Mooners and Shakers: Crypto-friendly bank Silvergate looks shaky as Coinbase and others turn backs; Bitcoin doesn’t care

Yep, we typed in "broken silver gate" into Getty Images.

Uh oh, this one had been looming – the crypto-connected, Californian bank Silvergate Capital (SI.N) appears to be in dire financial straits. Crypto-firm titans Coinbase, Galaxy Digital and others have now dropped the institution as their banking partner.

At Coinbase all client funds continue to be safe, accessible & available.

In light of recent developments & out of an abundance of caution, Coinbase is no longer accepting or initiating payments to or from Silvergate.

— Coinbase 🛡️ (@coinbase) March 2, 2023

If this has sent shockwaves of fresh fear through the industry regarding further “crypto contagion”, though, you wouldn’t know it if you woke up simply checking your portfolio. (Which is the very first thing you do every morning, right?)

And that’s because the market, while dipping a bit overnight (AEDT) has since largely recovered and thus has really barely moved, with Bitcoin (BTC) hanging in there still around US$23.5k.

Still, given all the recent regulatory fears, stemming from zealous SEC actions towards and against crypto firms, and lingering Terra LUNA and FTX-related PSTD across the crypto landscape, you’d have to say, this Silvergate news really isn’t too encouraging for an industry hoping to recover strongly this year.

So what’s happened with Silvergate?

According to CoinDesk and Reuters and others, the heavily crypto-focused bank Silvergate has shed more than 50% of its value on the back of an announcement filed to the SEC that it would be delaying the filing of its annual report. There are growing concerns that the bank may in the death throes of going under.

“The Company is currently analyzing certain regulatory and other inquiries and investigations that are pending with respect to the Company,” reads part of the filing, which generally strikes a tone that questions its own survival.

Silvergate’s major crypto clients Coinbase, Circle, Paxos, Crypto.com, Bitstamp, Cboe Digital Markets, Galaxy and Gemini have all now revealed that they are suspending business with the institution. Silvergate has been a lurking concern in the crypto industry ever since it took a bank-run hit after the FTX exchange implosion in November spooked the bank’s clients.

Coinbase and Galaxy Digital have both emphasised they’ve had minimal exposure to Silvergate, as have other big industry players, including the Bitcoin-bullish MicroStrategy.

Regarding $MSTR and $SI. https://t.co/0l6p2PDkhS

— Michael Saylor⚡️ (@saylor) March 2, 2023

1/ We maintain relationships with several banking partners. We are sensitive to the concerns around Silvergate and are in the process of unwinding certain services with them and notifying customers. Otherwise, all Circle services, including USDC are operating as normal.

— Circle (@circle) March 2, 2023

2/ In addition, we have stopped accepting customer deposits / processing withdrawals via ACH and wire transfers through Silvergate to the @Gemini exchange.

— Gemini (@Gemini) March 2, 2023

At the time of writing, Coinbase shares (COIN) seem to be in recovery mode, having dipped close to 10% on the Silvergate news. COIN is now down 1.5% over the past 24 hours, but heavy Coinbase investor Cathie Wood and ARK Invest will still be satisfied with its five-day performance: +4.8%.

