Mooners and Shakers: Cardano builds on Vasil hard fork narrative; Bitcoin indecisive around $20k

Getty Images

Bitcoin can’t seem to make up its mind around $20k, which leaves most of the rest of the crypto market scratching heads as well. That said, Cardano appears to have caught a healthy, Vasil hard fork-related weekend glow.

Why is US$20k for BTC such a talked about level in crypto circles? Aside from being a nice round number, which us humans seem to like, it also represents roughly the peak of the 2017-2018 bull market and supposedly has some technical support and resistance.

However, as the YouTuber Crypto Zombie points out in a recent video, BTC back then really only hit that level and stayed there for about a day and a half. He notes that a level well below that – about US$13,900 – is what traders and investors should probably pay more attention to…

Some notable analysts tend to think the OG crypto has bottomed or is bottoming out, so could it still come down that far? Absolutely it could, if a trad Septembear Revenant-style savaging plays out.

As for Cardano… let’s take a look at what’s going on there in just a sec…

Top 10 overview

With the overall crypto market cap at US$1.03 trillion and up about 1% since yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

So yep, Cardano (ADA) has been the standout performer in the crypto majors over the weekend and past 24 hours, which is now also reflecting as a double-digit gain rarity over the past week.

What’s going on? In a word… Vasil. This is Cardano’s latest “hard fork” upgrade, and is touted as the major Ethereum rival’s biggest and most significant yet.

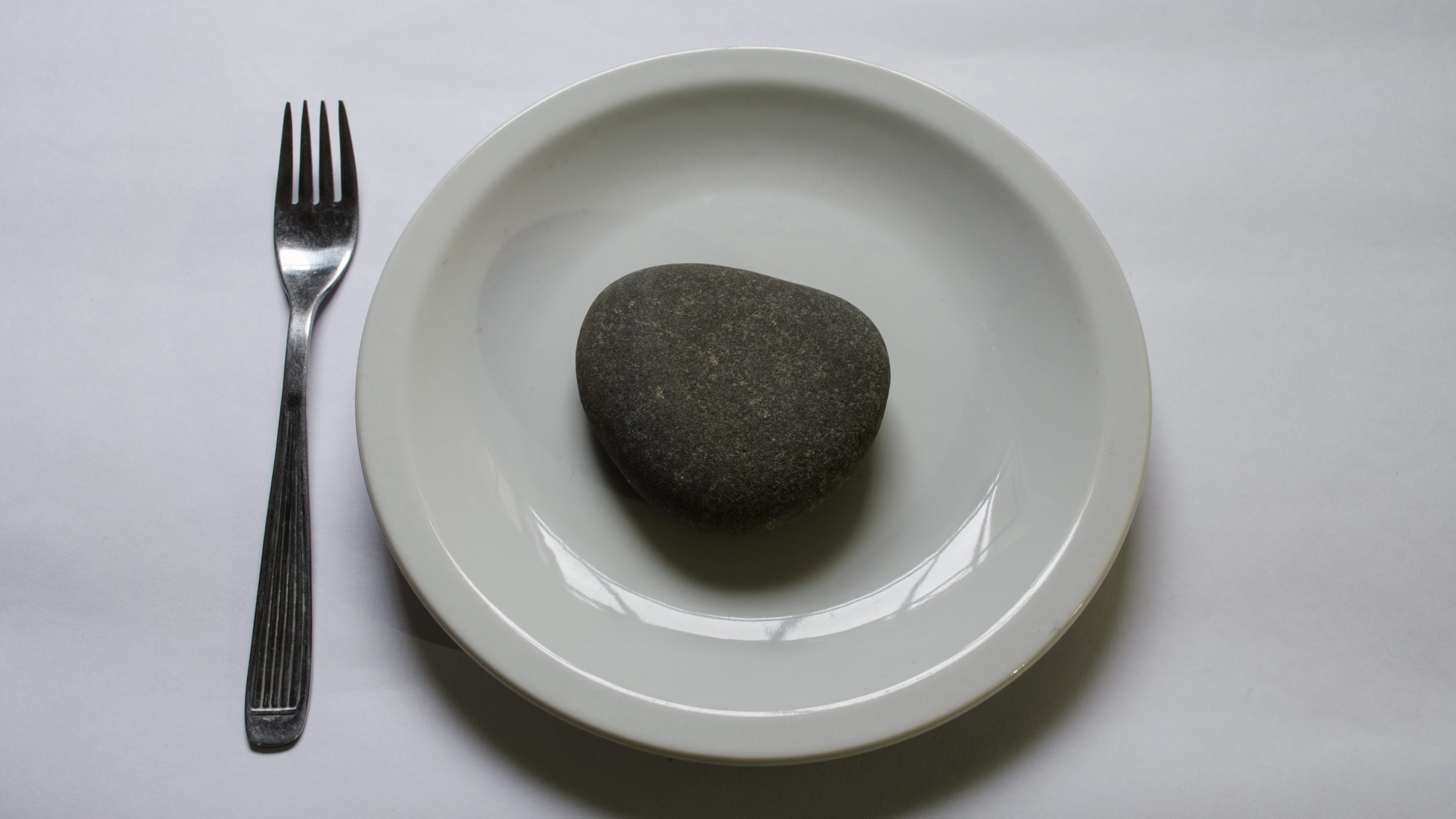

Probably more than most, Cardano has been heavily criticised in the past for its snail-like pace when it comes to its progression and development. Delayed three months from its original target date, the Vasil hard fork has now been set in stone (hopefully something like granite and not pumice) for September 22.

