Mooners and Shakers: CBA limits crypto payments, but tech-stock rally could lift Bitcoin and pals

Getty Images

It’s nervy, mixed emotions time for those who dabble and/or dive deep into crypto investing. The CBA has thrown some more crap news into the mix locally, but there’s still hopium around a tech-stock-rally wake ride and a Fed pause in June.

The latter point there centres around the market seemingly pricing in a June pause to the US Federal Reserve’s interest-rate hiking, albeit with the strong potential for another increase in July.

This is what “they” are saying, according to Eddy “Market Highlights” Sunarto. The CME FedWatch tool, a sentiment predictor of sorts, is currently predicting a 72.5% chance of the Fed taking a break from it all and scratching chins in June while they figure out what to scribble down in their playbook next.

Australia’s biggest bank cools on crypto

Meanwhile, which big Aussie bank has gone a little cool on crypto today? The Commonwealth Bank.

According to reports, the bank is introducing new measures that will see payments to some “high-risk cryptocurrency exchanges” declined, delayed and limited.

The details about which crypto exchanges exactly have not yet been divulged by the bank, but CBA noted that the measures are being introduced to help protect consumers from scammers exploiting cryptocurrencies and investors.

So, at the worst, for certain, as-yet-unnamed crypto exchanges it could be the path to a complete de-banking move by the CBA. While at best, as BTC Markets’ CEO Caroline Bowler notes below, for exchanges the bank deems to carry less risk, it appears as if 24-hour delays on deposits will be imposed, along with $10,000 monthly deposit limits.

Reporting from @jessicasier @FinancialReview that @CommBank have banned AUD transfers to “high-risk” crypto exchanges & limited transactions with others to $10k per month, with a 24 hr delay. $700k per day leaves CBA as scammed money heading to crypto. Banks & the crypto industry…

— Caroline Bowler (@CaroBowler) June 8, 2023

I’m guessing it’s the exchanges where scammers are routing the largest amount or those with the loosest AML/KYC checks. Stringent checks go some of the way towards minimizing scam payments but not a panacea.

— Caroline Bowler (@CaroBowler) June 8, 2023

Remember when the Commonwealth Bank was all set to trial a crypto-trading service in late 2021? Yeah, things have changed.

I appreciate @CommBank protecting me. I feel very safe.

Like all CBA customers, I'm very irresponsible and happy to wait 24 hours before buying any crypto.

After all, the money in my CBA account is not my money and CBA can do what it wants with it.

