly positive for markets. Stockhead‘s Eddy Sunarto rounds up the macro situation with far more clarity in this morning’s Market Highlights.

The general upshot is, though, that Wall Street has a bit of a jittery, nervy, upset tummy, with its major indices closing well in the red on Thursday.

Elizabeth “Rabs” Warren still hates crypto

Bitcoin and crypto have followed suit, but also have some added pressures, such as the rabidly anti-crypto Democratic senator Elizabeth “Gary Gensler is my Totes Fave Regulator” Warren. The US (Massachusetts) senator is blaming the impending demise of the formerly crypto-firm-partnered Silvergate Bank on “crypto risk”.

You caused bank run with spurious accusations and are now claiming you predicted it. Olympic level mental gymnastics 🙄

— Coin Bureau (@coinbureau) March 9, 2023

A dip of the lid to Coin Bureau’s response there, though. His “bank run” comment refers to a letter that Warren and two anti-crypto Republican senators wrote containing numerous accusations (largely relating to the FTX implosion). Much of the crypto community believes the accusations to be based on a lack of substance and/or misinformation.

Make no mistake. @SenWarren incited a bank run.

What a precedent to set in American politics.

— DeFi Dad ⟠ defidad.eth (@DeFi_Dad) March 9, 2023

Silvergate fallout? Is Signature Bank next?

Meanwhile, as colleague Eddy reports, “Signature Bank was also down 10% after its crypto-bank peer Silvergate Capital announced plans to liquidate.

“The demise of Silvergate has now left traders with the problem of finding a new services company to help make payments and other deposit-related services.”

So where did all the US crypto firms that’ve left their partnerships with Silvergate behind turn to? Signature Bank. Here’s hoping crypto VC at QED Investors Christian Limon is correct with this assessment…

Why a similar situation is not likely at Signature Bank:#SignatureBank pic.twitter.com/eKMIH1rxdi

— Christian Limon (@cplimon) March 9, 2023

NYAG sues KuCoin, claims Ethereum is a security

And finally, before we move onto an overview of the blood-stained price action in the crypto market, there’s one more thing to briefly discuss. This:

New York Attorney General Sues KuCoin, Claims Ethereum Is a Security

► https://t.co/cIMS4bdeMY https://t.co/cIMS4bdeMY— Decrypt (@decryptmedia) March 9, 2023

As reported by Decrypt, among other media this morning, the New York Attorney General’s office has filed a lawsuit against the Seychelles-based crypto exchange KuCoin for allegedly violating securities and commodities laws in the state.

James would appear to be onside with the SEC boss Gary Gensler’s stance that Bitcoin is the only crypto asset that can be classified as a commodity.

Gary Gensler’s adopted little sister is trying to get a piece of the regulatory spotlight. https://t.co/ToiPADdA10

— The Wolf Of All Streets (@scottmelker) March 9, 2023

The head of the Commodity Futures Trading Commission (CFTC) Rostin Behnam, however, is having none of that:

Breaking: the head of the CFTC says Ethereum is a commodity (not a security) and he has serious legal defense to support his argument pic.twitter.com/RdpmH3j2zB

