Mooners and Shakers: Celsius repays Bitcoin loan; BTC, ETH and most top 100 cryptos pump

Getty Images

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Bitcoin and Ethereum are pumping, Celsius has reportedly repaid its BTC loan, and most top coins are having a good day. That’s it, bear market’s officially over, up only from here.

Sorry, getting carried away there – haven’t seen a crypto green day quite like this one for a bit (although yesterday wasn’t too bad, either).

Just a relief-rally pump? Possibly. With the next lot of US inflation data looming on July 13 and many experts predicting another 75bp rate hike from the Fed, there’s no way the flat-to-bearish-downtrend outlook can be discounted yet.

That said, at least one prominent US financial analyst is seeing an orange-hued light at the end of what’s been a pretty dank, miserable, over-leveraged tunnel so far this year.

Mike McGlone, the senior commodity strategist over at Bloomberg reckons the following…

#Bitcoin could be one of the greatest bull markets in history at a relatively discounted price to start 2H. Or the crypto may be a failing experiment in the process of being made redundant, like #crudeoil. Our bias is Bitcoin adoption is more likely to continue rising pic.twitter.com/qtLRR6isXF

— Mike McGlone (@mikemcglone11) July 6, 2022

Elaborating further in a separate tweet, the analyst also noted: “With the Bloomberg Galaxy Crypto Index nearing a similar drawdown as the 2018 bottom and Bitcoin’s discount to its 50- and 100-week moving averages similar to past foundations, risk vs reward is tilting toward responsive investors in 2H”.

Translation on both of those tweets… Bitcoin could rebound spectacularly well in the second half of this year. And the good news for that particular thesis is, we’re now in the second half of this year.

Well, that’s one expert’s opinion – and it’s a hopium-filled one for the crypto-hodling faithful. There are still plenty of prominent bearish voices hanging around Twitter, attempting to keep it real and calling for a $10k Bitcoin as the “generational bottom”.

Celsius pays off Maker protocol Bitcoin loan

There’s news circulating today that the recently embattled crypto lender Celsius Network – a prominent crypto contagion story – has now fully paid back its large Bitcoin loan from the Maker protocol, one of crypto’s biggest DeFi platforms.

This may be releasing some of the pressure on the market today… or it may have absolutely nothing to do with it. Either way, it’s at the very least good news for Maker. And Celsius, too – which has now been able to reclaim about US$440 million worth of collateral/liquidity.

Not everyone is overly enthused about the news, though…

Celsius paying off their loan is NOT good news. People still can’t withdraw their money. I won’t celebrate till users get their funds back from these crooks.

— Heidi (@blockchainchick) July 7, 2022

Just a reminder, in case you’d forgotten, Celsius halted all customer withdrawals and transactions on June 12 to avoid a death spiral situation with a run on its deposits.

