Mooners and Shakers: Coinbase gains in Spain; Bitcoin chops back to US$26k

Coinhead

Coinhead

We’ll pick out a few analytical takes in a minute, but first, what’s making news so far today?

• Crypto exchange beast Coinbase has, according to it, been granted approval from the Bank of Spain to begin providing crypto services to Spanish citizens.

The exchange is targeting European expansion, with this latest approval coming after it secured VASP (Virtual Asset Service Provider) registrations in Italy, Ireland, and the Netherlands.

Note: the EU recently adopted the Markets in Crypto Assets (MiCA) regulation, providing crypto companies in Europe with some much needed clarity. (Are you taking note, USA and, erm… Australia?)

• Still on Coinbase, it’s also rumoured to have recently been circling FTX Europe’s assets to bolster its positioning in Europe, according to a Fortune article. That said, the article also clarifies that acquisition talks “never reached a late stage”.

#Coinbase Gets Registration From 🇪🇸 Bank Of Spain Amid #FTX Europe 🇪🇺 Acquisition Talks

Coinbase obtains cryptocurrency exchange and custodian wallet provider registration with the Bank of Spain as part of expansion strategy. pic.twitter.com/p1v8z3aQFG

— DG Crypto News (@dgcryptonews) September 23, 2023

• JP Morgan has labelled Ethereum’s performance, or at least its user activity, post 2022’s Shanghai upgrade as “disappointing”, per a new report by the Wall Street titan, highlighted by The Block.

Ethereum’s daily transactions, daily active addresses and total value locked (TVL) within Ethereum-based decentralised finance (DeFi) protocols have all declined since the network’s big 2022 upgrades, the firm’s analysts noted.

Ethereum devs and asset holders are now looking ahead to the snappily titled ‘protodanksharding’ EIP-4844 upgrade, for a hoped-for increase in Ethereum network activity. The JP Morgan analysts, however, note that “continued bearish crypto forces remain a headwind” in general.

Lark “Just a Dude Talking About Crypto on the Internet” Davis, however says: “Dudes, it is a bear market, chill.”

JP Morgan turning bearish on Ethereum.

Said they are "disappointed"

Dudes, it is a bear market, chill. pic.twitter.com/mgfK1KpnCi

— Lark Davis (@TheCryptoLark) September 24, 2023

A 224k plus Twitter/X-followed trader who goes by the pseudonym Bluntz believes Bitcoin has likely entered a lower-high setup (bearish) after failing to push past US$27k-ish resistance last week.

The local bottom is not yet in, Bluntz believes, although it could be if it sinks just below US$24k.

potential lower high being put in today on #btc today.

i don't think the "bottom" is in yet because structure just doesn't look right yet for me, i think the 24.8k lows need to be convincingly taken out first and the last 39 days of price action potentially part of a larger… pic.twitter.com/J2XN7DTRlG

— Bluntz (@Bluntz_Capital) September 21, 2023

Meanwhile, Dave the Wave (140k-odd followers on X) reckons the bull-goose crypto asset is on target for a bullish 2024, based on the idea that the monthly moving average convergence divergence (MACD) has pulled back into an underbought “buy zone” territory.

Q4 then 2024. Bring it on.

Monthly MACD shows a maturing market as predicted along the lines of the LGC model.

MACD has crossed bullishly and well re-set just below the zero-line.

Price has now been in the LGC buyzone for 15 months. pic.twitter.com/iKPKiwvOfo

— dave the wave🌊🌓 (@davthewave) September 22, 2023

Then there’s this one, from Stockmoney Lizards, another popular chart posting trader type who tends to like a good ol’ zoom-out (with a US$200k Bitcoin prediction for 2025, no less).

A lot of voices out there saying "this time is different"

