Mooners and Shakers: Cardano leads daily gains in majors as Bitcoin chills out

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

The crypto market as a whole may be relatively flat over the past 24 hours but there are always major daily winners and losers to be found. Like yesterday, Cardano (ADA) is on the right side of that equation.

The prominent Ethereum layer 1 rival and proof-of-stake blockchain’s native token ADA has surged back above the US$1 dollar mark it lost in mid February and has flipped the high-performing Terra (LUNA) once again in the top 10, although only just.

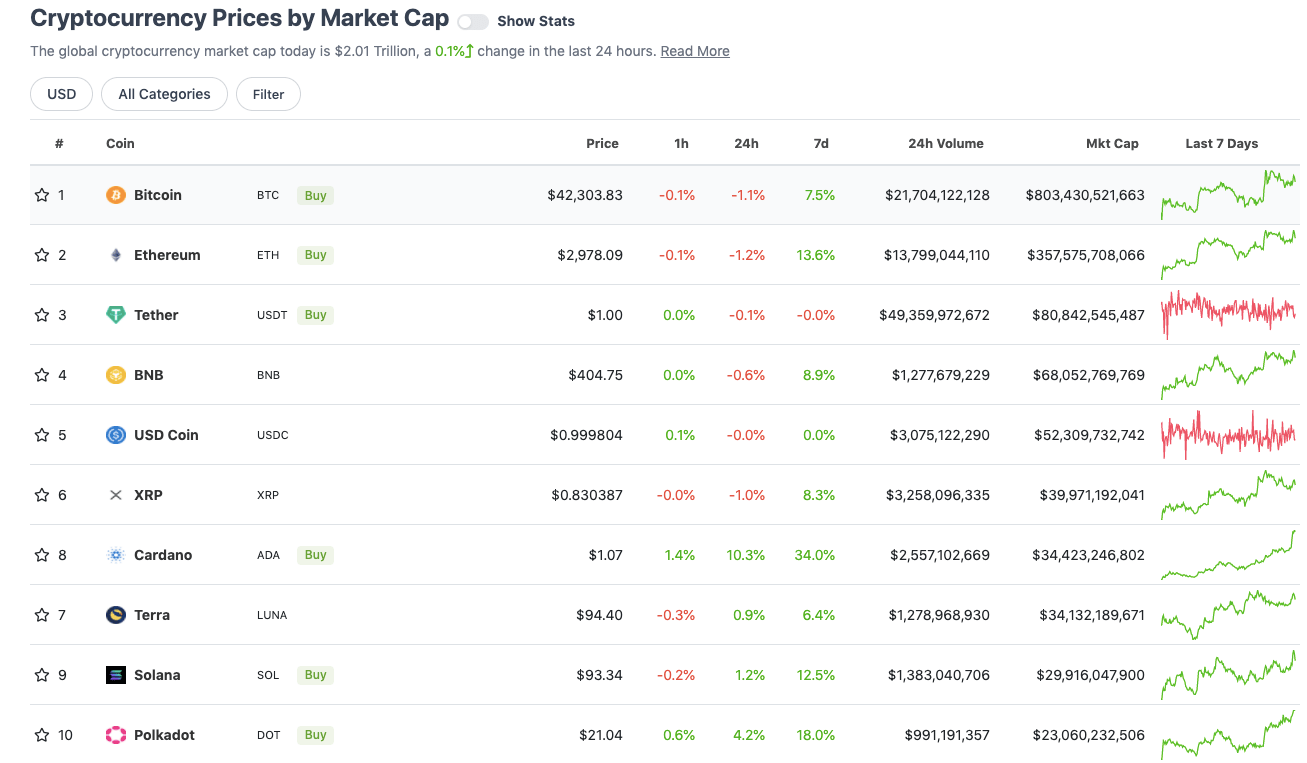

Top 10 overview

With the overall crypto market cap at about US$2.01 trillion, crabbing roughly 0.1% from this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Cardano’s ADA is likely surging on the back of the following news:

lol that’s the news that sent $ADA today over a dollar? I’m shorting 😂

— Res (@resdegen) March 23, 2022

That’s a positive development, despite what the tribalistic ADA haters will say (it’s a divisive coin, for some reason).