https://t.co/0eKT4uva9r— Jabz (@jabranthelawyer) June 8, 2023

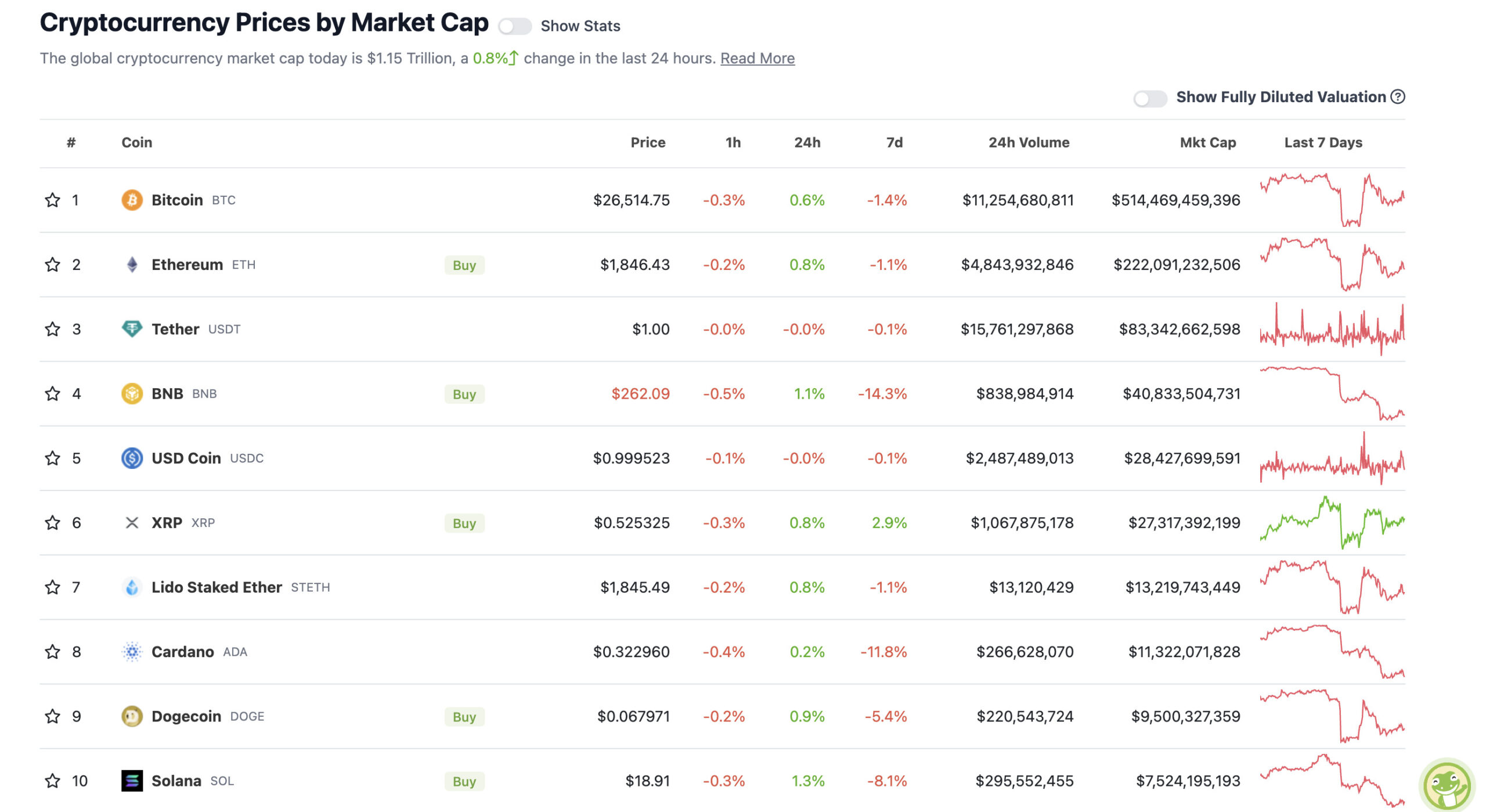

Top 10 overview

With the overall crypto market cap at US$1.15 trillion, up almost an entire percentage point since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin and Ethereum and the other majors, even BNB, have all stemmed the SEC-related bleed for the moment. In fact, BTC was on something of a surge late last night towards US$27k once again, but has since clearly curbed its enthusiasm somewhat.

Nevertheless, something of a rally in tech stocks on Wall Street, as Eddy notes in his morning roundup, has had at least a little knock-on effect for the crypto market today.

“Mega tech stocks like Apple, Alphabet, Microsoft all rose after a big jump in US weekly jobless claims signalled a cooling jobs market,” wrote Eddy.

Unemployment claims coming in worse than expected. $DXY pulling back a little, alongside the Yields.

— Michaël van de Poppe (@CryptoMichNL) June 8, 2023

It’s going to take a lot more stock market positivity, however, for crypto to quell its regulatory fear uncertainty and doubt, one would think.

Just on that, here’s crypto/XRP-focused US lawyer John E Deaton calling the SEC’s Gary Gensler a bad person again…

@GaryGensler is truly a bad human being with no integrity whatsoever. Where was this when he was at MIT? https://t.co/B7XAPadbGV

— John E Deaton (@JohnEDeaton1) June 8, 2023

Some (although a “maybe, maybe not” for others – see below) however, think that the S&P 500 has entered a new bull market. Again, this from Eddy:

“Overnight, the S&P 500 entered a new bull market as the index gained 0.62%. The index is also up 20% from its lows in October 2022, which is a marker of a bull market.”

Despited everything weighing crypto down right now, that is at least some hopium for all markets, including risk assets, right there.

Maybe. Maybe not. https://t.co/OPioRNOOYZ pic.twitter.com/utJWjblAsu

— Sven Henrich (@NorthmanTrader) June 8, 2023

Uppers and downers: BSCEX – what the…?

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• BSCEX (BSCX), (market cap: US$542 million) +1,195%

• ImmutableX (IMX), (market cap: US$716 million) +5%

• Render (RNDR), (market cap: US$832 million) +4%

• EOS (EOS), (market cap: US$987 million) +3%

• Polygon (MATIC), (market cap: US$7.3 billion) +2%

Erm, now we haven’t headlined BSCEX, because, frankly, we don’t know much about it. But with a pump like that out of nowhere, you can bet a stupendous dump is just around the corner.

Judging by its name and logo, we gather its Binance related. In fact, a further look into it tells us it’s a Binance-created “decentralized non-custodial cryptocurrency exchange-centered ecosystem that runs on Binance Smart Chain (BSC)” – according to this Medium article. In other words, a Binance DEX.

And no, we’re not seeing too much about it on Crypto Twitter just at the moment. Not financial advice, but probs best avoided for the moment and perhaps altogether.

SLUMPERS

• Lido DAO (LDO), (market cap: US$1.89 billion) -6%

• Sui (SUI), (mc: US$385 million) -4%

• Frax Share (FXS), (mc: US$429 million) -3%

• Klaytn (KLAY), (mc: US$597 million) -2%

• Radix (XRD), (mc: US$685 million) -2%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Timeline is more scared now than it was at $20k, and we’re still holding above $26k $BTC.

That’s saying something..

— Miles Deutscher (@milesdeutscher) June 8, 2023

NEWS: #Binance's lawyers claimed that Gary Gensler once offered to serve as an advisor to Binance in 2019.

📰: https://t.co/iJVTndtwvR pic.twitter.com/tMfvYQqB2k

— CoinGecko (@coingecko) June 8, 2023

https://twitter.com/twobitidiot/status/1666918347542351874

— Elon Musk (@elonmusk) June 9, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.