Top 10 overview

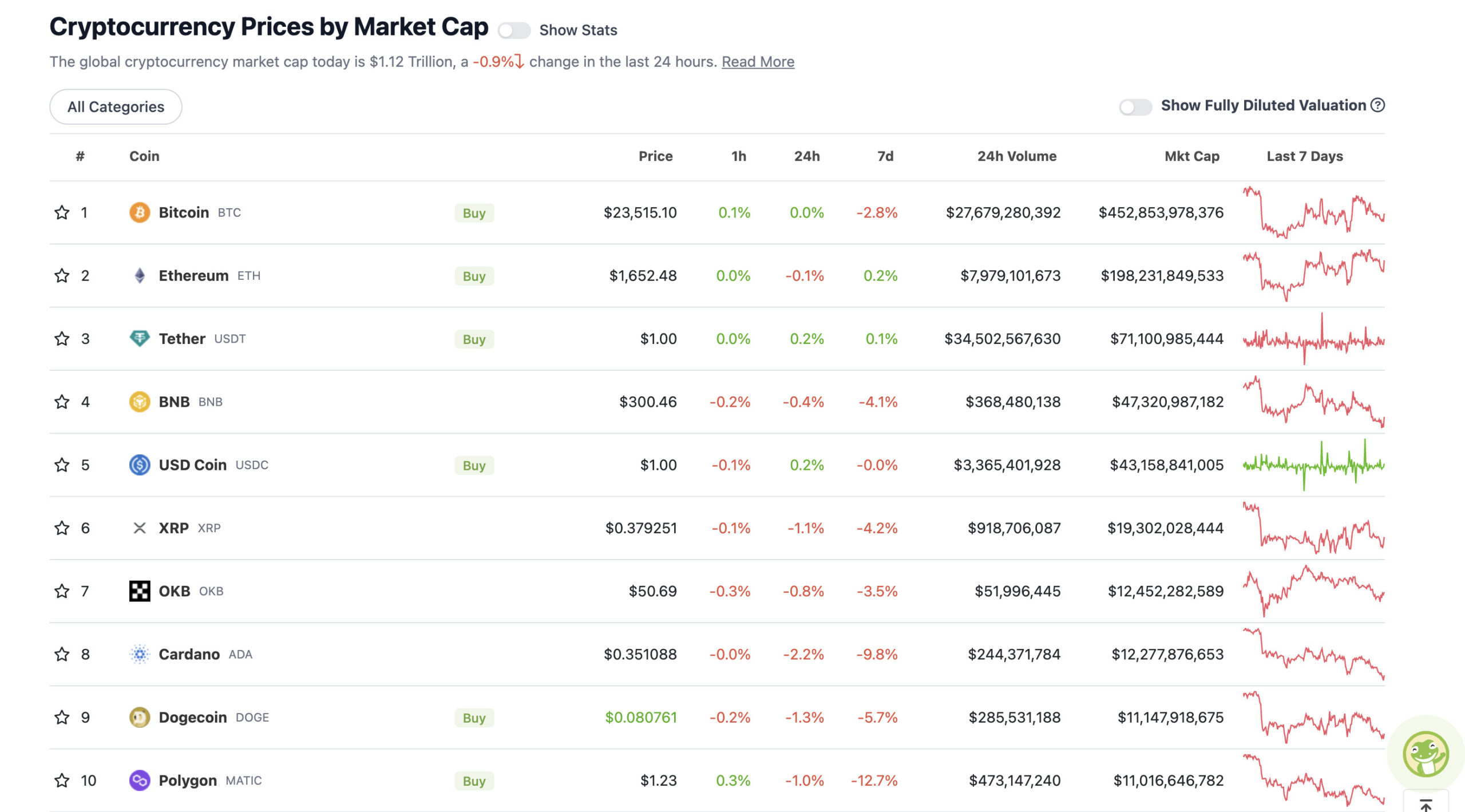

With the overall crypto market cap at US$1.12 trillion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So as you can see, for the moment at least, the needle has barely moved in the crypto majors since this time yesterday. Perhaps the Silvergate news has yet to sink in? Or is the crypto market so completely “meh” now when it comes to the FTX contagion?

Quite possibly. Partner at crypto VC firm Placeholder Chris Burniske and Dutch trader Michaël van de Poppe both certainly believe Bitcoin is holding up extremely well in the face of this news, with potential for further upside.

Lots getting thrown at crypto — stronger dollar, rising rates again, stiff regulation — and yet, $BTC still holding > $23K.

— Chris Burniske (@cburniske) March 2, 2023

Silvergate potentially going bankrupt, pushing prices down a bit more.

On the other hand; people piling into positions since the news and no real movement on #Bitcoin.

This might be an assumption people are heavily skewed to the short side here.

Time for a squeeze.

— Michaël van de Poppe (@CryptoMichNL) March 2, 2023

Even Roman Trading – who has certainly just lately been more inclined to lean short-mid-term bearish based on, you know, charts and a less-than-inspiring macro financial scene – can see the possibility of a BTC pump to US$25k or higher. Well… before “exhaustion” and potential reversal, that is.

https://twitter.com/Roman_Trading/status/1631375847583096832

Uppers and downers: 11–100

Sweeping a market-cap range of about US$9.67 billion to about US$465 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Casper Network (CSPR), (market cap: US$480 million) +10%

• EOS (EOS), (mc: US$1.36 billion) +3%

• Lido DAO (LDO), (mc: US$2.56 billion) +1%

• Mina Protocol (MINA), (mc: US$839 million) +1%

DAILY SLUMPERS

• Frax Share (FXS), (market cap: US$830 million) -8%

• Klaytn (KLAY), (mc: US$788 million) -7%

• Conflux (CFX), (mc: US$467 million) -7%

• ImmutableX (IMX), (mc: US$840 million) -6%

• GMX (GMX), (mc: US$617 million) -5%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Want some ETH hopium? “Moustache” has some for you…

One can dream. I can't get away from this chart.

Similarities to 2016-2017 are still outstanding.

Is it just taking more than twice as long?Personally my preferred scenario – BlowOffTop.🎯

Altcoins, $BTC – everything would fly more than you can imagine. pic.twitter.com/vaqWkKageb

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) March 2, 2023

upcoming ethereum NFTs I'm excited about ✨

top 10 is ranked

watchlist is unrankedwe update these every few days on @mintorskip

it's free go sign up 🫡 pic.twitter.com/9m7HkHucAx

— Giancarlo (@GiancarloChaux) March 2, 2023

PFP collections account for 70% of the total NFT market cap. pic.twitter.com/90g2L0zql7

— Delphi Digital (@Delphi_Digital) March 2, 2023

This one is quickly becoming a portfolio favourite of mine https://t.co/v0jwQEl0dY

— Matthew Harcourt 🇦🇺 (@DeFiGuy3) March 2, 2023

An oldie but a goodie, this one…

#Bitcoin https://t.co/7nFOcPLEcz

— naiive (@naiivememe) March 2, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.