But actually, it looks like complete perfection … pic.twitter.com/Dwiq7de9b5

— Stockmoney Lizards (@StockmoneyL) September 24, 2023

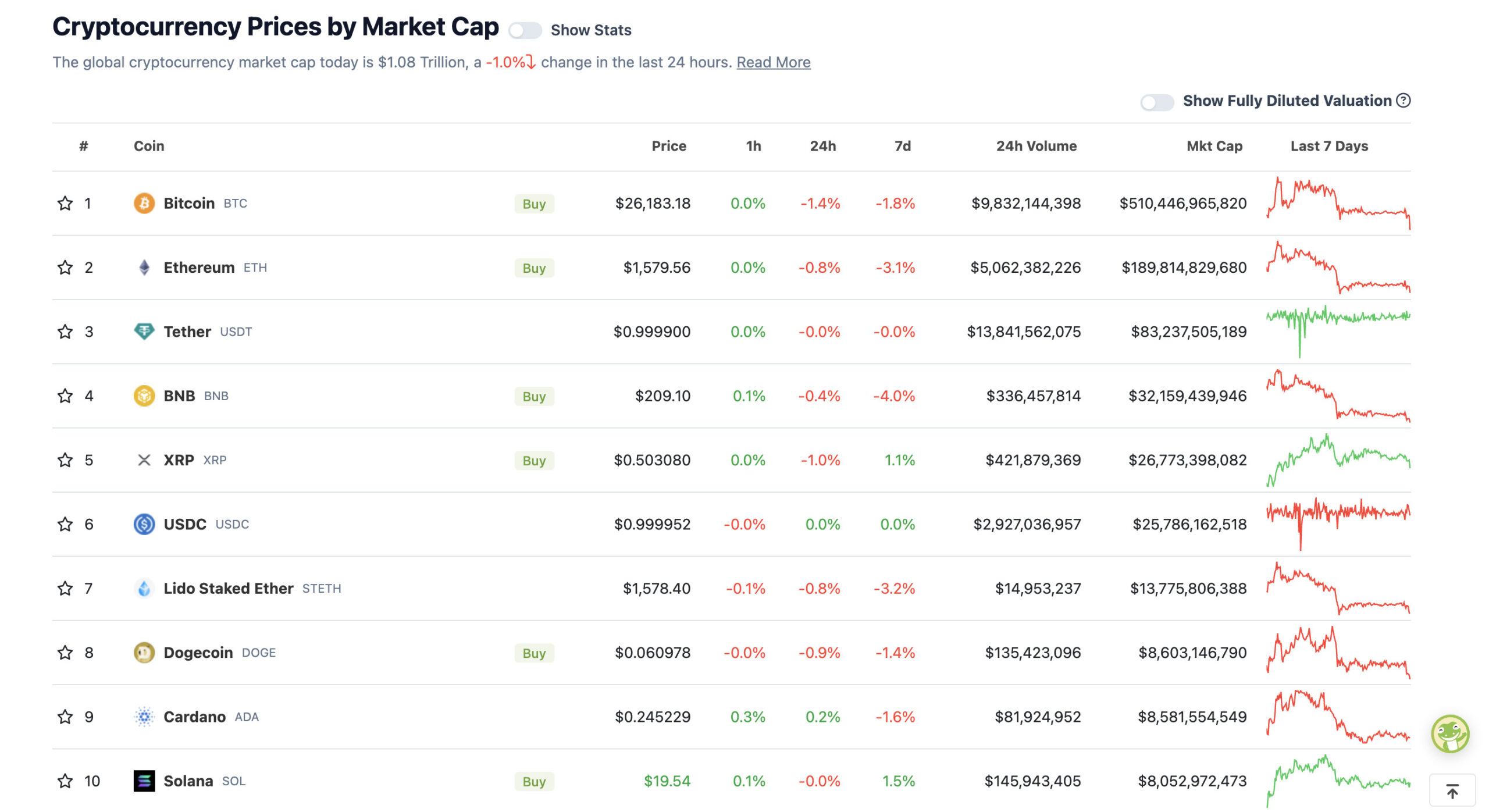

With the overall crypto market cap at US$1.08 trillion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• WEMIX (WEMIX), (market cap: US$390 million) +12%

• CurveDAO (CRV), (market cap: US$451 million) +9%

• Kaspa (KAS), (market cap: US$991 million) +5%

• Aptos (APT), (market cap: US$1.25 billion) +3%

• Rollbit Coin (RLB), (market cap: US$364 million) +3%

SLUMPERS

• Radix (XRD), (market cap: US$629 million) -7%

• Toncoin (TON), (market cap: US$7.5 billion) -5%

• ImmutableX (IMX), (market cap: US$688 million) -5%

• Hedera (HBAR), (market cap: US$1.66 billion) -4%

• The Graph (GRT), (market cap: US$792 million) -3%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

2024 has so many bullish catalysts for Bitcoin:

– Spot ETF

– Rate Cuts

– US Debt Buybacks (stimulus)

– Election year

– HalvingWhat did I miss?

— EllioTrades (@elliotrades) September 23, 2023

We're 41 months into this 4-Year Crypto Cycle.

7 months away from April 2024.

The Bitcoin Halving.

It is the one chart that's never failed us in the past 12 years since when Bitcoin was first born.

For the past 12 years, the Bitcoin halving has consistently been the major…

— Ben Simpson (@bensimpsonau) September 24, 2023

Total Ethereum on exchanges keeps falling.

Now at lowest levels in years.

Ethereum in staking contract is basically up only, currrently at 28 million.

There is a 2 year queue for all ETH to exit.Spot ETH ETFs are coming.

No one is ready for this… pic.twitter.com/UwkgbqX1ie

— Lark Davis (@TheCryptoLark) September 24, 2023

BREAKING: Bitcoin miner Core Scientific buys 27,000 Bitcoin mining rigs for $23 million in cash and a $53.9m equity investment. pic.twitter.com/V7tzP2Ecmg

— Bitcoin Archive (@BTC_Archive) September 24, 2023