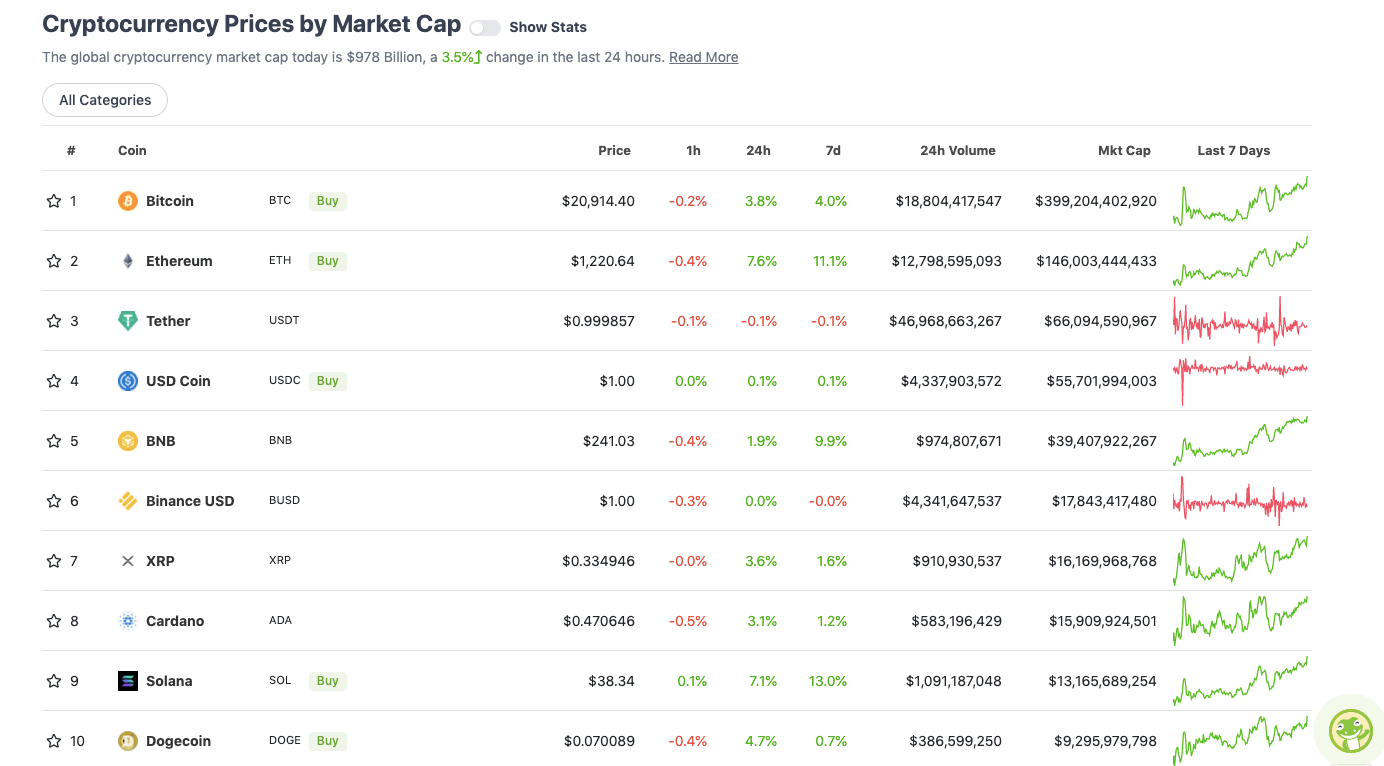

Top 10 overview

With the overall crypto market cap up 3.5% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Ethereum (ETH) is the biggest daily winner in the majors today. With the successful launch of its “Sepolia” testnet, the leading smart contract blockchain moved one step closer to its “Merge” event yesterday – the move to shift consensus model from proof of work, to proof of stake.

The community seems excited. This bloke even wrote a near 9-minute song about it. That said, he does write a song a day…

THIS SONG CAME OUT EPIC

It's nearly 9 minutes long. It's worth watching the whole thing, for what happens at the end!

HAPPY SEPOLIA MERGE DAY!https://t.co/oWHboWMZjI

(👆bid on the nft) pic.twitter.com/W3LOw9HA2w— 16 years of song a day (@songadaymann) July 6, 2022

Meanwhile, for good measure, here are a couple more go-to Twitter-based analytical voices on the market, specifically Bitcoin.

One for the short-term bulls…

U.S. is green again.

That's good.

Equities starting to look better as commodities are dropping down (and yields too), resulting into some momentum towards risk-on assets.

Expecting to continue coming 1-2 months with summer relief rally for #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) July 7, 2022

… and one playing for the Bears…

At this point it’s exchanges / whales doing derivative buys so their buddies can sell their spot #bitcoin.

Macro economics are horrible and only getting worse as well.

I’m not sure how anyone is bullish in this environment.#cryptocurrency #cryptotrading #cryptonews

— Roman (@Roman_Trading) July 7, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8 billion to about US$400 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Aave (AAVE), (market cap: US$969 million) +14%

• Internet Computer (ICP), (mc: US$1.49 billion) +11%

• THORChain (RUNE), (mc: US$712 million) +9%

• Convex Finance (CVX), (mc: US$401 million) +9%

• Avalanche (AVAX), (mc: US$5.6 billion) +8%

DAILY SLUMPERS

At the time of writing, these are the only five coins in the top 100 letting the side down and slipping into the red. Not by much, though…

• Tenset (10SET), (market cap: US$769 million) -3%

• Tether Gold (XAUT), (mc: US$436 million) -1%

• eCash (XEC), (mc: US$812 million) -1%

• Arweave (AR), (mc: US$584 million) -1%

• Evmos (EVMOS), (mc: US$555 million) -1%

Around the blocks

To finish, a selection of randomness that stuck with us on our daily journey through the Crypto/financial Twitterverse.

The president of El Salvador’s latest tweet for gold bug and Bitcoin hater Peter Schiff is pretty to the point…

How’s your bank going?

— Nayib Bukele (@nayibbukele) July 6, 2022

https://twitter.com/Fwiz/status/1545047863733805057

#Bitcoin going up

Exactly as expected after the UK forced Boris out of office 🇬🇧🚀

— That Martini Guy ₿ (@MartiniGuyYT) July 7, 2022

💥FORBES: $140 Billion ready to be deployed into #Bitcoin and alts. 🤔

— Bitcoin Archive (@BTC_Archive) July 7, 2022

💥BREAKING: Robinhood just enabled ALL USERS to send + receive #Bitcoin

— Bitcoin Archive (@BTC_Archive) July 7, 2022

I made this

— Nude Robot (@RudeNobot) July 6, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.