— Crypto Tea (@CryptoTea_) March 9, 2023

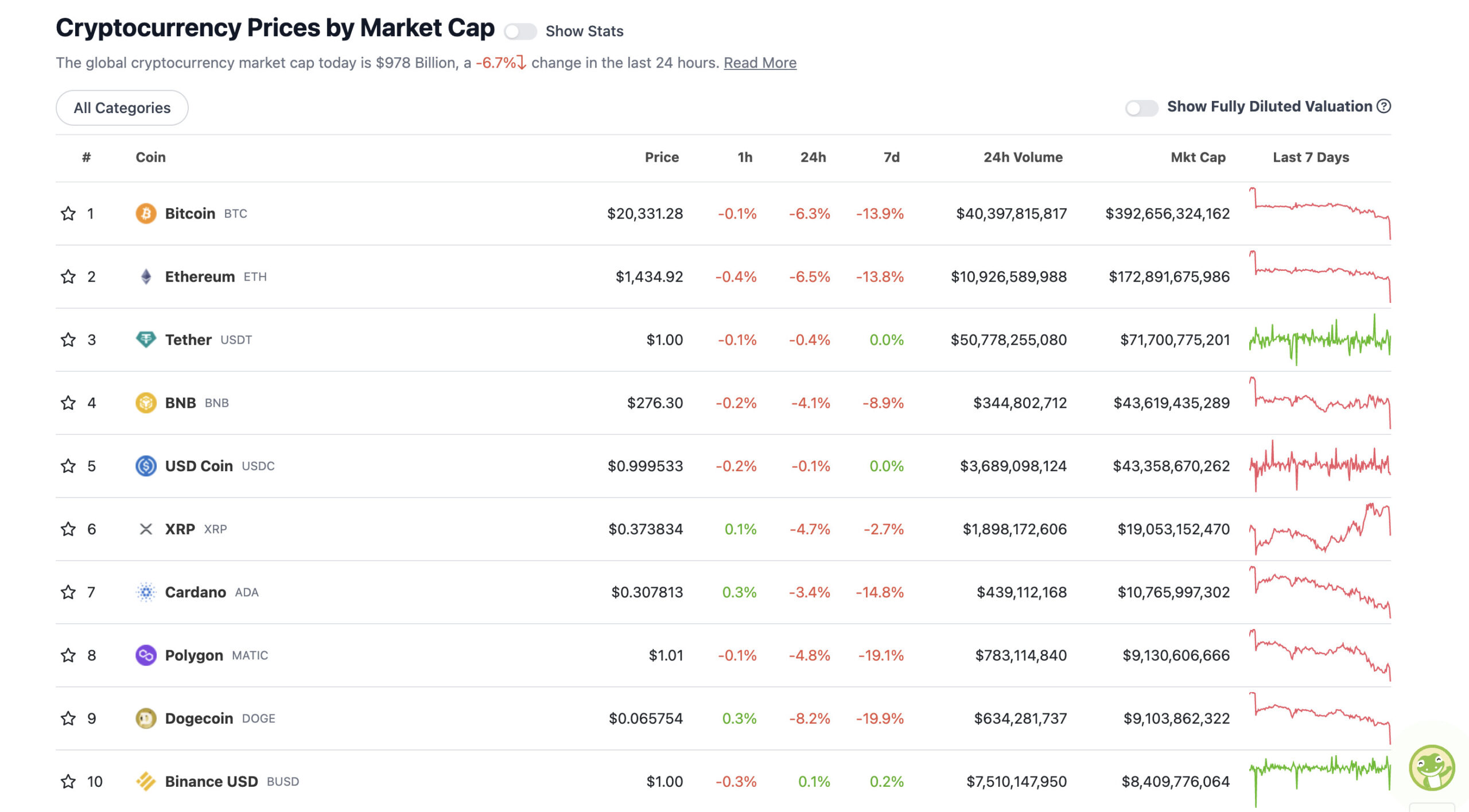

Top 10 overview

With the overall crypto market cap at US$978 billion, down nearly 7% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Yep, for reasons already discussed, the weekly and daily price action in the crypto majors is bloodier than the entire first season of The Last of Us.

At the time of writing, though, Bitcoin seems to have held onto a branch around US$20,300. What next? Over to you, Crypto Twitter analysts…

48 hours ago, I was an idiot for being bearish $BTC because $30k was surely next.

Now my $18,400 target in March isn't low enough.

Gotta love CT. 😂

— Justin Bennett (@JustinBennettFX) March 9, 2023

$BTC 1D

Looking at this scenario for a possible short swing trade.

HS bearish reversal forming with neckline 21.5. $DXY is looking bullish which makes me think this will cause a swing reversal with risk assets.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/wh3JALy7wg

— Roman (@Roman_Trading) March 9, 2023

https://twitter.com/eddyiskongz/status/1633964545915129857

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.3 billion to about US$372 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Klaytn (KLAY), (market cap: US$666 million) +5%

• Aptos (APT), (mc: US$1.88 billion) +4%

DAILY SLUMPERS

• Huobi (AHTGIX), (market cap: US$643 million) -18%

• TRON (TRX), (mc: US$5.3 billion) -11%

• Synthetix (SNX), (mc: US$736 million) -11%

• ApeCoin (APE), (mc: US$1.6 billion) -10%

• VeChain (VET), (mc: US$1.47 billion) -9%

• SingularityNET (AGIX), (mc: US$397 million) -8%

• Fantom (FTM), (mc: US$931 million) -7%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

No, ETH isn't a security just because someone makes an unfounded allegation, even if that "someone" is an enforcement agency in court.

Agencies are like any other plaintiff: they can write whatever they want in a complaint. It may get some press, but it doesn't change a thing.

— Jake Chervinsky (@jchervinsky) March 9, 2023

Yikes. https://t.co/vSPqP4uT13

— The Wolf Of All Streets (@scottmelker) March 9, 2023

— Matt Willemsen (@matt_willemsen) March 9, 2023

Hmm, more terrific news for Bitcoin here…

JUST IN: 🇺🇸 Biden admin proposes 30% tax on electricity used for #Bitcoin & crypto mining – NY Times

It’s “hindering the transition to a low-emission energy future,” the White House says. pic.twitter.com/75402YIoGi

— Bitcoin Magazine (@BitcoinMagazine) March 9, 2023

The single greatest error a country can make is to attack Bitcoin or Ethereum

The US Govt just chose to do BOTH today

The big loser here will be the USA, not the protocols

— EllioTrades (@elliotrades) March 9, 2023

I don‘t mind seeing prices dump. Everytime I see a correction, it gives me another buying opportunity.

I‘m here for the next bull run, which will be massive.#Crypto

— Dom's Crypto (@Doms_Crypto) March 9, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.