VASIL UPGRADE: DATE CONFIRMED 💪

Following the successful completion & extensive testing of all core components, plus confirmed community readiness, we along with @cardanostiftung can today announce 22nd September for the #Vasil upgrade on the #Cardano mainnet. 🧵$ADA

1/9— Input Output (@InputOutputHK) September 2, 2022

That’s just one week after the far-more publicised Ethereum Merge upgrade, which is said to be occurring around September 15. It’s the Stake of Origin of crypto upgrades. Mate against (former*) mate, proof-of-stake against proof-of-stake. Or something.

(* Cardano founder Charles Hoskinson was a co-founder of Ethereum along with Vitalik Buterin and others. Although there hasn’t been any particular public beef between the two for some time, it’s well known that the relationship has cooled ever since Hoskinson left Ethereum due to, let’s call it “creative differences”. These days, we imagine the Hosk is unlikely to be Buterin’s top pick for a night out on the sauce…)

my entire net worth is in this man's hands

— LilMoonLambo (@LilMoonLambo) September 4, 2022

Meanwhile, Hoskinson said: “What’s so amazing about that date is it randomly and just so happenly [sic] falls on the independence day of Bulgaria,” adding that: “[it’s] probably the hardest update we’ve ever had to do as an ecosystem.”

The hard fork upgrade is named after Bulgarian mathematician Vasil Dabov, a prominent Cardano ambassador who passed away last December.

Vasil is Coming September 22nd, 2022 https://t.co/SKHf84nFwU

— Charles Hoskinson (@IOHK_Charles) September 2, 2022

Meanwhile, back on Bitcoin and the rest again for a moment, Dutch trader/analyst Michaël van de Poppe keeps always keeps things pretty real with the market’s down trends, but he’s actually seeing some upside potential for crypto in the near term…

To me, it seems more apparent that a breakout to the upside happens, rather than to the downside.

Yes, a sweep is likely, but the ROI is better for longing than shorting.

Most of the altcoins have the exact same view.

— Michaël van de Poppe (@CryptoMichNL) September 4, 2022

Although fellow chart watcher Charles Edwards is pointing to a potentially bearish sign from a Bitcoin “whale” that has been moving some 5,000 Mt Gox-era BTC around…

Every time a Bitcoin OG moved 5000+ BTC in the past, price subsequently dropped 20-80% in the following months.

Will this weeks transaction at $19.6K be the same, or is this time different? pic.twitter.com/RHLeDIXO95

— Charles Edwards (@caprioleio) September 4, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$8.4 billion to about US$430 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• GMX (GMX), (market cap: US$454 million) +9%

• DeFiChain (DFI), (mc: US$688 million) +9%

• The Sandbox (SAND), (mc: US$1.45 billion) +5%

• Cosmos Hub (ATOM), (mc: US$3.8 billion) +4%

• Loopring (LRC), (mc: US$461 million) +4%

DAILY SLUMPERS: Helium out of gas

• Celsius (CEL), (market cap: US$611 million) -4%

• Axie Infinity (AXS), (mc: US$1.3 billion) -3%

• EOS (EOS), (mc: US$1.49 billion) -3%

• Filecoin (FIL), (mc: US$1.72 billion) -2%

• Chiliz (CHZ), (mc: US$1.13 million) -2%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Apparently Bitcoin’s dying… again…

#Bitcoin is dying pic.twitter.com/2N58QjudNO

— Bitcoin Magazine (@BitcoinMagazine) September 4, 2022

And here’s an interesting observation from noted trader Gareth Soloway, who has been predicting very bearish medium-term outcomes for Bitcoin, crypto and most risk assets so far this year. Is this the first sign that tune might be set to change? He does say “it will take a while”, though…

This headline is the first of what is to come. While it will take a while, the markets/economy will force all countries/central banks to get in line. "S.Korea pledges pre-emptive action to stabilize markets". Good for risk assets in the near-term.

— Gareth Soloway (@GarethSoloway) September 4, 2022

World's biggest podcaster Joe Rogan: "I got some #bitcoin" pic.twitter.com/lTEhtIOYGs

— Bitcoin Magazine (@BitcoinMagazine) September 4, 2022

Seems crazy that many discount Web3 games claiming they’ll never be as successful as Web2 games like CoD & WoW. As if the best game devs wouldn’t prefer to branch off & build on open platforms that grant more freedom. Newsflash: they are. Games take time to build. They’re coming.

— Santiago R Santos (@santiagoroel) September 4, 2022

https://twitter.com/WallStreetSilv/status/1566320157160382464

Happy Father’s Day to the Aussie crypto-dads. pic.twitter.com/QkwSfldxWJ

— SRGC (@srgcollectooor) September 4, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.