That said, not sure why any ADA holder would want to stake through Coinbase when they can do it perfectly fine and securely through one of Cardano’s wallets (eg. Daedalus or Yoroi) without forking out a middleman cut for the exchange.

Meanwhile Polkadot (DOT) is the other layer 1 chain having a good’un on the daily and weekly timeframes. Today’s decent DOT price action could be due to US$250 million in funding launched by several Polkadot parachains and a bunch of VCs – with the purpose of driving adoption for Acala’s flagship stablecoin aUSD.

Acala (ACA) is one of Polkadot’s most prominent parachains and is known as the network’s DeFi hub – essentially a protocol that builds and develops decentralised finance applications. The ACA token is also up about 18% over the past seven days.

Acala, nine parachain teams, and a group of venture funds have launched the $250 million 'aUSD Ecosystem Fund' 🅰️💸

The fund is seeking early-stage projects from any @Polkadot or @KusamaNetwork parachain with strong $aUSD stablecoin use cases 🚀https://t.co/OJ2V47ZUry pic.twitter.com/NDgLg2bG8N

— Acala (@AcalaNetwork) March 23, 2022

As for Bitcoin (BTC), it’s been in chill-out mode over the past several hours after its strong surge yesterday.

There’s a US$3.3 billion BTC options expiry occurring on March 25 and bullish traders will be looking for the OG asset to defend the US$42k level. US media outlet Cointelegraph put together some detailed analysis today on how that might actually play out.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$22.9 billion to about US$987 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• Xido Finance (XIDO), (mc: US$1.38 billion) +54%

• Loopring (LRC), (mc: US$1.44 billion) +42%

• Humans.ai (HEART), (mc: US$1.33 billion) +28%

• Mina Protocol (MINA), (mc: US$1.11 billion) +19%

• Radix (XRD), (mc: US$1.61 billion) +12%

DAILY SLUMPERS

• Bitcoin Cash (BCH), (market cap: US$6.84 billion) -5%

• THORChain (RUNE), (mc: US$2.54 billion) -4%

• Maker (MAKER), (mc: US$1.78b) -4%

• Ecomi (OMI), (mc: US$1.63b) -3%

• Leo Token (LEO), (mc: US$5.64b) -3%

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• KRYLL (KRL), (market cap: US$60 million) +111%

• Crypterium (CRPT), (mc: US$25m) +60%

• Universe.XYZ (XYZ), (mc: US$68m) +49%

• Opulous (OPUL), (mc: US$30m) +39%

• Smooth Love Potion (SLP), (mc: US$866m) +30%

DAILY SLUMPERS

• SafeMoon (SFM), (market cap: US$443 million) -25%

• Biswap (BSW), (mc: US$160m) -14%

• Trust Wallet Token (TWT), (mc: US$255m) -13%

• Wonderland (TIME), (mc: US$108m) -11%

• OriginTrail (TRAC), (mc: US$264m) -10%

Around the blocks

There’s been some positive altcoin price action over the past few days, and as we’re rounding off this article, ETH has just ticked back over US$3,000 once more.

But here’s a salient reminder here from Dutch trader and crypto analyst Michaël van de Poppe…

The markets are moving upwards, relief rallies everywhere.

Good signs.

However, take your profits. The markets are still fragile and can turn quite swiftly.

Just a simple piece of advice.

— Michaël van de Poppe (@CryptoMichNL) March 23, 2022

Meanwhile, following on from the big Ray Dalio/Bridgewater crypto-investing news earlier, here’s another scrap of institutional adoption to finish on.

Wall Street bank Cowen Inc (assets under management: US$15.8 billion) has announced it’s planning to allow its moneybags clients to spot trade 16 different cryptos. These will include Bitcoin, Ethereum and Solana, according to a Bloomberg article.

💥 NEW: Wall Street bank Cowen Inc to offer spot #bitcoin trading to its institutional clients 🙌

— Bitcoin Magazine (@BitcoinMagazine) March 23, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.